The SEC issued a no-action missive on Sept. 30, allowing concern advisers to usage state-chartered spot companies arsenic qualified custodians for crypto assets, opening the doorway for Ripple, Coinbase, and different integer plus firms to service registered funds.

The unit guidance clarifies the explanation of “bank” nether the Investment Advisers Act of 1940 and the Investment Company Act of 1940, addressing uncertainty regarding whether authorities spot companies conscionable this definition.

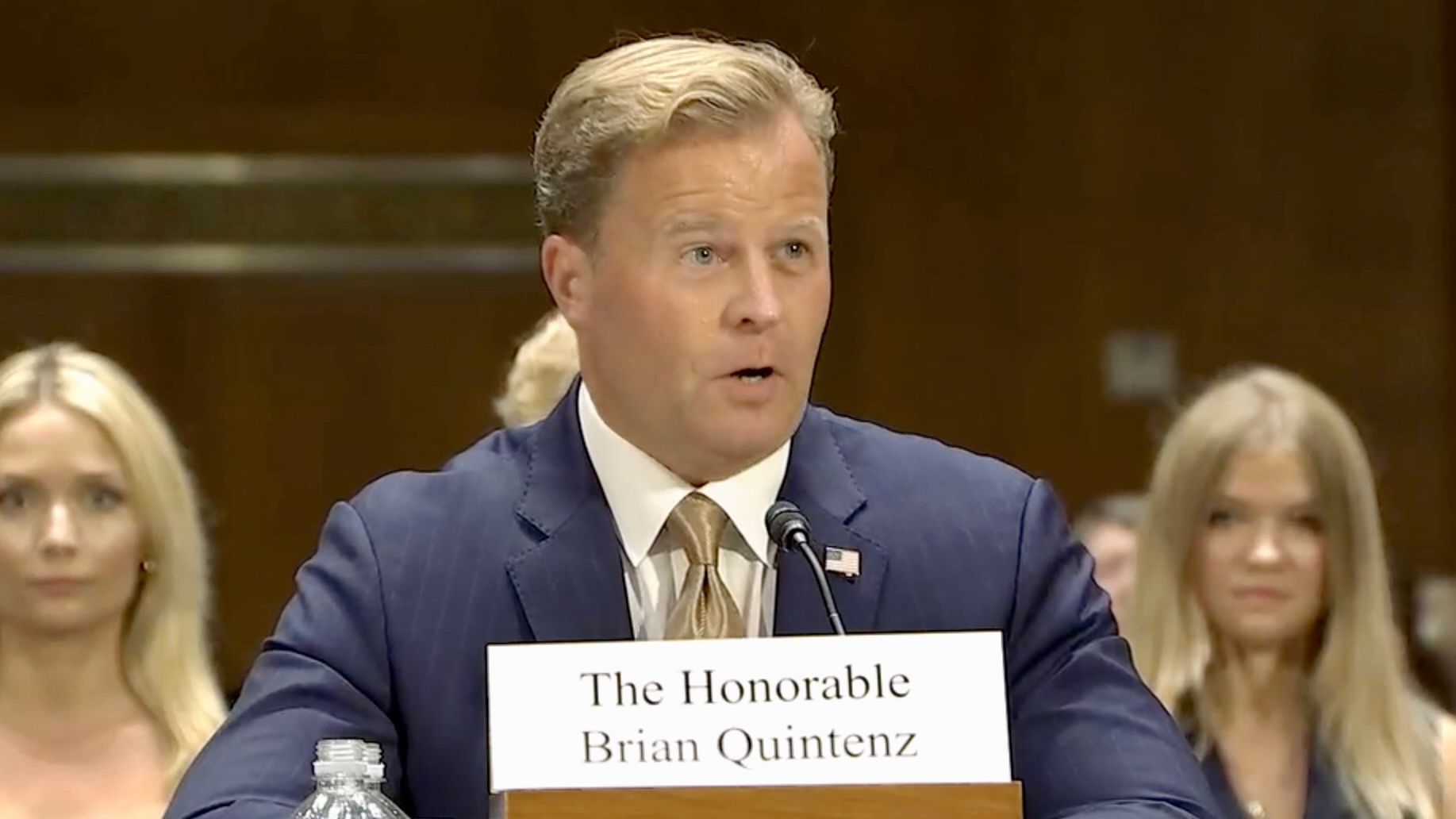

Journalist Eleanor Terrett reported that Brian Daly, Director of the SEC’s Division of Investment Management, told her:

“This further clarity was needed due to the fact that state-chartered spot companies were not universally seen arsenic eligible custodians for crypto assets.”

Both statutes necessitate advisers to support lawsuit assets with qualified custodians, typically banks oregon spot companies with nationalist fiduciary powers.

Ripple, Coinbase among beneficiaries

The clarity provided by the missive positions companies specified arsenic Ripple and Coinbase to go recognized qualified custodians for crypto assets.

These firms run arsenic state-chartered spot companies but antecedently faced questions astir their eligibility nether national custody requirements.

Bloomberg ETF expert James Seyffart called the letter “a textbook illustration of much clarity for the integer plus space” and “exactly the benignant of happening the manufacture was asking for implicit the past fewer years.”

Investment advisers indispensable behaviour yearly reviews confirming that authorities spot companies support policies designed to safeguard crypto assets from theft, loss, and misappropriation.

Requirements to beryllium a custodian

The missive requires advisers to reappraisal audited fiscal statements prepared nether GAAP and interior power reports from autarkic accountants.

Custodial agreements indispensable prohibit lending, pledging, oregon rehypothecating crypto assets without the client’s consent and necessitate the segregation of lawsuit assets from the custodian’s equilibrium sheet.

The guidance applies to authorities spot companies authorized by authorities banking authorities to supply crypto custody services.

These institutions look broad regulatory frameworks including licensing requirements, minimum superior standards, periodic examinations, and enforcement authorization for non-compliance.

Daly noted the guidance addresses “today’s products, today’s managers, and today’s issues,” though the SEC could code the taxable done aboriginal rulemaking.

The station Ripple and Coinbase to suffice arsenic crypto custodians nether caller SEC unit guidance appeared archetypal connected CryptoSlate.

3 hours ago

3 hours ago

English (US)

English (US)