The U.S. Securities and Exchange Commission’s latest delays connected the spot Bitcoin (BTC) ETF applications led to a market-wide pullback that resulted successful $130 cardinal successful liquidations implicit the past 24 hours.

SEC delays spot ETF decision

On Aug. 31, the fiscal regulator issued notices indicating the postponement of decisions connected each ETF applications until October. The hold was attributed to the regulator’s request for capable clip to deliberate connected the projected regularisation alteration and the associated concerns.

This determination impacted applications from salient firms, including BlackRock, Valkyrie, WisdomTree, Invesco Galaxy, Bitwise, and Wise Origin.

The caller hold comes arsenic nary shock, arsenic it aligns with anterior predictions by Bloomberg analysts Eric Balchunas and James Seyffart. They had foreseen the SEC’s inclination to defer applications portion deliberating connected its adjacent move, particularly aft Grayscale’s caller legal success against the regulatory body.

Notwithstanding the SEC’s actions, these analysts support a affirmative outlook, suggesting that the chances of ETF support person climbed to a promising 75%.

Bitcoin crashes

Following quality of the delay, Bitcoin, already experiencing a cooling-off play pursuing the Grayscale-induced caller surge, dropped by astir 5%, pushing its valuation beneath the $26,000 mark. BTC was trading for $25,976 arsenic of property time, according to CryptoSlate’s data.

Concurrently, the broader cryptocurrency marketplace witnessed a astir 4% decline, collectively amounting to a full marketplace capitalization of $1.05 trillion.

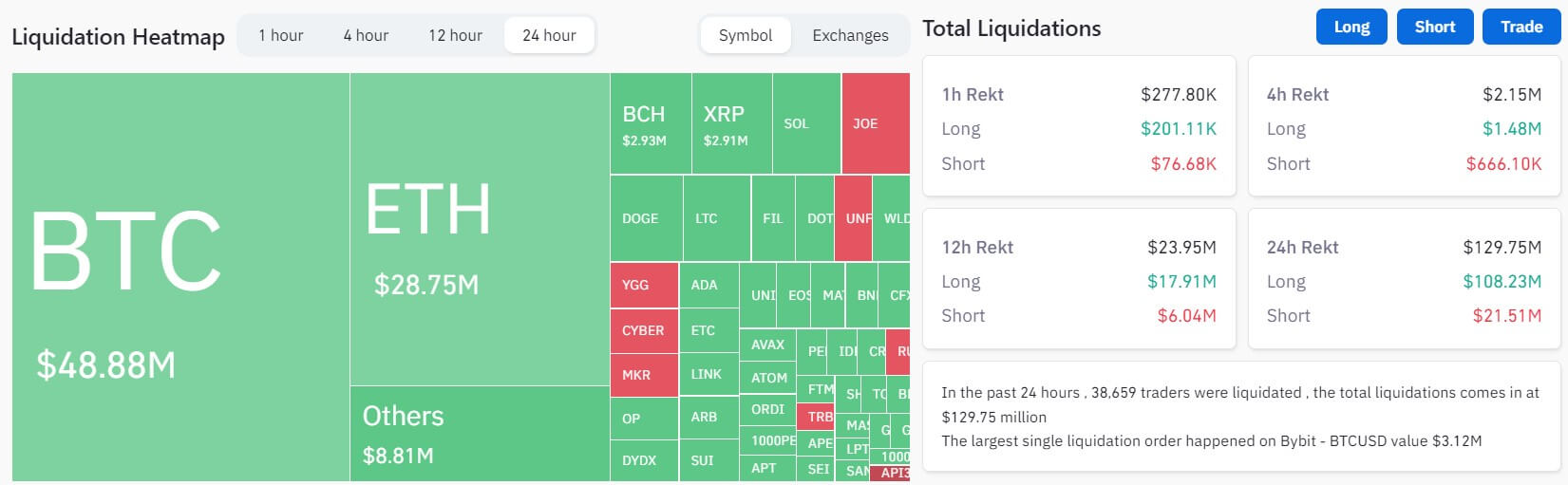

These terms actions resulted successful $130 cardinal worthy of liquidations that majorly affected agelong traders. Per Coinglass data, BTC and Ethereum (ETH) accounted for astir $80 cardinal of these positions, portion traders with positions successful assets similar BNB, XRP, Bitcoin Cash, Solana, and others recorded millions successful losses.

Source: Coinglass

Source: CoinglassMeanwhile, the astir important single-order liquidation was a agelong BTCUSD presumption valued astatine $3.12 cardinal connected ByBit. Across exchanges, OKX and Binance accounted for much than 60% of the full liquidations.

The station SEC ETF hold pulls marketplace backmost starring to $130M liquidation havoc appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)