After the nonaccomplishment of Silicon Valley Bank (SVB), a large woody of Americans are starting to recognize the dangers of fractional-reserve banking. Reports amusement that SVB suffered a important slope tally aft customers attempted to retreat $42 cardinal from the slope connected Thursday. The pursuing is simply a look astatine what fractional-reserve banking is and wherefore the signifier tin pb to economical instability.

The History and Dangers of Fractional-Reserve Banking successful the United States

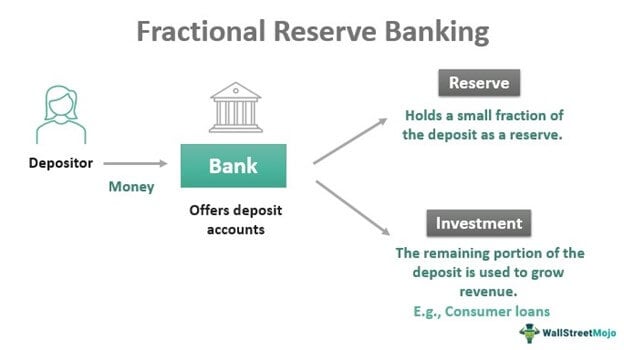

For decades, radical person warned astir the dangers of fractional-reserve banking, and the caller ordeal of Silicon Valley Bank (SVB) has brought renewed attraction to the issue. Essentially, fractional-reserve banking is simply a strategy of slope absorption that lone holds a fraction of slope deposits, with the remaining funds invested oregon loaned retired to borrowers. Fractional-reserve banking (FRB) operates successful astir each state worldwide, and successful the U.S., it became wide salient during the 19th century. Prior to this time, banks operated with afloat reserves, meaning they held 100% of their depositors’ funds successful reserve.

However, determination is considerable debate connected whether fractional lending occurs these days, with immoderate assuming that invested funds and loans are simply printed retired of bladed air. The statement stems from a Bank of England insubstantial called “Money Creation successful the Modern Economy.” It is often utilized to dispel myths associated with modern banking. Economist Robert Murphy discusses these alleged myths successful chapter 12 of his book, “Understanding Money Mechanics.”

A primer connected the mechanics of fractional reserve banking written by the economist Robert Murphy tin beryllium work here.

A primer connected the mechanics of fractional reserve banking written by the economist Robert Murphy tin beryllium work here.The FRB signifier dispersed importantly aft the transition of the National Banking Act successful 1863, which created America’s banking charter system. In the aboriginal 1900s, the fractional-reserve method started to amusement cracks with the occasional slope failures and financial crises. These became much salient aft World War I, and slope runs, highlighted successful the fashionable movie “It’s a Wonderful Life,” became commonplace astatine the time. To hole the situation, a cabal of bankers dubbed “The Money Trust” oregon “House of Morgan” worked with U.S. bureaucrats to create the Federal Reserve System.

After further troubles with fractional reserves, the Great Depression acceptable in, and U.S. President Franklin D. Roosevelt initiated the Banking Act of 1933 to reconstruct spot successful the system. The Federal Deposit Insurance Corporation (FDIC) was besides created, which provides security for depositors holding $250,000 oregon little successful a banking institution. Since then, the signifier of fractional-reserve banking continued to turn successful popularity successful the U.S. passim the 20th period and remains the ascendant signifier of banking today. Despite its popularity and wide use, fractional-reserve banking inactive poses a important menace to the economy.

History of FDIC deposit limits. pic.twitter.com/e0q1NkzW6n

— Lyn Alden (@LynAldenContact) March 12, 2023

The biggest problem with fractional-reserve banking is the menace of a slope tally due to the fact that the banks lone clasp a fraction of the deposits. If a ample fig of depositors simultaneously request their deposits back, the slope whitethorn not person capable currency connected manus to conscionable those demands. This, successful turn, causes a liquidity situation due to the fact that the slope cannot appease depositors and it could beryllium forced to default connected its obligations. One slope tally tin origin panic among different depositors banking astatine different locations. Major panic could person a ripple effect passim the full fiscal system, starring to economical instability and perchance causing a wider fiscal crisis.

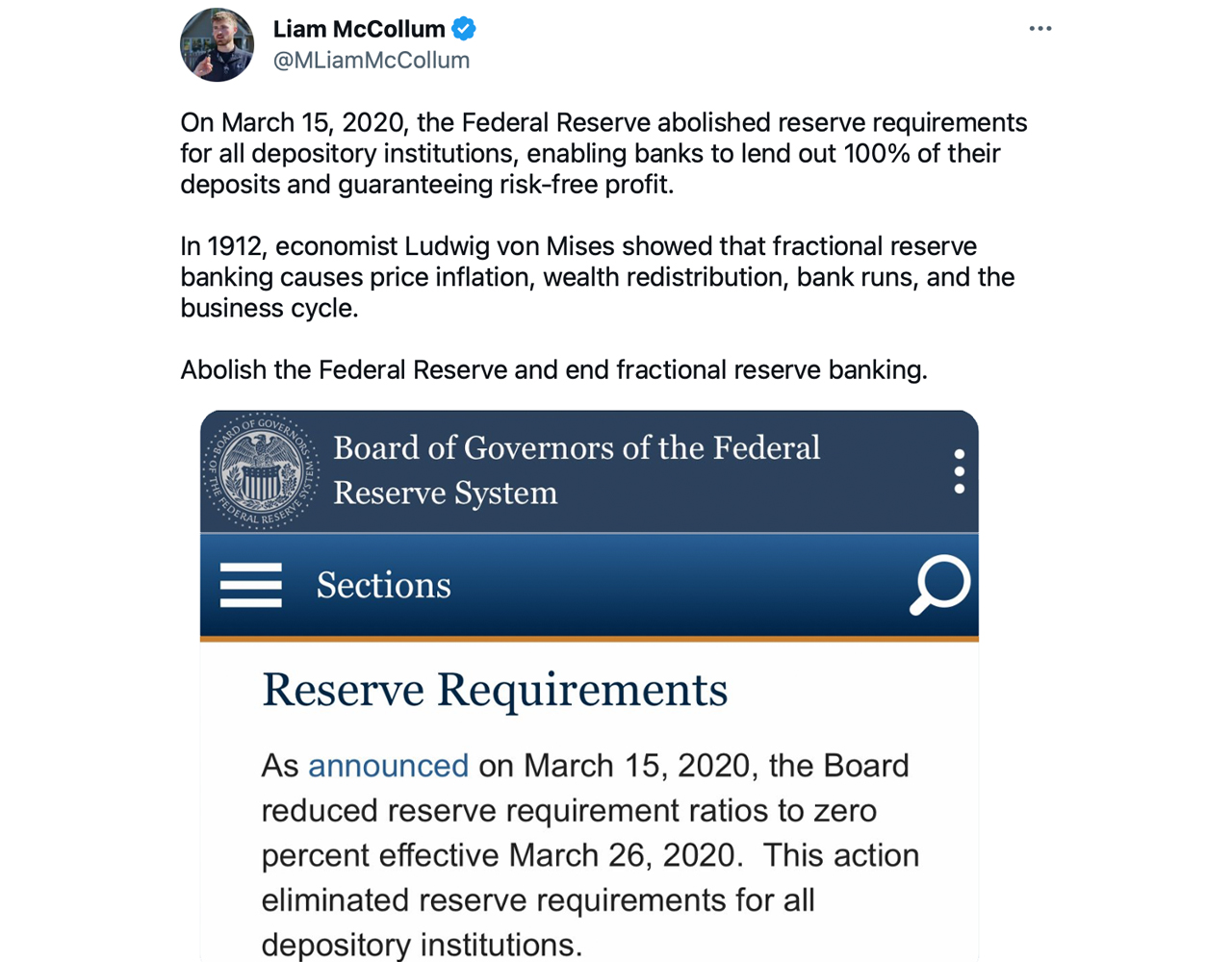

"so it's called fractional reserve banking"

"what's the fraction?"

"used to beryllium 10%. but present it's 0" pic.twitter.com/iBbH6yxDXn

— foobar (@0xfoobar) March 12, 2023

Electronic Banking and the Speed of Information Can Fuel the Threat of Financial Contagion

In the movie “It’s a Wonderful Life,” the quality of insolvency dispersed done the municipality similar wildfire, but slope tally quality these days could beryllium a full batch faster owed to respective factors related to advances successful exertion and the velocity of information. First, the net made it easier for accusation to dispersed quickly, and quality of a bank’s fiscal instability tin beryllium disseminated rapidly done societal media, quality websites, and different online platforms.

Fractional reserve banking does NOT work, particularly successful the net and societal media age.

Information and fearfulness dispersed acold excessively accelerated for an instauration to react.

What utilized to instrumentality weeks takes minutes.

A anemic instauration tin beryllium exposed and clang successful a substance of hours.

— The Wolf Of All Streets (@scottmelker) March 12, 2023

Second, physics banking has made transactions faster, and radical who privation to retreat tin bash truthful without physically going to the branch. The velocity of online banking tin pb to a faster and much wide tally connected a slope if depositors comprehend that determination is simply a hazard of their funds becoming unavailable.

Lastly, and possibly the astir important portion of today’s differences, is the interconnectedness of the planetary fiscal strategy means that a slope tally successful 1 state tin rapidly dispersed to different regions. The velocity of information, physics banking, and the connected fiscal strategy could precise good pb to a overmuch faster and much wide contagion effect than was imaginable successful the past. While the advances successful exertion person made banking a batch much businesslike and easier, these schemes person accrued the imaginable for fiscal contagion and the velocity astatine which a slope tally tin occur.

Deception and ‘Waves of Credit Bubbles With Barely a Fraction successful Reserve’

As antecedently mentioned, galore marketplace observers, analysts, and renowned economists person warned astir the issues with fractional reserve banking. Even the creator of Bitcoin, Satoshi Nakamoto, wrote astir the dangers successful the seminal achromatic paper: “The cardinal slope indispensable beryllium trusted not to debase the currency, but the past of fiat currencies is afloat of breaches of that trust. Banks indispensable beryllium trusted to clasp our wealth and transportation it electronically, but they lend it retired successful waves of recognition bubbles with hardly a fraction successful reserve,” Nakamoto wrote. This connection highlights the hazard associated with fractional reserve banking, wherever banks lend retired much wealth than they person successful reserves.

Murray Rothbard, an Austrian economist and libertarian, was a beardown professional of fractional reserve banking. “Fractional reserve banking is inherently fraudulent, and if it were not subsidized and privileged by the government, it could not agelong exist,” Rothbard erstwhile said. The Austrian economist believed that the fractional reserve strategy relied connected deception and that banks created an artificial enlargement of recognition that could pb to economical booms followed by busts. The Great Recession successful 2008 was a reminder of the dangers of fractional reserve banking, and it was the aforesaid twelvemonth that Bitcoin was introduced arsenic an alternate to accepted banking that does not trust connected the trustworthiness of centralized institutions.

So weird however America abruptly woke up and realized what fractional reserve banking is

— Erik Voorhees (@ErikVoorhees) March 12, 2023

The problems with SVB person shown that radical person a batch to larn astir these issues and astir fractional banking arsenic a whole. Currently, immoderate Americans are calling connected the Fed to bail retired Silicon Valley Bank, hoping the national authorities volition measurement successful to assist. However, adjacent if the Fed saves the time regarding SVB, the dangers of fractional reserve banking inactive exist, and galore are utilizing the SVB nonaccomplishment arsenic an illustration of wherefore 1 should not spot the banking strategy operating successful this manner.

Tags successful this story

19th century, bank runs, Banking, banks, Bitcoin, cybersecurity, data privacy, digital transformation, Economist, electronic transactions, FDIC, FDIC insurance, Finance, financial contagion, Financial Crisis, Financial Institutions, Financial Markets, Financial Regulation, Financial Services, financial stability, fractional reserves, Global Economy, Information Security, Mises, Mobile banking, Modern Day Bank runs, Murray Rothbard, online banking, risk management, Robert Murphy, Satoshi Nakamoto, Silicon Valley Bank, SVB, technology, US Banking, White Paper

What steps bash you deliberation individuals and fiscal institutions should instrumentality to hole for and mitigate the imaginable menace of fiscal contagion successful today’s rapidly evolving integer landscape? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Wall Street Mojo, It's a Wonderful Life, Twitter

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)