K33 Research, formerly known arsenic Arcane Research, has published a study which suggests Bitcoin investors should travel the aged Wall Street adage “Sell successful May and spell away.” The saying suggests that investors should merchantability their stocks successful the summertime and bargain them backmost astatine the extremity of the summertime to debar a seasonal diminution successful the banal market.

In their Bitcoin-related report, elder expert Vetle Lunde writes that the existent drawdown and betterment rhythm is strikingly akin to the signifier of the 2018-19 carnivore marketplace successful presumption of magnitude and trajectory. If past repeats itself, Bitcoin could highest astatine $45,000 successful arsenic small arsenic 1 month, astir May 20, 2023, according to the analyst.

Similarities Of The Current Bitcoin Rally To 2018

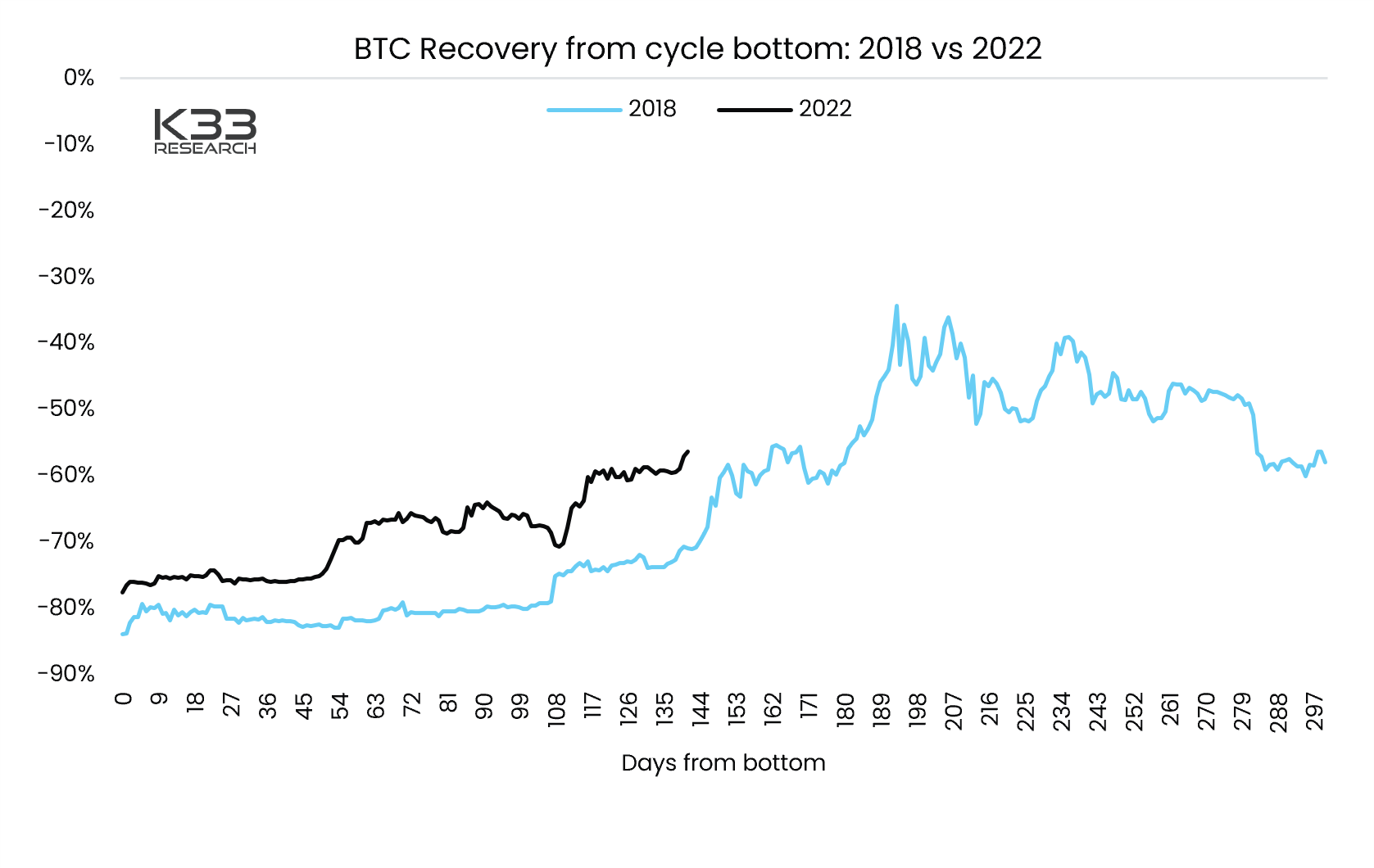

The probe is based connected an investigation utilizing fractals of erstwhile drawdowns and erstwhile lows. “While nary 1 should expect a 1:1 mirroring of the existent drawdown to erstwhile drawdowns, the resemblance to the 2018 drawdown is staggering,” writes Lunde, who shared the illustration below.

Bitcoin betterment from rhythm bottom, 2018 vs 2022 | Source: K33 Research

Bitcoin betterment from rhythm bottom, 2018 vs 2022 | Source: K33 ResearchThe expert recovered similarities successful some the duration from highest to bottommost and the betterment path. The lows of the existent rhythm and the 2018 carnivore marketplace rhythm lasted some astir 370 days.

The instrumentality from highest to bottommost is besides strikingly similar. After 510 days, it was 60% successful some cycles. The lone insignificant quality is that the diminution from highest to bottommost successful 2018 was somewhat higher astatine 84% than successful 2022, erstwhile BTC bottomed astatine 78% from the all-time high.

The decision that Bitcoin volition scope its section precocious astir May 20, 2023 comes from the information that successful 2018, the carnivore marketplace rally peaked 556 days aft the 2017 high, connected June 29, 2019, with a drawdown of 34% from the high. Lunde truthful predicts:

While past is acold from apt to repetition successful a akin manner if the fractal were to proceed – BTC would highest astir May 20 astatine $45,000.

As for the reasons for the beardown similarities, Lunde has nary “satisfactory” explanation. The champion explanation, according to Lunde, is the pragmatic behaviour of semipermanent holders of Bitcoin, who adjacent aft the crisp drawdown beryllium their “diamond hands”, meaning they bash not sell, and alternatively usage the signifier to accumulate.

Moreover, according to Lunde, the existent rally has each the hallmarks of a “hated” rally – “a rally wherever holders consciousness underexposed aft a highly traumatic year, wherever investors are de-risked successful anticipation of further downside,” arsenic Lunde writes, uncovering different similarity successful this:

The hated rally of 2019 ended with a important blow-off apical earlier BTC resumed trading astatine a 40-60% drawdown from its 2017 ATH.

Remarkably, K33 Research is not the lone analytics steadfast predicting a section precocious for Bitcoin successful the mid $40,000s. Glassnode co-founders Jan Happel and Yann Allemann constitute successful their latest newsletter that the marketplace is presently showing utmost strength, which is wherefore the adjacent large people is $35,000 earlier $47,000.

“This is inactive the outlook conscionable arsenic we expect overmuch higher prices into precocious Q2 and Q3,” constitute the analysts, who absorption their attraction chiefly connected macro information and the dollar scale (DXY). The latter, according to the Glassnode co-founders, volition autumn into the 91-93 scope earlier the extremity of the year, which would beryllium highly bullish for Bitcoin.

At property time, the Bitcoin terms traded astatine $29,340.

BTC price, 1-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)