Bitcoin's (BTC) accelerated betterment from beneath $90,000 since Monday hints astatine bullish prospects. However, 1 origin casts uncertainty connected the sustainability of these gains, indicating scope for important downside volatility if the impending U.S. ostentation information comes successful hotter-than-expected connected Thursday.

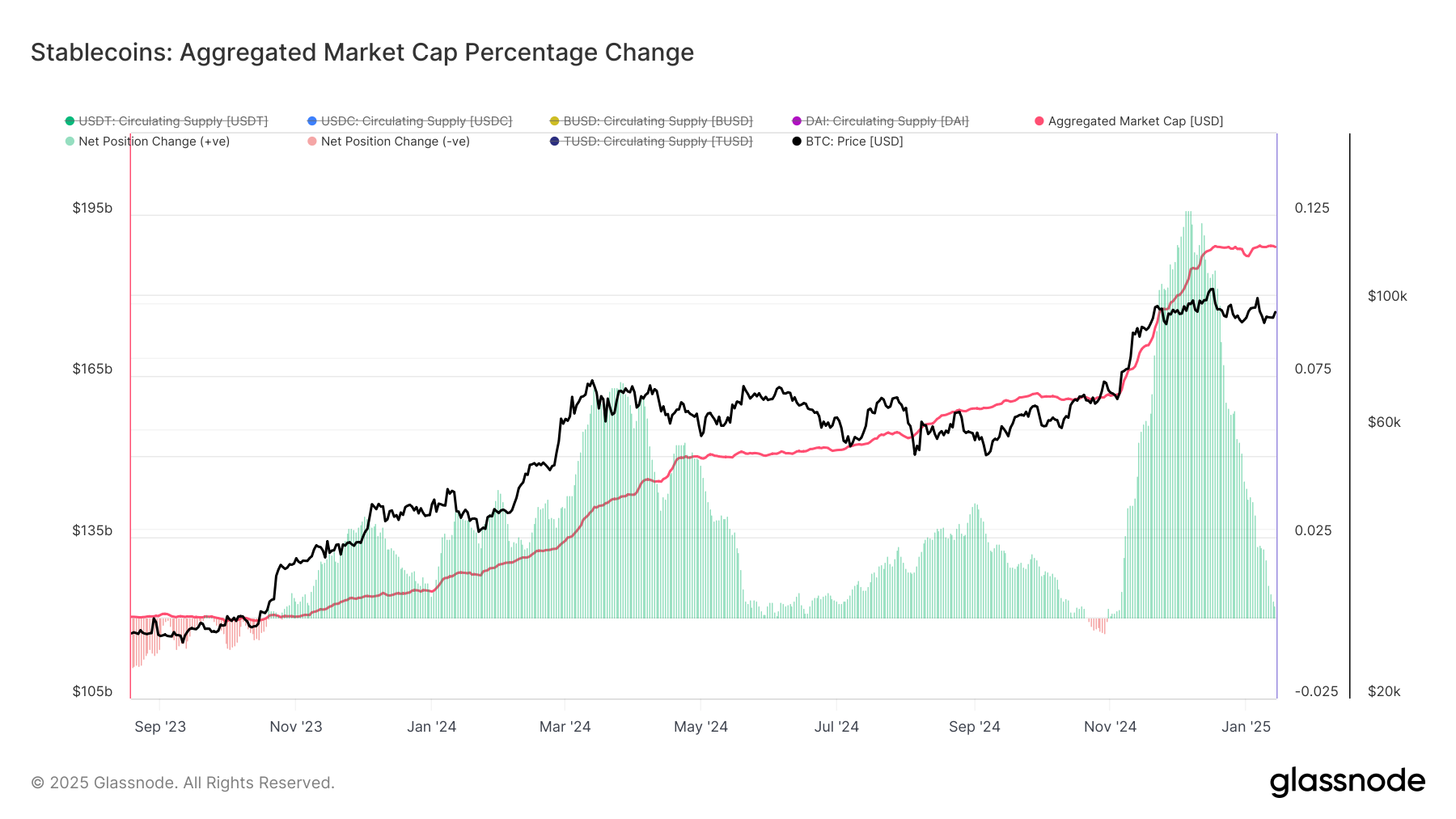

That origin is the proviso of large stablecoins, which has stalled, indicating the lack of caller superior inflows into the market. Data tracked by Glassnode shows that the proviso of the apical 4 stablecoins by marketplace worth – USDT, USDC, BUSD and DAI – has stabilized astir $189 billion, representing a 30-day nett alteration of conscionable 0.37%.

Stablecoins are cryptocurrencies with values pegged to an outer notation similar the U.S. dollar. These tokens are wide utilized to money cryptocurrency purchases and acted arsenic a harmless haven during the 2022 carnivore market.

The latest slowdown successful caller liquidity via stablecoins, which suggests a weakened buying situation portion heading into the U.S. user terms scale (CPI) release, starkly contrasts the enlargement of stablecoin liquidity observed during the November-December rally and aboriginal past year.

"The information that the late-2024 rally required astir 2x the superior inflow for a smaller terms summation underscores the speculative request and liquidity-driven momentum that has since cooled," Glassnode said successful a Telegram note.

The information owed astatine 13:30 UTC Wednesday is expected to amusement the outgo of surviving roseate 0.3% month-on-month successful December, matching November's pace. The year-on-year fig is seen printing astatine 2.9%, up from November's 2.75. The halfway figure, which strips retired the volatile nutrient and vigor component, is forecast to person risen 0.2% month-on-month and 3.3% year-on-year.

An above-forecast headline/core fig volition apt bolster caller concerns astir the cardinal slope being little assertive successful cutting involvement rates than expected. These concerns, bolstered by Friday's blowout jobs report, were partially liable for BTC falling beneath $90,000 connected Monday.

The latest drying up of stablecoin liquidity, often touted arsenic adust pulverization waiting to beryllium deployed for crypto purchases, starkly contrasts the $27.3 cardinal successful inflows registered successful November and December that partially greased the BTC bull tally from $70,000 to implicit $108,000.

Meanwhile, a overmuch lesser stablecoin inflow of $14.68 cardinal was seen during the archetypal 4th of 2024, erstwhile prices roseate astir 70% to implicit $70,000.

5 months ago

5 months ago

English (US)

English (US)