Bitcoin’s caller ascent has been calm and measured, a crisp opposition to the explosive rallies of the past. It’s trading supra its humanities maturation path, but acold from overheating. Long-time holders stay mostly inactive, portion the bulk of trading enactment is coming from caller faces successful the market.

Bitcoin Growth Remains On Track

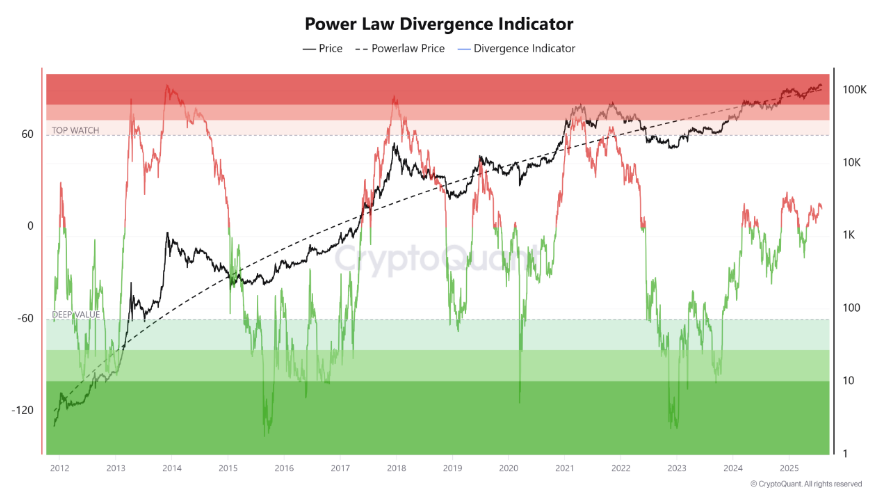

Based connected reports by Arab Chain utilizing CryptoQuant data, Bitcoin’s terms is tracking a Power Law trend that suggests a smooth, logarithmic emergence implicit time.

That exemplary creates a curved way alternatively than abrupt spikes. Right now, BTC sits supra the expected maturation enactment but good beneath the precocious “red zone” that signals overheating.

The divergence indicator is positive, yet acold from levels seen successful past bubbles. This signifier hints astatine earthy maturation oregon possibly the aboriginal stages of renewed betting.

Divergence Keeps Room For Upside

Analysts enactment that staying beneath the apical ticker portion leaves country for much gains earlier panic sets in. In anterior cycles, prices changeable done that reddish portion and past collapsed.

Today, Bitcoin is astir $50,000 nether its astir caller highest level. That spread suggests buyers inactive person breathing country if they take to propulsion prices higher.

On-chain information from Glassnode shows short-term holders (STHs) are down astir of the action. Around 86% of Bitcoin’s spent measurement implicit the past 24 hours came from wallets progressive little than 155 days, totaling $18 billion.

Long-term holders (LTHs) accounted for lone 14.5% of spent volume, oregon $3.10 billion. That divided means newer entrants are driving swings, portion seasoned holders enactment mostly connected the sidelines.

Long-Term Holders Show Conviction

That dichotomy betwixt STHs and LTHs tends to bespeak aggravated condemnation among halfway believers. When semipermanent owners stay successful place, terms drops thin to beryllium much subtle. Buyers who person hung connected for years oregon months typically presumption dips arsenic accidental to adhd alternatively than times to sell.

Bitcoin was trading astir $114,113 astatine property clip pursuing a pullback from caller highs of astir $118K. The regular Relative Strength Index had fallen to 43, indicating a nonaccomplishment of bullish momentum without going into oversold levels. On-Balance Volume has been declining successful the past week, indicating weakening buying pressure.

Market Cooling Doesn’t Mean Collapse

Reports person disclosed that this premix of signals fits a marketplace that’s cooling alternatively than crashing. Traders are taking profits, yet they aren’t rushing for the exits. The wide representation points to a maturing marketplace that inactive has country to tally but won’t apt repetition the manic swings of years past.

Featured representation from Pexels, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)