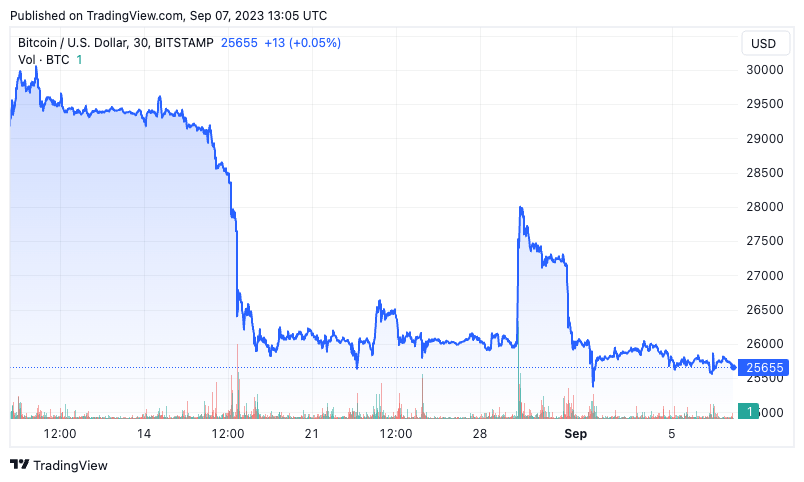

Bitcoin’s driblet from $29,000 successful mid-August has importantly changed marketplace dynamics. Despite the short-lived leap to $27,000 pursuing the quality astir Grayscale’s triumph against the SEC, Bitcoin is inactive hovering astir $25,700.

Graph showing Bitcoin’s terms from Aug. 1 to Sep. 7, 2023 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from Aug. 1 to Sep. 7, 2023 (Source: CryptoSlate BTC)A deeper dive into on-chain metrics reveals that this downward unit chiefly comes from short-term holders offloading their assets.

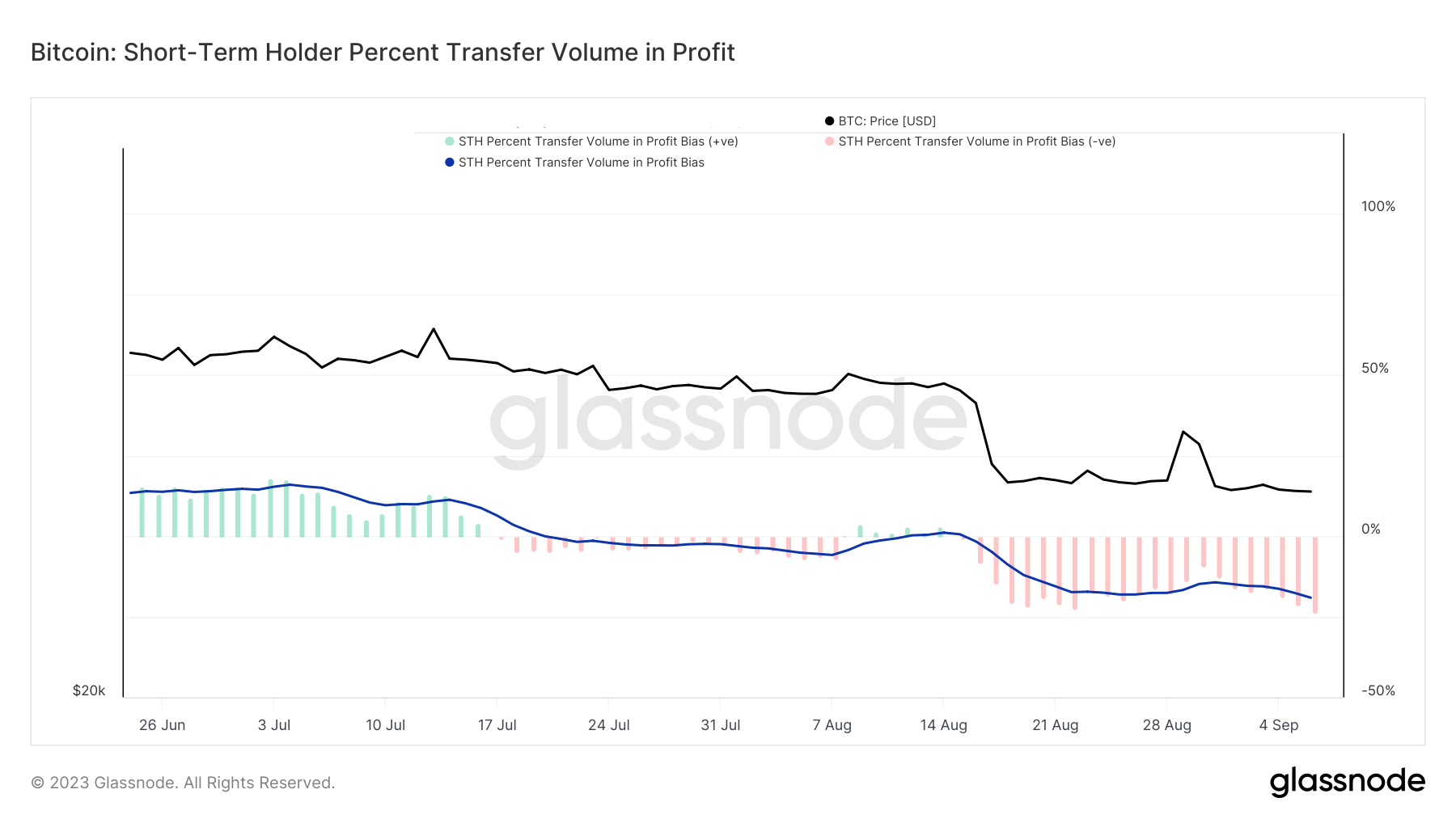

One of the astir telling metrics successful this script is the short-term holder percent transportation measurement successful profit. This metric offers insights into the bias of on-chain worth settled by short-term holders, either successful nett oregon loss.

A affirmative worth indicates that implicit 50% of the short-term holder transportation measurement is successful profit, portion a antagonistic worth suggests the opposite, signaling that much than fractional of the short-term holder transportation measurement is successful loss.

Data from Glassnode shows a dip successful the STH transportation measurement nett correlating with Bitcoin’s diminution from $29,400. As of Sep. 6, the STH transportation measurement bias stood astatine –23.5 %, indicating that a important information of the transportation measurement from short-term holders was astatine a loss.

Graph showing the short-term holder percent transportation measurement successful nett from June to September 2023 (Source: Glassnode)

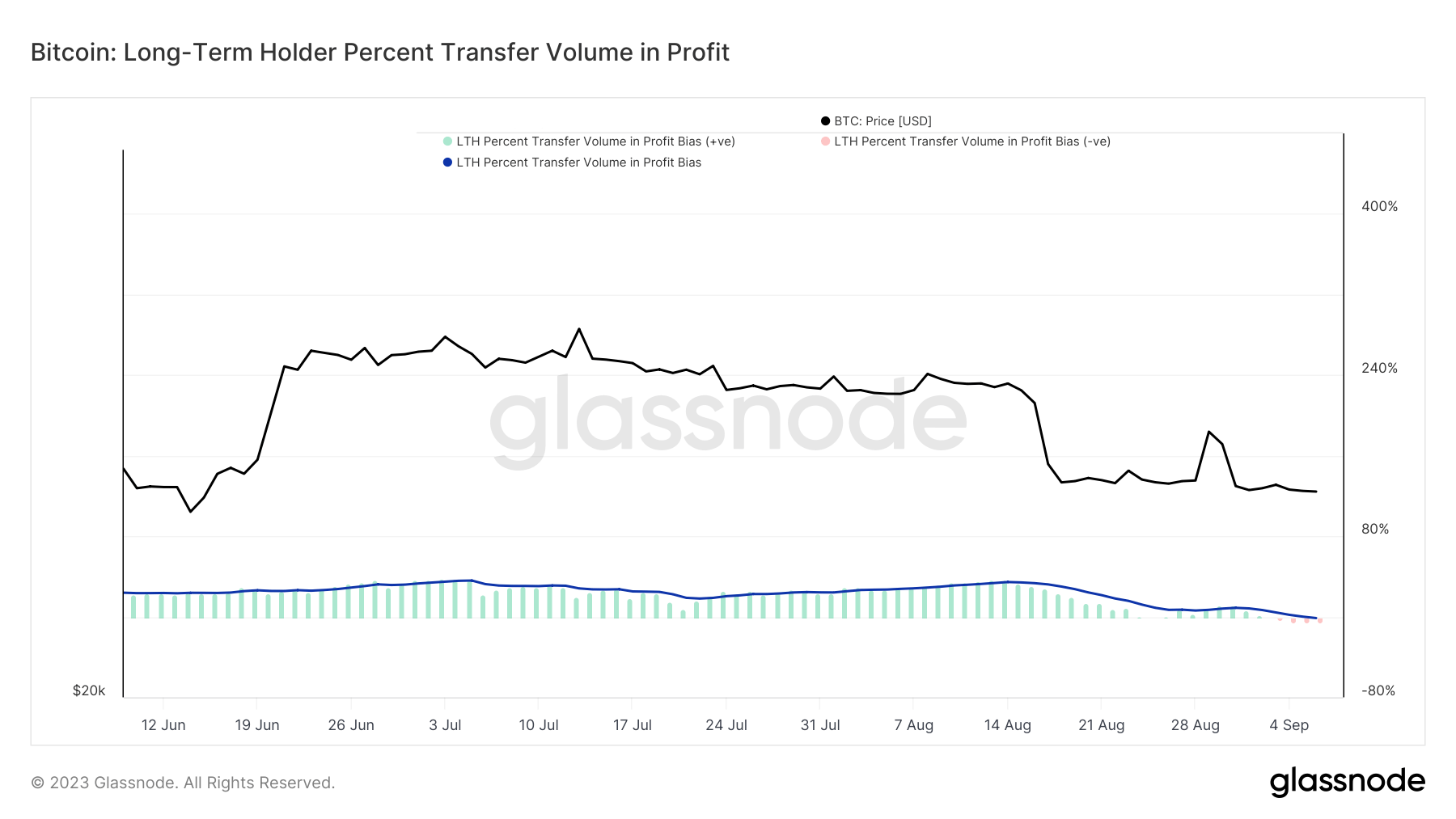

Graph showing the short-term holder percent transportation measurement successful nett from June to September 2023 (Source: Glassnode)Contrastingly, semipermanent holders grounds a much resilient stance. Their metrics began to amusement transfers successful nonaccomplishment lone arsenic of Sep. 3. By Sep. 6, the semipermanent holder percent transportation measurement bias was recorded astatine -5.5%, indicating that astir semipermanent holders stay successful nett contempt the market’s caller turbulence.

Graph showing the semipermanent holder percent transportation measurement successful nett from June to September 2023 (Source: Glassnode)

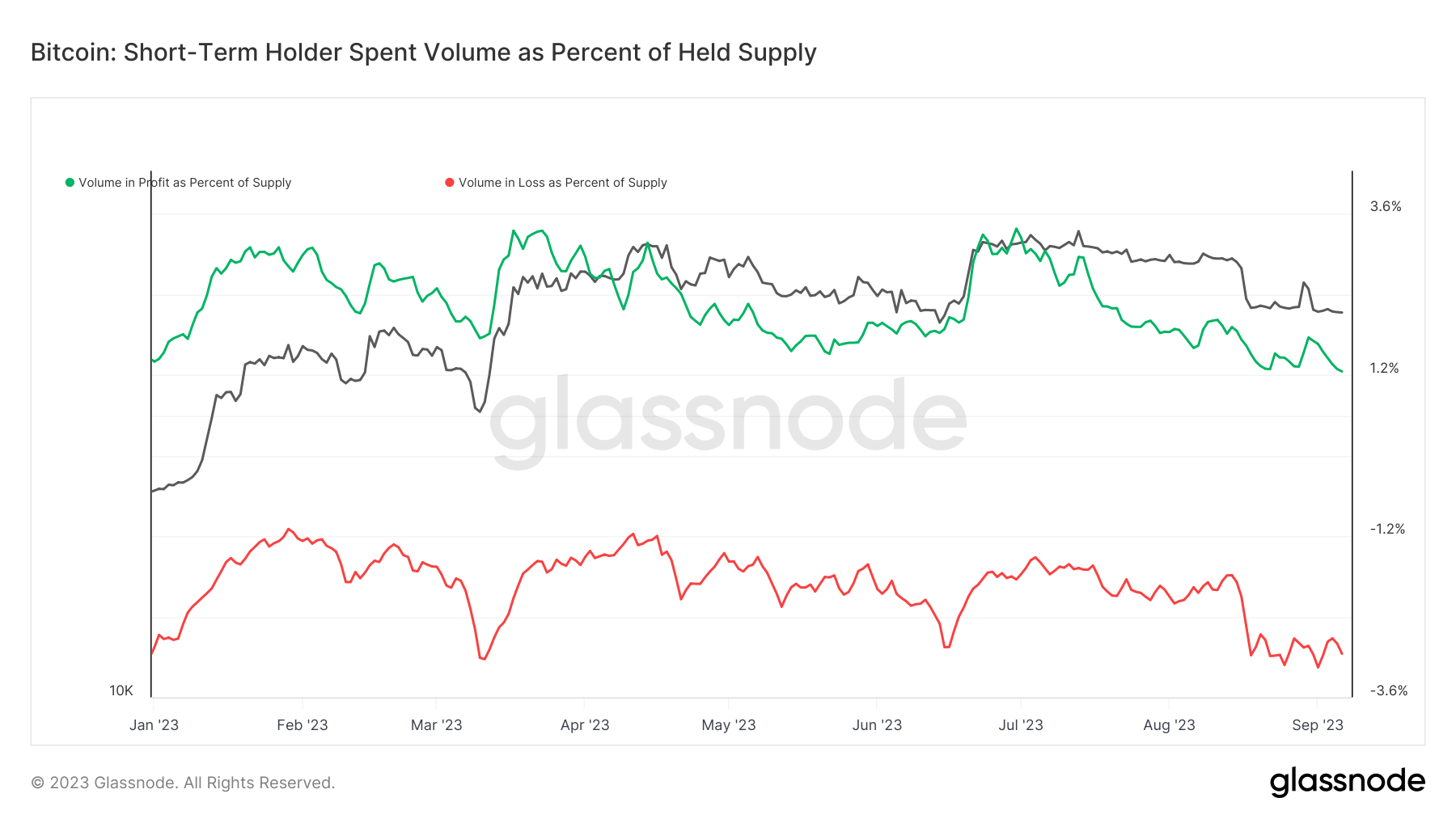

Graph showing the semipermanent holder percent transportation measurement successful nett from June to September 2023 (Source: Glassnode)Another metric worthy noting is the short-term holder spent measurement arsenic a percent of held supply. This metric showcases the proportionality of on-chain transportation measurement by short-term holders comparative to their full maintained supply. Historically, important movements successful this metric person been associated with high-volatility events. On Sept. 3, 3.1% of the full short-term holder proviso transacted astatine a loss. The past clip specified a precocious percent was observed was successful mid-March, correlating with Bitcoin’s terms plummeting from $23,000 to $20,000.

Graph showing short-term holder spent measurement arsenic a percent of held proviso YTD (Source: Glassnode)

Graph showing short-term holder spent measurement arsenic a percent of held proviso YTD (Source: Glassnode)The heightened selling unit from short-term holders could bespeak a deficiency of assurance successful Bitcoin’s short-term terms trajectory. However, the resilience shown by semipermanent holders suggests a continued content successful Bitcoin’s semipermanent value.

The station Short-term holders carnivore the brunt of Bitcoin’s volatility appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)