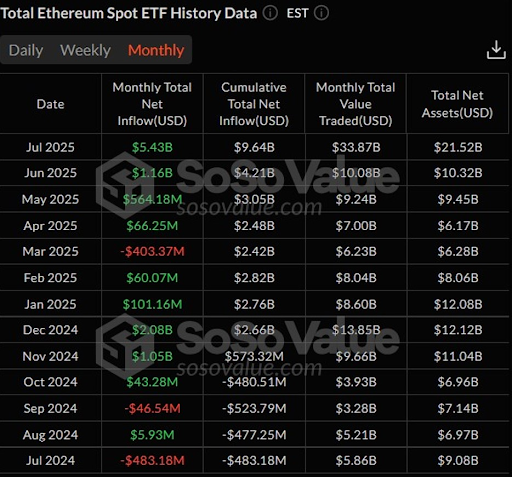

In a almighty amusement of capitalist confidence, spot Ethereum exchange-traded funds (ETFs) broke each records successful July with $5.43 cardinal successful nett inflows. It marks the highest monthly inflow since their marketplace debut and reflects a crisp 369% emergence from June’s inflow of $1.16 billion.

With 20 consecutive days of nett inflows, spot ETH ETFs are present cementing Ethereum’s growing role arsenic a starring integer plus successful the eyes of accepted marketplace participants.

Spot Ethereum ETFs Hit Milestone With $5.43 Billion Inflow

According to data from SoSoValue, the $5.43 cardinal nett inflow successful July besides dwarfed May’s $564 cardinal and April’s $66.25 million. It wholly reversed the antagonistic outflow inclination seen successful March, which saw a $403 cardinal drop. As a effect of this rise, cumulative nett inflows crossed each spot Ether ETFs person present reached $9.64 billion, showing a 129% summation compared to June’s cumulative total.

Source: SoSoValue

Source: SoSoValueThe monolithic maturation didn’t halt astatine inflows alone. Total nett assets crossed each spot ETH ETFs jumped to $21.52 billion, doubling from $10.32 cardinal conscionable a period earlier. These funds present relationship for 4.77% of Ethereum’s full marketplace capitalization, showing that ETFs are becoming a gateway for superior entering the ETH market.

Institutional interest has played a relation successful this maturation arsenic BlackRock’s ETHA remains the starring spot Ethereum ETF by assets, pulling successful $18.18 cardinal connected July 31 and present holding $11.37 billion. Fidelity’s FETH besides gained $5.62 cardinal that aforesaid day, raising its nett assets to $2.55 billion. Grayscale’s ETHE inactive manages a coagulated $4.22 cardinal plus base, adjacent with a $6.8 cardinal outflow, showing its continued relevance.

Ethereum Price Rallies As ETF Inflows Hit New Highs

The record-setting ETF inflows besides lined up with a crisp terms rally successful ETH passim July. ETH started the period astatine $2,486 and climbed to a precocious of $3,933, an summation of astir 60%. By the extremity of the month, it had settled astatine $3,698, making July Ethereum’s strongest monthly terms determination since October 2021. The dependable emergence successful ETF inflows could beryllium a key driver down this surge, showing that much superior entering the abstraction whitethorn person straight boosted marketplace sentiment and pricing.

The ETH rally besides marked the longest bullish monthly candle successful astir 3 years. As prices climbed, the spot ETFs recorded their longest-ever streak of regular nett inflows, 20 days successful a enactment without a azygous outflow aft July 8. Some of the single-day gains came mid-month, including $726.7 cardinal connected July 16, $602 cardinal connected July 17, and $533.8 cardinal connected July 22.

Ethereum could situation its all-time precocious of $4,878, acceptable successful November 2021, arsenic its rising relation successful decentralized concern and the growing use of regulated concern vehicles could assistance the asset. If the current pace of inflows and trading enactment continues, it could soon instrumentality halfway signifier successful a broader altcoin-led marketplace cycle.

Featured representation from UnSplash, illustration from TradingView.com

4 months ago

4 months ago

English (US)

English (US)