Monitoring unrealized nett and nonaccomplishment is simply a cornerstone of marketplace analysis. While realized nett and nonaccomplishment connection a snapshot of the market’s past behavior, unrealized profit, and nonaccomplishment supply a model into the market’s imaginable trajectory. This favoritism becomes adjacent much pronounced erstwhile we zero successful connected short-term holders.

Short-term holders, defined arsenic entities holding Bitcoin (BTC) for little than 155 days, play a pivotal relation successful shaping the marketplace dynamics. Their behavior, driven by caller marketplace trends and short-term goals, profoundly influences Bitcoin’s price. Conversely, terms movements tin besides sway their decisions, creating a feedback loop that stabilizes oregon destabilizes the market.

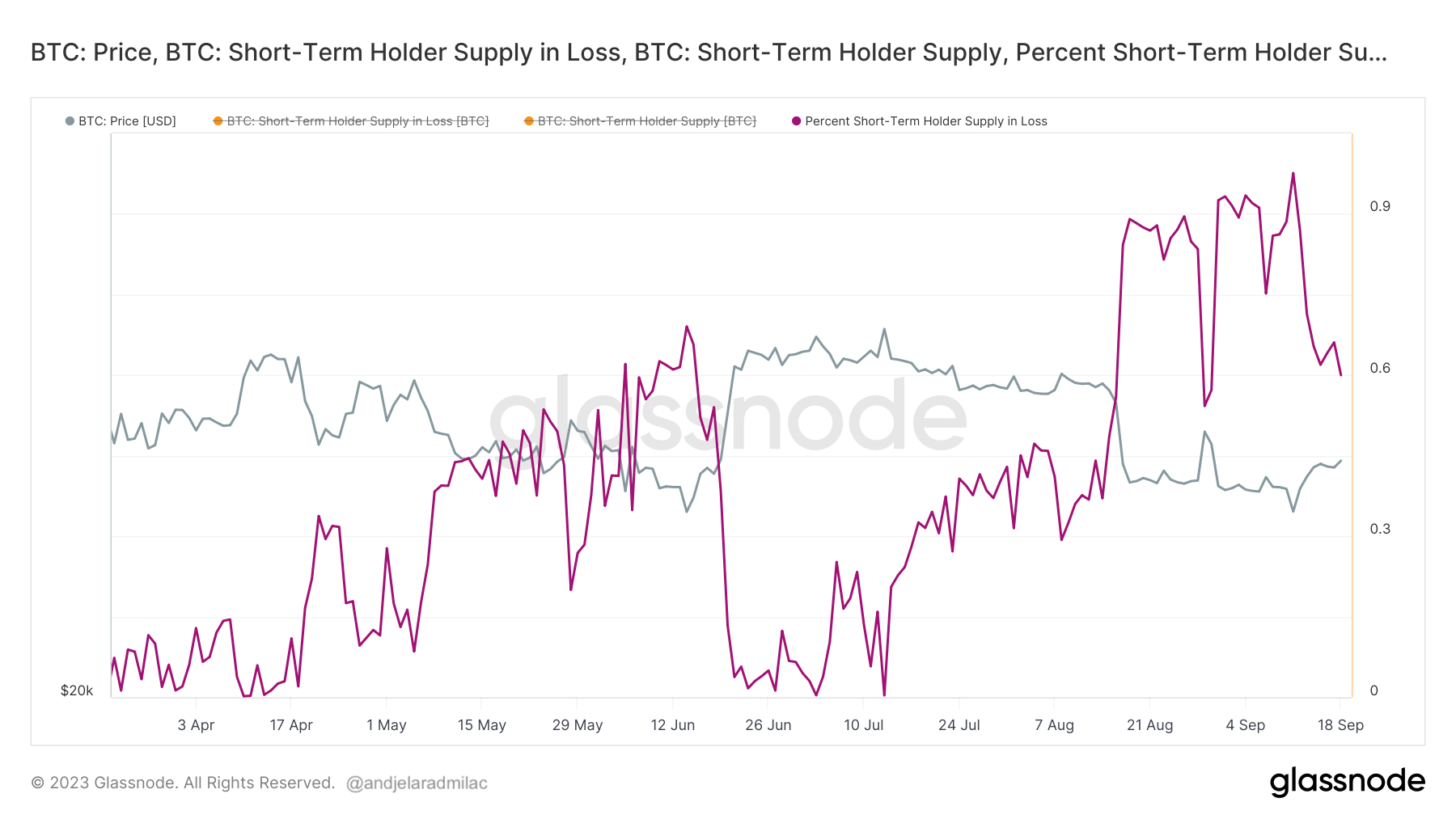

Recent information from Glassnode sheds airy connected the authorities of short-term holders. Following Bitcoin’s little dip to $25,000 connected Sep. 11, the percent of short-term holder proviso successful nonaccomplishment roseate to 97.61%. Bitcoin’s betterment to $27,000 reduced the proviso nonaccomplishment to 59%. On Sep. 19.

Graph showing the percent of short-term holder proviso successful nonaccomplishment from March 22 to Sep. 19, 2023 (Source: Glassnode)

Graph showing the percent of short-term holder proviso successful nonaccomplishment from March 22 to Sep. 19, 2023 (Source: Glassnode)The MVRV ratio shows short-term holders’ unrealized nett oregon nonaccomplishment comparative to the asset’s marketplace value.

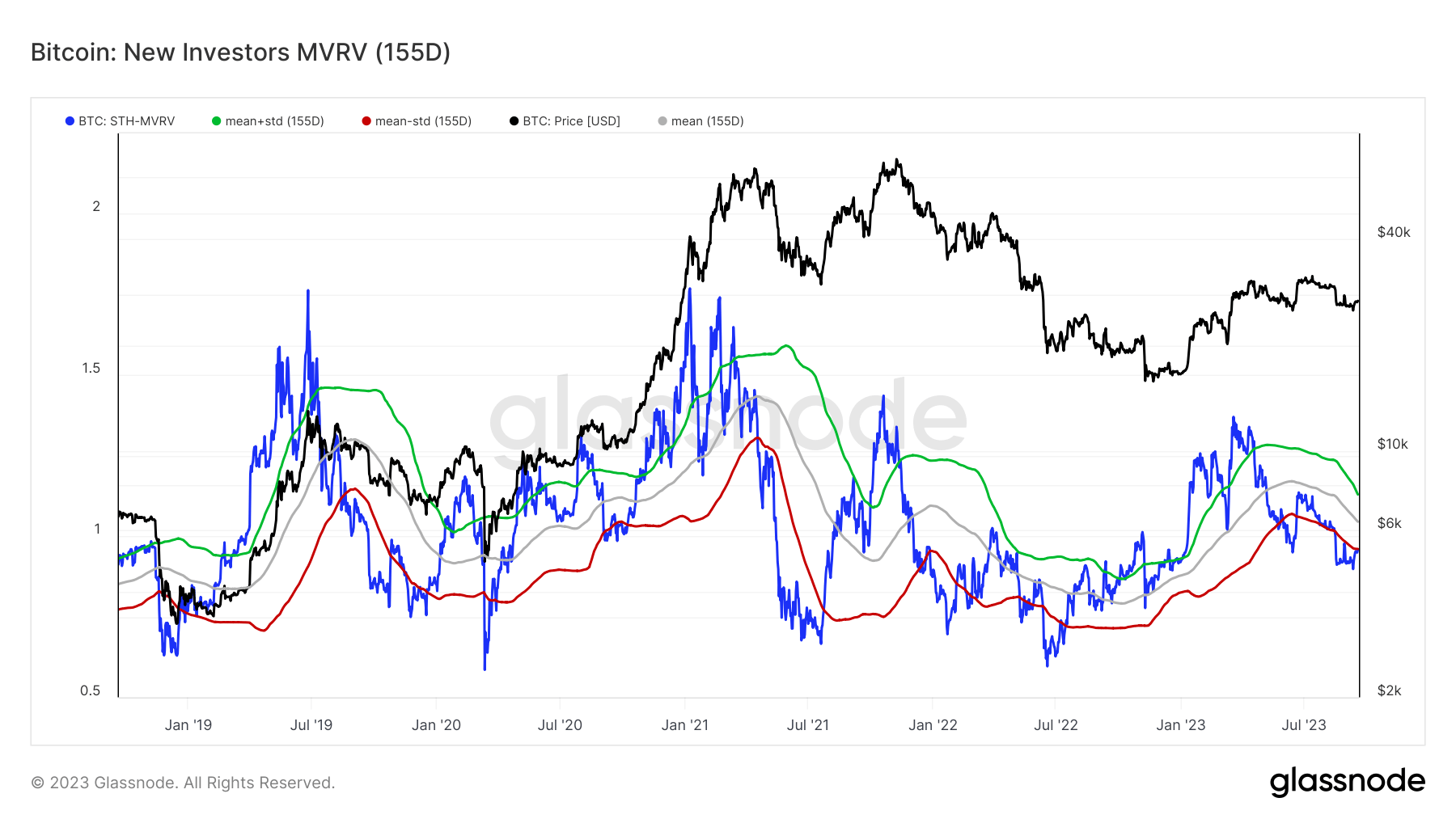

By juxtaposing the extremes successful STH-MVRV against its 155-day average, we tin make precocious and little bands for the indicator. The precocious set represents the mean positive 1 modular deviation, portion the little set is the mean minus 1 modular deviation.

These bands amusement that galore of the market’s highs and lows correlated with important deviations extracurricular these boundaries. This indicates that caller investors were either reaping important profits oregon nursing important losses during these periods.

Graph showing the STH-MVRV ratio from Sep. 2018 to Sep. 2023. Note that marketplace tops and marketplace bottoms correlate with utmost deviations of the STH-MVRV ratio (Source: Glassnode)

Graph showing the STH-MVRV ratio from Sep. 2018 to Sep. 2023. Note that marketplace tops and marketplace bottoms correlate with utmost deviations of the STH-MVRV ratio (Source: Glassnode)As of Sep. 11, the STH-MVRV ratio hovers astatine 0.95, brushing against the little band. It’s worthy noting that the STH-MVRV dipped beneath this little threshold connected Aug. 15, coinciding with Bitcoin’s terms descent from $29,000 to $26,000. The ratio has remained beneath this set since then.

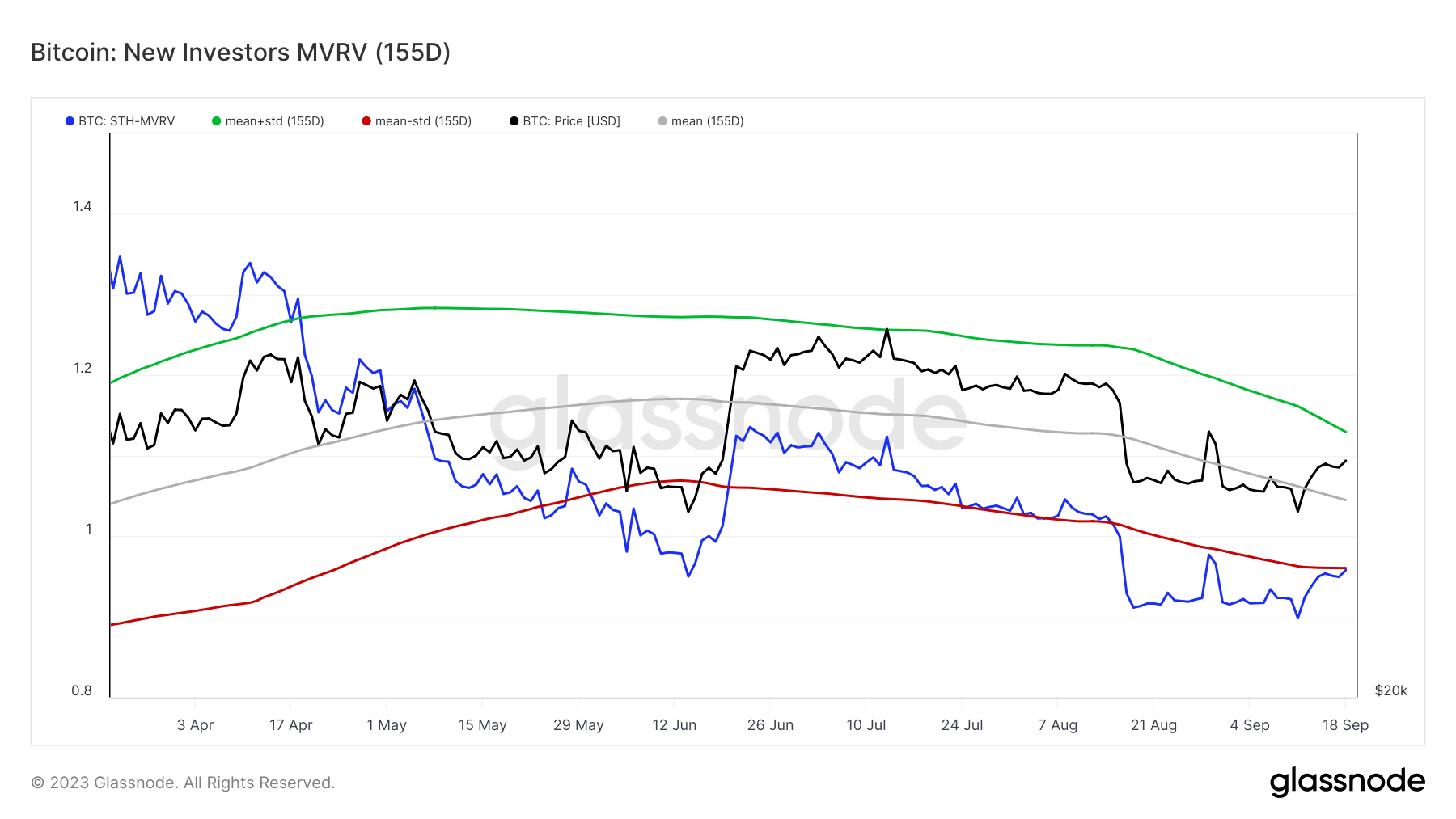

Graph showing the STH-MVRV ratio from March 22 to Sep. 22, 2023 (Source: Glassnode)

Graph showing the STH-MVRV ratio from March 22 to Sep. 22, 2023 (Source: Glassnode)The existent presumption of the STH-MVRV ratio, coupled with the percent of short-term holder proviso successful loss, suggests a heightened authorities of seller exhaustion. In the discourse of Bitcoin’s price, seller exhaustion implies that the selling unit starts to wane arsenic astir short-term holders who privation to merchantability person already done so. Historically, specified scenarios person often paved the mode for terms recoveries arsenic selling pressures diminish.

The station Short-term holders amusement signs of seller exhaustion appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)