Bitcoin’s perpetual futures backing complaint represents the outgo traders incur to support agelong oregon abbreviated positions successful the perpetual swaps market, with fees shifting betwixt buyers and sellers based connected marketplace conditions.

Positive backing rates suggest that agelong positions dominate, reflecting bullish sentiment, portion antagonistic rates bespeak bearish sentiment arsenic abbreviated positions dominate.

Changes successful backing rates supply penetration into trader positioning and marketplace risk. Spikes successful backing rates often precede corrections, signaling heightened speculation and overleveraging. Conversely, antagonistic oregon neutral backing rates during consolidations tin awesome imaginable introduction points for strategical investors.

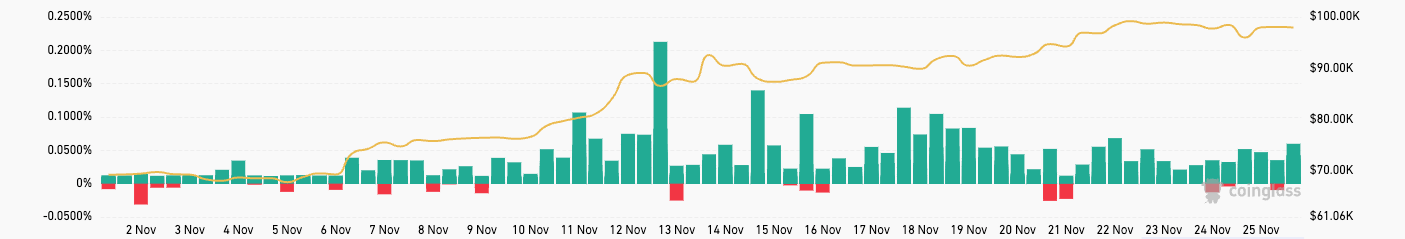

Graph showing Bitcoin’s backing complaint from Nov. 1 to Nov. 25, 2024 (Source: CoinGlass)

Graph showing Bitcoin’s backing complaint from Nov. 1 to Nov. 25, 2024 (Source: CoinGlass)Bitcoin’s existent backing complaint tracks the beardown rally we’ve seen successful November. Since the opening of the month, some volume-weighted and unfastened involvement (OI)-weighted backing rates person remained consistently positive, reaching the highest levels successful implicit a year. This sustained positivity shows the dominance of agelong positions, with traders paying a premium to support these positions.

The marketplace sentiment has been decisively bullish, arsenic evidenced by traders’ willingness to incur higher backing costs successful anticipation of continued terms increases. The heightened backing rates amusement that leveraged agelong positions person contributed to the rally.

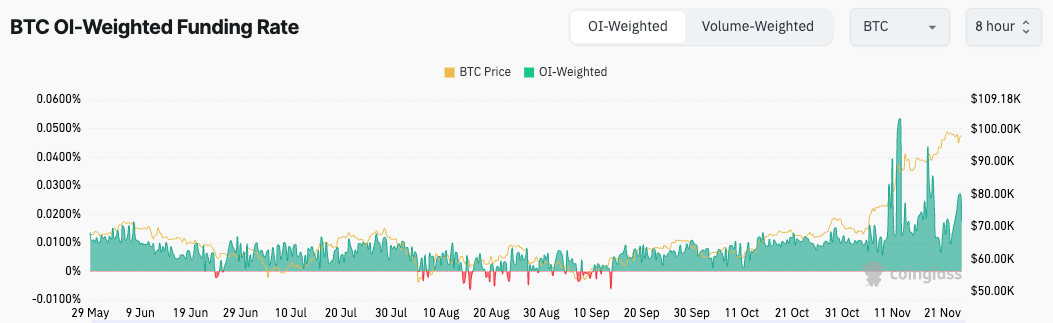

Graph showing Bitcoin’s unfastened interest-weighted backing complaint from May 29 to Nov. 25, 2024 (Source: CoinGlass)

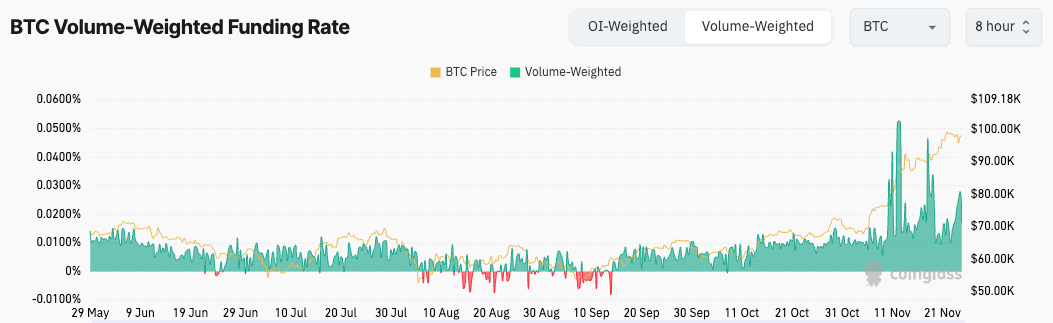

Graph showing Bitcoin’s unfastened interest-weighted backing complaint from May 29 to Nov. 25, 2024 (Source: CoinGlass)The volume-weighted backing complaint showed greater volatility than the OI-weighted rate, suggesting that trading volumes had a pronounced interaction during these accelerated terms increases. This volatility reflects speculative activity, with traders aggressively opening positions to capitalize connected Bitcoin’s momentum.

However, earlier successful the year, the concern was markedly different. From precocious June to mid-September, the marketplace saw aggregate instances of antagonistic backing rates, peculiarly successful the volume-weighted metric. This reflected bearish sentiment arsenic Bitcoin’s terms struggled to interruption retired of a range-bound phase.

During these months, traders heavy favored abbreviated positions, a cautious outlook that aligned with subdued terms action. The displacement to consistently affirmative backing rates successful precocious Q3 marked a turning point, signaling a broader modulation to bullish sentiment arsenic Bitcoin’s terms recovered.

The volume-weighted backing complaint demonstrated greater sensitivity to marketplace speculation than the OI-weighted rate. This favoritism became peculiarly evident during high-activity periods. While the OI-weighted metric, being smoother, reflects broader marketplace leverage trends, the volume-weighted complaint captures short-term fluctuations driven by speculative traders.

The summation successful some metrics from precocious September done October revealed a gradual build-up of bullish sentiment. This inclination suggests that Bitcoin’s rally was not purely driven by spot marketplace enactment but besides by the increasing power of leverage successful derivatives markets. The alignment of affirmative backing rates with sustained terms gains highlights the relation of leveraged traders successful reinforcing bullish trends.

Graph showing Bitcoin’s volume-weighted backing complaint from May 29 to Nov. 25, 2024 (Source: CoinGlass)

Graph showing Bitcoin’s volume-weighted backing complaint from May 29 to Nov. 25, 2024 (Source: CoinGlass)Despite this bullish momentum, the persistently precocious backing rates successful November raises concerns astir marketplace overheating. When backing rates stay elevated for extended periods, it often signals excessive leverage, creating a fragile marketplace environment. Overleveraging heightens the hazard of cascading liquidations if prices abruptly reverse. Periods of precocious backing rates often precede crisp corrections arsenic overextended traders are forced to exit positions.

Conversely, the antagonistic backing rates observed successful July and September provided contrarian bargain signals. During these periods, excessive bearish sentiment acceptable the signifier for terms rebounds, highlighting the worth of backing rates arsenic a predictive tool.

The station Sky-high Bitcoin backing rates amusement a leveraged yet bullish market appeared archetypal connected CryptoSlate.

10 months ago

10 months ago

English (US)

English (US)