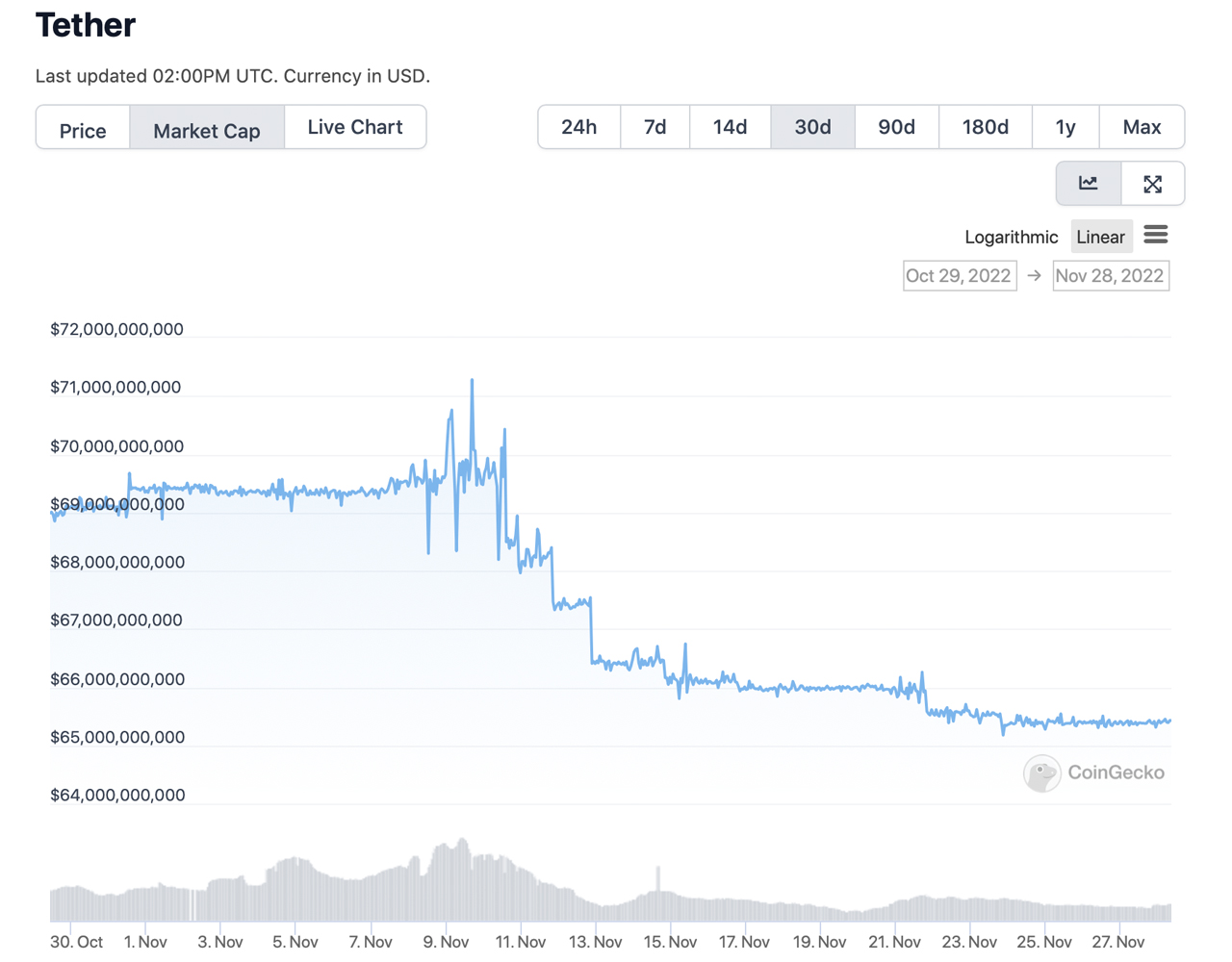

During the past month, the marketplace capitalization of each the stablecoins successful beingness dropped by much than 2%, shedding astir $2.98 cardinal since the extremity of October. Statistics amusement that tether, the largest stablecoin by marketplace valuation, saw its marketplace headdress suffer much than 5% during the past 30 days. Tether’s marketplace headdress slipped from past month’s $69.13 cardinal to today’s $65.48 billion.

Stablecoin Economy Drops Lower, Tether Market Cap Sheds 5%

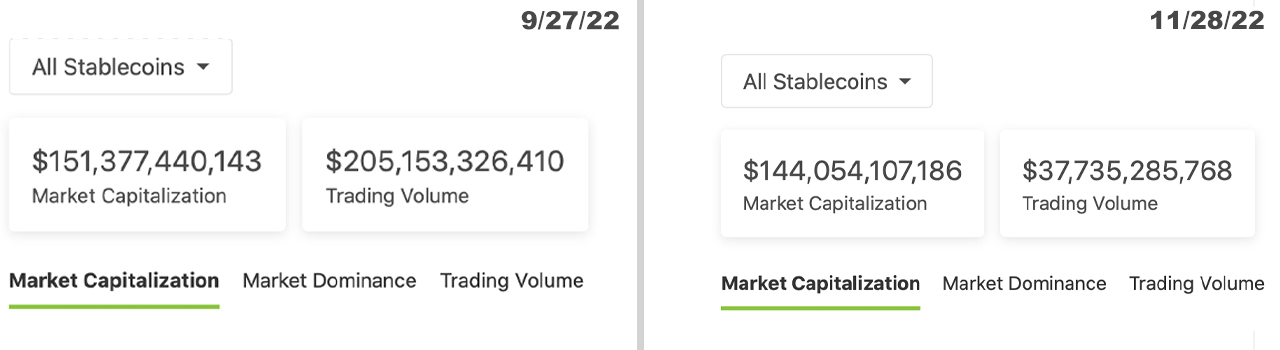

Statistics amusement that the stablecoin economy’s marketplace valuation has reduced during the past 30 days by astir 2.02%. On Oct. 31, 2022, the stablecoin system was valued astatine $147.03 cardinal and today, it’s down to $144.05 billion.

Furthermore, the marketplace capitalization of each the stablecoins successful beingness is overmuch little than it was 2 months ago, arsenic the marketplace headdress dropped by 4.83% from $151.37 cardinal to today’s $144 cardinal total. Data indicates that this past month, tether (USDT) has seen its marketplace capitalization driblet much than 5% little from $69.13 cardinal to the existent $65.48 billion.

However, the second-largest stablecoin by marketplace cap, usd coin (USDC) has seen its marketplace valuation summation during the past 30 days, jumping astir 1.5% higher. The stablecoin BUSD’s valuation continues to turn period aft month, and implicit the past 30 days, it’s up 4.8%. Out of the apical 5 stablecoins today, BUSD’s marketplace headdress grew the astir implicit the past month.

Makerdao’s DAI stablecoin has shed 9.7% this past period and the stablecoin’s marketplace capitalization was the biggest loser retired of the apical 10 dollar-pegged crypto tokens. On Oct. 31, DAI’s marketplace headdress was astir $5.77 cardinal and today, it’s coasting on astatine $5.20 billion. With tether and DAI starring the losses implicit the past period retired of the apical 10 stablecoins, frax (FRAX) followed down the 2 tokens shedding astir 3.1% past month.

Stablecoin commercialized measurement has dropped a large woody implicit the past 2 months but the tokens inactive correspond a bulk of today’s trades. For instance, connected Sept. 27, 2022, stablecoins captured $205 cardinal retired of the $225 cardinal successful planetary trades. On Oct. 31, stablecoins recorded $55.91 cardinal successful trades retired of the full worldwide crypto commercialized measurement ($71 billion).

During the past 24 hours stablecoins person captured $37.73 cardinal and the aggregate commercialized measurement among each the crypto coins successful beingness contiguous is astir $46.56 billion. This means retired of the $46 cardinal successful trades among each the crypto assets, stablecoins equate to 81.04% of those trades.

Tags successful this story

BUSD, Circle, Crypto Trade Volume, DAI, dollar-pegged crypto tokens, FRAX, makerdao, Makerdao’s DAI, Paxos, Stablecoin, stablecoin asset, Stablecoin Economy, stablecoin commercialized volume, Stablecoins, Tether, Tether stablecoin, Tether's USDT, top 5 stablecoins, top 10 stablecoins, Tron's Stablecoin, trueusd, tusd, usd coin, USDC, USDD, USDP, USDT

What bash you deliberation astir the authorities of the stablecoin marketplace today? What bash you deliberation astir the stablecoin economy’s valuation slipping by adjacent to 5% during the past 2 months? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)