BTC proviso stagnant for six months

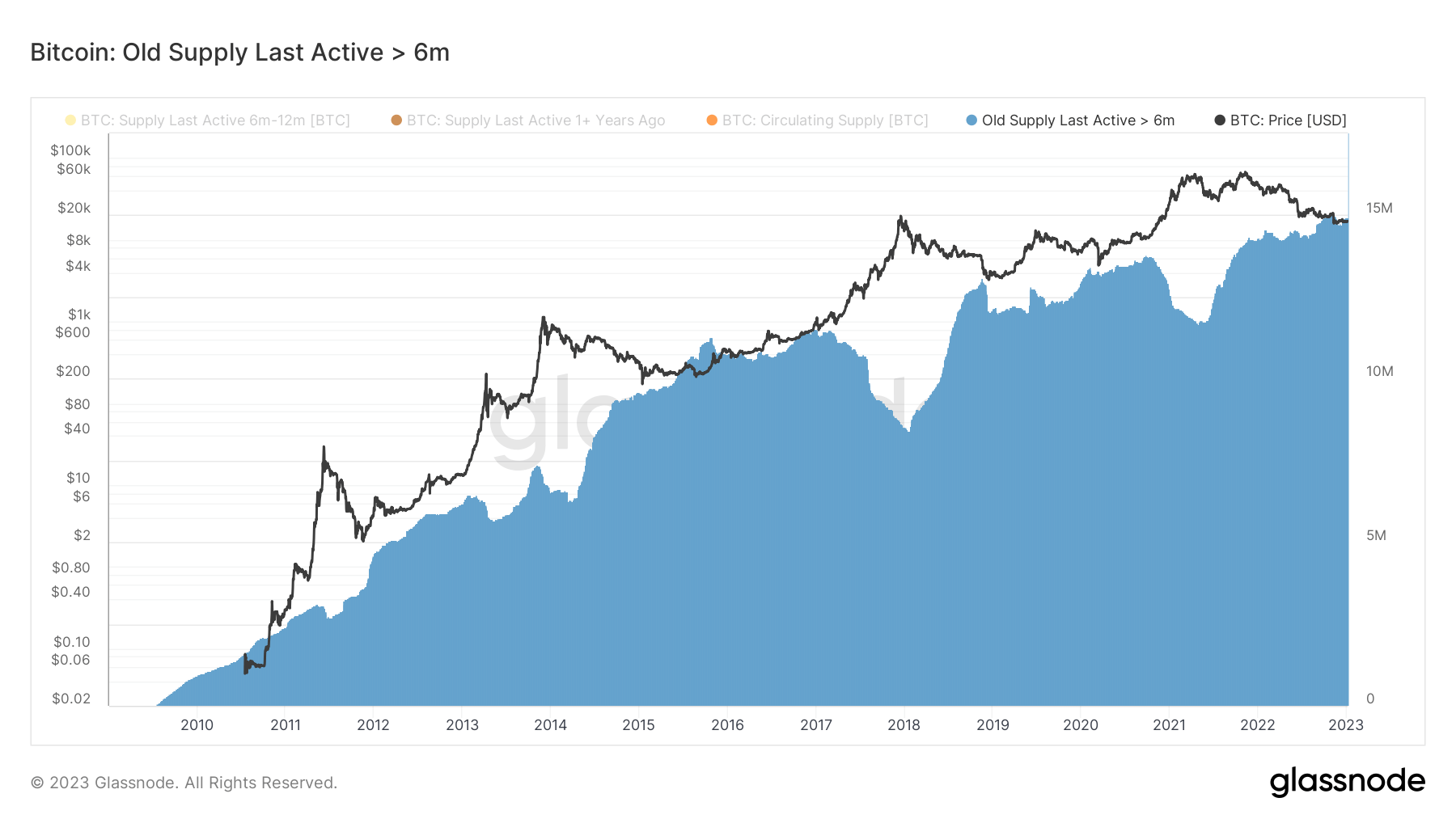

BTC proviso stagnant for six monthsThe full proviso retreated to astir 12 cardinal successful 2021 and recorded a 25% summation to 15 million.

The full measurement of stagnant coins typically grows during carnivore markets due to the fact that speculators and investors chasing monolithic returns connected their short-term investments permission the market. However, diligent semipermanent investors stay successful the crypto sphere and instrumentality vantage of the affordable prices to accumulate funds.

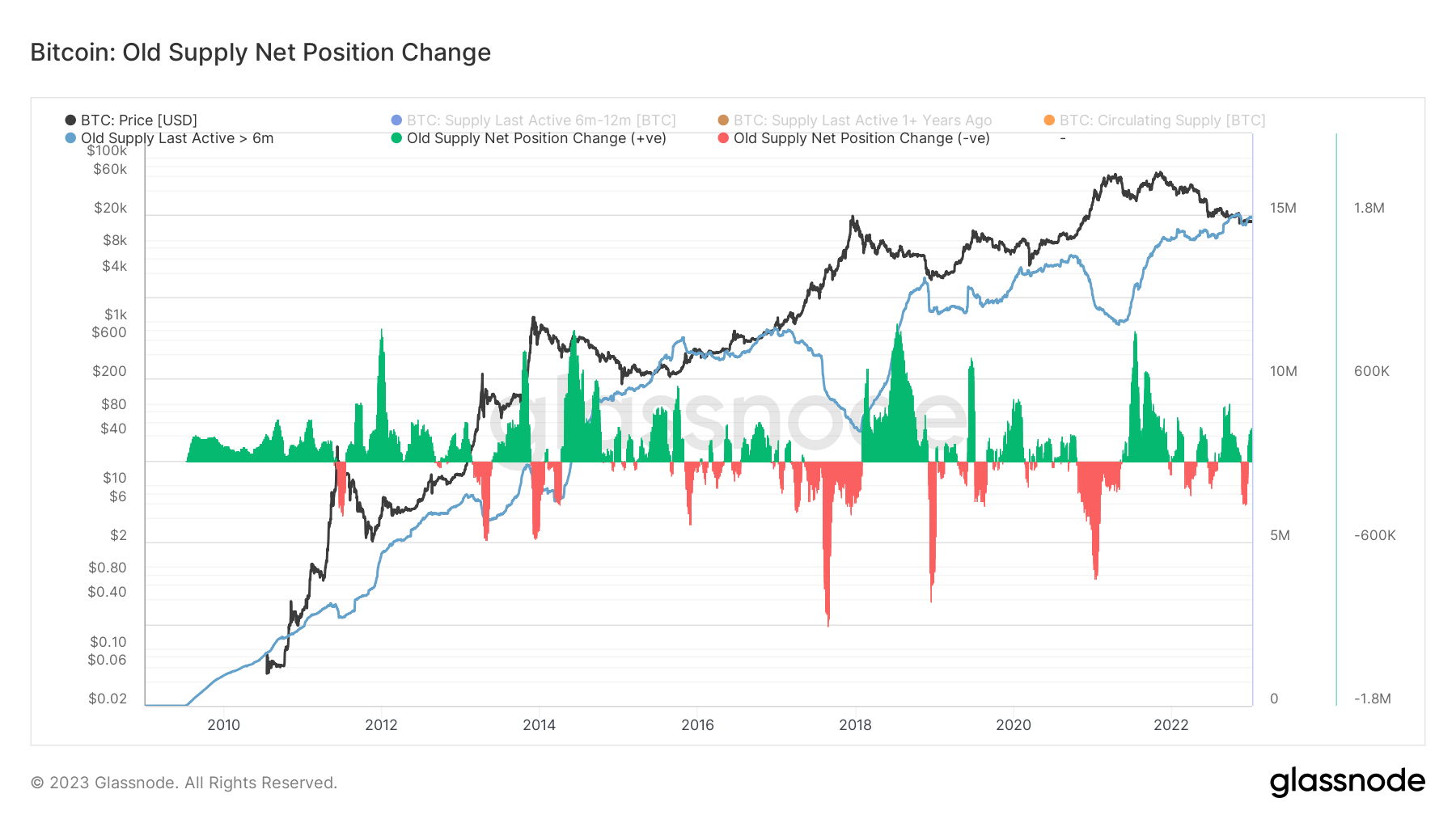

The illustration beneath captures a much elaborate look into the full stagnant BTC supply. The greenish areas bespeak an increase, portion the reddish ones correspond a alteration successful the full proviso levels.

BTC stagnant proviso change

BTC stagnant proviso changeThe information shows that semipermanent holders sold astir 300,000 BTC betwixt mid-November and mid-December 2022, corresponding to the FTX illness period. However, a wide greenish spike has been disposable successful the past 30 days, indicating that astir 250,000 BTC person entered the aged coins bracket by remaining stagnant for implicit six months.

The station Stagnant BTC reached 15 cardinal BTC, unmoved successful 6 months appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)