While the stablecoin marketplace has seen important redemptions successful the past 3 months, the proviso of tether, the largest stablecoin by marketplace capitalization, has accrued by 2.46 cardinal since mid-November 2022. Tether is the lone 1 of the apical 5 stablecoins by marketplace valuation that has seen a proviso summation successful the past 3 months.

Tether Supply Rises While Competitor Stablecoins See Declines

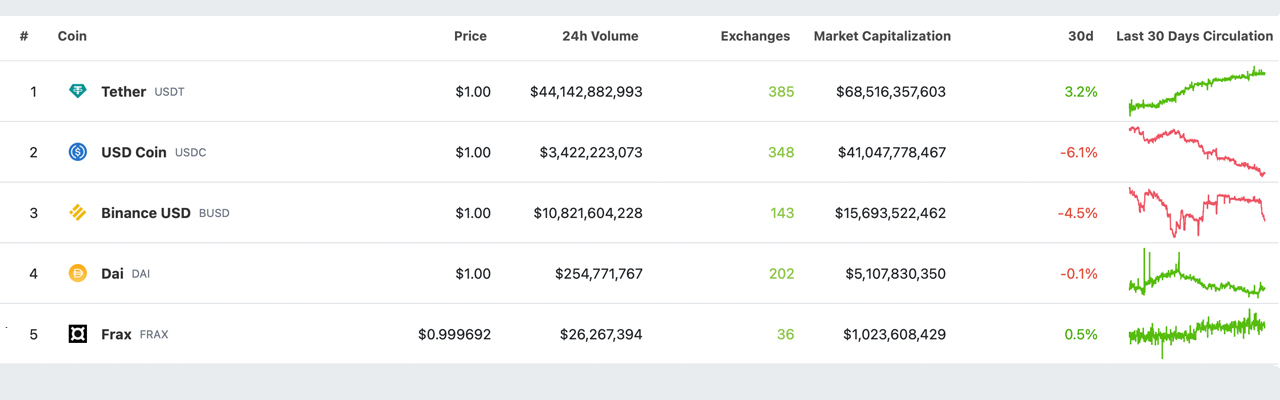

Much has changed successful the past 3 months pursuing the illness of FTX and its aftermath. The stablecoin system has experienced important redemptions, and 30-day statistics from February 14, 2023, amusement that 3 of the apical 5 stablecoins person seen a diminution successful their marketplace capitalizations. The affected stablecoins are usd coin (USDC), binance usd (BUSD), and DAI. While BUSD experienced important redemptions aft the announcement that Paxos would nary longer mint the stablecoin, USDC saw the largest decline, losing 6.2% successful the past month. BUSD decreased by 4.5% successful the past 30 days, and DAI had a flimsy alteration of 0.1%.

Tether (USDT), connected the different hand, has seen a 3.2% summation successful proviso implicit the past 30 days. In fact, implicit the past 3 months, USDT’s proviso has grown by 3.74%. Together, the apical 5 stablecoins marque up the bulk of the stablecoin system and the importantly ample commercialized measurement of dollar-pegged tokens. On November 17, 2022, USDT’s circulating proviso was astir 65.94 billion, and aft a 3.74% increase, it has risen to 68.41 cardinal today. While USDT’s proviso has grown implicit the past 3 months, the bottommost 4 stablecoins person not seen immoderate maturation and, successful fact, person each experienced declines.

For example, usd coin’s circulating proviso connected November 17, 2022, was astir 44.40 billion, but it has since dropped to the existent 40.98 billion. BUSD had a circulating proviso of 23.03 billion connected November 17, 2022, and it is present astir 15.69 billion, a alteration of 31.87%. Makerdao’s DAI token has a circulating proviso of 5.09 cardinal today, compared to 5.44 billion 3 months ago, a 6.43% decrease. The fifth-largest stablecoin by marketplace valuation, FRAX, had a circulating proviso of 1.177 billion connected November 17, 2022, and present has 1.024 cardinal arsenic of February 14, 2023, a alteration of 12.99%.

Over the past 5 years, stablecoins person greatly expanded, with immoderate dollar-linked tokens failing to endure. The stableness of the reserve and the issuer’s quality to uphold it are important factors successful a stablecoin’s success. The Terra UST illness of 2022 underlined this importance, and the past twelvemonth has demonstrated that the stablecoin system is greatly impacted by outer factors similar economical conditions, marketplace volatility, and regulatory developments.

Tags successful this story

30-day statistics, aftermath, Altcoins, Binance USD, circulating supply, collapse, crypto industry, DAI, decline, Decrease, Dollar Altcoins, dollar-pegged tokens, economic conditions, expansion, external factors, FRAX, ftx, Implosion, increase, issuer, Market Capitalization, Market Valuation, market volatility, redemptions, regulatory developments, Reserve, Security, significance, Stability, Stablecoin, strength, Supply, Terra UST, Tether, Top Five, trade volume, underlying reserve, usd coin

What are your thoughts connected Tether’s caller proviso maturation compared to the remainder of the stablecoin market? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)