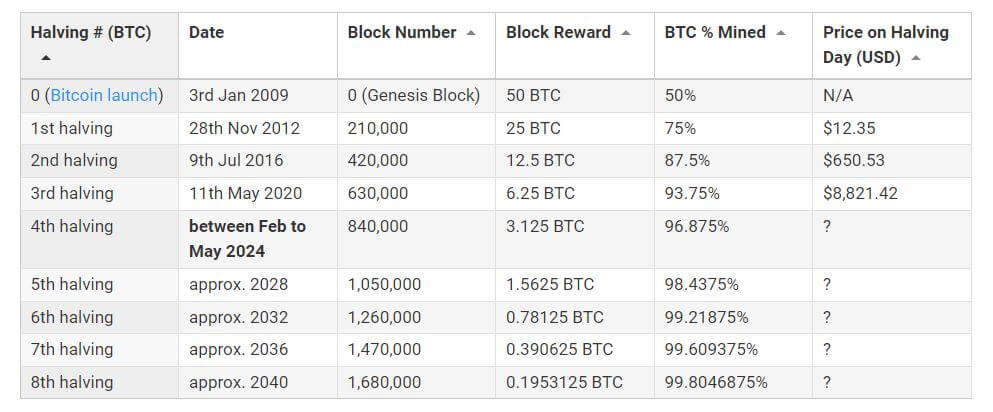

The Bitcoin halving refers to an lawsuit wherever miners’ artifact rewards are chopped successful half. This occurs astir each 4 years, depending connected erstwhile a full of 210,000 blocks person been mined from the erstwhile halving go-live date.

As a result, the fig of caller tokens entering circulation slows and less tokens participate the proviso – making Bitcoin much scarce implicit time.

This process volition proceed to the past halving successful 2136 erstwhile the mining reward volition beryllium chopped to 0.00000001 BTC.

Where are we successful the existent Bitcoin halving cycle?

The 3rd and adjacent halving is connected way to finalize connected March 25, 2024, with astir 75,000 blocks near to excavation earlier hitting that point.

Based connected this moving estimate, the fig of days from the erstwhile halving, connected May 11, 2020, comes to 1,414 days. Previous halvings took:

- 1st halving: Nov. 28, 2012 to July 8, 2016 – 1,318 days.

- 2nd halving: July 9, 2016 to May 10, 2020 – 1,401 days

The terms connected halving time has, truthful far, recorded gains supra the terms connected the erstwhile halving day, lending enactment to the mentation that BTC scarcity drives terms upwards.

But is that the afloat story?

Realized Price

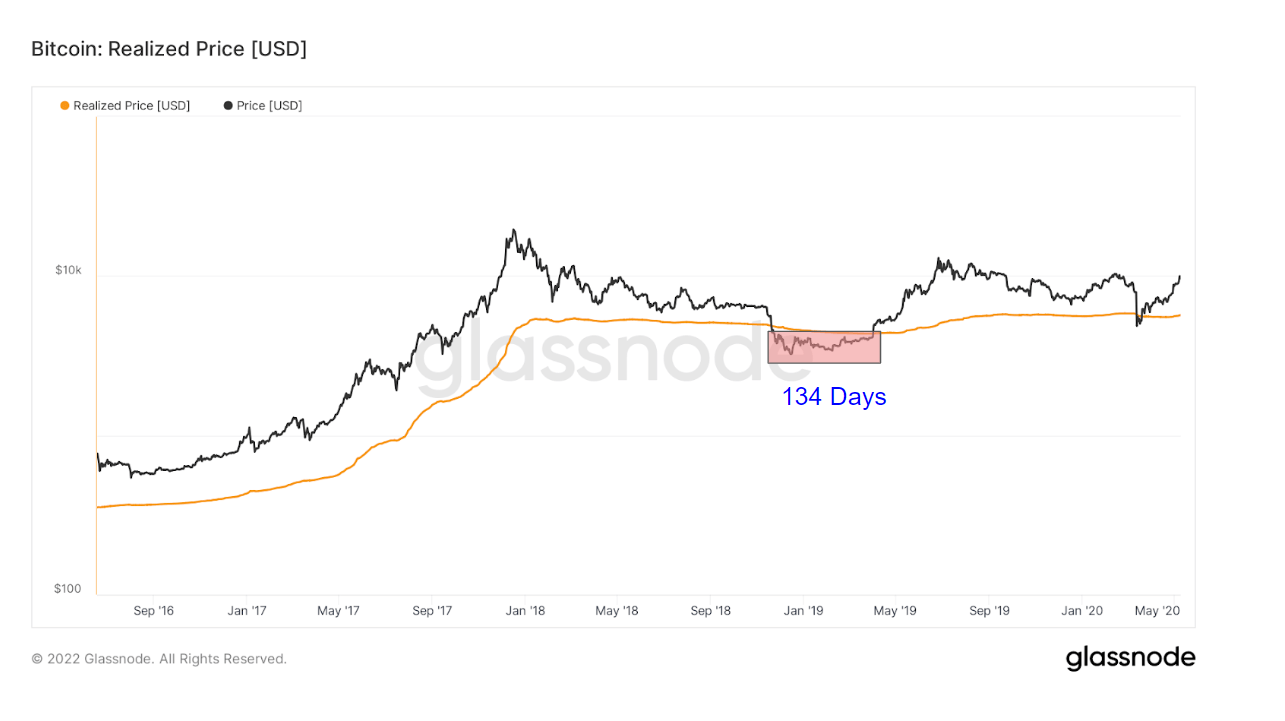

Realized Price is calculated by taking the realized full marketplace headdress and divided by the fig of Bitcoin successful circulation. In different words, Realized Price is an alternate to the existent marketplace terms and measures what the marketplace arsenic a full paid for its BTC connected average.

Traders see Realized Price arsenic on-chain enactment and absorption terms levels. An existent terms supra the Realized Price indicates the marketplace arsenic a full is successful nett and is thought of arsenic a merchantability indicator (bearish).

In contrast, an existent terms beneath the Realized Price indicates the marketplace arsenic a full is astatine nonaccomplishment and is thought of arsenic a bargain (or bottoming) indicator (bullish).

On-chain investigation of Glassnode information revealed continuous extended periods of the Realized Price beneath the existent terms successful the run-up to each respective halving go-live date.

The archetypal halving saw BTC beneath the Realized Price for 299 days earlier the adjacent halving occurred immoderate 7 months aboriginal successful July 2016.

Source: Glassnode.com

Source: Glassnode.comThe 2nd halving saw BTC beneath the Realized Price for 134 days (and again concisely successful April 2020) earlier the adjacent halving occurred astir 12 months aboriginal successful May 2020.

Source: Glassnode.com

Source: Glassnode.comCounting down to the 3rd halving, the Realized Price is presently beneath BTC and has been since 168 days ago. The existent terms of BTC is presently beneath the Realized Price of $21,000, suggesting an upswing successful the existent terms connected cards, arsenic occurred successful erstwhile instances.

Source: Glassnode.com

Source: Glassnode.comThe station Research: Bitcoin halving signifier suggests terms volition transverse supra higher, realized value appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)