By Omkar Godbole (all times ET unless stated otherwise)

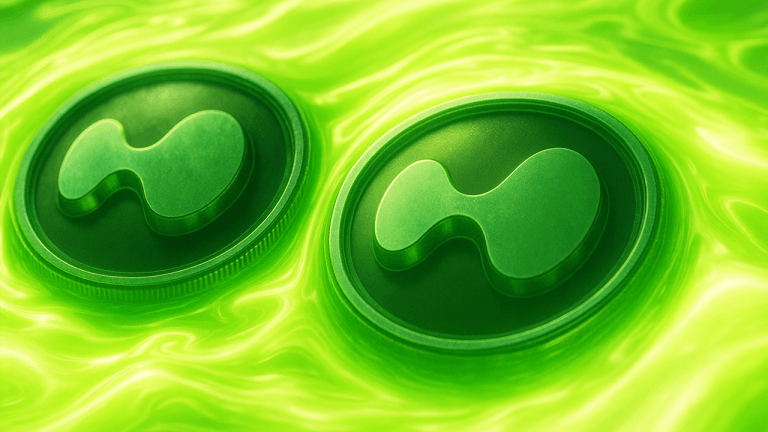

DeFi coins are successful the spotlight arsenic bitcoin (BTC) and ether (ETH) notch humble gains up of Tuesday's large jobs revisions information from the Bureau of Labor Statistics, which are expected to uncover a overmuch weaker occupation marketplace successful the twelvemonth ended March 2025.

Usually, anemic jobs information means much Fed complaint cuts — and that’s bullish for BTC. But there’s much to the story: BTC mightiness beryllium king, but it doesn’t output anything. That’s wherever decentralized concern comes into the play, offering returns connected idle coins done lending and borrowing protocols. This makes DeFi coins each the much charismatic arsenic rate-cut bets vigor up.

Arthur Hayes, laminitis of Maelstrom, nailed it: “DeFi volition get immoderate of this currency searching for yield.” He pointed to Ethena’s sUSDe token, boasting a coagulated 7% yield, arsenic a apical beneficiary of the impending Fed complaint cuts.

So, support an oculus retired for DeFi, which is already showing signs of strength.

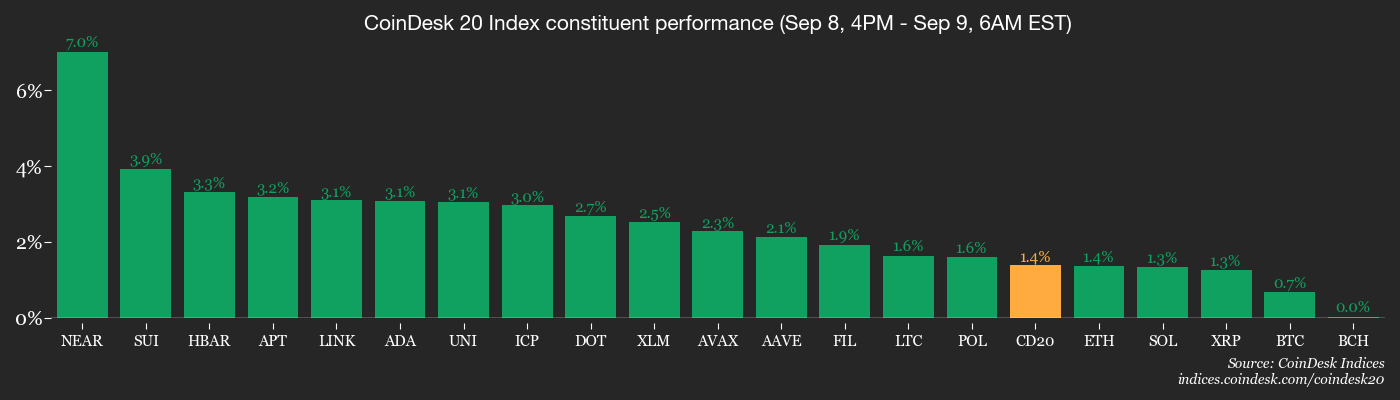

The CoinDesk DeFi Select Index (DFX) has jumped 3% successful the past 24 hours, lasting retired arsenic 1 of the top-performing crypto subsectors alongside the CoinDesk Memecoin and Metaverse Select Indices and the CoinDesk 80 Index. The broader CoinDesk 20 Index has gained a 1.6%.

Within DeFi, decentralized speech tokens are stealing the show. HYPE surged 9% successful 24 hours, pushing its seven-day gains to 22%. Even much eye-catching is lesser-known DEX MYX Finance’s autochthonal token, MYX, which exploded with a staggering 260% summation successful conscionable 1 time — yes, you work that right.

Adding to the bullish signals, TradingView’s DeFi dominance scale has climbed to 3.49%, the highest since aboriginal February, underscoring increasing appetite for DeFi assets successful the existent marketplace environment.

Other sectors could summation arsenic well. Most analysts expect retail investors to propulsion superior from wealth marketplace funds and transmission it into stocks and crypto alike arsenic the Fed begins to chopped rates.

But there's a catch. If the complaint chopped occurs alongside worsening economical conditions, past investors whitethorn clasp wealth marketplace investments, which are highly liquid and considered safe. So, support an oculus connected the economical data, peculiarly the U.S. shaper terms scale connected Wednesday and the user terms scale connected Thursday. Both could adhd to ostentation concerns.

The governmental concern successful Europe, peculiarly successful France, and Japan and resulting enslaved marketplace jitters could besides destabilize markets. Stay alert!

What to Watch

- Crypto

- Sept. 9: Shares of SOL Strategies (HODL) are expected to commencement trading connected the Nasdaq Global Select Market nether the ticker awesome STKE. OTCQB trading arsenic CYFRF volition end, and shares volition proceed connected the Canadian Securities Exchange arsenic HODL.

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Macro

- Sept. 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases August user terms ostentation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.31%

- Core Inflation Rate YoY Est. 4.21% vs. Prev. 4.23%

- Inflation Rate MoM Est. 0.06% vs. Prev. 0.27%

- Inflation Rate YoY Est. 3.58% vs. Prev. 3.51%

- Sept. 9, 10 a.m.: The U.S. Bureau of Labor Statistics releases preliminary yearly benchmark revision to employment data.

- Nonfarm Payrolls Annual Revision Prev. -818K

- Sept. 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases August user terms ostentation data.

- Inflation Rate MoM Est. -0.15% vs. Prev. 026%

- Inflation Rate YoY Eat. 5.1% vs. Prev. 5.23%

- Sept. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. 0.9%

- Core PPI YoY Est. 3.5% vs. Prev. 3.7%

- PPI MoM Est. 0.3% vs. Prev. 0.9%

- PPI YoY Est. 3.3% vs. Prev. 3.3%

- Sept. 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases August user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- Sept. 9: GameStop (GME), post-market, $0.19

Token Events

- Governance votes & calls

- Uniswap DAO is voting connected an updated Unichain-USDS Growth Plan to accelerate adoption done performance-based incentives and DAO-guided distribution. The connection introduces minimum KPIs, a “no result, nary reward” model. Voting ends Sept. 9.

- Goldfinch DAO is voting connected the Goldfinch Foundation’s yearly fund of $400,000 and 200,000 GFI, arsenic good arsenic an further $70,000 and 100,000 GFI successful returnable market-making liquidity. Voting ends Sept. 10.

- Compound DAO is voting connected extending its COMP output strategy with MYSO’s decentralized protocol and scaling it up to $9 cardinal worthy of tokens, targeting a 15% yearly output for the DAO. Voting ends Sept. 11.

- Hyperliquid to ballot connected who issues its USDH stablecoin. Major contenders see Paxos, Frax and a conjugation involving Agora and MoonPay. Voting takes spot Sept. 14.

- Unlocks

- Sept. 9: Sonic (S) to unlock 5.02% of its circulating proviso worthy $46.02 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $50.89 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $17.01 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $17.8 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $49.12 million.

- Token Launches

- Sept. 9: Avantis (AVNT) to beryllium listed connected Binance Alpha, Bybit, KuCoin, MEXC, Gate.io, and others.

- Sept. 10: Linea (LINEA) to beryllium listed connected Binance Alpha, KuCoin, MEXC, KuCoin, Bitget OKX, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Day 3 of 4: Future Proof Festival (Huntington Beach, California)

- Day 1 of 2: Fintech Week London 2025

- Day 1 of 2: WOW Summit Hong Kong 2025

- Day 1 of 5: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 10: Future of Finance (New York)

- Sept. 12: Independent Investor Summit (New York)

- Sept. 12-15: ETHTokyo 2025

Token Talk

By Oliver Knight

- Sam Altman-founded Worldcoin (WLD) continued its ascent connected Tuesday, taking different limb up to notch a 51% summation implicit 24 hours and 122% implicit the past week.

- The astir caller emergence followed Eightco Holdings' (OCTO) Monday announcement of a $250 cardinal backstage placement, paving the mode for a worldcoin treasury strategy.

- It's worthy noting that treasury strategy announcements for different tokens prompted muted upside, for illustration a $1.65 cardinal raise to signifier a solana (SOL) treasury connected Monday led to a summation of conscionable 1.7% implicit 24 hours, suggesting further catalysts down the WLD move.

- WLD trading measurement surged to $3.7 cardinal successful 24 hours, a 250% emergence connected the erstwhile time and a 2,000% emergence from Friday's total.

- From a method perspective, the WLD terms has breached retired of an eight-month scope that had it suppressed with a median astatine astir $1.00. It is expected to driblet backmost to trial $1.62 earlier perchance revisiting the $2.00 mark.

- The rally comes amid a backdrop of wider altcoin strength; the CoinMarketCap altcoin play scale is astatine 57/100 arsenic it approaches its highest constituent this year, indicating that further upside whitethorn beryllium connected the cards if crypto majors BTC and ETH tin proceed to thrust distant from captious levels of support.

Derivatives Positioning

By Omkar Godbole

- The marketplace remains calm contempt Friday's payroll information reigniting concerns astir the hazard of stagflation. Bitcoin’s 30-day implied volatility, arsenic measured by Volmex’s BVIV, has eased to 38% from 44% astatine the extremity of August. Ether’s volatility index, EVIV, slipped to 66%, backing disconnected from its August highest of 77%.

- The one-day implied volatility indices for some the 2 largest cryptocurrencies stay small changed, signaling nary signs of panic up of Tuesday’s announcement by the U.S. Bureau of Labor Statistics, which is expected to revise payroll figures downward for earlier this year.

- Open involvement (OI) successful futures tied to the apical 20 tokens has accrued successful the past 24 hours, indicating superior inflows. The biggest inflows are into WLD, ENA, SOL, DOGE and XRP. OI successful BTC futures has accrued by astir 3%.

- Solana stands retired connected the CME, with futures OI hitting a grounds precocious of 6.82 cardinal SOL and an annualized three-month premium of implicit 15%, which is astir treble those of BTC and ETH.

- Traders are continuing to retreat superior from CME’s bitcoin futures, portion unfastened involvement successful ether futures is extending its descent from caller highs. Positioning successful CME options tied to bitcoin and ether remains elevated, indicating hedging demand.

- On Deribit, the bearish bias for BTC puts has softened but remains noticeable, adjacent arsenic the spot terms has bounced adjacent to $113,000. The aforesaid tin beryllium said for ether.

- Block flows astatine OTC table Paradigm amusement agelong positions successful September puts combined with penning of upside calls, reflecting traders' continued caution and reluctance to afloat perpetrate to an upside breakout.

Market Movements

- BTC is up 0.8% from 4 p.m. ET Monday astatine $112,972.37 (24hrs: +0.86%)

- ETH is up 1.68% astatine $4,359.91 (24hrs: +0.72%)

- CoinDesk 20 is up 1.45% astatine 4,158.99 (24hrs: +1.66%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.84%

- BTC backing complaint is astatine 0.0068% (7.446% annualized) connected KuCoin

- DXY is down 0.19% astatine 97.27

- Gold futures are up 0.4% astatine $3,692.10

- Silver futures are up 0.35% astatine $41.57

- Nikkei 225 closed down 0.42% astatine 43,459.29

- Hang Seng closed up 1.19% astatine 25,938.13

- FTSE is up 0.1% astatine 9,230.32

- Euro Stoxx 50 is down 0.16% astatine 5,354.02

- DJIA closed connected Monday up 0.25% astatine 45,514.95

- S&P 500 closed up 0.21% astatine 6,495.15

- Nasdaq Composite closed up 0.45% astatine 21,798.70

- S&P/TSX Composite closed unchanged astatine 29,027.73

- S&P 40 Latin America closed unchanged astatine 2,802.69

- U.S. 10-Year Treasury complaint is up 1.5 bps astatine 4.061%

- E-mini S&P 500 futures are up 0.12% astatine 6,513.75

- E-mini Nasdaq-100 futures are up 0.22% astatine 23,851.25

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,581.00

Bitcoin Stats

- BTC Dominance: 58.19% (-0.26%)

- Ether-bitcoin ratio: 0.03859 (0.39%)

- Hashrate (seven-day moving average): 983 EH/s

- Hashprice (spot): $52.7

- Total fees: 3.99 BTC / $446,538

- CME Futures Open Interest: 133,255 BTC

- BTC priced successful gold: 31 oz

- BTC vs golden marketplace cap: 8.77%

Technical Analysis

- BTC's hourly illustration shows that prices are looking to interruption retired of an inverse head-and-shoulders pattern.

- The determination supra the neckline (the dashed line) would exposure absorption astatine $117,439.

Crypto Equities

- Coinbase Global (COIN): closed connected Monday astatine $302.2 (+1.05%), unchanged successful pre-market

- Circle (CRCL): closed astatine $112.46 (-1.83%), +1.12% astatine $113.72

- Galaxy Digital (GLXY): closed astatine $24.22 (+3.11%), -2.19% astatine $23.69

- Bullish (BLSH): closed astatine $50.12 (-4.26%), +5.19% astatine $52.72

- MARA Holdings (MARA): closed astatine $15.2 (+0.07%), unchanged successful pre-market

- Riot Platforms (RIOT): closed astatine $13.44 (+1.13%), -1.04% astatine $13.30

- Core Scientific (CORZ): closed astatine $13.93 (+2.28%), -2.94% astatine $13.52

- CleanSpark (CLSK): closed astatine $9.17 (-0.76%), +0.87% astatine $9.25

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.69 (+0.81%), -0.27% astatine $29.61

- Exodus Movement (EXOD): closed astatine $26.3 (+9.45%), -7.03% astatine $24.45

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $329.9 (-1.78%), -0.33% astatine $328.80

- Semler Scientific (SMLR): closed astatine $28.29 (+0.6%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $15.67 (+4.92%), -3.06% astatine $15.19

- Upexi (UPXI): closed astatine $5.66 (-6.29%), +4.42% astatine $5.91

- Mei Pharma (MEIP): closed astatine $3 (-29.08%), +1.67% astatine $3.05

ETF Flows

Spot BTC ETFs

- Daily nett flows: 364.3 million

- Cumulative nett flows: $54.83 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$96.7 million

- Cumulative nett flows: $12.64 billion

- Total ETH holdings ~6.39 million

Source: Farside Investors

Chart of the Day

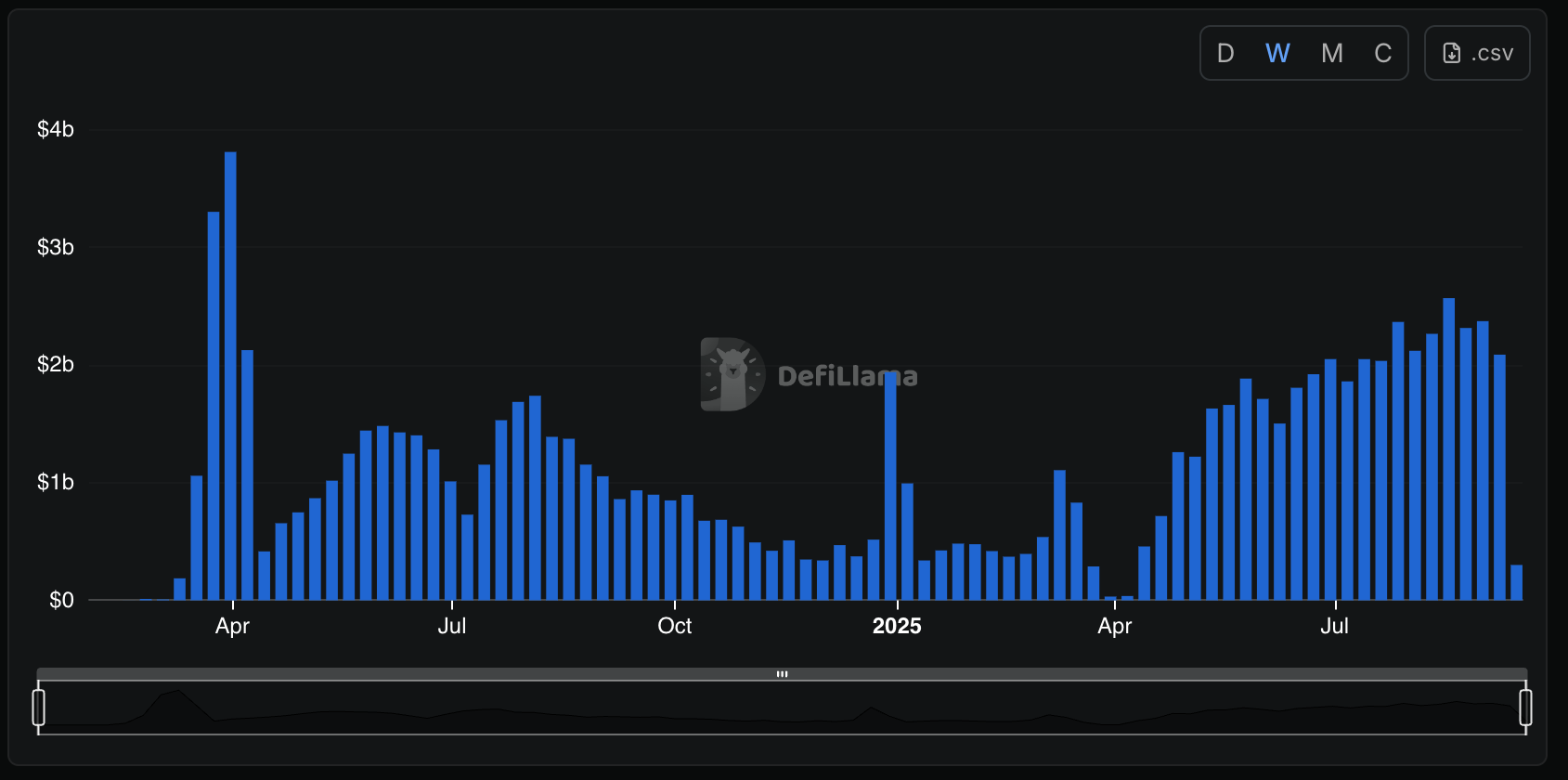

- The illustration by DeFiLlama shows play trading volumes successful perpetuals listed connected decentralized speech MYX Finance.

- Volumes person importantly accrued since April, reaching a precocious of $2.56 cardinal successful mid-August. This partially explains the terms rally successful the DEX's autochthonal token.

While You Were Sleeping

- Winklevoss-Founded Crypto Exchange Gemini Taps Nasdaq arsenic Strategic Investor, Sources Say (Reuters): Nasdaq’s $50 cardinal backstage placement successful Gemini comes with a tie-up giving its clients entree to custody and staking, portion the exchange's organization clients summation Calypso tools for managing collateral.

- This $7T Cash Pile Could Fuel the Next Rally successful Bitcoin And Altcoins (CoinDesk): Analysts accidental trillions parked successful U.S. wealth marketplace funds could rotate into crypto and equities arsenic Fed complaint cuts instrumentality hold.

- Sky Pitches Genius-Compliant USDH Stablecoin With $8B Balance Sheet and 4.85% Yield (CoinDesk): Competing against 4 rivals, the latest bid to contented the stablecoin offers 4.85% returns connected USDH, $2.2 cardinal successful redemption liquidity and a $25 cardinal DeFi concern connected Hyperliquid.

- Ripple Extends Digital Asset Custody Partnership With BBVA successful Spain (CoinDesk): The Spanish multinational fiscal services radical says integrating Ripple’s custody tech volition fto it present end-to-end crypto retention with the information of a large bank, arsenic EU rules spur broader adoption.

- Ant Digital Arm Puts $8 Billion Energy Assets connected Its Blockchain (Bloomberg): The endeavor solutions limb of the Chinese fintech has uploaded information from 15 cardinal upwind and star units to AntChain and raised funds for 3 projects by tokenizing those assets.

- France’s Government Has Collapsed. What Comes Next? (The New York Times): François Bayrou’s furniture remains successful caretaker mode until Emmanuel Macron appoints a successor, portion protesters vow to disrupt France connected Wednesday and unions hole wide strikes for Sept. 18.

- The Renewed Bid to End Quarterly Earnings Reports (The Wall Street Journal): The Long-Term Stock Exchange (LTSE), an speech catering to firms with semipermanent goals, plans to inquire the SEC to fto nationalist companies record semiannually to chopped costs and easiness short-term pressure.

In the Ether

5 hours ago

5 hours ago

English (US)

English (US)