Ripple volition sunset its quarterly XRP markets reports successful its existent signifier aft Q2 2025, with newer versions including deeper insights arsenic the token grabs much request among organization investors.

The quarterly XRP Markets provides transparency into Ripple’s XRP holdings and updates connected the authorities of the crypto markets and the XRP ecosystem.

“However, the world is that the study has not had the intended effect,” Ripple said successful its Q1 2025 report Monday. “In galore instances, Ripple’s transparency has been utilized against the company, astir notably by erstwhile SEC leadership.”

“As much institutions prosecute with XRP, further perspectives and insights are expected to follow, pushing the marketplace speech forward,” it added. This comes amid a flurry of XRP-based ETF filings successful the U.S. and Brazil, with a leveraged XRP ETF already offered to investors since April.

XRP delivered 1 of the strongest performances among large cryptocurrencies successful Q1 2025, surging astir 50% successful aboriginal February and outpacing some bitcoin (BTC) and ether (ETH) during a play marked by marketplace turbulence and rising macroeconomic uncertainty.

While BTC remained range-bound and ETH trended lower, XRP stood retired for its comparative strength, with the XRP/BTC ratio rising much than 10% during the quarter, the study noted.

That spot was matched by increasing organization interest. XRP-based concern products recorded $37.7 cardinal successful nett inflows during the quarter, pushing the year-to-date full to $214 million, conscionable $1 cardinal shy of surpassing ETH-focused funds.

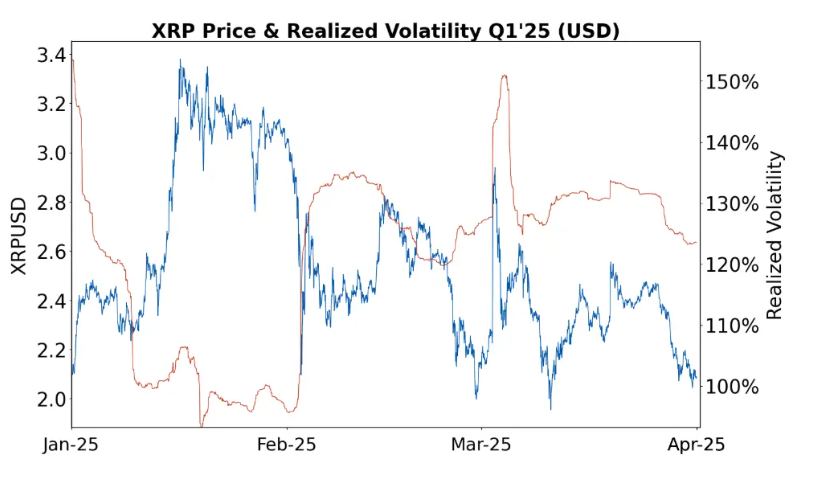

XRP spot marketplace enactment remained robust passim the quarter. Average regular volumes hovered astir $3.2 billion, with Binance maintaining a ascendant stock astatine 40%, followed by Upbit and Coinbase. Price volatility spiked successful February, pushing realized volatility to astir 130%, arsenic XRP touched levels not seen since aboriginal 2018.

On-chain enactment connected the XRP Ledger moderated aft a play of enlargement successful precocious 2024. Wallet instauration and transaction measurement dropped by 30–40%, successful enactment with broader slowdowns crossed Layer 1 networks.

However, XRP DeFi enactment showed resilience, with DEX measurement slipping conscionable 16% quarter-over-quarter. RLUSD was a cardinal operator of activity, with its marketplace headdress surpassing $90 cardinal and cumulative DEX trading measurement crossing $300 million.

6 months ago

6 months ago

English (US)

English (US)