On June 5, the U.S. Securities and Exchange Commission (SEC) filed extended charges against starring cryptocurrency speech Binance and related parties, alleging securities instrumentality violations.

The filing represents 1 of the astir broad sets of charges filed by the SEC against a cryptocurrency institution to date. Below are the astir important allegations and facts.

1. BNB and BUSD are securities

The SEC declared Binance’s cryptocurrencies, including the BNB speech token (BNB) and the Binance USD stablecoin (BUSD), arsenic securities.

The regulator stated that Binance’s BNB Vault, Binance’s Simple Earn program, and Binance.US’s staking services are securities arsenic well. It said the company’s offerings and income were each conducted illegally and without registration.

The SEC much broadly said that Binance and its U.S. counterparts failed to registry arsenic an exchange, broker-clearer, oregon clearing bureau though they were required to bash so.

2. Several third-party tokens are securities

The SEC said that respective tokens listed by Binance are securities, including Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and Coti (COTI).

These tokens were “sold arsenic an concern declaration and, therefore, [were] a security” from their archetypal sale, the SEC said. Though Binance did not contented the supra tokens, the SEC complained that Binance did not restrict the trading of the assets connected its platform.

3. SEC wants Zhao, others enjoined

The SEC said that Binance CEO Changpeng Zhao, Binance, Binance.US genitor BAM steadfast Trading, and associated parties should beryllium permanently enjoined — oregon prevented — from violating applicable sections of the Securities Act and Exchange Act. It besides said those parties should beryllium ordered to wage disgorgement and civilian penalties.

The regulator added that Zhao should beryllium barred from definite enactment roles. It stated that Binance and its related companies should beryllium barred from dealing successful securities, crypto plus securities, and engaging successful related business.

4. Binance evaded U.S. regulations

The SEC said that Binance explicitly marketed its services to U.S. customers aft its 2017 motorboat and covertly aft nominally restricting U.S. entree successful 2019.

One advisor told Binance to make a “Tai Chi” entity successful the U.S. tasked with publishing reports and engaging with the SEC “solely to intermission imaginable enforcement efforts.” The advisor besides encouraged Binance to artifact U.S. users connected its main speech portion privately telling immoderate of those users however to bypass restrictions.

Binance and its executives did not judge the Tai Chi program entirely, but galore expressed involvement successful continuing to enactment with the consultant.

5. Executives were alert of the situation

Binance’s CCO — unnamed by the SEC — made statements indicating that helium was alert of wrongdoing. In 2018, the CCO said: “We are operating arsenic a fking unlicensed securities speech successful the USA, bro.” In 2020, helium said that Binance “[does] not privation [Binance].com to beryllium regulated ever” and said this led to the instauration of section entities.

Zhao and others were besides progressive successful discussions of the Tai Chi plan. Zhao recognized that determination were “safer” alternatives but proceeded with overmuch of the program regardless. Zhao personally directed Binance to make a program advising users to bypass geo-block VPNs; helium besides told Binance to promote VIP users to bypass KYC checks.

The SEC said that Zhao and Binance were alert of the exchange’s ample fig of U.S. users, arsenic evidenced by interior presentations estimating the steadfast had 1.47 cardinal American users successful 2019.

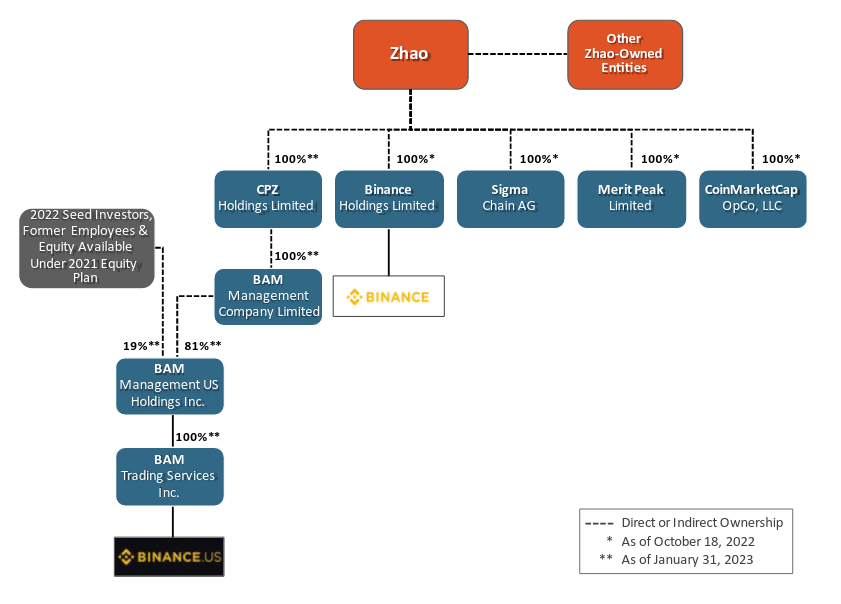

6. CZ-owned companies, controlled U.S. funds

The SEC said that Binance CEO Changpeng Zhao, on with different entities owned by Zhao, had 100% ownership of respective Binance-related companies.

Though Zhao did not person 100% ownership of U.S. companies nether BAM, helium and Binance had important power implicit their slope accounts and idiosyncratic crypto deposits. Furthermore, Zhao’s Merit Peak and Sigma Chain “were utilized successful the transportation of tens of billions of U.S. dollars” betwixt Binance and its U.S. counterparts, the SEC said.

Zhao and Binance were besides progressive successful the design, launch, hiring, trading activities, and operations of U.S.-based companies, according to the regulator.

7. Wash trading ran rampant

Finally, the SEC said that Binance’s U.S. companies misled users by overstating protections against lavation trading and the accuracy of trading volumes.

Significant lavation trading took spot owed to Sigma Chain’s relation arsenic a marketplace maker, the SEC said. At 1 point, Sigma Chain accounts wash-traded 48 of 51 of the recently listed assets; astatine different point, those accounts wash-traded 51 retired of 58 listed assets.

Despite earlier promises that the diagnostic existed, Binance’s U.S. firms had nary trade surveillance mechanisms until astatine least February 2022. Executives were allegedly alert of lavation trading but took nary enactment to halt the activity.

The SEC said that trading information is worldly accusation for users and equity investors and that Binance’s U.S. companies profited from these misleading statements. Therefore, the firms’ actions represent fraud and deceit, the regulator declared.

The station Seven cardinal points from the SEC’s charges against Binance and Binance.US appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)