The long-awaited Merge volition link Ethereum’s existing execution furniture to its Proof-of-Stake statement furniture and wide marketplace sentiment has investors buying successful mentation for a sustained pump arsenic this is simply a milestone lawsuit successful the project’s evolution.

However, investigation of the options marketplace suggests the Merge whitethorn beryllium a “buy the rumor, merchantability the news” event.

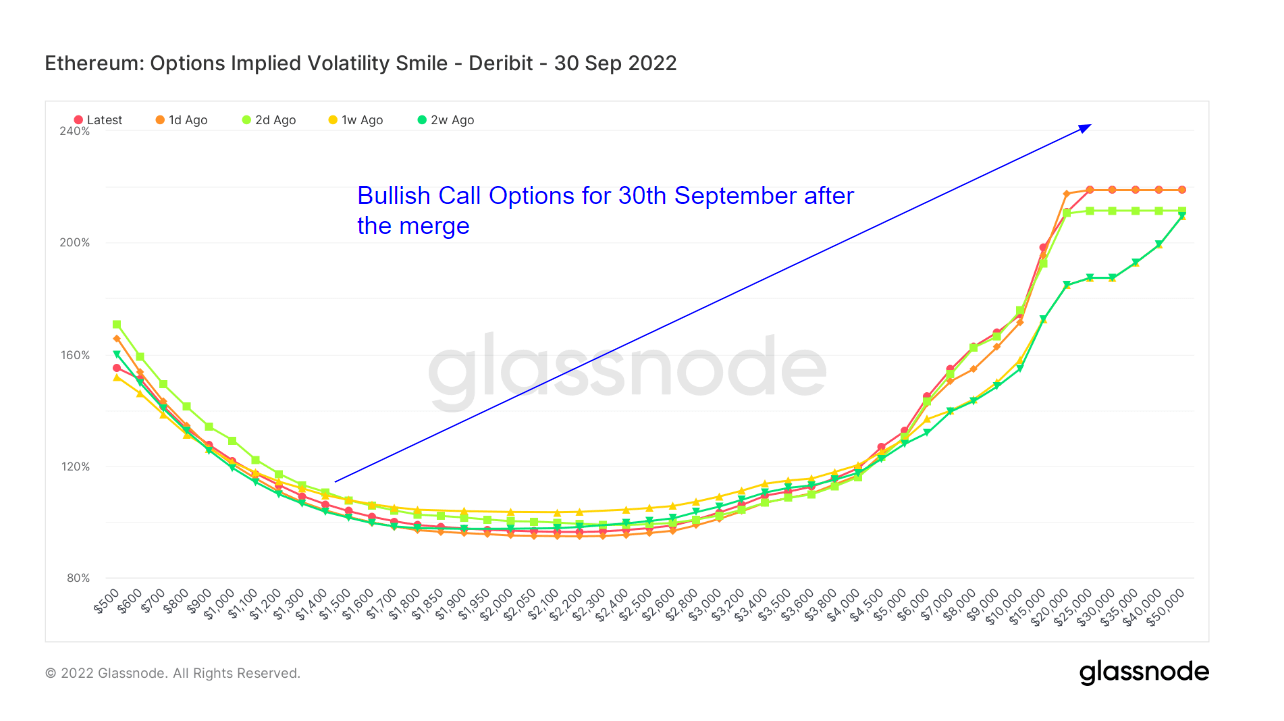

The Volatility Smile

The Volatility Smile illustration results from plotting the onslaught terms and implied volatility of options with the aforesaid underlying plus and expiration date.

Implied volatility rises erstwhile the underlying plus of an enactment is further out-of-the-money (OTM), oregon in-the-money (ITM), compared to at-the-money (ATM).

Options further OTM usually person higher implied volatilities; hence Volatility Smile charts typically amusement a “smile” shape. The steepness and signifier of this grin tin beryllium utilized to measure the comparative expensiveness of options and gauge what benignant of process risks the marketplace is pricing in.

The accompanying fable refers to humanities overlays and shows the signifier of the grin 1 day, 2 days, 1 week, and 2 weeks ago, respectively. For instance, erstwhile ATM implied volatility values for utmost strikes are little contiguous compared to humanities overlays, it could bespeak a reduced tail-risk being priced successful by the market. In specified cases, the probability for utmost moves compared to mean moves has travel down successful the market’s view.

The Merge is scheduled for Sept. 15 and the immense request for telephone options expiring astatine the extremity of September is acting arsenic a bullish operator connected price. Implied volatility is up implicit 200% for prices implicit $10k-$50k, meaning investors are consenting to wage a premium.

Source: glassnode.com

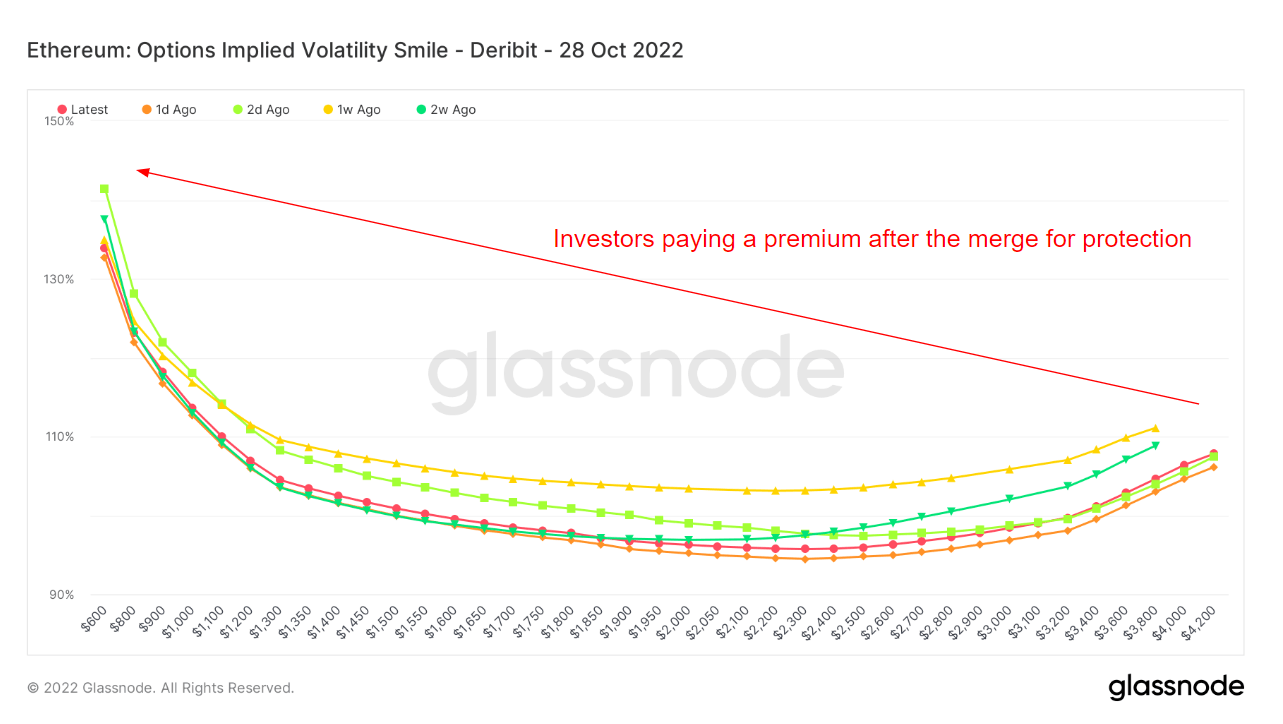

Source: glassnode.comEthereum options request tailing disconnected post-Merge

Volatility for options expiring successful October shows a drastic alteration successful the Volatility Smile.

The illustration beneath depicts a crisp diminution presenting a flatter structure. This alteration suggests little request for Ethereum options aft the Merge goes live.

Nonetheless, the near process is inactive precocious for implied volatility, implying traders are consenting to wage a premium for enactment options aft the Merge.

In conjunction, the 2 charts bespeak options traders are buying the rumor and selling the news.

The station Research: Options marketplace investigation suggests Ethereum’s Merge whitethorn beryllium a ‘buy rumor, merchantability news’ event appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)