The post Ripple News: XRP ETFs Continue to See Demand as Crypto Prices Fall appeared first on Coinpedia Fintech News

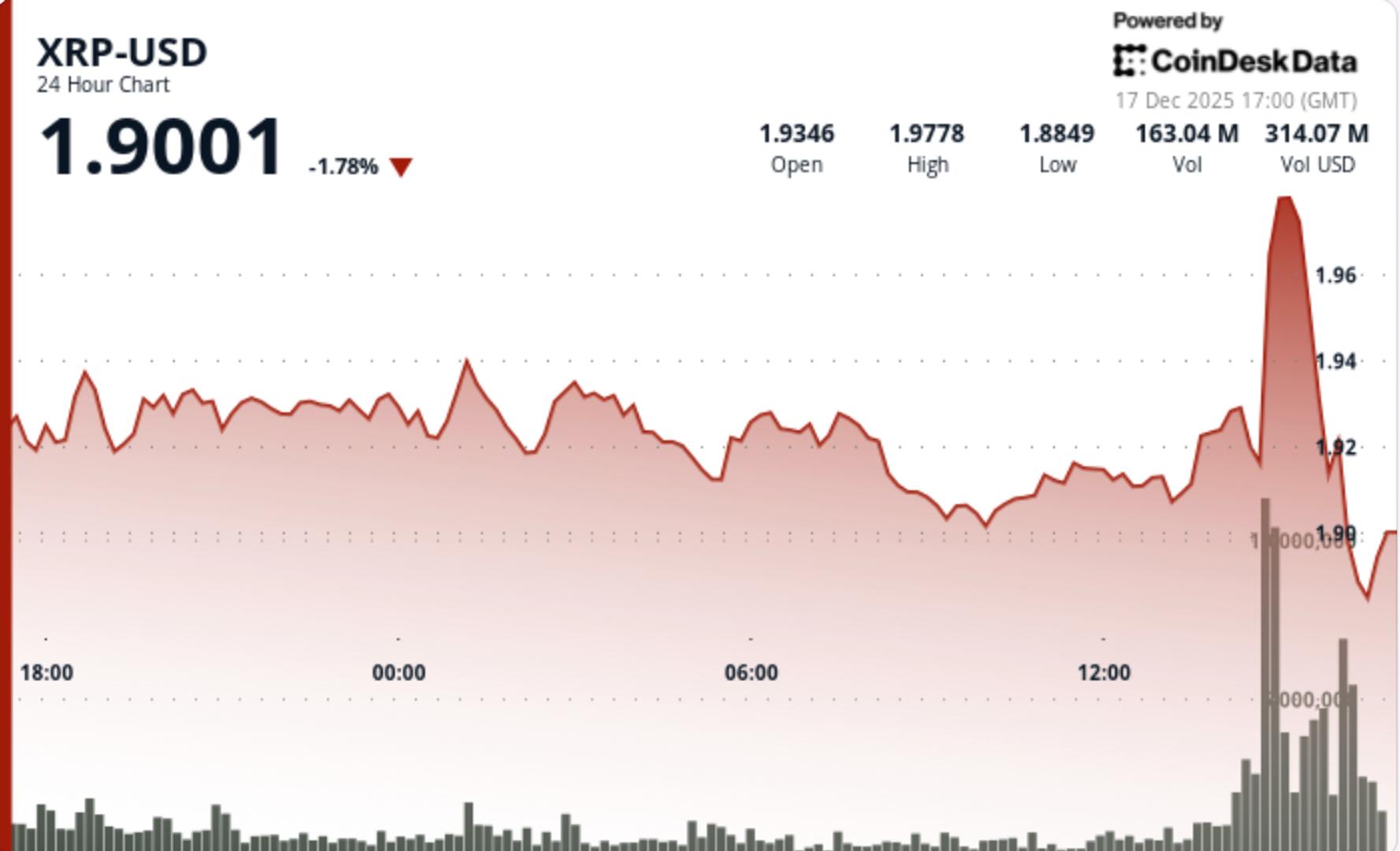

The broader crypto market has been under pressure in recent weeks, with prices moving lower. Bitcoin has slipped below $88,000, Ethereum has dropped more than 1%, and several altcoins have followed the downward trend.

Despite this pullback, one area of the market is clearly standing out: XRP exchange-traded funds (ETFs). While Bitcoin and Ether ETFs have seen steady outflows, XRP ETFs are moving in the opposite direction.

XRP Spot ETFs Record 30 Straight Days of Inflows

Since launching on November 13, spot XRP ETFs have recorded 30 consecutive days of net inflows, a performance that sharply contrasts with Bitcoin and Ether products.

Ripple CEO Brad Garlinghouse also opened up about the milestone, noting that XRP spot ETFs have now become the fastest crypto spot ETFs to reach $1 billion in assets under management (AUM) in the U.S. since Ethereum.

This strong performance comes in a crowded market. More than 40 crypto ETFs have launched in the U.S. this year alone, yet XRP products are clearly separating themselves from the rest.

Crypto ETFs Face Outflows as Prices Decline

According to Sui Chung, CEO of CF Benchmarks, Bitcoin and Ether ETFs have lost around $10 billion in assets over the past few weeks.

Chung explained that this decline is driven by two main factors:

- Investors taking profits after earlier gains

- Capital rotating into other asset classes, such as equities and fixed income

Shifts in interest rate expectations have also influenced investor behavior, with some seeing better short-term opportunities outside large-cap crypto assets.

XRP ETFs Stand Out as Capital Rotates

While the broader crypto ETF market has struggled, XRP and Solana ETFs have emerged as clear bright spots.

Together, these newer ETFs have attracted between $1.5 billion and $2 billion in inflows, with XRP showing especially steady demand over the past month.

Chung said in an interview with CNBC that many investors are not leaving crypto entirely. Instead, they are rotating profits from Bitcoin and Ether ETFs into altcoin ETFs, including XRP.

Why Investors Are Choosing XRP

XRP’s strong inflows are not happening by chance. Several factors are driving investor interest:

First, XRP is one of the most recognized crypto assets in the market. Its long history gives investors familiarity and confidence, especially compared to newer tokens.

Second, XRP’s price performance over recent years has been strong, keeping it firmly on the radar of both retail and institutional investors.

Third, XRP offers diversification. During periods when Bitcoin and Ether are under pressure, some investors see XRP as a way to stay exposed to crypto without relying only on the largest assets.

Altcoin ETFs Offer a Different Approach

Chung said that this trend does not mean investors are turning bearish on Bitcoin or Ether.

Instead, many are adjusting their exposure. Altcoin ETFs like XRP provide access to different networks, use cases, and growth stories, which can be appealing when large-cap crypto prices are moving sideways or lower.

1 hour ago

1 hour ago

<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US.

<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US.

English (US)

English (US)