The S&P 500 Index has staged a singular turnaround since April, but its show inactive lags considerably down BTC.

The US banal market’s V-shaped betterment since April has driven the S&P 500 Index to grounds highs — yet measured successful Bitcoin, the benchmark is inactive down importantly this year, underscoring the integer asset’s beardown outperformance.

On Thursday, the S&P 500 Index closed astatine a grounds precocious of 6,280.46, extending its year-to-date summation to 7%. However, erstwhile measured successful Bitcoin (BTC), the large-cap scale is down 15% truthful acold successful 2025, according to marketplace commentator The Kobeissi Letter.

Citing information from Bitbo, The Kobeissi Letter besides pointed retired that the S&P 500 has dropped a staggering 99.98% against Bitcoin since 2012.

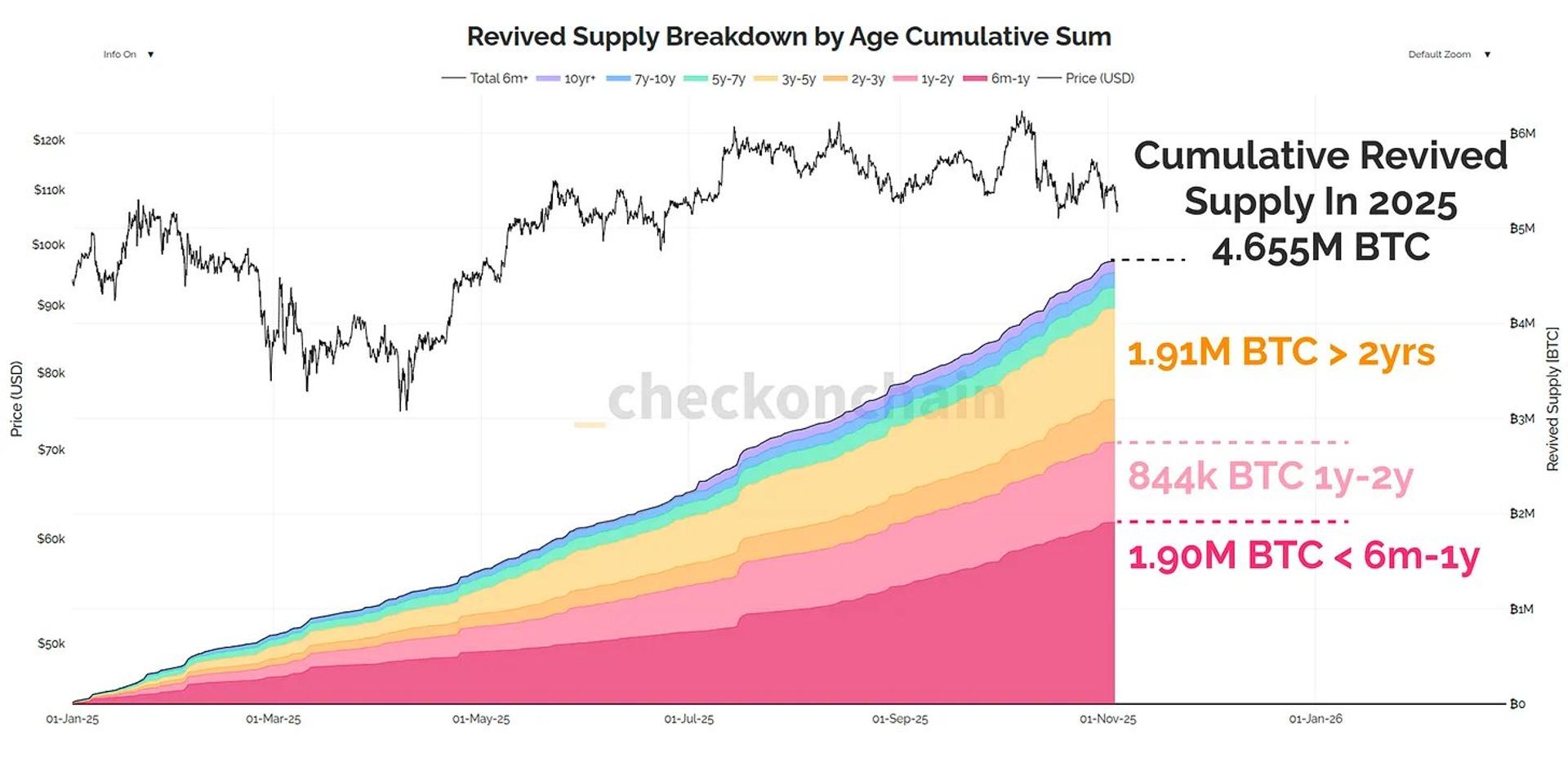

Bitcoin’s terms surged to a caller all-time precocious connected Friday, concisely topping $118,800 connected Coinbase, according to Cointelegraph Markets Pro. BTC has gained 5.5% successful the past 24 hours, 9% implicit the past week and is up 24% truthful acold this year.

Although Bitcoin has dramatically outperformed the benchmark banal scale since its inception, its show against large tech stocks similar Nvidia (NVDA), Tesla (TSLA) and Netflix (NFLX) has been arsenic remarkable.

Analyst Charlie Bilello highlighted Bitcoin’s meteoric emergence implicit the past decennary compared to these and different assets, underscoring BTC’s standout outperformance.

Related: Bitcoin terms expected to accelerate if regular adjacent supra $113K is secured

From stocks to Bitcoin: ETF investors heap into BTC successful 2025

Bitcoin’s grounds rally this twelvemonth has been fueled successful portion by increasing organization demand, with investors pouring wealth into BTC spot exchange-traded funds (ETFs) alongside accepted equity funds.

As of Friday, the 12 US spot Bitcoin ETFs held a combined 1,264,976 BTC worthy $148.6 billion, according to Bitbo data, representing implicit 6% of Bitcoin’s full supply.

In the archetypal fractional of 2025, beardown request for Bitcoin helped propulsion integer plus ETFs to the third-largest money class by inflows, down lone short-term authorities indebtedness and gold, according to State Street data.

On Thursday, US spot Bitcoin ETFs saw their second-largest regular inflow connected record, bringing successful a full of $1.17 billion.

Related: Ego Death Capital raises $100M to concern Bitcoin-focused startups

3 months ago

3 months ago

English (US)

English (US)