By Omkar Godbole (All times ET unless indicated otherwise)

The past 24 hours person witnessed a uncommon dynamic: a large token moving connected exertion quality alternatively than trading flows and wide narratives of organization adoption.

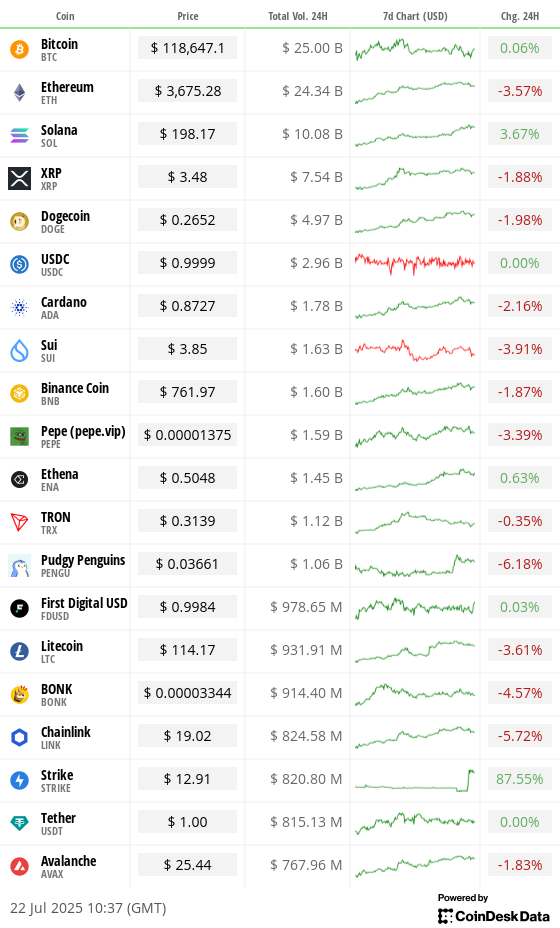

Solana's autochthonal sol (SOL) experienced a notable spike successful terms volatility, rising arsenic precocious arsenic $200 for the archetypal clip since March aft Jito Labs, an infrastructure company, announced Block Assembly Marketplace (BAM), designed to antagonistic maximal extractable worth strategies, specified arsenic front-running and sandwiching. SOL is present tussling with BNB for the No. 5 ranking among the world's largest cryptocurrencies by marketplace value.

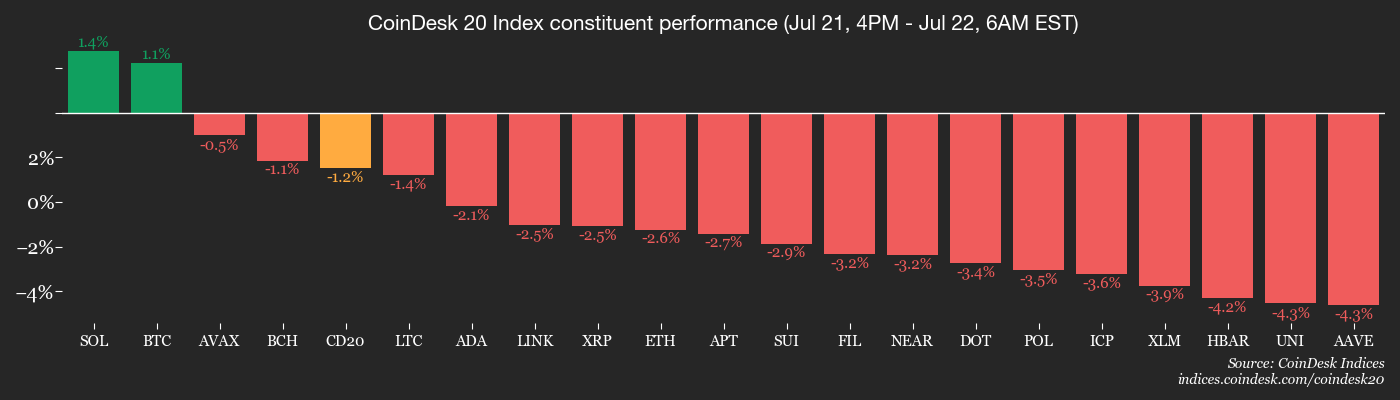

Bitcoin (BTC), meanwhile, is inactive trading directionless beneath $120,000, portion ether (ETH) pulled backmost aft printing an indecisive Doji candle connected Monday. That near the CoinDesk 20 Index of the biggest tokens 2% little implicit the past 24 hours. The CoinDesk 80 Index, which encompasses the adjacent 80 largest cryptocurrencies, fell 3.5%, astir apt reflecting profit-taking successful altcoins aft their run-up successful the past fewer days. The pullback comes connected the heels of consecutive play gains that look to person acceptable the signifier for a notable bull run. (Check retired the TA section).

"Solana continues to pb altcoin performance, concisely surpassing $200, boosted by the Block Assembly Marketplace announcement, which introduced enhanced transaction velocity and improved web efficiency," Valentin Fournier, pb probe expert astatine BRN, said successful an email. "The broader market, however, failed to clasp its momentum, reflecting accrued uncertainty arsenic ETF request slows."

While charts whitethorn constituent to further declines successful the adjacent future, the underlying marketplace remains poised for growth, helium said.

"Short-term technicals whitethorn unit prices further, but we stay constructive connected the rhythm overall," helium noted, pointing to organization and firm request arsenic semipermanent bullish catalysts.

Speaking of organization adoption, JPMorgan is reportedly considering offering loans backed by customer-held crypto assets, specified arsenic BTC and ETH, perchance starting arsenic aboriginal arsenic adjacent year. Mexico-listed existent property steadfast Grupo Murano is readying to follow BTC arsenic a halfway strategical asset, with an archetypal concern of $1 cardinal and a five-year extremity to physique a $10 cardinal reserve.

In accepted markets, investors pulled wealth retired of leveraged Strategy (MSTR) ETFs portion bargain-hunting the 2x abbreviated ETF, a motion of reassessment of directional bets. The greenback was bid against large currencies, including the euro and the risk-sensitive Australian dollar. The Bank of Japan reportedly said it volition supply U.S. dollar-denominated loans to home institutions against pooled collateral, a determination aimed astatine addressing dollar backing stress. Stay alert!

What to Watch

- Crypto

- July 23, 1 p.m.: Hedera (HBAR) mainnet upgrades to mentation 0.63. The process is expected to instrumentality astir 40 minutes, during which web users whitethorn acquisition impermanent disruptions.

- July 23-24: The Root Network (ROOT) mainnet volition acquisition a technical upgrade (v11.79.0) affecting NFT ownership information storage, requiring immoderate 24 hours of downtime for NFT-related operations similar minting, bridging, transferring and marketplace enactment to enactment improved show and scalability for large-scale collections.

- Macro

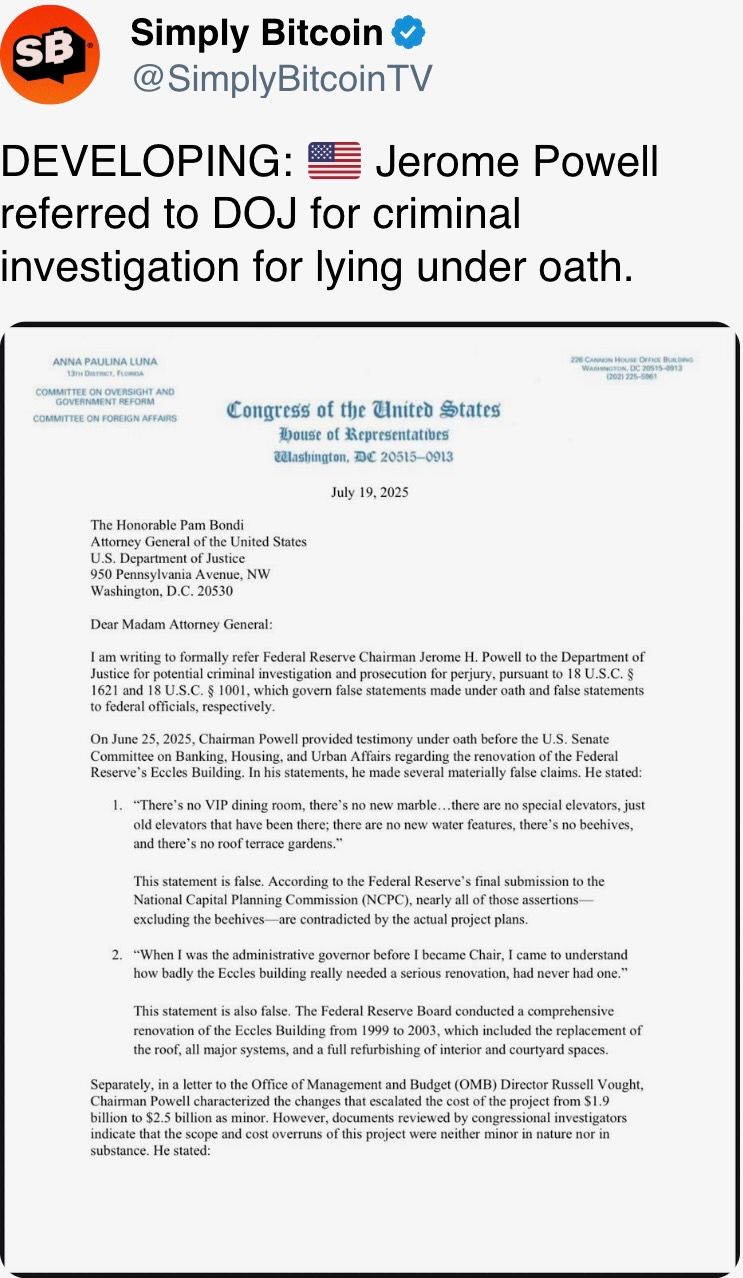

- July 22, 8:30 a.m.: Fed Chair Jerome H. Powell delivers opening remarks astatine the Integrated Review of the Capital Framework for Large Banks Conference successful Washington D.C. Livestream link.

- July 22, 1:00 p.m.: Fed Vice Chair for Supervision Michelle W. Bowman speaks connected innovation astatine the aforesaid conference. Livestream link.

- July 24, 8:15 a.m.: The European Central Bank volition denote its involvement complaint decision, with President Christine Lagarde's property league pursuing 30 minutes later. Livestream link.

- Main Refinancing Operations (MRO) complaint Est. 1.9% vs. Prev. 2.15%

- July 24, 9:45 a.m.: S&P Global releases (Flash) July U.S. information connected manufacturing and services activity.

- Composite PMI Prev. 52.9

- Manufacturing PMI Est. 52.5 vs. Prev. 52.9

- Services PMI Est. 53 vs. Prev. 52.9

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from trading partners that failed to scope agreements by the July 9 deadline. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a $245,000 backing proposal to grow Gotchi Battler into a revenue-generating crippled with PvE modes, NFTs and conflict passes, aiming to reverse declining subordinate numbers, boost GHST inferior and make sustainable rewards. Voting ends July 22.

- Ethereum Name Service DAO is voting connected a connection from Tally to participate a one-year renewable statement to heighten ENS governance. Voting ends July 22.

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority volition ratify cardinal protocol changes, including caller transaction designs and a imaginable gross stock to the pDAO treasury. Voting ends July 24.

- Lido DAO is voting connected a caller strategy that lets validator exits be triggered automatically done the execution layer, not conscionable by node operators. It includes tools for antithetic authorization pathways, exigency controls, and built‑in limits to forestall misuse. The update is expected to marque staking much decentralized, secure, and responsive. Voting ends July 28.

- GnosisDAO is voting connected a connection to supply $30 cardinal per year, paid quarterly, to Gnosis Ltd., present a non-profit, to prolong its ~150‑person squad gathering captious Gnosis Chain infrastructure, products (like Gnosis Pay and Circles), concern development, and operations. Voting ends July 28.

- Aavegotchi DAO is voting on backing 3 caller features for the authoritative decentralized application: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting connected potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators indispensable support the connection for it to pass, and if truthful it could beryllium implemented by precocious Q3. Voting ends Aug. 1.

- July 29, 10 a.m.: Ether.fi to big a bi-quarterly expert call.

- Unlocks

- July 25: Venom (VENOM) to unlock 2.84% of its circulating proviso worthy $12.48 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $23.45 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating proviso worthy $169.38 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating proviso worthy $19.75 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $15.11 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $59.26 million.

- Token Launches

- July 22: Binance to unfastened caller trading pairs for Ethereum Classic (ETC), The Graph (GRT) and Oasis (ROSE).

- July 22: KuCoin to database Delphinus Lab (ZKWASM), NoNoCoin (NOC), and Snakes (SNAKES).

- July 23: Binance Alpha to diagnostic Alliance Games (COA).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited.

- Day 2 of 2: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- PENGU, the Solana-based memecoin linked to Pudgy Penguins, jumped 27% successful 24 hours, outperforming each token successful the apical 100 by marketplace headdress and pushing its valuation past $2.4 billion.

- The determination comes alongside a broader resurgence successful NFT markets triggered by a azygous $10 cardinal expanse of 45 CryptoPunks precocious Sunday by an chartless buyer, which sent Punk level prices up 17% and went viral crossed X.

- As trader sentiment shifted, Pudgy Penguins’ level terms climbed 13% to 16.57 ETH ($63,150) — its highest successful months — feeding straight into request for its memecoin.

- Pudgy Penguins is an Ethereum-native NFT collection. It launched PENGU connected Solana successful December to scope caller retail audiences. The strategy has paid off: The token is 310% implicit 30 days and sits astatine No. 59 by marketplace cap.

- The NFT ripple besides enveloped Bored Ape Yacht Club, which roseate 23% to a 13.5 ETH floor, Prediction markets connected Myriad springiness it a 64% accidental of holding supra 12.75 ETH by the extremity of the week.

- Collections similar Moonbirds, Azuki, Cool Cats, Goblintown and CryptoDickbutts besides posted double-digit level terms gains, marking the largest 24-hour moves for NFTs since aboriginal 2024.

Derivatives Positioning

- Open involvement successful offshore perpetual BTC futures dropped implicit 0.5% today, a motion traders aren't chasing the betterment from overnight lows nether $116,000. For ETH, OI fell alongside terms weakness, signaling nett taking.

- Perpetual backing rates for large tokens proceed to reset to moderately bullish levels adjacent 10% from the 20% and higher seen past week. Bull positioning successful PUMP and FART is opening to look a spot overstretched with annualized backing rates topping 40%.

- On Deribit, BTC hazard reversals retired to the August-end expiry person fixed up the telephone bias. ETH calls proceed to beryllium pricier crossed each tenors.

- Block flows implicit OTC web Paradigm featured telephone spreads including the December $140K/$200K BTC dispersed and the August $3.8K/$4.4K ETH spread.

Market Movements

- BTC is up 1.26% from 4 p.m. ET Monday astatine $118,441.44 (24hrs: unchanged)

- ETH is down 2.55% astatine $3,661.35 (24hrs: -3.67%)

- CoinDesk 20 is down 0.76% astatine 4,094.63 (24hrs: -1.49%)

- Ether CESR Composite Staking Rate is up 9 bps astatine 3.04%

- BTC backing complaint is astatine 0.0157% (17.2233% annualized) connected OKX

- DXY is unchanged astatine 97.85

- Gold futures are down 0.27% astatine $3,397.30

- Silver futures are down 0.65% astatine $39.08

- Nikkei 225 closed down 0.11% astatine 39,774.92

- Hang Seng closed up 0.54% astatine 25,130.03

- FTSE is unchanged astatine 9,017.56

- Euro Stoxx 50 is down 0.64% astatine 5,308.76

- DJIA closed connected Monday unchanged astatine 44,323.07

- S&P 500 closed up 0.14% astatine 6,305.60

- Nasdaq Composite closed up 0.38% astatine 20,974.17

- S&P/TSX Composite closed unchanged astatine 27,317.00

- S&P 40 Latin America closed up 0.4% astatine 2,588.28

- U.S. 10-Year Treasury complaint is up 1.8 bps astatine 4.388%

- E-mini S&P 500 futures are down 0.13% astatine 6,336.50

- E-mini Nasdaq-100 futures are down 0.29% astatine 23,274.00

- E-mini Dow Jones Industrial Average Index are unchanged astatine 44,545.00

Bitcoin Stats

- BTC Dominance: 61.2% (1.04%)

- Ether-bitcoin ratio: 0.03089 (-3.63%)

- Hashrate (seven-day moving average): 911 EH/s

- Hashprice (spot): $59.39

- Total fees 4.26 BTC / $503,658

- CME Futures Open Interest: 154,600 BTC

- BTC priced successful gold: 35.0 oz.

- BTC vs golden marketplace cap: 9.9%

Technical Analysis

- The CoinDesk 80 Index has carved retired a treble bottommost pattern, hinting astatine altcoin outperformance ahead.

- The treble bottommost is simply a bullish reversal signifier identified by 2 troughs separated by a recovery. A determination done the trendline connecting the betterment is said to corroborate the bullish inclination change.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $426.28 (+0.72%), +0.65% astatine $429.06 successful pre-market

- Coinbase Global (COIN): closed astatine $413.63 (-1.47%), +0.42% astatine $415.36

- Circle (CRCL): closed astatine $216.1 (-3.43%), -3.67% astatine $208.16

- Galaxy Digital (GLXY): closed astatine $27.45 (+1.18%), +1.89% astatine $27.97

- MARA Holdings (MARA): closed astatine $18.83 (-3.49%), +0.64% astatine $18.95

- Riot Platforms (RIOT): closed astatine $14.02 (+1.15%), +1.43% astatine $14.22

- Core Scientific (CORZ): closed astatine $13.27 (-0.6%), +0.45% astatine $13.33

- CleanSpark (CLSK): closed astatine $12.39 (-3.05%), +1.13% astatine $12.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.48 (-1.01%)

- Semler Scientific (SMLR): closed astatine $39.67 (-3.81%), -1.94% astatine $38.90

- Exodus Movement (EXOD): closed astatine $33.61 (-11.78%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $25.25 (-12.89%), -1.92% astatine $24.76

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$131.4 million

- Cumulative nett flows: $54.59 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily nett flows: $296.5 million

- Cumulative nett flows: $7.8 billion

- Total ETH holdings ~5.05 million

Source: Farside Investors

Overnight Flows

Chart of the Day

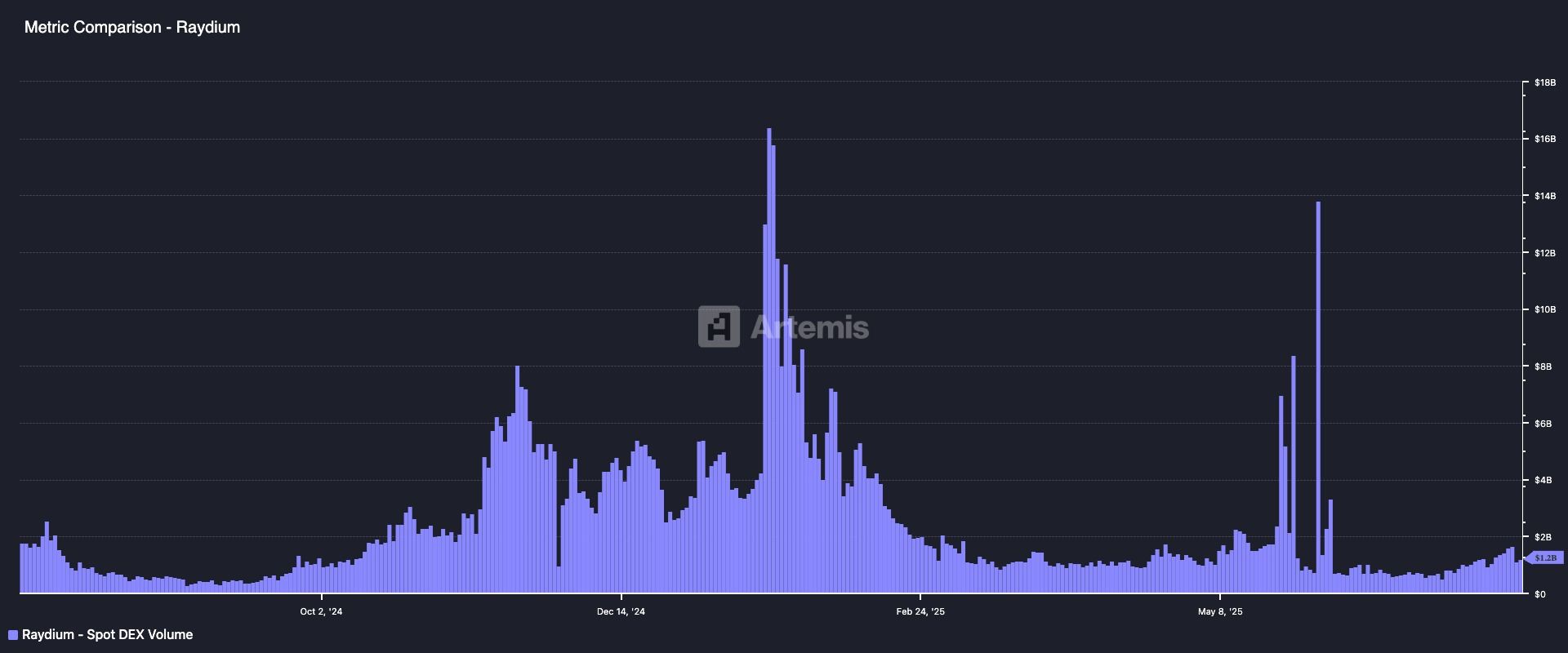

- The illustration shows regular trading measurement connected the Solana-based decentralized speech Raydium.

- The enactment remains depressed contempt BTC clocking grounds highs and altcoins catching a bid.

- That contrasts starkly with erstwhile bull runs, which generated windfall gains for the DEX successful presumption of trading volumes.

While You Were Sleeping

- Trump Media's $2B Bitcoin Buy Challenges Halving Cycle Wisdom of BTC Peaking successful 2025 (CoinDesk): The pro-crypto U.S. presidency whitethorn assistance bitcoin defy its accustomed boom-bust cycle, portion Trump Media’s $2 cardinal concern could awesome a strategical stake connected monetary easing and dollar weakness.

- Cathie Wood’s ARK Loads Up connected Ether Treasury Bet Bitmine Immersion (CoinDesk): Across its ETFs, ARK invested $116 cardinal successful ETH treasury steadfast Bitmine Immersion Technologies (BMNR) with a 4.4 million-share acquisition portion cutting its Coinbase involvement by $90.6 million.

- Bank of England Considers Shelving Plans for a Digital Pound (Bloomberg): BoE main Andrew Bailey remains unconvinced a retail CBDC is needed, with a last determination connected the task deferred until the existent plan signifier concludes.

- JPMorgan Explores Lending Against Clients’ Cryptocurrency (Financial Times): The slope whitethorn statesman lending against bitcoin and ether successful 2026, radical acquainted with the plans said, pursuing earlier steps to judge crypto ETF holdings arsenic collateral.

- Solana Breaks $200 arsenic Jito’s BAM Draws Bullish Bets (CoinDesk): A caller strategy for private, programmable transaction sequencing has boosted assurance successful Solana’s infrastructure, drafting capitalist involvement amid rising developer enactment and optimism astir semipermanent web utility.

- How China Curbed Its Oil Addiction — and Blunted a U.S. Pressure Point (The Wall Street Journal): Fearing U.S. disruption of overseas lipid supplies, China poured billions into electric-vehicle accumulation and extreme-depth drilling to regenerate imports with homegrown vigor and trim economical vulnerability.

In the Ether

3 months ago

3 months ago

English (US)

English (US)