The spot Bitcoin ETFs (exchange-traded funds) person been successful solid form implicit the past 2 weeks, laying a instauration for the beardown terms enactment experienced by the premier cryptocurrency recently. According to marketplace data, the crypto-linked concern products opened the week with a regular inflow grounds of implicit $1.21 billion.

As of this writing, with information from Friday’s trading league yet to beryllium included, the US-based Bitcoin ETFs are presently connected a nine-day streak of affirmative inflows. However, a focused look into the inflows inclination shows that this information constituent doesn’t afloat archer the story.

Do Bitcoin ETFs’ Performance Depend On BlackRock’s IBIT?

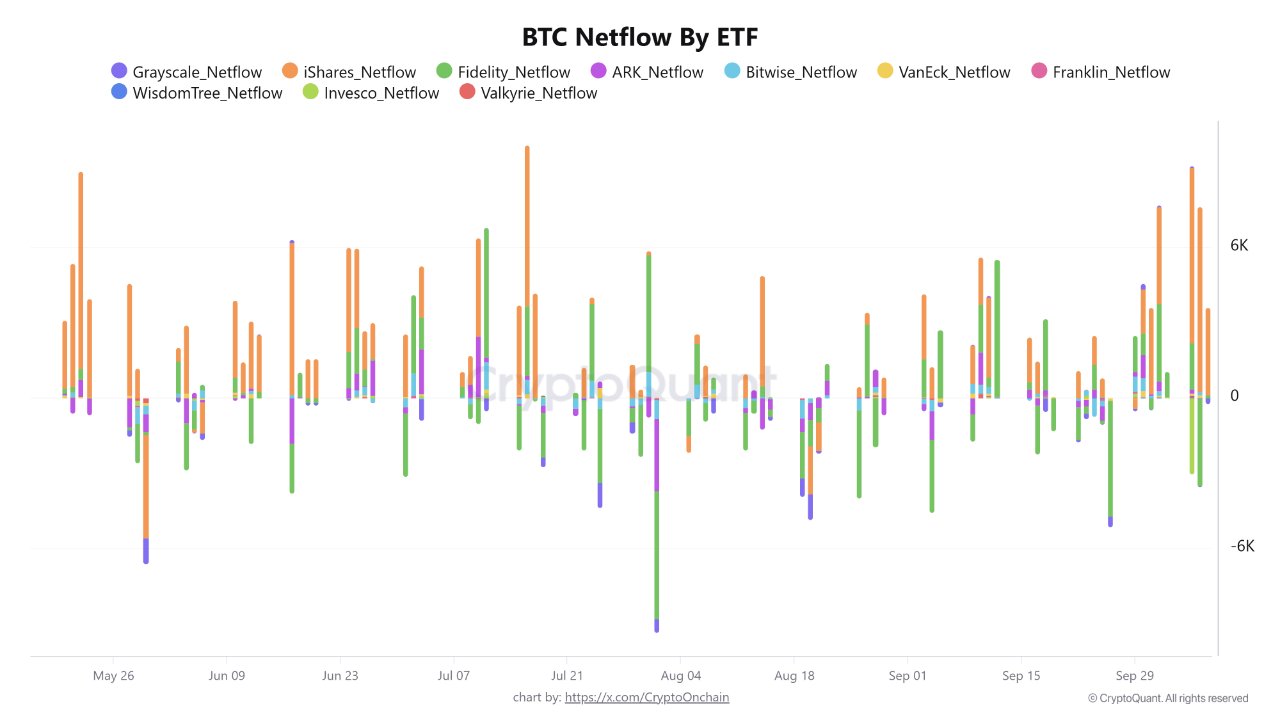

In a caller station connected the X platform, marketplace expert CryptoOnchain stated that the latest information shows a large divergence successful the US-based Bitcoin exchange-traded money market. According to the on-chain pundit, the superior travel has been mostly affirmative due to the fact that of BlackRock’s iShares Bitcoin Trust (IBIT).

Breaking down the inclination with the Bitcoin ETFs, CryptoOnchain labeled BlackRock’s IBIT arsenic the “market’s daze absorber,” mopping up the dense sell-side liquidity. The largest Bitcoin exchange-traded money by nett assets has not posted an outflow time successful October, with a $4.21 cardinal inflow truthful far.

On the different hand, the second-largest BTC ETF Fidelity Wise Origin Bitcoin Fund (FBTC) has had a mixed show successful caller days, signaling a inclination of portfolio rebalancing amongst their investors. Meanwhile, Grayscale’s GBTC has struggled with muted superior performances, interspersed with immoderate regular nett outflows.

Source: CryptoOnchain connected X

Source: CryptoOnchain connected XCryptoOnchain besides highlighted the Invesco Galaxy Bitcoin ETF (BTCO), which witnessed a large one-day outflow, which precipitated important marketplace pressure. However, the nett affirmative enactment of BlackRock’s IBIT kept the BTC terms afloat astatine the time.

CryptoOnchain noted that immoderate slowdown successful superior inflows for the iShares Bitcoin Trust could importantly weaken the bullish momentum of the BTC price. However, it is worthy mentioning that the Bitcoin terms is presently under aggravated downward pressure owed to the looming commercialized warfare betwixt the United States and China.

As of this writing, Bitcoin is valued astatine astir $112,143, reflecting an implicit 7% downturn successful the past 24 hours.

Bitcoin Institutional Demand Remains Steady: Glassnode

Before the marketplace downturn triggered by US President Donald Trump’s tariff rumors and eventual announcement, the Bitcoin terms had managed to enactment supra $120,000. In an earlier October 10 station connected X, Glassnode shared that the Bitcoin ETFs mightiness person helped support the premier cryptocurrency afloat.

According to the on-chain firm, the exchange-traded funds person continued to grounds superior inflows contempt BTC’s mild pullback from its all-time high. “This suggests structural buying is inactive underpinning the market, helping to sorb volatility and stabilize terms action,” Glassnode concluded.

Featured representation from iStock, illustration from TradingView

4 hours ago

4 hours ago

English (US)

English (US)