Deribit's options marketplace for Solana's SOL token has go active, with whales engaging successful bearish bets arsenic the token's terms continues to diminution up of an impending multi-billion dollar unlock.

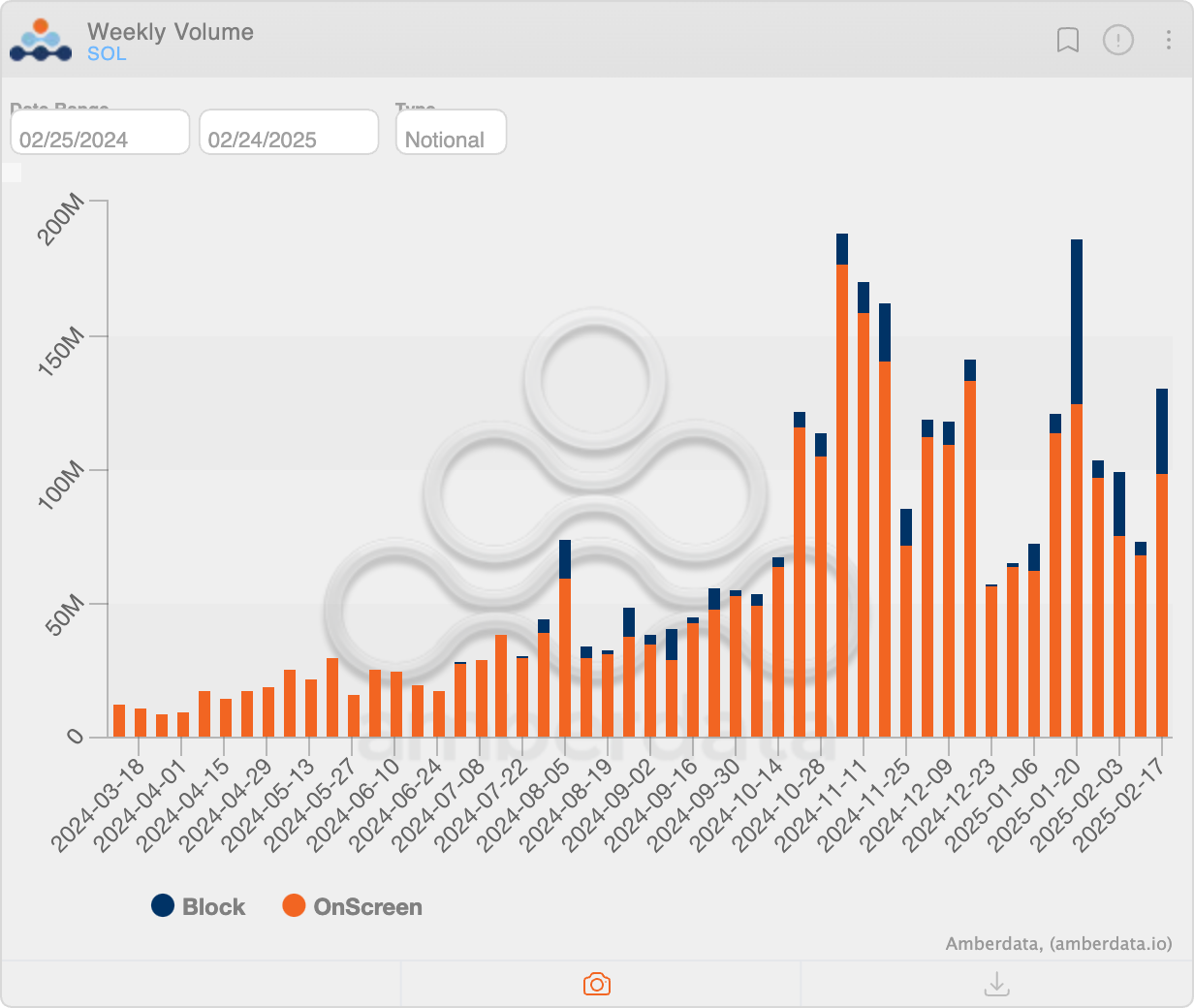

Last week, SOL artifact trades totaling $32.39 cardinal successful notional worth crossed the portion connected Deribit, representing astir 25% of the full options enactment of $130.74 million. The remainder of the enactment comprised surface trades, according to Amberdata. That's the second-highest proportionality of artifact trades to full enactment connected record.

A "block trade" successful options refers to a significant, privately negotiated options transaction betwixt 2 parties involving a ample fig of contracts. Such trades, typically associated with whale activity, are executed over-the-counter and extracurricular the regular bid publication and past booked connected the exchange, allowing for a minimal interaction connected the marketplace prices.

Options are derivative contracts that springiness the purchaser the close but not the work to bargain oregon merchantability the underlying asset, successful this case, SOL, astatine a preset terms connected oregon earlier a circumstantial date. A telephone enactment gives the close to buy, portion a enactment enactment provides the close to sell. On Deribit, which accounts for implicit 85% of the planetary crypto options activity, 1 options declaration represents 1 SOL.

Last week's spike successful SOL artifact trades featured a penchant for enactment options, which traders usage to hedge against oregon nett from a imaginable terms slide.

"Nearly 80% of the block-trade measurement was concentrated successful enactment contracts. Compared to lone 40% puts for BTC and 37.5% puts for ETH during the aforesaid timeframe," Greg Magadini, manager of derivatives astatine Amberdata, said.

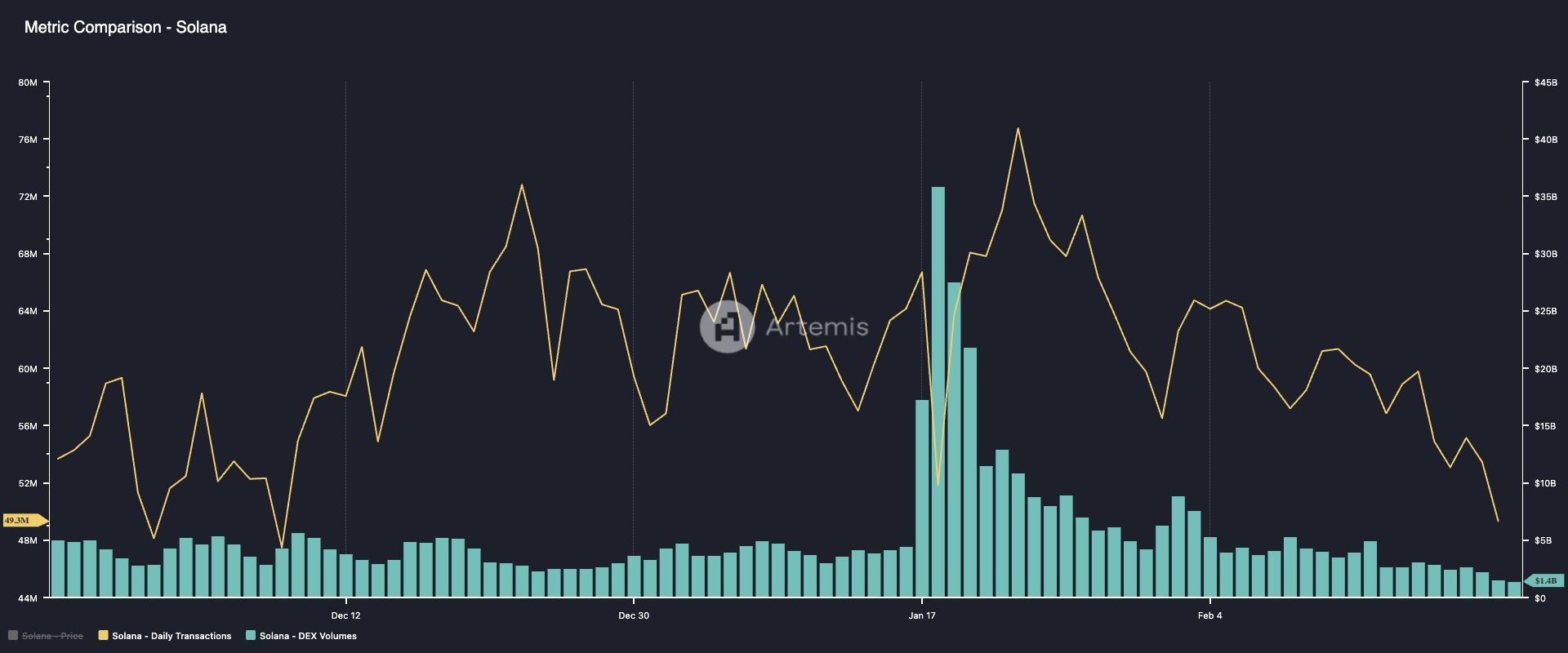

The whale request for enactment options comes arsenic SOL's outlook appears grim pursuing the 46% terms descent to $160 successful conscionable implicit 5 weeks. The enactment connected the Solana blockchain, which became a go-to-place for memecoin traders past year, peaked with the motorboat of the TRUMP token connected Jan. 17, 3 days earlier Donald Trump was inaugurated arsenic the President of the U.S.

Since then, the fig of regular transactions connected Solana and the cumulative regular measurement connected the Solana-based decentralized exchanges has declined significantly, according to information root Artemis. That has weakened the bullish lawsuit for SOL.

Plus, the impending SOL token unlock connected Jan. 1 presents a important headwind, per Deribit's Asia Business Development Head Lin Chen.

"Solana (SOL) volition person a large token unlock lawsuit connected March 1, releasing 11.2 cardinal SOL tokens, valued astatine astir $2.07 billion. This represents 2.29% of the full supply. A important information of the unlock comes from the FTX property and a instauration sale," Chen said.

Chen explained that the ample unlock could breed marketplace volatility arsenic it accounts for astir 59% of SOL's regular spot trading volume. Hence, its earthy to spot a batch of hedging travel successful enactment options successful anticipation of a imaginable extended SOL terms slide.

"Many traders would besides instrumentality this accidental to agelong Vol[atility] to make bully yield," Chen noted.

8 months ago

8 months ago

English (US)

English (US)