The imaginable support of a spot Bitcoin ETF successful the United States has stirred sizeable attraction successful caller weeks. Dan Morehead, CEO and laminitis of Pantera Capital, has present shared invaluable insights connected this substance successful his latest “Blockchain Letter”, emphasizing the unsocial circumstances surrounding this event.

Morehead challenges the accepted Wall Street mantra, “Buy the rumor, merchantability the news,” questioning its relevance successful the existent spot ETF context. He reflects connected however this adage played retired historically, specifically citing the CME Futures motorboat and Coinbase’s nationalist listing. Both instances exhibited important terms surges successful the BTC marketplace earlier their respective events, followed by steep downturns, aligning with the adage’s prediction.

Spot Bitcoin ETF Is A “Buy The Rumor, Buy The News” Event

In his elaborate analysis, Morehead recounts however the Bitcoin marketplace rallied dramatically, up to 2,448%, starring up to the CME futures launch. However, this bullish inclination abruptly reversed connected the precise time the futures were listed, marking the commencement of an 84% diminution into a carnivore market. He parallels this with the Coinbase nationalist listing scenario, wherever the marketplace again surged, this clip by 848%, reaching its highest connected the time of Coinbase’s listing, lone to beryllium succeeded by a 76% drop.

Morehead, with a interaction of humor, notes successful his letter, “Will idiosyncratic delight punctual maine the time earlier the Bitcoin ETF officially launches? I mightiness privation to instrumentality immoderate chips disconnected the table.”

However, “this clip is different,” states Morehead. Further delving into the imaginable interaction of a spot ETF, helium posits that specified an ETF would correspond a important measurement successful the adoption. Unlike futures, which helium argues were a “step backwards,” the spot ETF could fundamentally alteration entree to BTC, opening up caller capitalist pools and perchance altering the request relation for Bitcoin permanently.

Unlike the erstwhile events of the CME futures and Coinbase listing, which had small real-world interaction connected Bitcoin accessibility, Morehead believes the spot ETF script is fundamentally different. He asserts, “A BlackRock ETF fundamentally changes entree to Bitcoin. It volition person a immense (positive) impact.” His presumption is that the ETF volition present BTC to broader capitalist classes, importantly altering the concern landscape.

Drawing a parallel with the history of golden ETFs, Morehead suggests that Bitcoin ETFs could likewise revolutionize Bitcoin investment, expanding its entreaty and legitimacy. He predicts a important displacement successful the request dynamics for Bitcoin, akin to however golden ETFs altered the golden market.

In his concluding remarks, Morehead revisits the archetypal question astir the ETF motorboat being a “sell the news” event. He argues, “Buy the rumor, bargain the news.” This operation encapsulates his content that, dissimilar past events, the instauration of a Bitcoin ETF volition not pb to a sell-off but volition people the opening of a caller epoch successful Bitcoin investment.

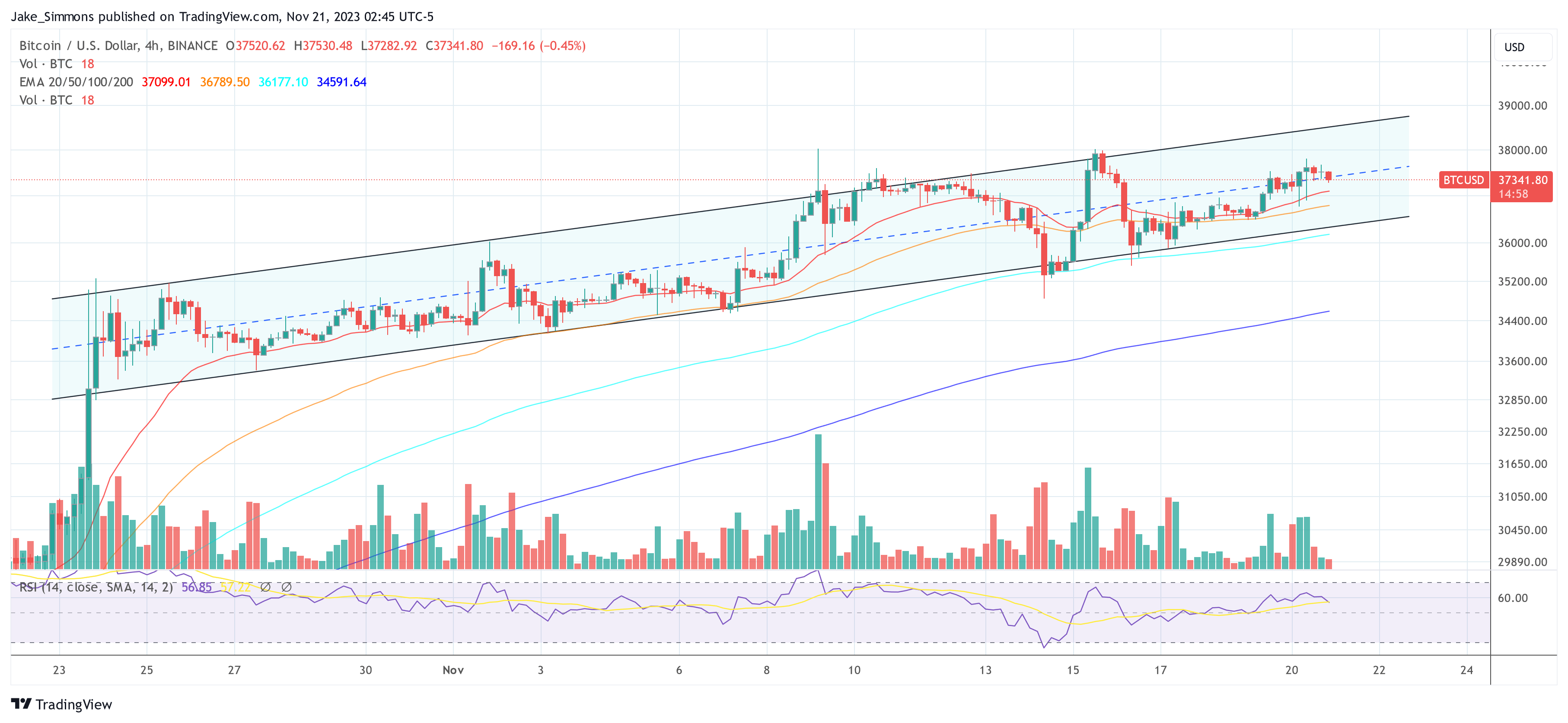

At property time, BTC traded astatine $37,341.

BTC terms remains wrong the inclination channel, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC terms remains wrong the inclination channel, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)