Glassnode information analyzed by CryptoSlate showed importantly greater unfastened involvement calls for Bitcoin and Ethereum.

Calls and puts notation to the buying and selling, respectively, of options. These derivative products springiness holders the right, but not the obligation, to bargain oregon merchantability the underlying plus astatine immoderate aboriginal constituent for a predetermined price.

This predetermined terms is besides called the onslaught price; successful conjunction with the spot price, it determines the option’s “moneyness.”

Calls, wherever the onslaught terms is little than the spot price, are “in the money,” arsenic traders tin bargain the enactment for little than the marketplace terms and merchantability immediately. Similarly, puts wherever the onslaught terms is higher than the spot terms are “in the money,” arsenic traders tin merchantability the enactment supra the marketplace price.

Being “out of the money” occurs erstwhile calls person a onslaught terms supra the marketplace terms oregon puts person a onslaught terms little than the marketplace price.

The dispersed of calls and puts crossed antithetic onslaught prices gives a wide gauge of marketplace sentiment portion besides giving accusation connected traders’ expectations for aboriginal prices.

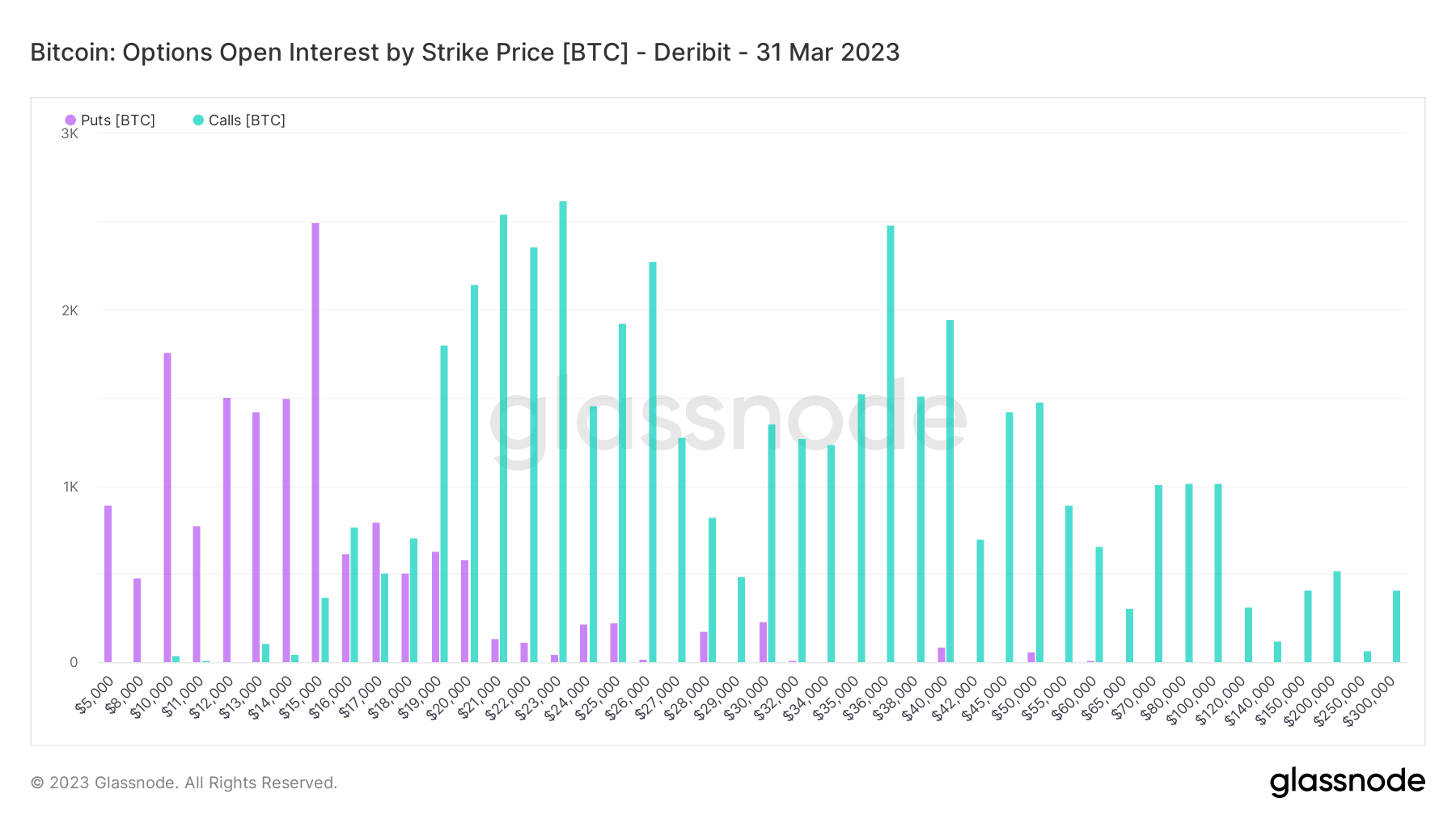

Bitcoin Open Interest

Q1 2023 Bitcoin Open Interest by Strike Price showed importantly much calls than puts, suggesting rising bullish sentiment among options traders.

Bitcoin is favored successful the $15,000 – $20,000 range, wherever the calls and puts are astir even. This is expected fixed that, since the FTX collapse, BTC has traded wrong this wide terms band.

Source: Glassnode.com

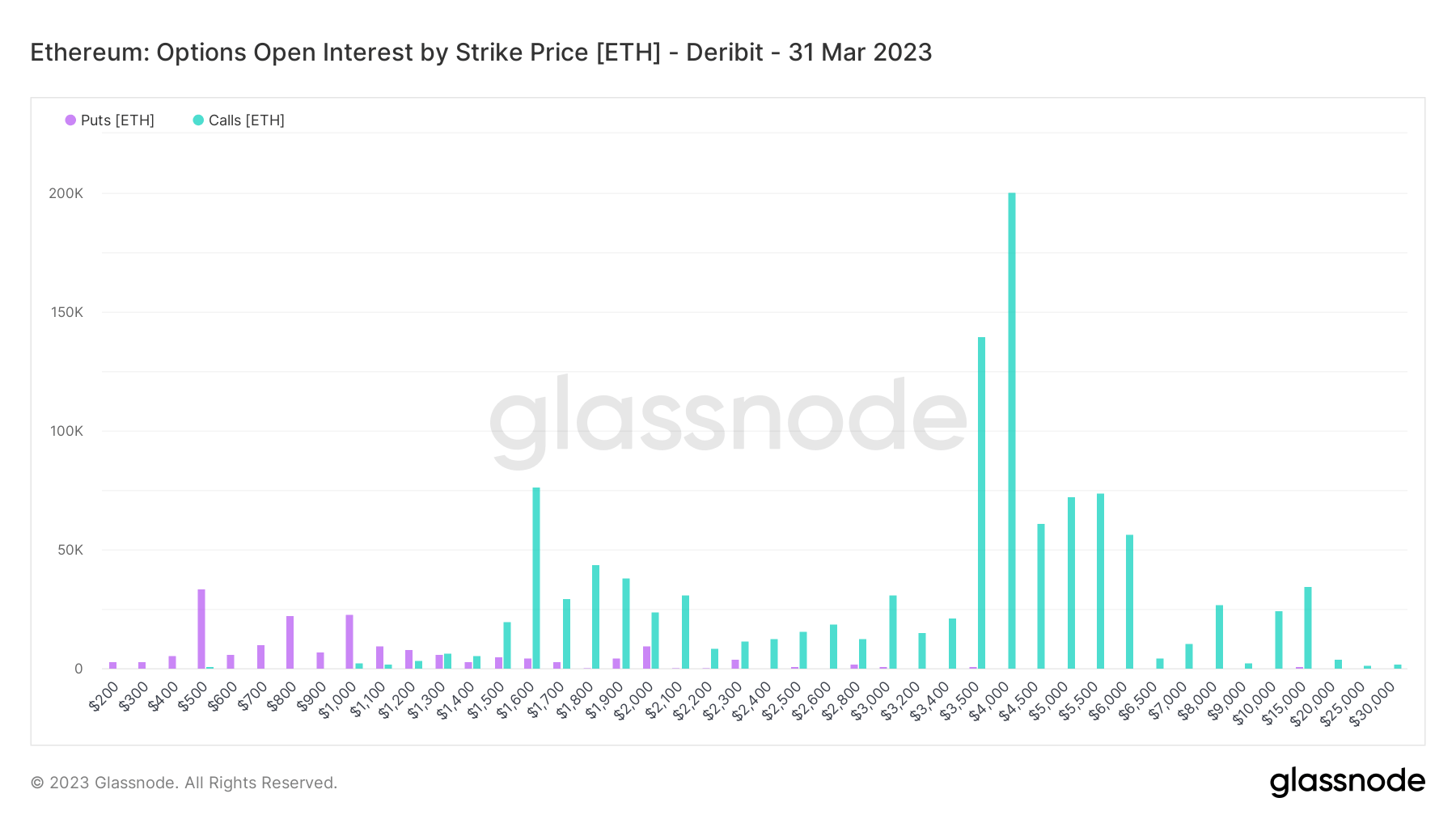

Source: Glassnode.comEthereum Open Interest

Q1 2023 Ethereum Open Interest by Strike Price showed the chiseled dominance of calls, adding to the bullish sentiment narrative.

Ethereum is mostly considered to person a higher beta than Bitcoin. However, successful a risk-off environment, this whitethorn not beryllium the case.

It was noted that the astir captious calls were for $3,500 and $4,000, astatine 150,000 and 200,000, respectively.

Options Open Interest

Options Open InterestAs the archetypal week of 2023 draws to a close, uncertainty remains the overriding theme. Further macro headwinds could adhd to crypto stagnation, thwarting options traders’ expectations.

The station Research: Sentiment among Bitcoin and Ethereum options traders flips bullish appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)