Exchange-related deposits and withdrawals of Bitcoin are often bully indicators of marketplace sentiment.

When the fig of speech deposits grows, the liquid proviso of Bitcoin grows and shows the market’s readiness to trade. Conversely, erstwhile the fig of speech withdrawals increases, investors look little funny successful trading and are looking to clasp their BTC disconnected exchanges.

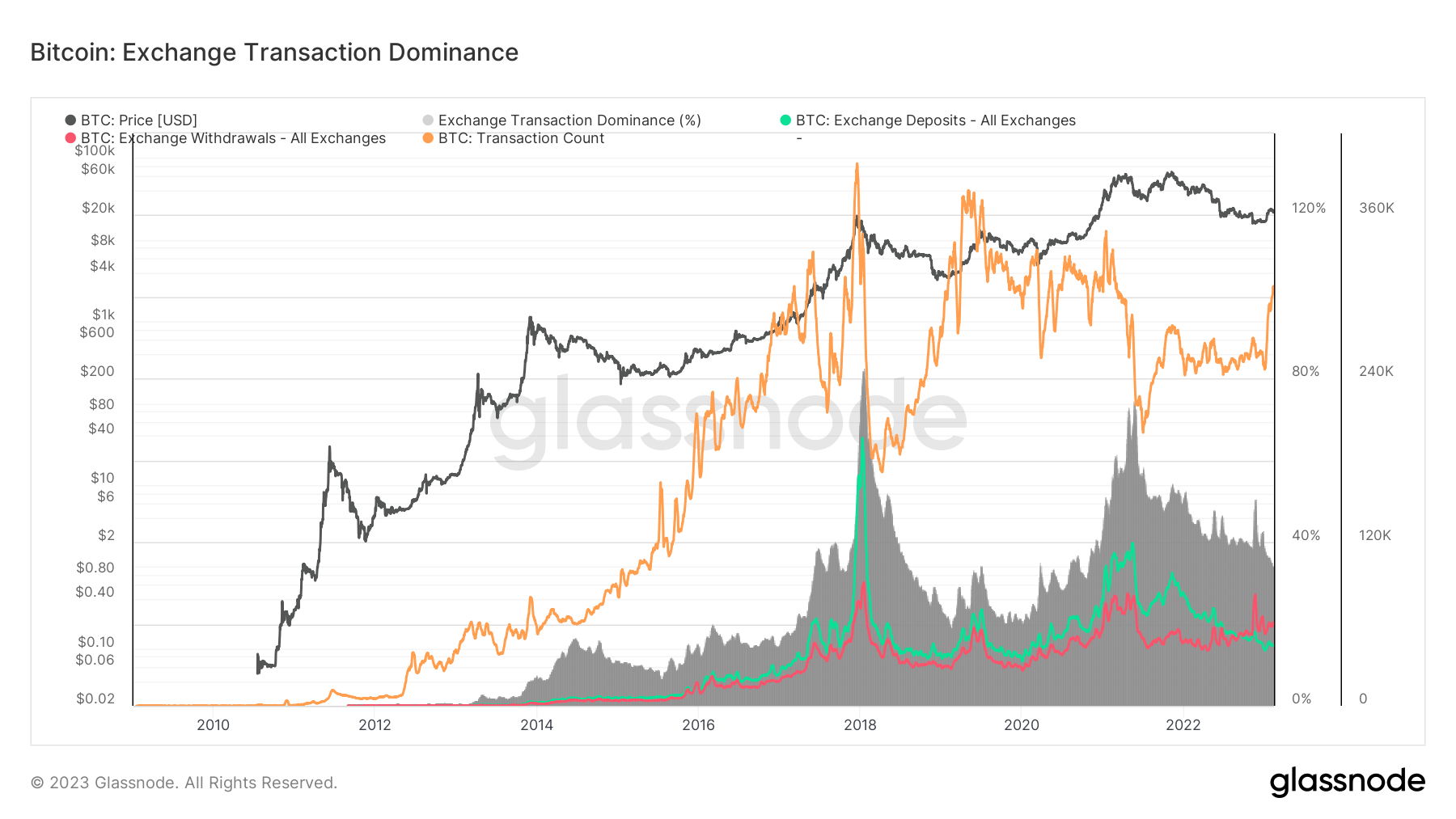

Looking astatine these exchange-related transactions against the full fig of Bitcoin transactions tin amusement whether the marketplace is gearing up for a bull run.

In February 2023, the full fig of Bitcoin transactions surpassed 307,000, reaching a two-year high.

Previous transaction fig peaks correlated with Bitcoin’s terms rallies. The 400,000 transactions recorded successful precocious 2017 helped substance the bull tally that pushed Bitcoin to its all-time precocious of $20,000. Around 80% of each Bitcoin transactions astatine the clip were exchange-related, with the bulk being speech deposits.

Subsequent jumps successful transaction numbers followed the aforesaid signifier — a increasing fig of transactions fueled a bull tally that entered into a correction erstwhile the transaction numbers peaked. Both speech deposits and withdrawals saw notable increases, with deposits surpassing withdrawals.

The erstwhile transaction fig precocious recorded successful aboriginal 2021 repeated the pattern. However, Bitcoin’s terms began rising adjacent aft the fig of transactions peaked, indicating that the bull tally experienced passim the twelvemonth was fueled by derivatives.

Graph showing the speech transaction dominance for Bitcoin from 2010 to 2023 (Source: Glassnode)

Graph showing the speech transaction dominance for Bitcoin from 2010 to 2023 (Source: Glassnode)Since 2014, the dominating inclination was for speech deposits to outpace withdrawals. This inclination was breached successful September 2022, erstwhile withdrawals outpaced deposits – September 2022 saw 53,000 BTC withdrawn, and 52,000 BTC deposited to exchanges.

This inclination has lone gotten stronger since the illness of FTX. In November, withdrawals reached 81,000 BTC arsenic investors raced to instrumentality their coins disconnected centralized exchanges. On Feb. 11, 44,000 BTC was deposited onto exchanges, portion 61,000 BTC near exchanges. The discrepancy betwixt withdrawals and deposits shows that investors are continuing to instrumentality ownership of the coins they acquired during the carnivore run.

The decreasing dominance of speech transactions further confirms this — little than 35% of each Bitcoin transactions successful February were exchange-related.

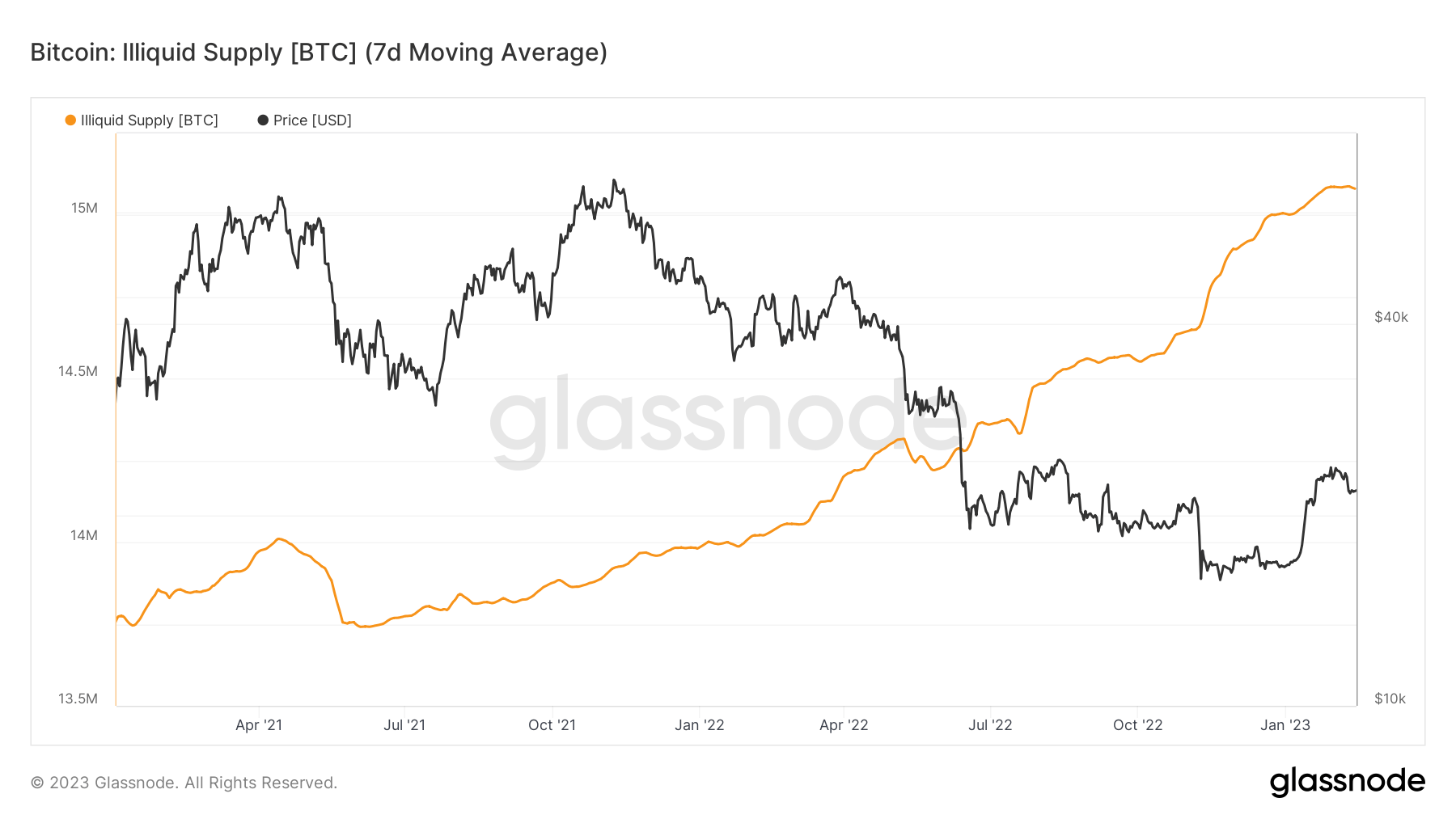

With a ample fig of BTC present being taken disconnected exchanges, Bitcoin’s illiquid proviso has seen important growth. Put simply, the liquidity of Bitcoin’s proviso shows the fig of coins really disposable for buying and selling. A increasing fig of illiquid Bitcoins (i.e., coins successful acold retention and dormant coins) is often seen arsenic a beardown bullish awesome arsenic it shows beardown capitalist holding sentiment.

Data analyzed by CryptoSlate showed a sustained summation successful Bitcoin’s illiquid proviso that began successful September 2021.

Graph showing Bitcoin’s illiquid proviso from January 2021 to February 2023 (Source: Glassnode)

Graph showing Bitcoin’s illiquid proviso from January 2021 to February 2023 (Source: Glassnode)The station Self custody continues to turn arsenic Bitcoin withdrawals outpace deposits appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)