Bitcoin experienced a important dip past week, losing implicit 9% successful 24 hours and dropping to $26,299 connected Aug. 18. Its terms plunged adjacent further during the weekend, settling astatine $26,198 connected Aug. 20.

A monolithic exodus of leverage from the derivatives marketplace chiefly triggered this abrupt decline. As leverage was flushed out, the spot marketplace rapidly followed suit, exerting adjacent much downward unit connected Bitcoin’s price.

And portion Bitcoin’s terms presently stands supra the $26,000 level, its stableness supra this threshold is nether question. There’s an underlying interest that if short-term holders commencement offloading their holdings driven by panic, the terms could driblet adjacent further.

Short-term holders are entities that person held onto their Bitcoin for little than 155 days. As newcomers to the market, they are typically much reactive to terms fluctuations, often making trading decisions based connected short-term marketplace dynamics alternatively than semipermanent potential.

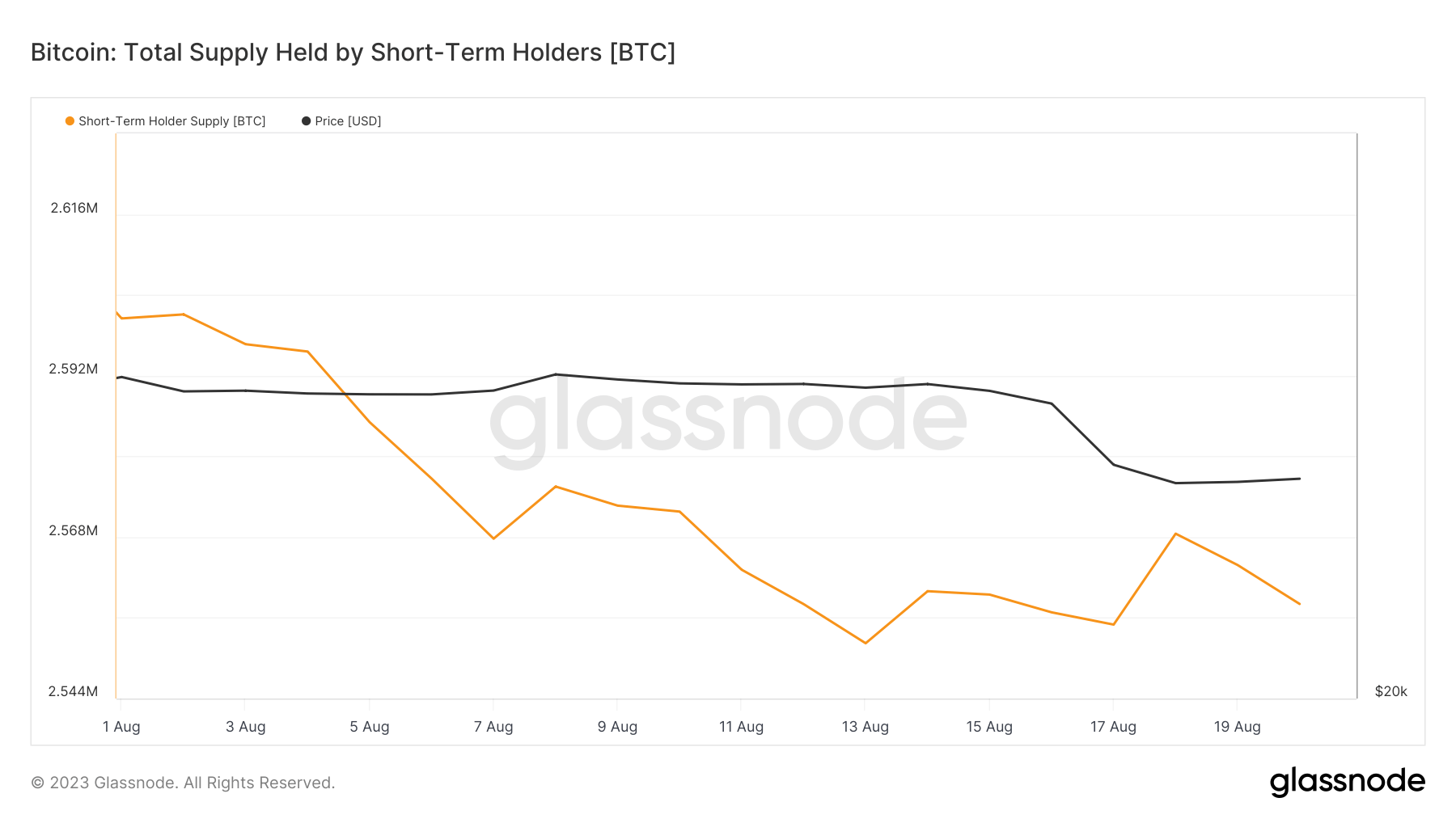

As Bitcoin’s terms took a nosedive, the information of its proviso held by short-term holders remained comparatively stable. However, their unrealized losses saw a important surge.

Graph showing Bitcoin proviso held by short-term holders successful August 2023 (Source: Glassnode)

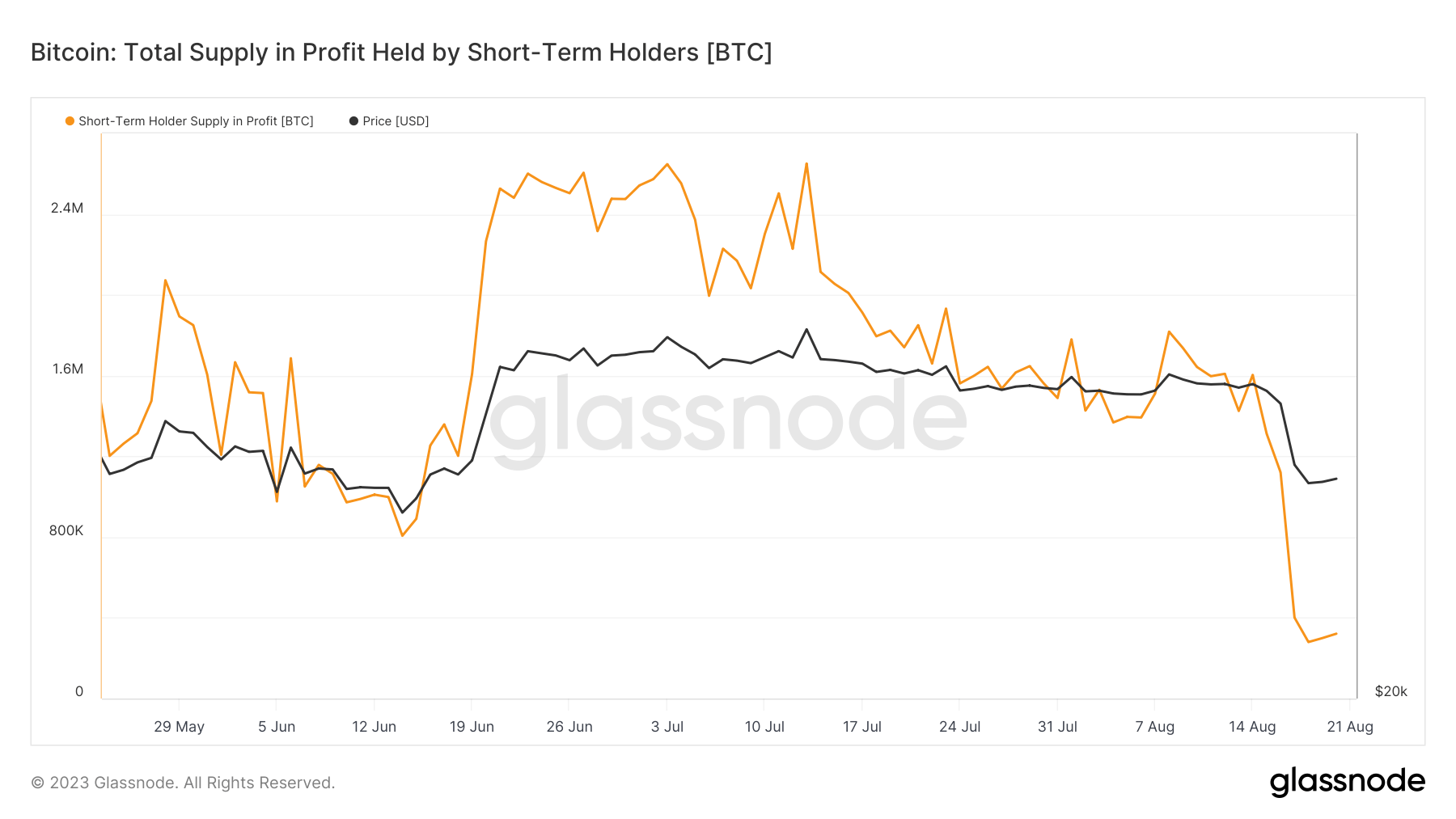

Graph showing Bitcoin proviso held by short-term holders successful August 2023 (Source: Glassnode)Data from Glassnode showed a near-vertical driblet successful the percent of short-term holder proviso successful profit. On Aug. 14, this fig stood astatine 2.56 cardinal BTC. A week later, connected Aug. 21, it stood astatine 321,238 BTC. This represents a flimsy summation from the 8-month debased recorded connected Aug. 18, erstwhile the short-term holder proviso successful nett dropped to 279,907 BTC — an 82% driblet from Aug .14.

Graph showing short-term holder proviso successful nett from May 21 to Aug. 21, 2023 (Source: Glassnode)

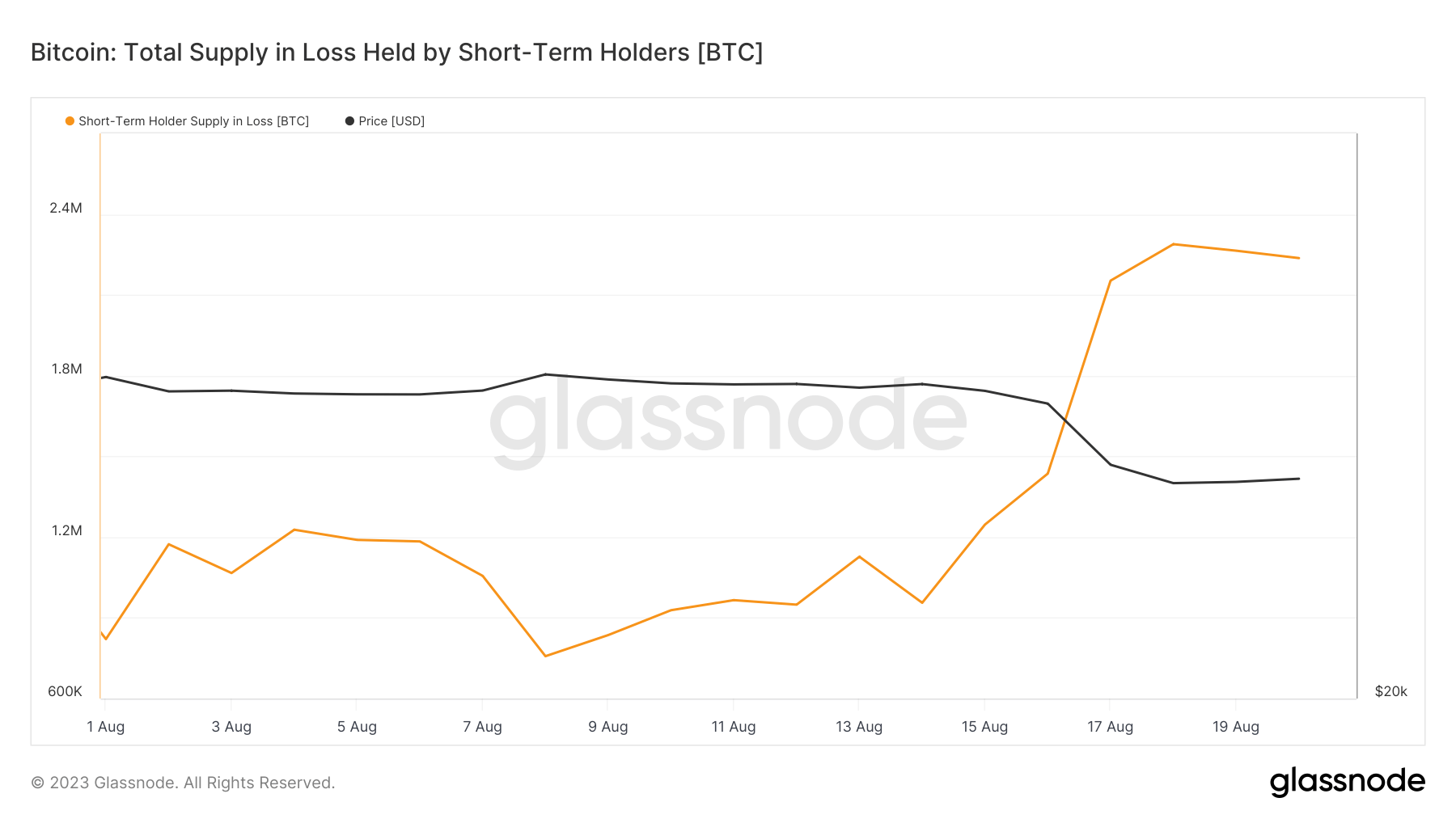

Graph showing short-term holder proviso successful nett from May 21 to Aug. 21, 2023 (Source: Glassnode)Short-term holders are presently sitting connected astir 1.28 cardinal BTC astatine a loss. If Bitcoin’s terms trajectory continues connected this volatile course, there’s a looming hazard that a sizeable information of this BTC could flood exchanges. This could make immense selling pressure, perchance triggering further terms cascades.

Graph showing short-term proviso astatine nonaccomplishment successful August 2023 (Source: Glassnode)

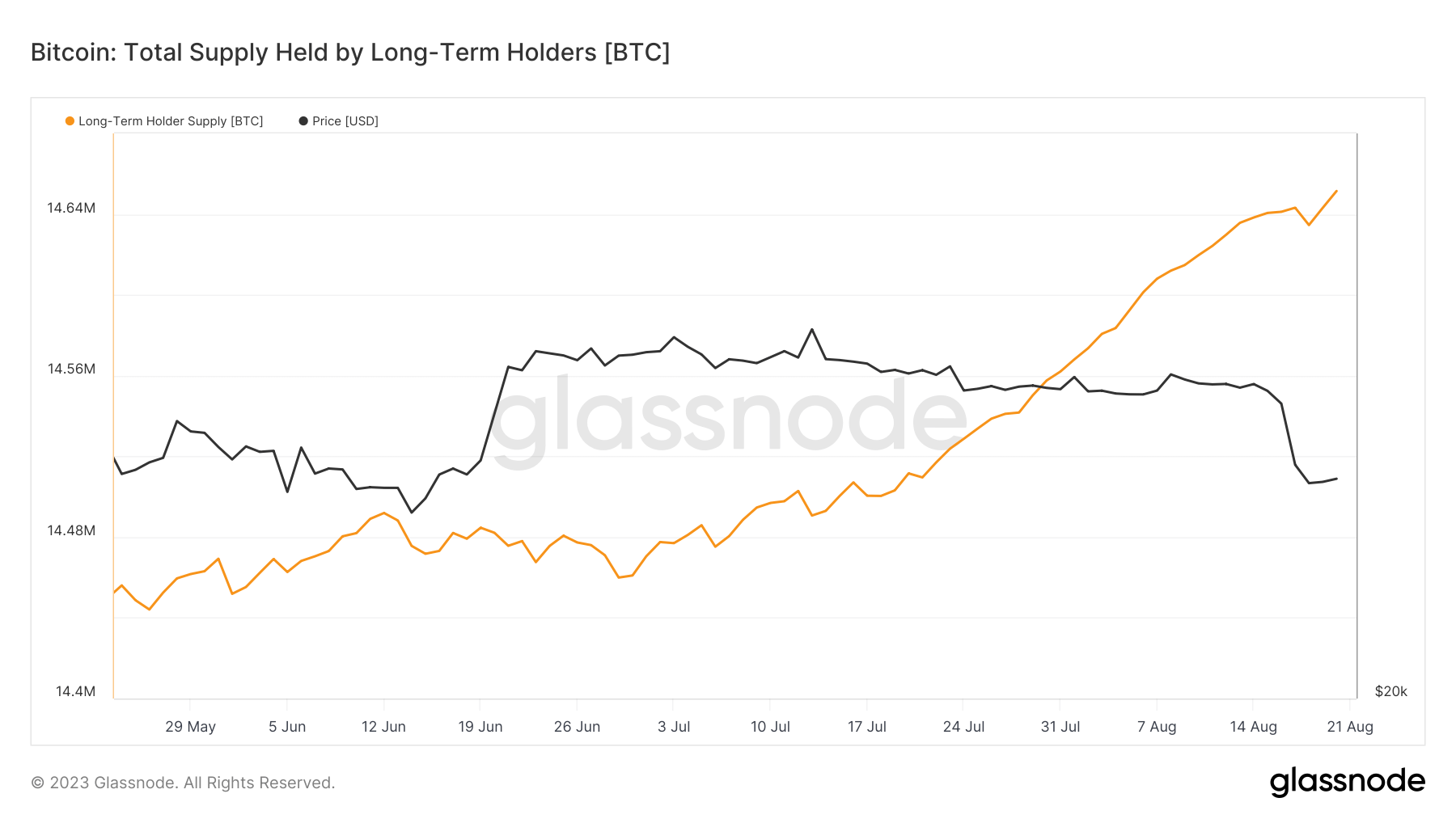

Graph showing short-term proviso astatine nonaccomplishment successful August 2023 (Source: Glassnode)The marketplace presently sits astatine a critical juncture, arsenic the actions of short-term holders successful the coming days could importantly power Bitcoin’s terms direction. Historically, semipermanent holders person absorbed astir of the coins distributed by short-term holders, rapidly re-establishing equilibrium connected the market. However, semipermanent holders person been expanding their supply, and there’s a anticipation that they could deficiency the liquidity indispensable to halt further terms drops.

Graph showing Bitcoin proviso held by semipermanent holders from May 21 to Aug. 21, 2023 (Source: Glassnode)

Graph showing Bitcoin proviso held by semipermanent holders from May 21 to Aug. 21, 2023 (Source: Glassnode)The station Short-term holders are sitting connected 1.3M BTC astatine a loss appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)