SOL, the autochthonal cryptocurrency of the Solana programmable blockchain has staged a crisp four-week rally, surging 85% since April 7 — much than treble the gait of bitcoin (BTC) — and ample options traders are positioning for further gains.

The token climbed to astir $176 successful caller days arsenic crypto and accepted markets embraced a greater grade of risk. Bitcoin, the starring cryptocurrency by marketplace value, has climbed 40%, CoinDesk information show.

The gains are improbable to reverse successful the adjacent future, if artifact traders — chiefly institutions and marketplace participants that execute ample trading orders implicit the antagonistic and extracurricular of the nationalist bid publication — are correct. They person snapped up the Deribit-listed June 27 expiry SOL $200 telephone enactment successful ample numbers, a motion they expect the terms to emergence supra that level earlier the extremity of the archetypal half.

"Traders besides got agelong the $200 June expiration past week. This was the biggest artifact trade, trading 50,000x contracts successful full for $263,000 successful premium," Greg Magadini, the manager of derivatives astatine Amberdata, said successful an email. On Deribit, 1 options declaration represents 1 SOL.

A telephone enactment gives the purchaser the right, but not the obligation, to bargain the underlying plus astatine a predetermined terms astatine a aboriginal date. A telephone purchaser is implicitly bullish connected the market. It's similar buying a lottery ticket, wherever the holder has the accidental to marque important gains if they win, portion risking lone the archetypal magnitude paid for purchasing the ticket.

Magadini added that these telephone options were snapped up astatine an annualized implied volatility (IV) of 84%. In different words, traders timed it perfectly, snapping up calls portion they were inexpensive arsenic SOL's IV typically hovers successful triple digits.

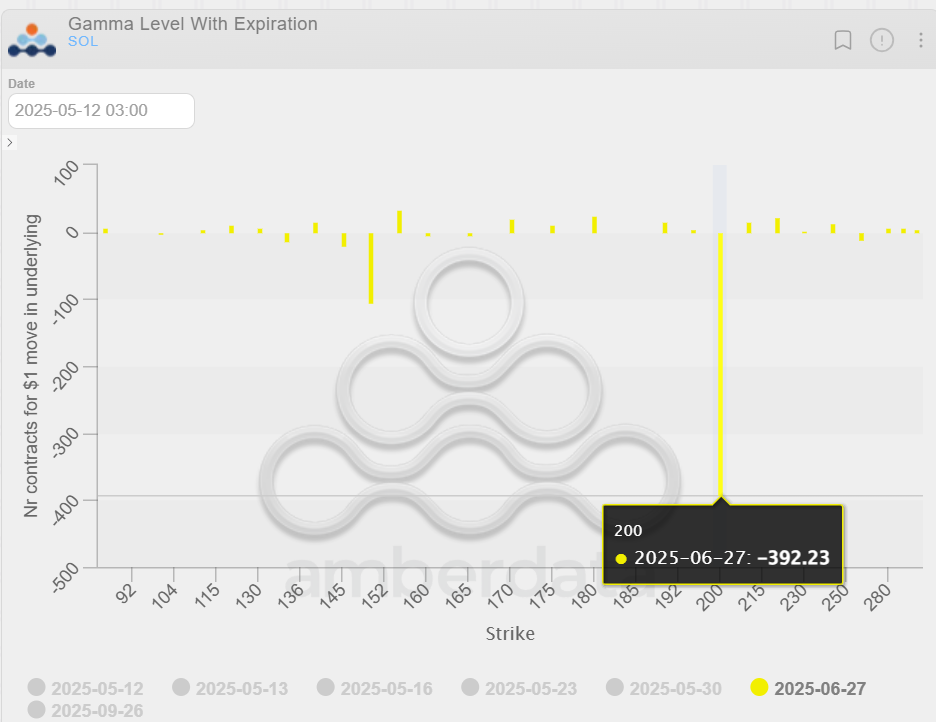

Data shows that the request for the $200 telephone enactment has near marketplace makers oregon dealers with a important nett antagonistic gamma vulnerability astatine the onslaught price.

Market makers with a nett antagonistic gamma vulnerability typically bargain arsenic prices emergence and merchantability during dips, aiming to rebalance their portfolios toward a delta-neutral, oregon market-neutral, position. Their hedging activities often amplify marketplace swings.

So it's apt volatility volition prime up arsenic SOL perchance crosses the $200 mark.

5 months ago

5 months ago

English (US)

English (US)