Five weeks person passed since Ethereum’s highly anticipated Shapella upgrade, which was acceptable to heighten the ratio and manageability of Ethereum’s transactional model.

In the weeks preceding the upgrade, the marketplace was ripe with volatility arsenic it geared up for the imminent changes the upgrade was astir to bring.

The Shapella upgrade’s power extends beyond the Ethereum ecosystem. It carries implications for assorted industries that leverage Ethereum’s blockchain, perchance transforming concern operations done enhanced ratio and transparency.

Almost 40 days person passed since the upgrade was implemented connected April 12, warranting a deeper look into Ethereum’s on-chain metrics.

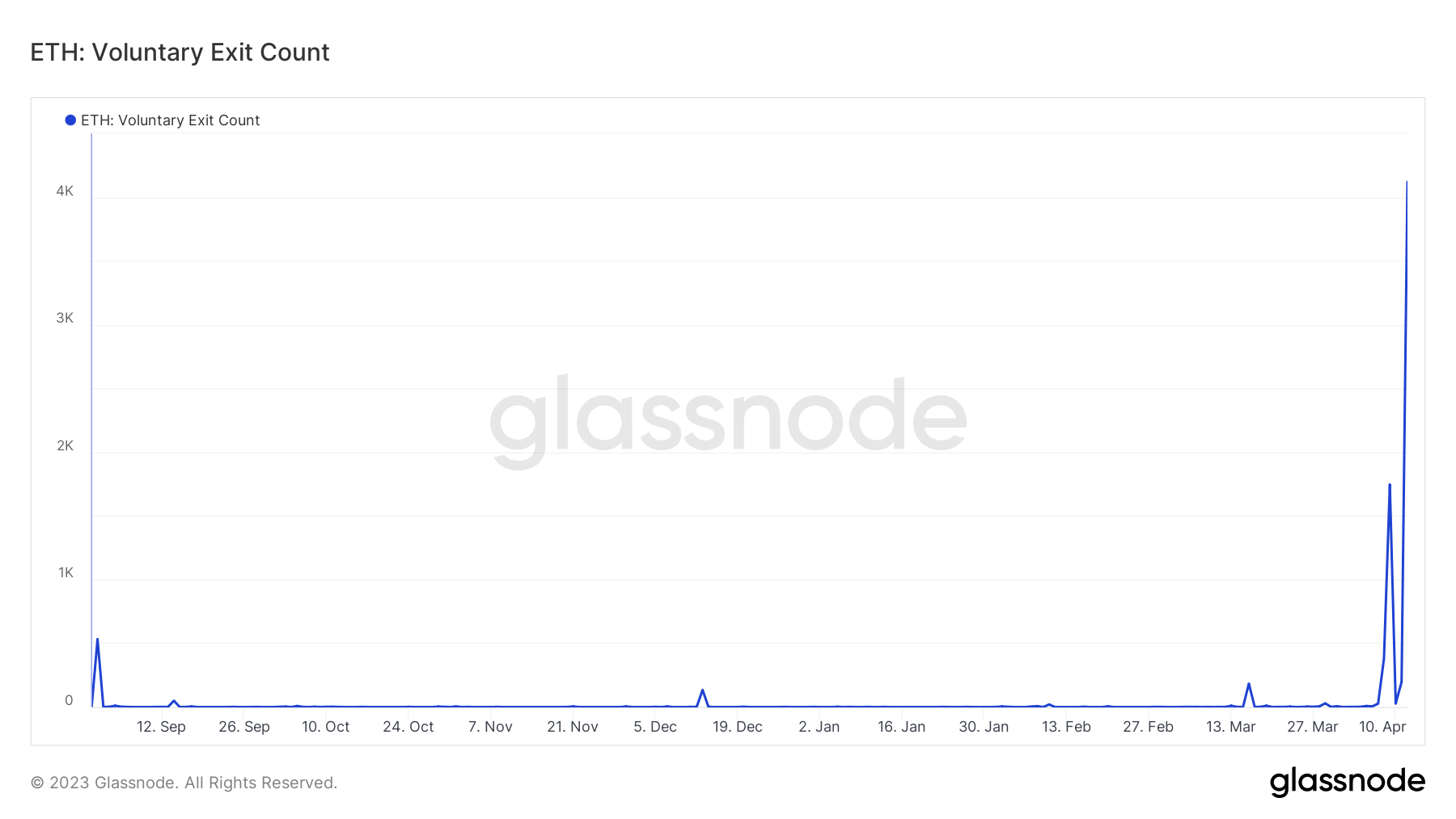

Leading up to Shapella, the voluntary exit number saw a important uptick. Approximately 860,500 ETH was pending withdrawal connected April 12, 12 hours post-upgrade, with astir 296,280 validators waiting successful the queue.

Graph showing the voluntary exit number from September 2022 to April 2023 (Source: Glassnode)

Graph showing the voluntary exit number from September 2022 to April 2023 (Source: Glassnode)Data from April 13 showed lone 17,000 validators were awaiting a afloat withdrawal. This indicates that a bulk of the ETH being withdrawn came from staking rewards alternatively than the staking principal.

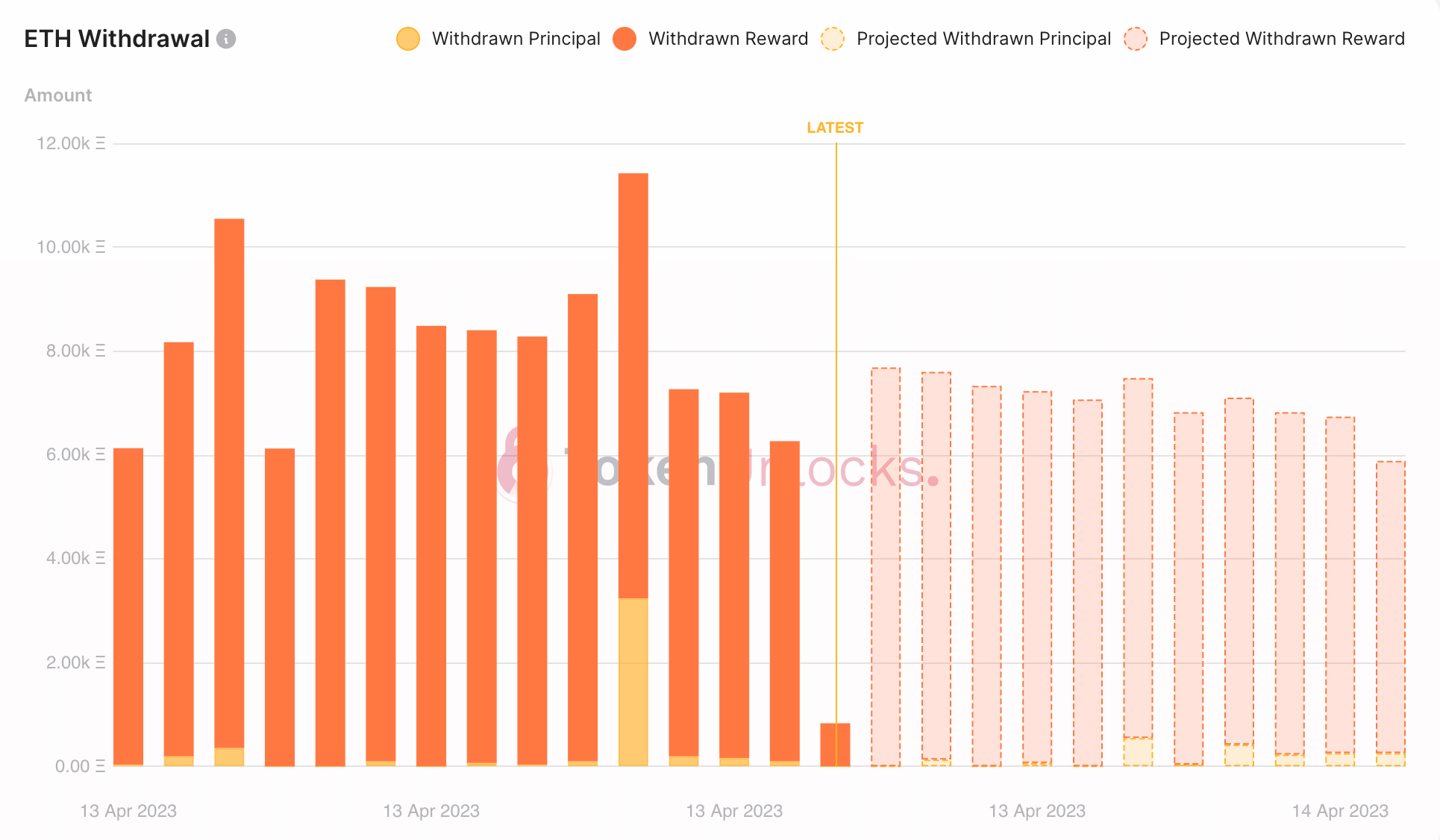

Chart showing Ethereum’s hourly withdrawal illustration connected April 13(Source: Token Unlocks)

Chart showing Ethereum’s hourly withdrawal illustration connected April 13(Source: Token Unlocks)There was besides a alteration successful the fig of progressive validators connected April 12, with the web seeing the archetypal back-to-back antagonistic alteration successful the fig of validators.

Ethereum’s realized price, the mean terms astatine which ETH past moved on-chain, stood astatine conscionable implicit $1,400 pre-upgrade.

Despite Ethereum’s and Bitcoin’s prices holding steady, liquid staking tokens took a important hit. CryptoSlate information showed the assemblage dropped by 13% successful the week preceding Shapella, betwixt April 5 and April 12, indicating the marketplace had been gearing up for the upgrade for a while.

As the weeks passed, Ethereum began to consciousness the upgrade’s much profound impact. By May 21, 5 weeks aft the upgrade, implicit 2.83 cardinal of staked ETH was withdrawn from the network.

Data from TokenUnlocks shows that 527,350 validators person made a partial exit from the web since the upgrade, withdrawing conscionable their accrued staking rewards. Only 811 validators made a afloat exit, withdrawing some their main and rewards.

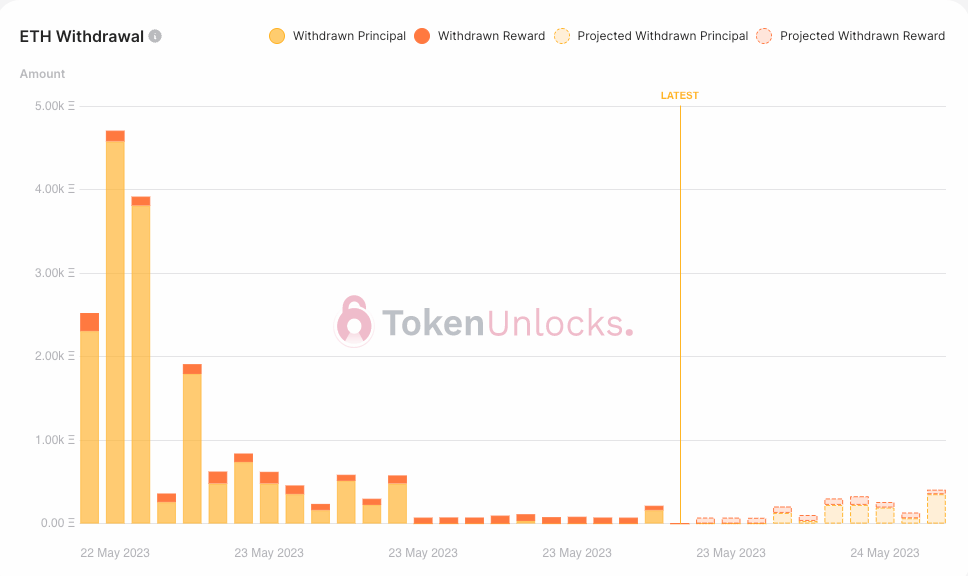

The bulk of withdrawn ETH successful the days aft Shapella was made up of staking rewards. However, 5 weeks pursuing the upgrade, the tides person shifted and astir of the withdrawn ETH comes from staking principal.

Chart showing Ethereum’s hourly withdrawal illustration connected May 21 (Source: Token Unlocks)

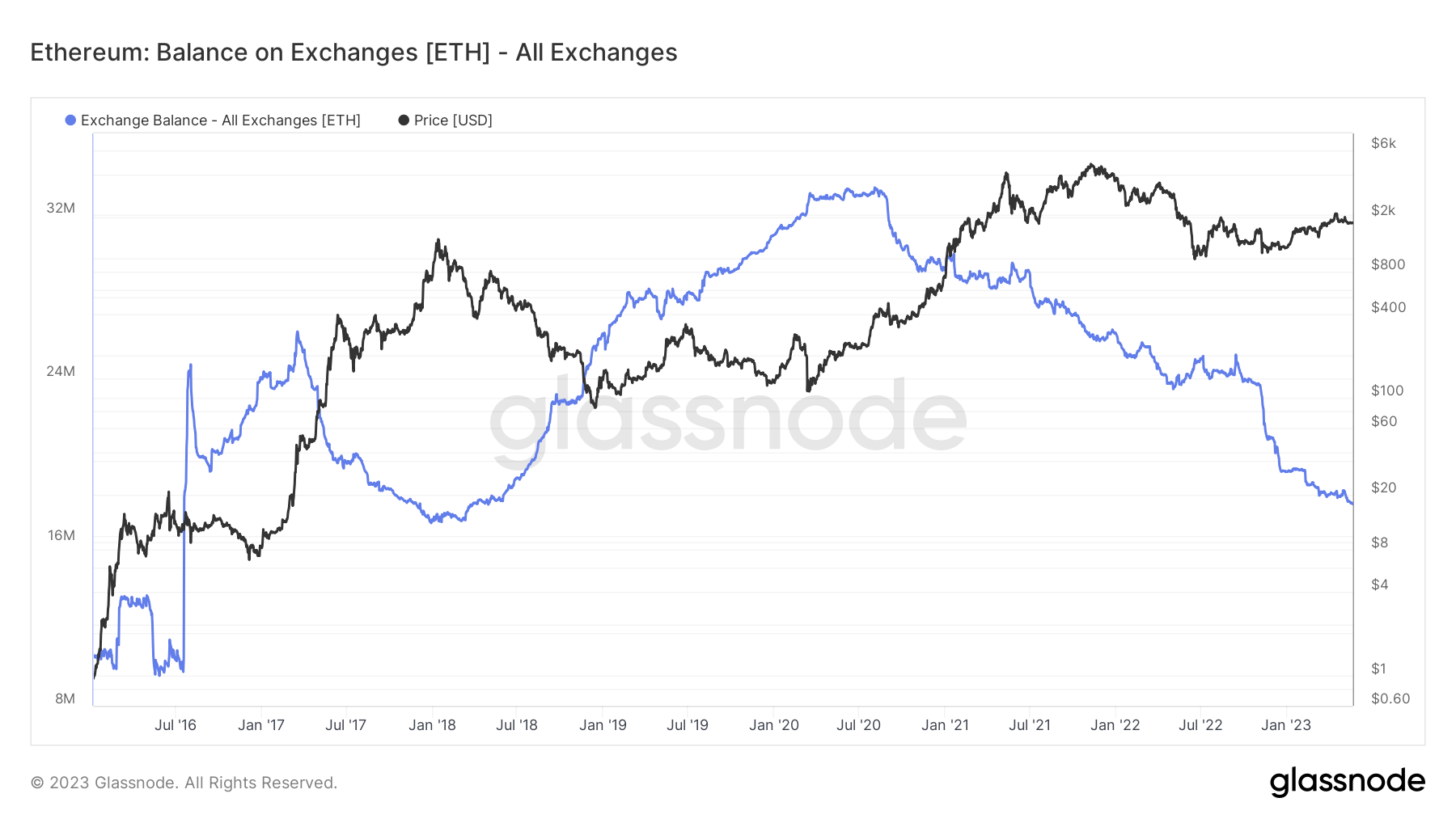

Chart showing Ethereum’s hourly withdrawal illustration connected May 21 (Source: Token Unlocks)By May 21, Ethereum’s equilibrium connected centralized exchanges decreased significantly. CryptoSlate reported that the fig of ETH crossed exchanges dropped to a five-year low, perchance indicating a displacement distant from trading and a caller absorption connected self-custody for investors.

Graph showing the Ethereum speech equilibrium from 2016 to 2023 (Source: Glassnode)

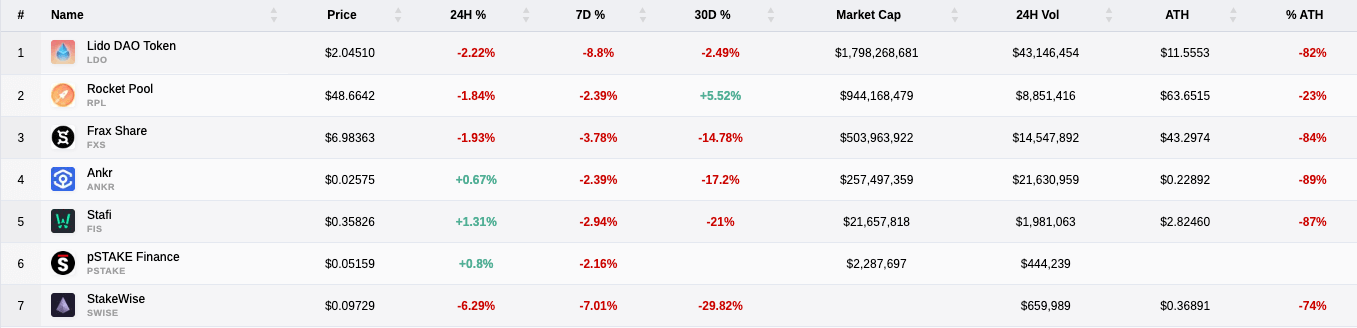

Graph showing the Ethereum speech equilibrium from 2016 to 2023 (Source: Glassnode)Liquid staking tokens proceed to amusement anemic show adjacent 5 weeks pursuing the upgrade, with the bulk of the tokens posting double-digit losses successful the past month.

Table showing the show of the liquid staking assemblage connected May 21 (Source: CryptoSlate)

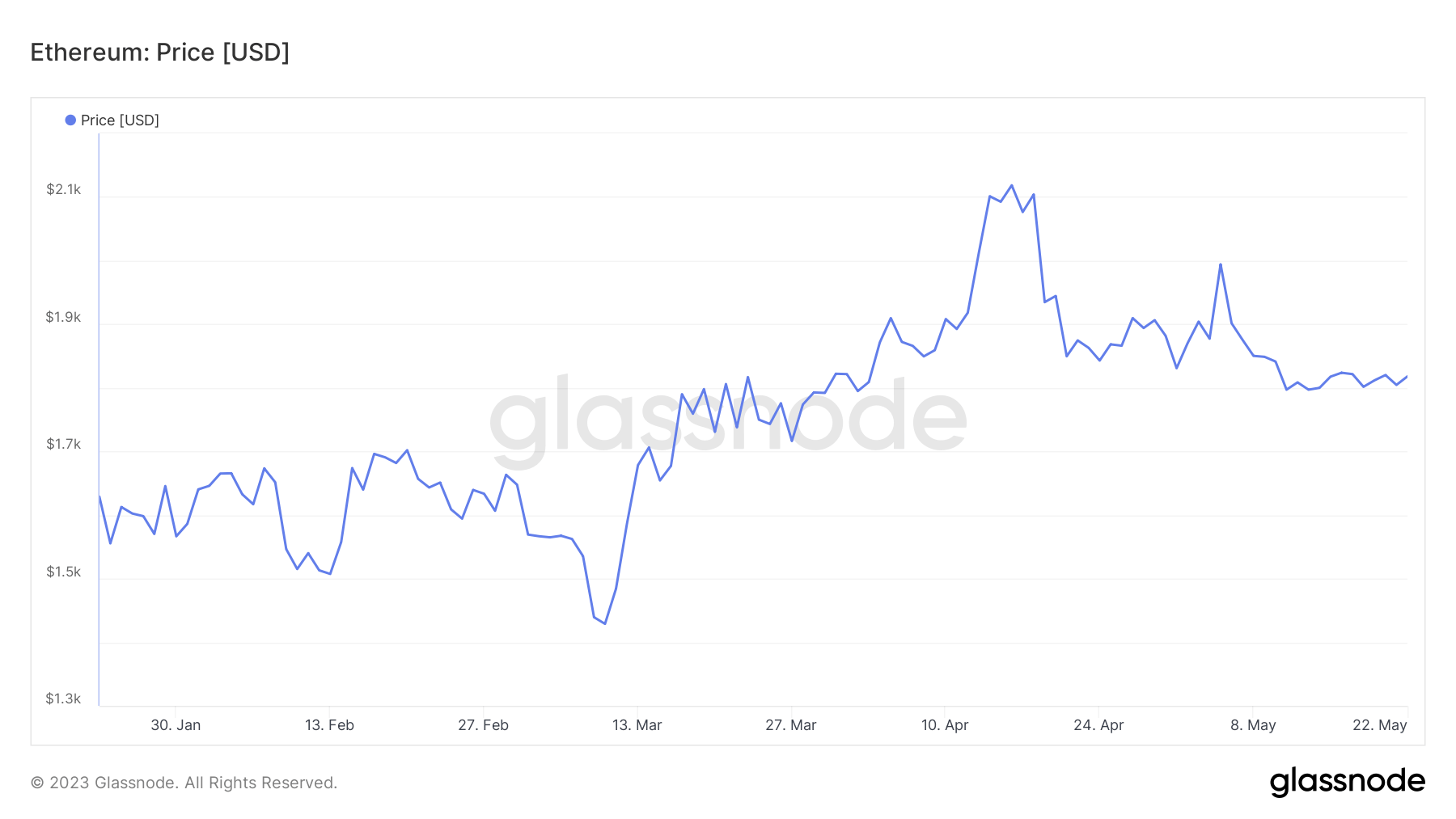

Table showing the show of the liquid staking assemblage connected May 21 (Source: CryptoSlate)In the period starring up to Shapella, Ethereum’s terms saw a notable summation arsenic the marketplace began gearing up for the upcoming volatility. ETH peaked 4 days aft the upgrade, reaching $2,110 connected April 16. However, the rally was short-lived and ETH began a accelerated diminution that pushed its terms beneath $1,800. Currently lasting astatine conscionable implicit $1,817, ETH seems to beryllium showing immoderate signs of stability.

Graph showing Ethereum’s terms successful 2023 (Source: Glassnode)

Graph showing Ethereum’s terms successful 2023 (Source: Glassnode)While the upgrade brought astir anticipated improvements, it besides instigated shifts that influenced validators’ actions, staking tokens’ performance, and the Ethereum network’s wide state. As the blockchain terrain continues to evolve, these metrics volition play a important relation successful guiding investigation and forecasting Ethereum’s aboriginal trajectory.

The station Research: Liquid staking tokens stay successful the reddish 5 weeks aft Ethereum’s Shapella upgrade appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)