Bitcoin’s terms has been a survey successful tranquility since it broke done the $30,000 level, mounting a choky trading scope betwixt $30,000 and $31,000 for astir of July. This play of debased volatility has near galore traders and analysts uncertain astir aboriginal terms movements. However, on-chain data, specifically the Spent Output Profit Ratio (SOPR), whitethorn supply a clearer representation of wherever the marketplace mightiness beryllium heading.

SOPR is simply a important metric successful Bitcoin analysis. It is calculated by dividing the terms sold by the terms paid for a Bitcoin, efficaciously measuring the nett oregon nonaccomplishment made by Bitcoin holders erstwhile they merchantability their coins. A rising SOPR indicates that holders are selling astatine a profit, portion a declining SOPR suggests selling astatine a loss. The entity-adjusted SOPR, which considers lone entities that person been progressive for astatine slightest a month, provides a much close gauge of the market.

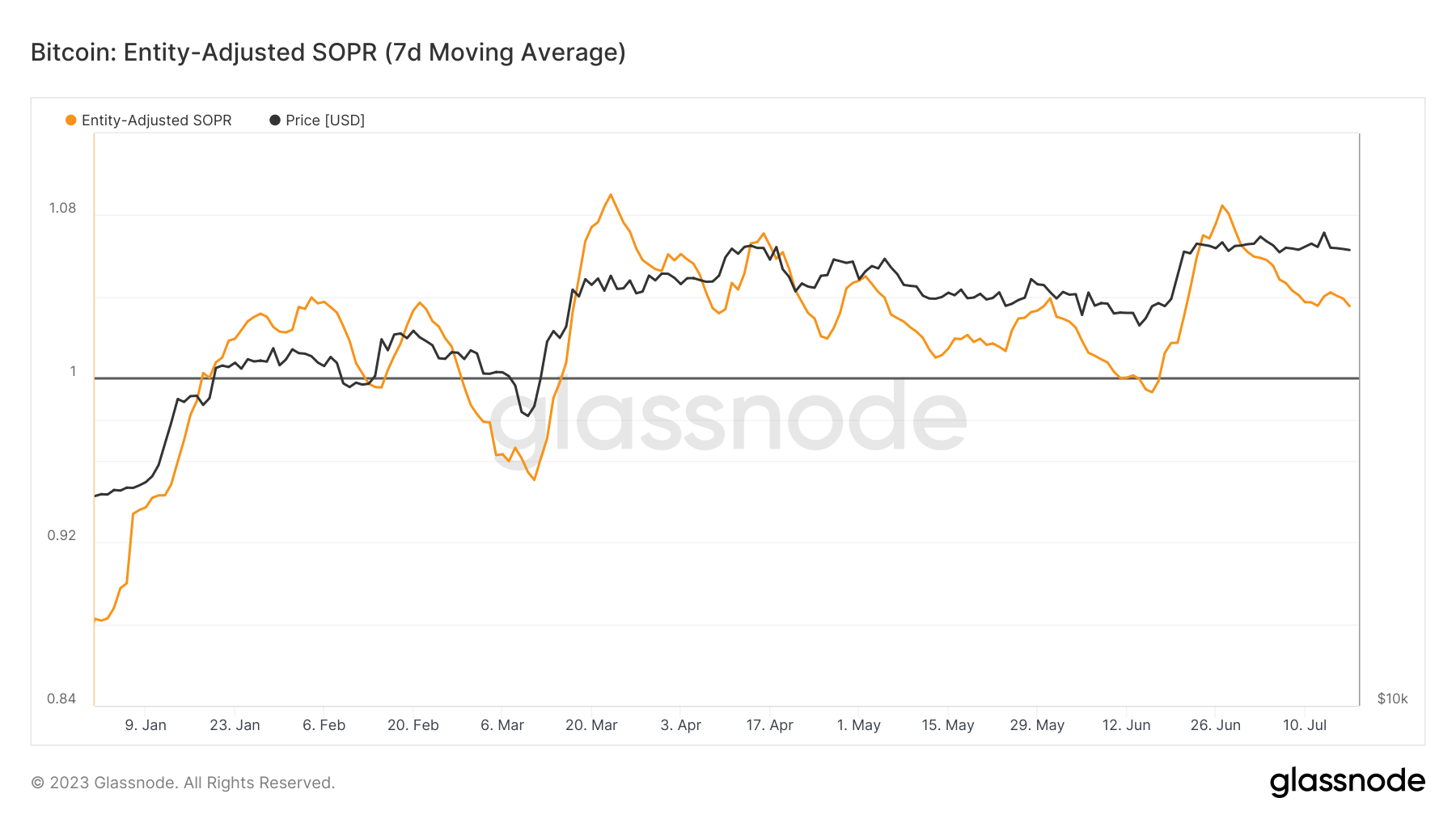

The 7-day moving mean of the entity-adjusted SOPR has been connected an upward trajectory since the commencement of the year, breaking supra the worth of 1. Despite experiencing respective crisp uptrends successful January, February, and June, it has been declining since June 27, dropping to a worth of 1.03 connected July 17.

Graph showing the entity-adjusted Bitcoin SOPR YTD (Source: Glassnode)

Graph showing the entity-adjusted Bitcoin SOPR YTD (Source: Glassnode)However, contempt the notable drop, the ratio remains successful a profit-dominant regime. This means that, connected average, the entities selling their Bitcoin are inactive doing truthful astatine a profit.

According to marketplace analysis, the existent sideways SOPR inclination could bespeak a marketplace successful a consolidation phase, perchance mounting the signifier for the adjacent important terms question successful Bitcoin.

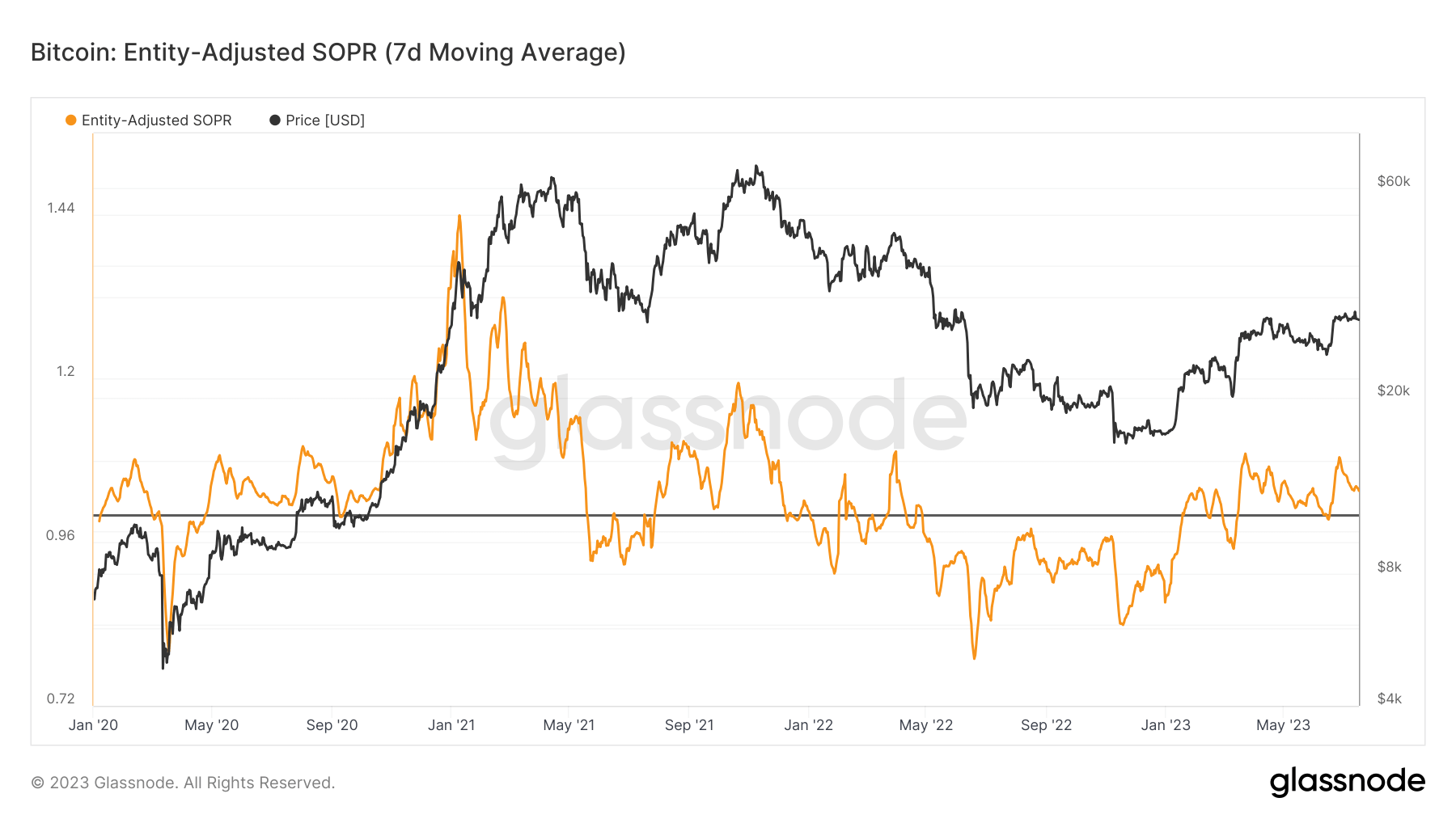

In the satellite of trading and investing, consolidation is simply a play of indecision that ends erstwhile the asset’s terms breaks beyond the restrictive barriers. A important terms rally could travel this period, arsenic successful 2016 and 2019.

Graph showing the entity-adjusted Bitcoin SOPR from January 2020 to July 2023 (Source: Glassnode)

Graph showing the entity-adjusted Bitcoin SOPR from January 2020 to July 2023 (Source: Glassnode)Moreover, a dependable SOPR could besides suggest a balanced marketplace wherever the fig of Bitcoin sellers making profits is astir adjacent to those incurring losses.. This equilibrium could perchance pb to a much unchangeable market, reducing the likelihood of utmost terms volatility successful the abbreviated term.

The station Sideways SOPR: A prelude to Bitcoin’s adjacent large move? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)