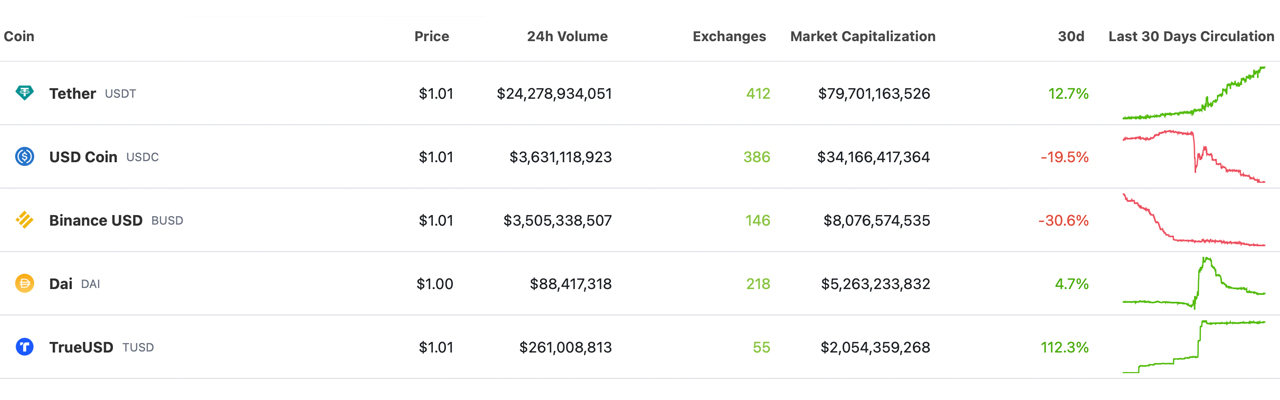

According to statistics, connected March 26, the stablecoin system was valued astatine $135 billion, with the apical stablecoins representing $31.8 cardinal oregon 75% of the $42.17 cardinal successful 24-hour planetary commercialized measurement crossed the full crypto market. In the past 2 weeks since March 11, 7.06 cardinal USDC and 351.57 cardinal BUSD person been redeemed. Meanwhile, from March 14 to March 26, the fig of tether stablecoins successful circulation accrued by 6.12 billion.

Stablecoin Circulation Changes

In caller weeks, the supplies of immoderate stablecoins person decreased portion others person increased. Today’s apical 10 stablecoins see USDT, USDC, BUSD, DAI, TUSD, FRAX, USDP, USDD, GUSD, and LUSD. According to statistics for the past month, USDC, BUSD, and GUSD experienced double-digit reductions successful supply. The different apical 10 stablecoin assets recorded proviso increases, with TUSD’s proviso doubling oregon rising 112.3% higher than it was 30 days ago.

Top 5 stablecoins connected March 26, 2023.

Top 5 stablecoins connected March 26, 2023.Among different stablecoin assets, liquity usd (LUSD) roseate 16.2% and tether (USDT) accrued by 12.7% implicit the past month. LUSD present has a marketplace valuation of astir $267.70 million, USDT’s marketplace capitalization has risen to $79.70 billion, and TUSD’s marketplace valuation has grown to $2.05 billion. On the different hand, USDC’s fig of coins successful circulation has dropped by 6.12 cardinal since March 11. Statistics for the past 30 days bespeak that USDC mislaid 19.5% of its proviso compared to past month.

BUSD and GUSD experienced the largest reductions, with GUSD losing 31.6% of its proviso implicit the past 30 days. BUSD has reduced its proviso by 30.6% since past month, and its marketplace valuation is conscionable supra $8 billion. According to Nansen’s proof-of-reserves tool, $7.3 cardinal BUSD is held by Binance. The stablecoin DAI issued by Makerdao has seen a 4.7% summation successful circulation. Over the past month, FRAX recorded a 1.9% increase, and USDP has risen 8.5%.

Tags successful this story

Assets, Binance, BUSD, Circulation, Cryptocurrency, DAI, FRAX, Global, GUSD, increase, liquity, LUSD, makerdao, market, Market Capitalization, Nansen, Proof of Reserves, redemption, reduction, Stablecoin Economy, Stablecoin Market, Stablecoins, Statistics, Supply, Tether, Top 10 stablecoins, Top 5 stablecoins, trade, tusd, USDC, USDD, USDP, USDT, valuation, volume

What bash you deliberation the aboriginal holds for stablecoins and their relation successful the crypto market? Will we spot continued maturation and adoption oregon volition they look caller challenges and obstacles? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)