Crypto’s US Dollar marketplace extent has importantly dropped implicit the past period pursuing Silvergate’s struggles, according to Kaiko data.

US exchanges are becoming little liquid.

Kaiko said U.S.-based exchanges and marketplace makers are becoming little liquid arsenic they look astir affected by Silvergate’s implosion.

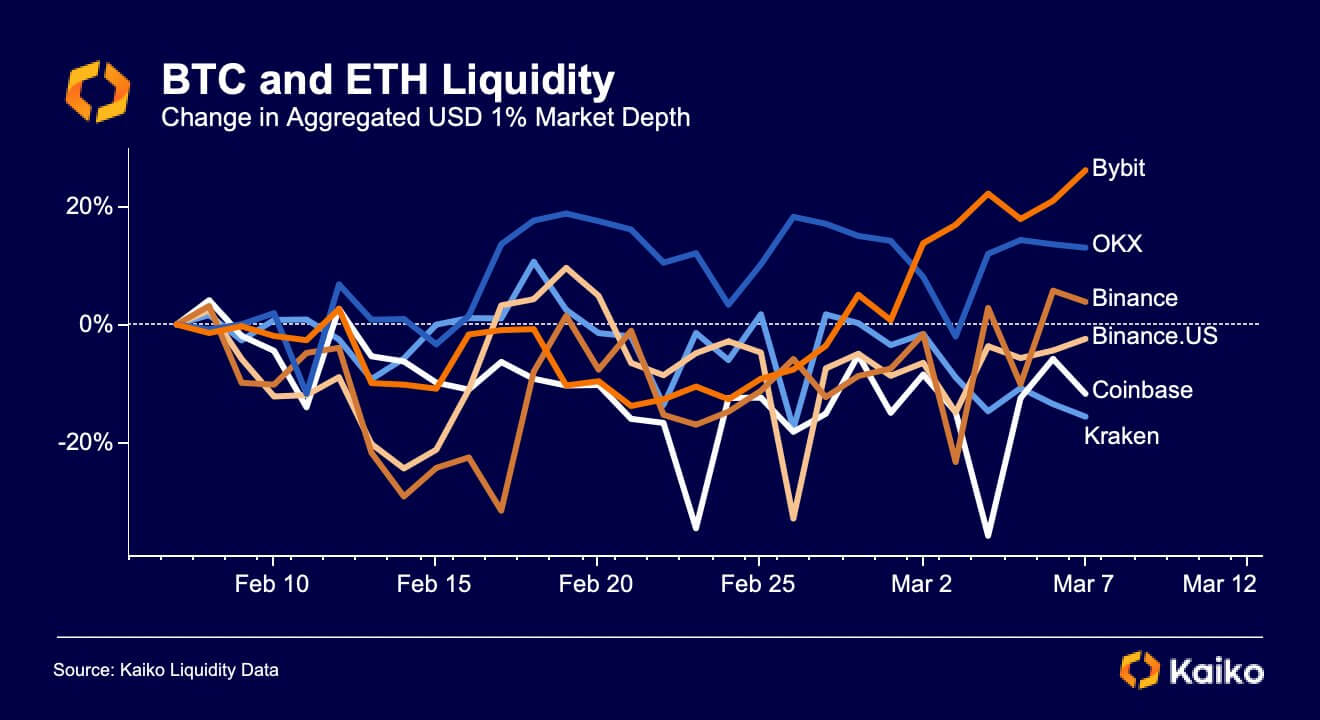

According to Kaiko data, Bitcoin and Ethereum’s marketplace extent improved crossed planetary exchanges similar Binance, OKX, and ByBit successful the past 30 days. However, they worsened connected US-based exchanges similar Coinbase and Kraken during the aforesaid period.

Source: Kaiko

Source: KaikoThe crypto market’s liquidity measures however the marketplace tin sorb ample bargain and merchantability orders without importantly affecting prices.

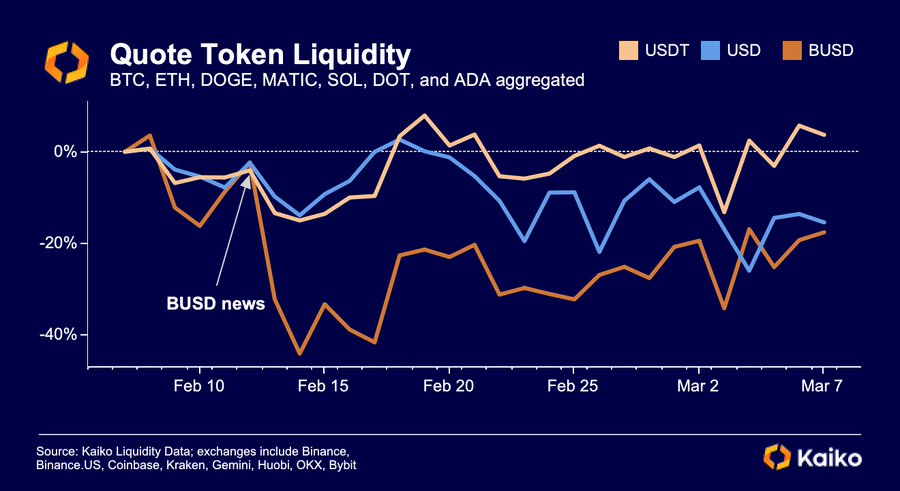

The on-chain information aggregator noted that the USD’s liquidity level was adjacent to that of Binance USD (BUSD) stablecoin. However, BUSD’s liquidity for its apical pairs had dropped by arsenic overmuch arsenic 40% erstwhile New York’s fiscal regulator ordered the asset’s issuer Paxos to halt further mints.

While BUSD’s liquidity level has begun to amended slightly, Kaiko said the Silvergate quality was “weighing connected USD pairs,” bringing it person to the level of the embattled stablecoin.

Meanwhile, the liquidity driblet crossed US exchanges appears to person contributed to ETH and BTC’s flimsy antagonistic marketplace extent implicit the period.

Silvergate relation successful crypto’s USD liquidity

The important USD liquidity diminution shows Silvergate’s relation successful connecting the accepted fiscal strategy and the crypto industry.

At its peak, the bank’s Silvergate Exchange Network (SEN) reportedly processed implicit $219 cardinal successful transfers and generated $9.3 cardinal successful gross during the 4th fourth of the 2021 marketplace rally.

Major crypto firms, including Coinbase, Gemini, Paxos, and Circle, utilized the services. Unfortunately, these institutions were forced to driblet the bank owed to concerns astir its quality to proceed operating.

Altcoins affected

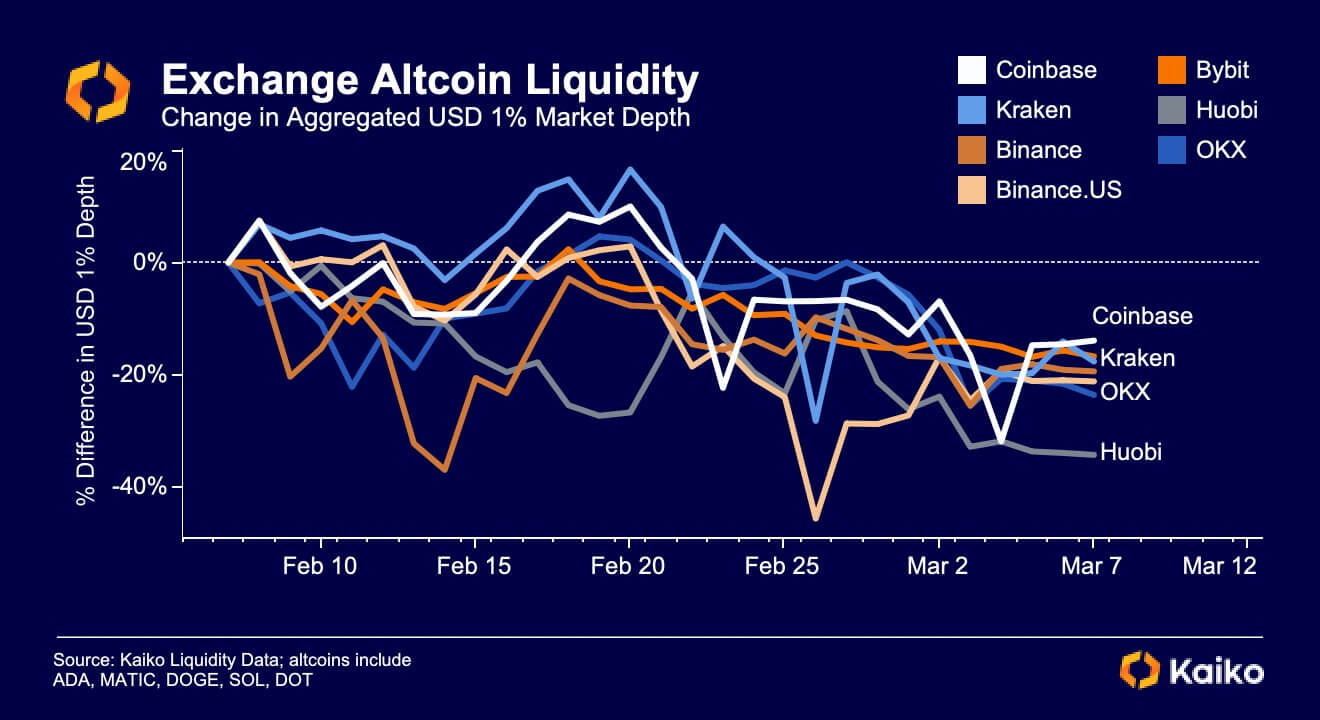

Meanwhile, the worsening liquidity appears to impact altcoins crossed respective exchanges.

Source: Kaiko

Source: KaikoKaiko’s information showed that respective exchanges had lost more than 15% of their marketplace extent for altcoins, similar Cardano’s ADA, Polygon’s MATIC, Dogecoin’s DOGE, Solana’s SOL, and Polkadot’s DOT during the past 30 days.

According to the data, the slightest affected speech was Coinbase, whose extent for these crypto-assets dropped 14%, portion others similar Bybit and Kraken mislaid 17% each. Binance and its US subsidiary shed 20%, respectively, portion Huobi is down 35%.

Source: Kaiko

Source: KaikoEuro’s measurement rises against USD.

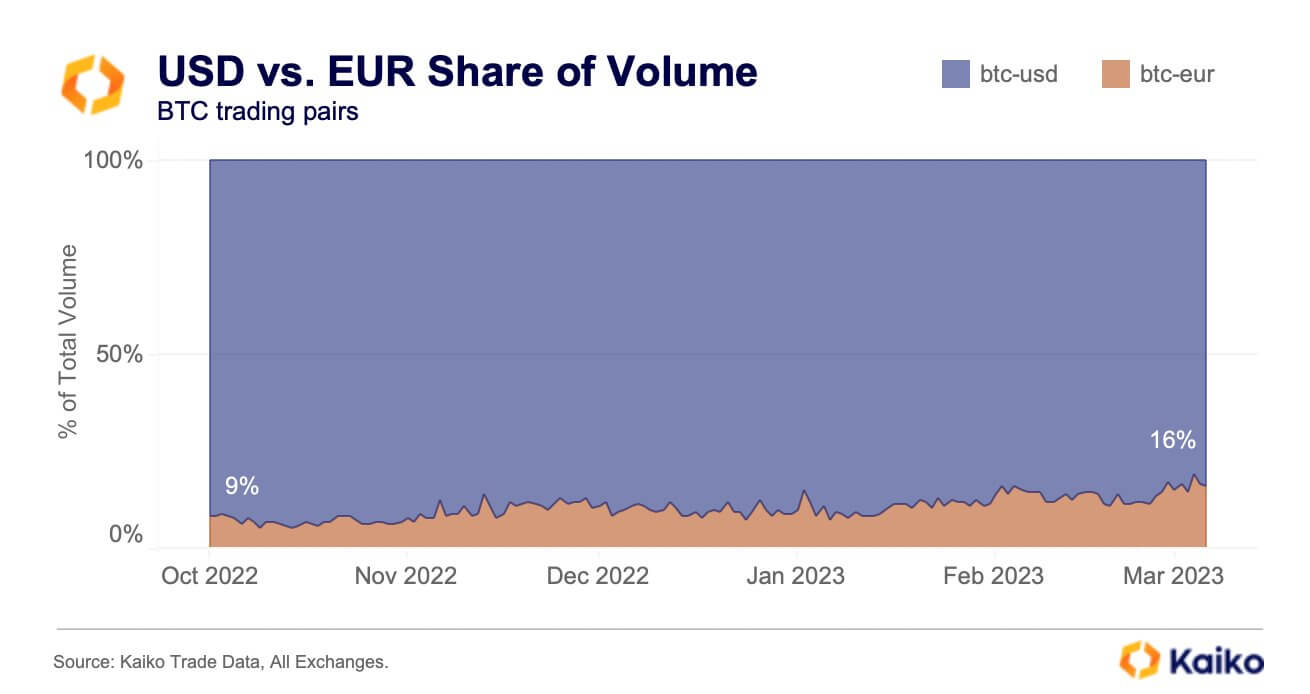

While USD’s liquidity has been dropping against the crypto market, the European Union’s Euro has been gaining crushed against Bitcoin, according to Kaiko data.

Kaiko pointed out that the Euro’s measurement comparative to USD has astir doubled since FTX’s collapse successful November 2022. According to the firm, Euro’s measurement roseate to 16% from 9% for BTC markets.

Source: Kaiko

Source: KaikoThe accrued Euro measurement has coincided with the emergence of Euro-backed stablecoins. As a result, the apical 2 stablecoin issuers, Tether and Circle, person introduced stablecoins backed by the Euro to summation marketplace share.

The station Silvergate troubles affecting crypto’s USD marketplace depth appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)