The cryptocurrency marketplace is simply a analyzable ecosystem, requiring galore metrics and indicators to gauge its wellness and foretell aboriginal trends. One specified metric, the Net Unrealized Profit/Loss (NUPL), provides a nuanced presumption of marketplace sentiment.

NUPL indicates marketplace sentiment by highlighting the quality betwixt unrealized nett and unrealized nonaccomplishment successful the Bitcoin supply.

The ‘unrealized’ facet refers to gains oregon losses not actualized by selling the asset. The realized headdress measures the worth of each coins astatine the terms they past moved, efficaciously capturing the nett concern of coin holders.

NUPL is calculated by subtracting this realized headdress from the marketplace headdress and dividing the effect by the marketplace cap. It’s a invaluable instrumentality that offers insights into the corporate marketplace sentiment.

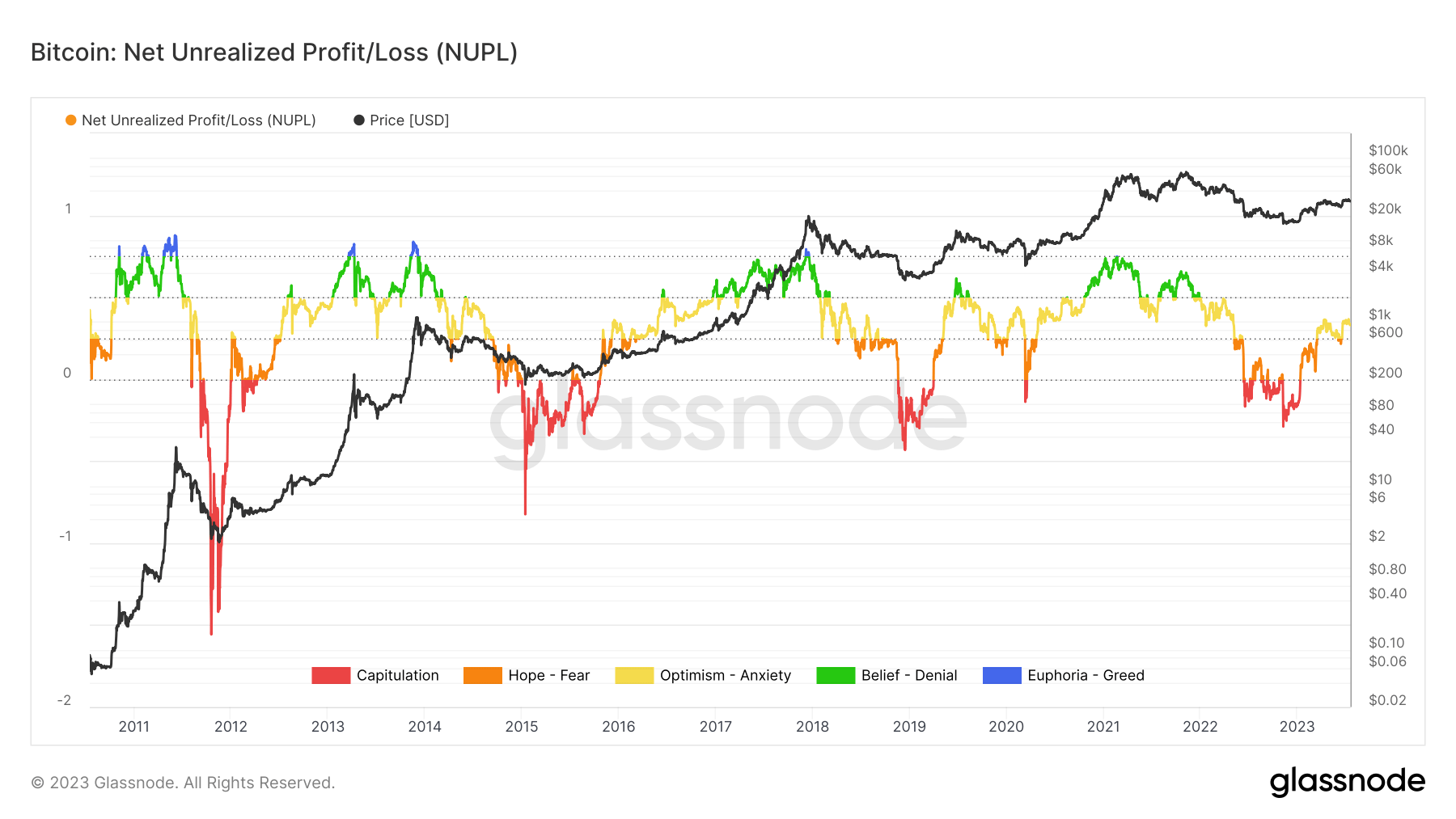

A NUPL people beneath 0 has historically correlated with periods of terms capitulation, indicating a bearish marketplace sentiment.

Conversely, a NUPL people higher than 0.75 typically correlates with periods of utmost greed and euphoria, suggesting a bullish marketplace sentiment. The transitional periods, wherever the NUPL ranges betwixt 0 and 0.25, person historically indicated fearfulness during downtrends and anticipation during uptrends.

A NUPL people betwixt 0.5 and 0.75 has correlated with periods of steadfast content successful Bitcoin’s rally.

Graph showing Bitcoin’s NUPL from 2010 to 2023 (Source: Glassnode)

Graph showing Bitcoin’s NUPL from 2010 to 2023 (Source: Glassnode)Since the opening of the year, NUPL has been connected a dependable rise, increasing to 0.33 connected July 20 from -0.15 connected January 1. This indicates that Bitcoin came retired of capitulation successful mid-January and spent 2 months successful the anticipation phase.

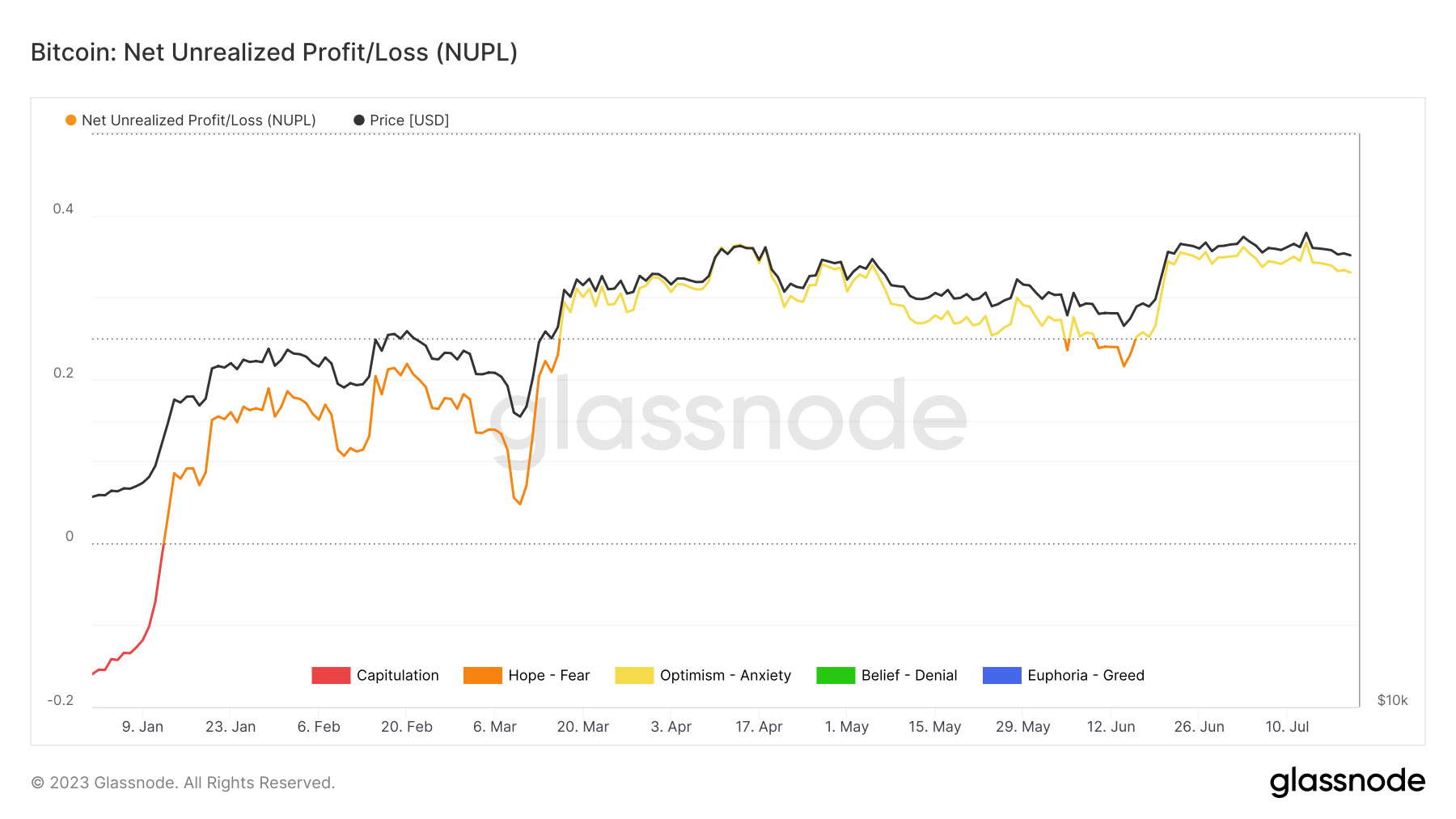

Since mid-March, NUPL has seen notable growth, showing the market’s optimism has been growing. After a little dip beneath 0.25 connected July 13, NUPL had accrued by 31% by July 20.

Graph showing Bitcoin’s NUPL YTD (Source: Glassnode)

Graph showing Bitcoin’s NUPL YTD (Source: Glassnode)This upward inclination successful NUPL suggests that the marketplace is becoming much optimistic, perchance starring to accrued buying unit and higher prices.

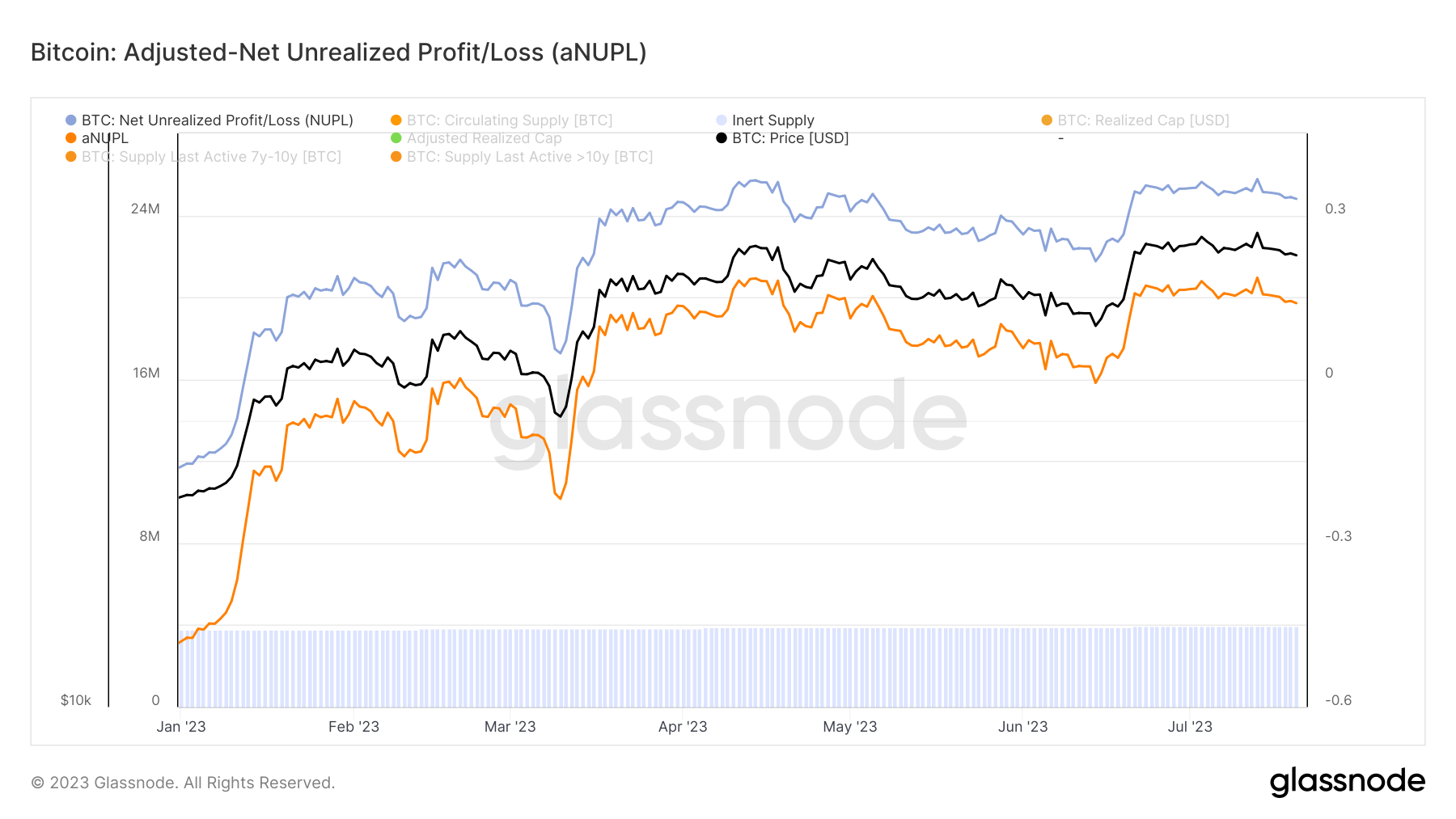

However, the NUPL tin sometimes beryllium skewed by dormant oregon mislaid coins. We usage the adjusted NUPL (aNUPL) to relationship for skewed data. This metric adjusts the marketplace headdress and NUPL to discount the effect of specified coins, assuming that the coins that haven’t been transacted with for implicit 7 years are equivalent to an inert supply.

The aNUPL has besides seen a important increase, rising by astir 130% since the opening of the year.

Graph showing Bitcoin’s aNUPL YTD (Source: Glassnode)

Graph showing Bitcoin’s aNUPL YTD (Source: Glassnode)The increasing NUPL and aNUPL bespeak a much optimistic marketplace sentiment. This could perchance pb to accrued buying unit and higher prices successful the adjacent term. However, it’s important to enactment that NUPL is simply a comparative measure, meaning it tin beryllium influenced by utmost movements successful the market, making it little reliable during periods of precocious volatility.

While NUPL provides invaluable insights, it should beryllium utilized in conjunction with other metrics and fundamental analysis for a much broad perspective, chiefly due to the fact that NUPL alone, similar each indicators, whitethorn not beryllium a beardown predictor of semipermanent terms movements.

The station Rising unrealized profits bespeak a much optimistic Bitcoin market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)