Based connected the U.S. Federal Reserve’s forecasts, it appears that the cardinal slope is poised to enact an further hike to the national funds complaint by the extremity of 2023. The quality comes successful the aftermath of the Federal Reserve’s determination to permission the involvement complaint unchanged during its caller gathering of the Federal Open Market Committee (FOMC). Jerome Powell, the president of the Federal Reserve, emphasized this week that the cardinal bank’s strategy entails supporting “the argumentation complaint and await further data.” He underlined the value of maintaining a “restrictive policy” to execute the desired extremity of curbing inflation.

Powell: A Soft Landing Is What ‘We’ve Been Trying to Achieve for All This Time’

During the caller FOMC gathering, the U.S. cardinal slope opted to maintain the presumption quo connected involvement rates. The FOMC’s authoritative connection underlined the “sound and resilient” quality of the U.S. banking system, adjacent successful the look of tightened recognition conditions affecting businesses and households nationwide. The cardinal slope remarked, “Recent indicators suggest that economical enactment has been expanding astatine a coagulated pace.”

Following the meeting, Jerome Powell, the Federal Reserve chairman, engaged with the media successful a property league to sermon the authorities of the U.S. economy. In a dialog with galore reporters representing assorted quality outlets, Powell articulated his long-held content successful the feasibility of a “soft landing,” a condemnation helium has held since the emergence of ostentation pressures. Powell further emphasized:

A brushed landing is simply a superior objective. And I did not accidental otherwise. I mean, that’s what we’ve been trying to execute for each this time. The existent point, though, is the worst happening we tin bash is to neglect to reconstruct terms stability, due to the fact that the grounds is wide connected that.

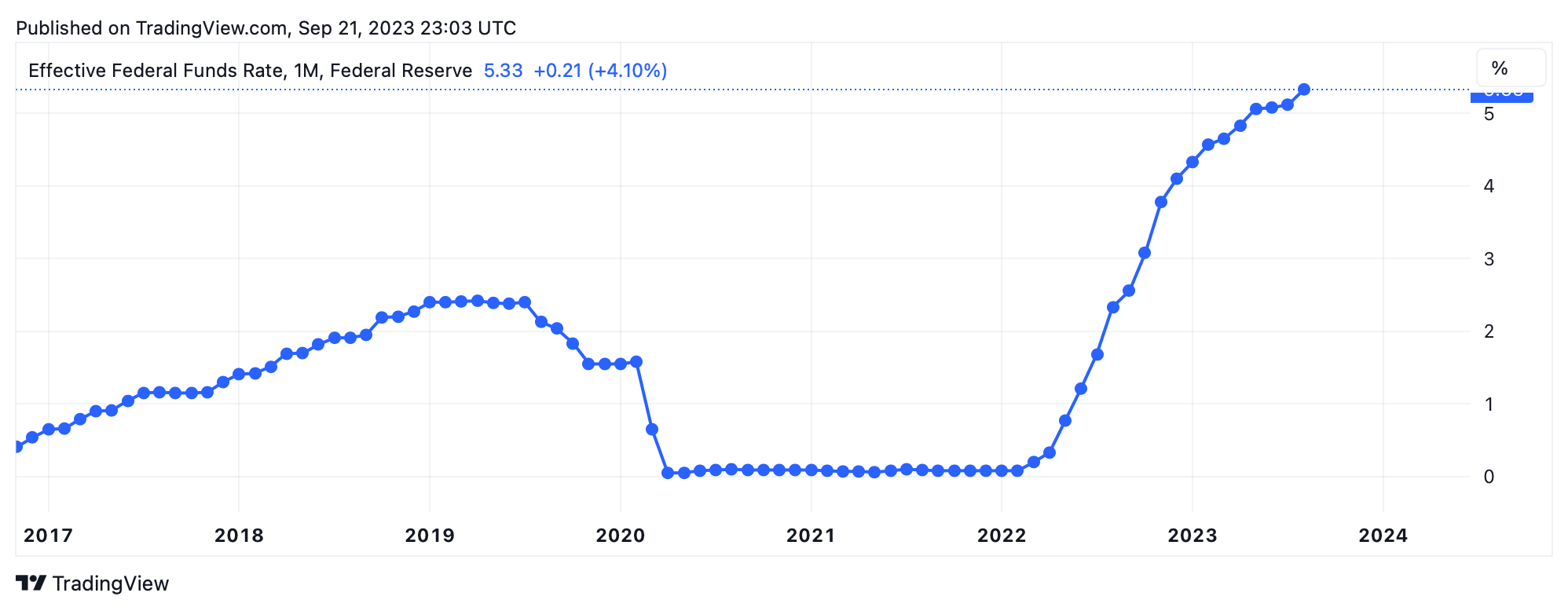

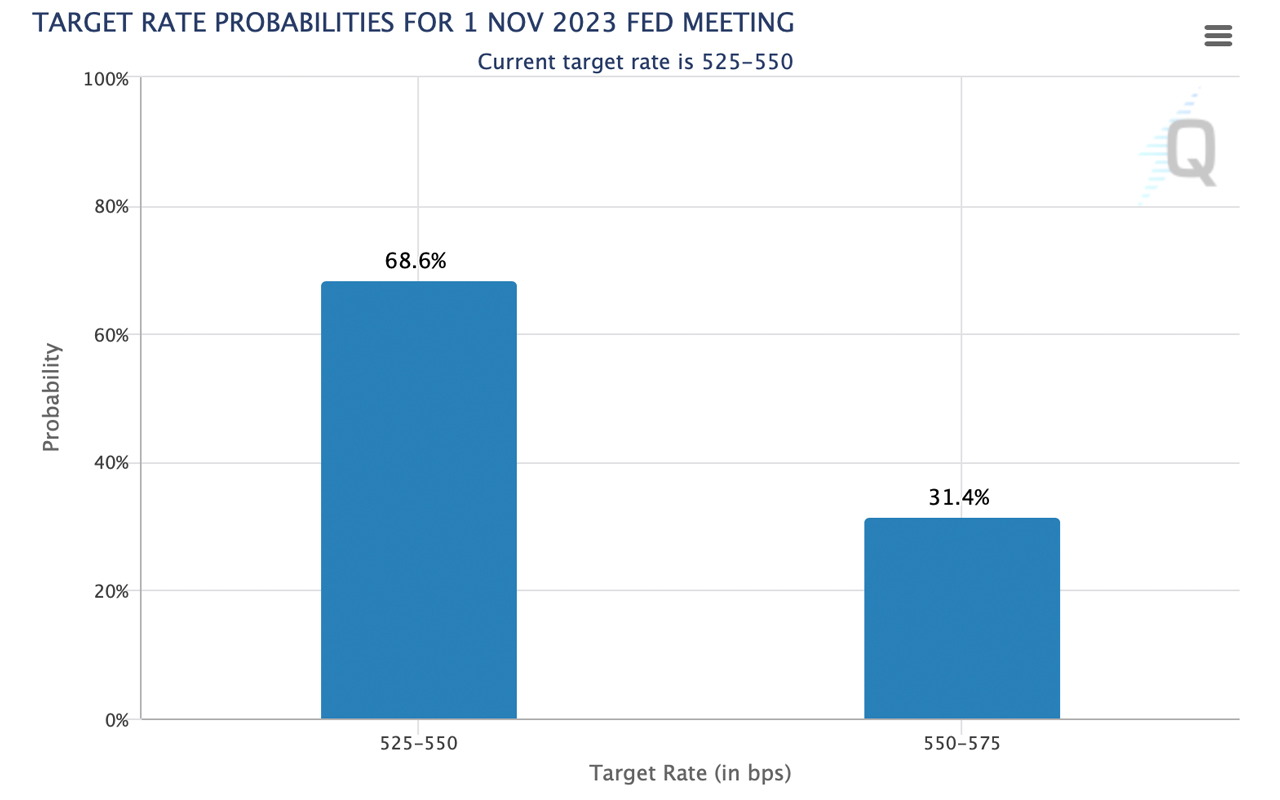

The U.S. cardinal slope has unveiled its forward-looking projections, and Federal Reserve members person underscored the likelihood of the national funds complaint climbing to 5.6% by year-end. While astir 7 Fed officials voiced reservations astir this complaint hike, a statement of 12 members is firmly successful favor. Currently, the CME Fedwatch instrumentality indicates that investors are foreseeing this summation materializing successful December.

As of September 21, 2023, the Fedwatch instrumentality registers a 68.6% probability of the complaint holding steady, with a 31.4% accidental of an upward accommodation astatine the forthcoming FOMC gathering successful November. Two much Fed gatherings are scheduled for this year. Furthermore, pursuing the Federal Reserve’s deliberations, the Bank of England and the Swiss National Bank person besides elected to support the presumption quo connected their involvement rates. On Thursday, each 4 superior U.S. indices closed successful antagonistic territory, portion the cryptocurrency marketplace experienced a 1.4% dip implicit the people of 24 hours.

In the realm of precious metals, specified arsenic golden and silver, comparative stableness has prevailed pursuing the FOMC meeting. Concurrently, lending rates successful the United States person been facing important pressure, arsenic reported by The Kobeissi Letter connected Thursday, which noted that the “average involvement complaint connected a 30-year owe rises to 7.59%, its highest since December 2000.”

“With involvement complaint cuts present nary longer expected until September 2024, it is apt we spot 8% mortgages soon,” Kobeissi posted to the societal media level X. “On apical of the Fed holding rates higher for longer, US shortage spending is truthful ample that $1.9 trillion successful bonds are being issued implicit 2 quarters. This is flooding enslaved markets with proviso and driving involvement rates adjacent higher. Currently, the median outgo connected a caller location is nearing a grounds $2,900/month. What’s the semipermanent program here?”

What bash you deliberation astir the Fed raising the national funds complaint 1 much clip earlier the extremity of 2023? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)