Gold has agelong been considered the perfect hedge against ostentation for a agelong time. The precious metallic has stood the trial of economical meltdown, rising against the crashing worth of the dollar, oregon truthful we thought.

Global events successful 2022 person shown that golden whitethorn nary longer beryllium the champion hedge against inflation.

So far, the satellite has witnessed a warfare betwixt Ukraine and Russia, U.S. ostentation hitting a 40-year high, and concerns of a looming recession.

However, contempt each of this, the terms of golden dropped 7.07% successful the past six months.

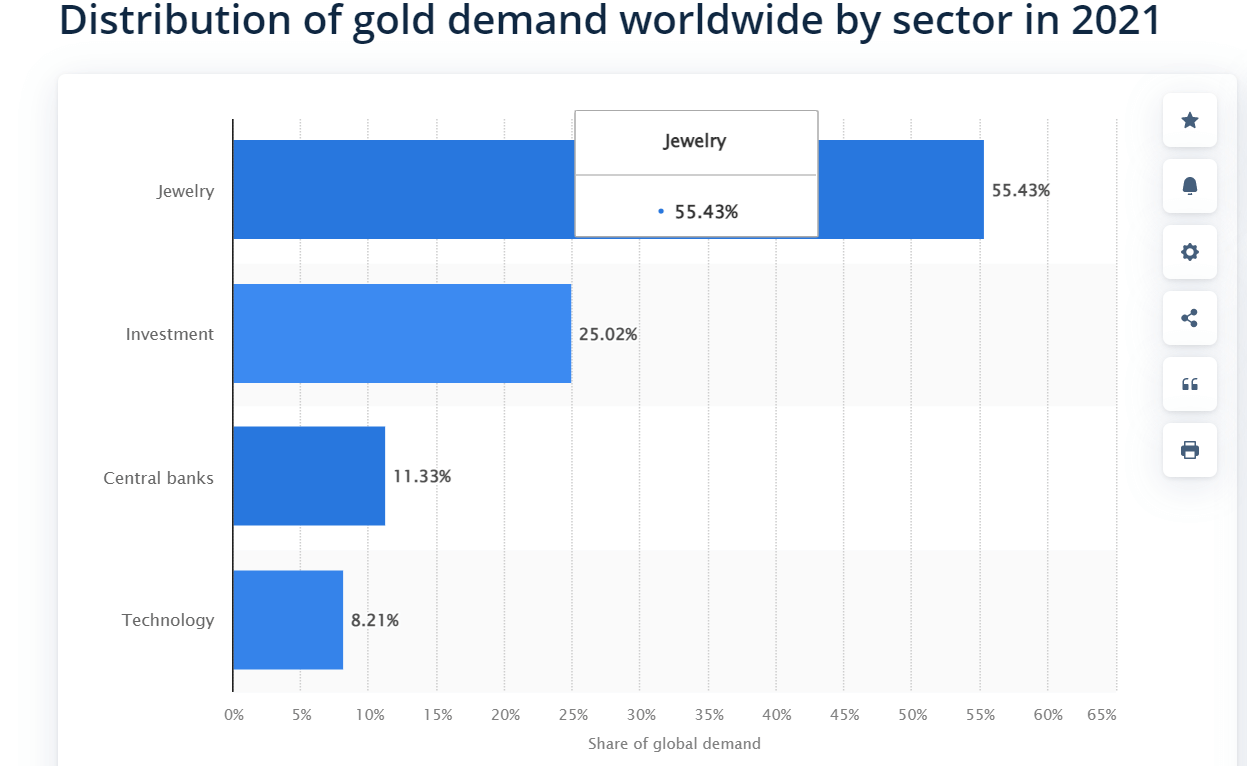

50% of gold’s request is for jewelry

The thought of golden arsenic an ostentation hedge looks adjacent much flawed erstwhile 1 looks intimately astatine the proviso and request of the precious metal.

Presently, golden has a marketplace headdress of astir $11 trillion. But implicit 50% of its request is for jewelry, portion 25% goes to concern and cardinal banks clasp astir 11.33%.

Source: Statista

Source: StatistaThere has been a crisp divergence betwixt the worth of golden and equities aft the U.S. abandoned the golden modular successful 1971.

As of January 1980, golden and equities had a marketplace headdress of $2.5 trillion, respectively.

As of 2022, the equities marketplace headdress has ballooned to $115 trillion, portion golden is astir $12 trillion. The crisp quality successful equities worth is owed to fiat currencies.

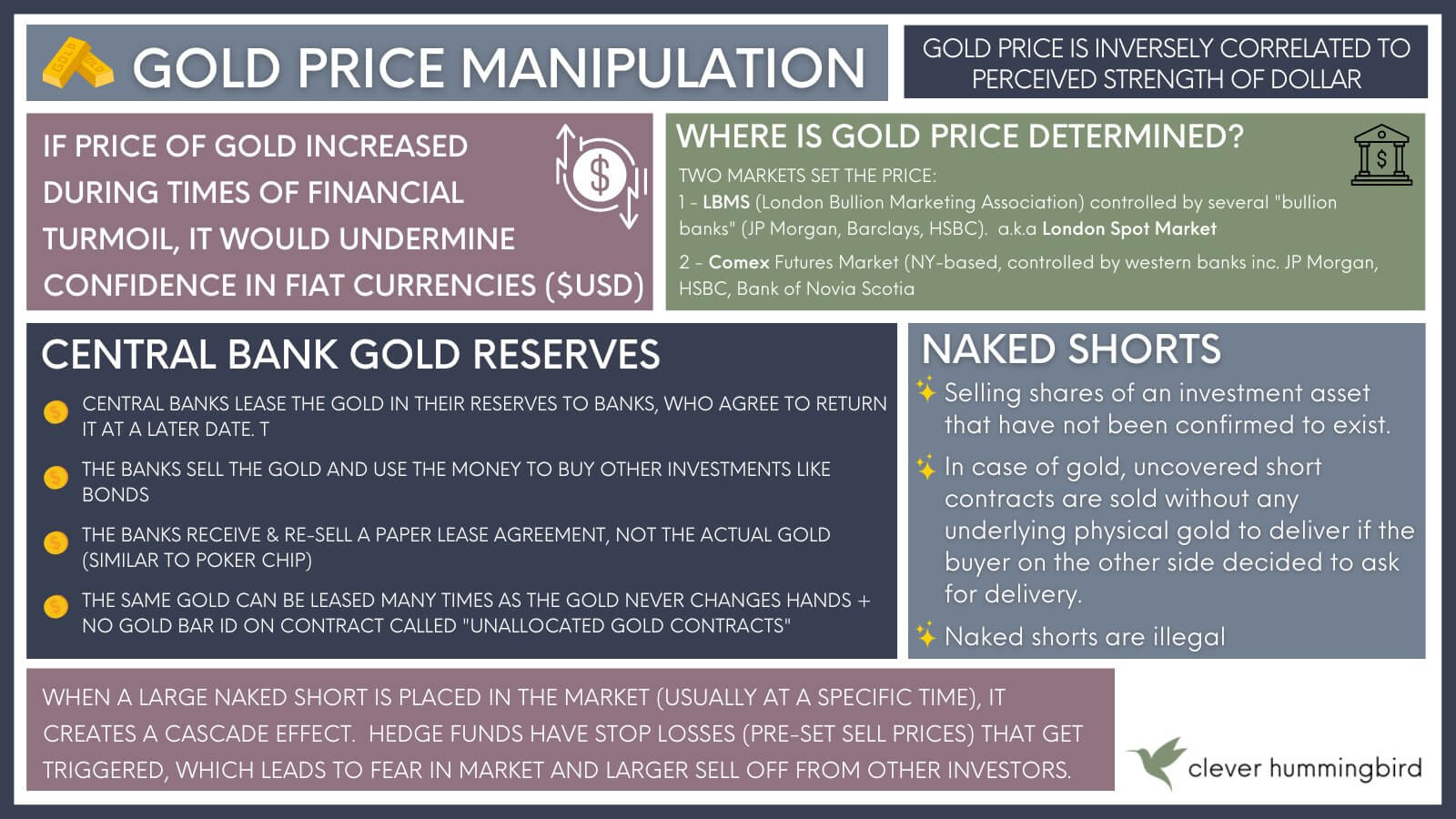

Are cardinal banks manipulating gold’s value?

With Central Banks holding a important stock of the precious metal, the diminution successful its worth suggests terms manipulation.

Central banks usually lend golden insubstantial certificates backed by golden to commercialized banks.

These banks usage the certificate to bargain bonds and different assets, which they merchantability for nett to bargain backmost the certificate.

This and different practices are communal ways the cardinal slope keeps the terms of golden debased since a important emergence successful its worth volition pb to radical selling dollars for gold.

Source: Clever hummingbird

Source: Clever hummingbirdBitcoin, the solution

Given the probability of terms manipulation for golden and fiat currency being a mediocre store of value, Bitcoin (BTC) remains the astir apt plus to measurement successful arsenic a hedge against inflation.

Despite its volatility, Bitcoin has each the qualities that marque it the champion semipermanent hedge against inflation. It is anonymous and decentralized, truthful it is not prone to manipulation.

Additionally, its constricted supply, durability, transparency, and impossibility of being counterfeited means it tin basal the trial of clip and proceed to emergence successful value.

In the past 5 years, the worth of BTC has grown 407% compared to gold’s 35%. Meanwhile, the U.S. dollar’s worth accrued 15% compared to different currencies, but ostentation has reduced its purchasing power.

While its volatility remains an issue, it is important to recognize that the worth of Bitcoin arsenic an ostentation hedge is successful its semipermanent possession.

For context, MicroStrategy’s Bitcoin adoption has helped its banal outperform Nasdaq, Gold, Silver, and FAANG stocks.

The station Research: Gold’s worth fell amid war, grounds ostentation and imaginable recession – is Bitcoin a amended hedge? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)