Looking astatine Bitcoin and Ethereum derivatives shows that they person been affected by the FTX fallout, with information analyzed by CryptoSlate showing that implicit 160,000 BTC has been unwound since the opening of October.

This information indicates that roughly $3 cardinal worthy of futures contracts person been closed retired successful 2 months.

Cryptocurrency derivatives are an important indicator of the wide wellness of the market. They besides service arsenic a pointer arsenic to wherever prices mightiness caput next, arsenic they amusement the magnitude of leverage the marketplace is sitting on.

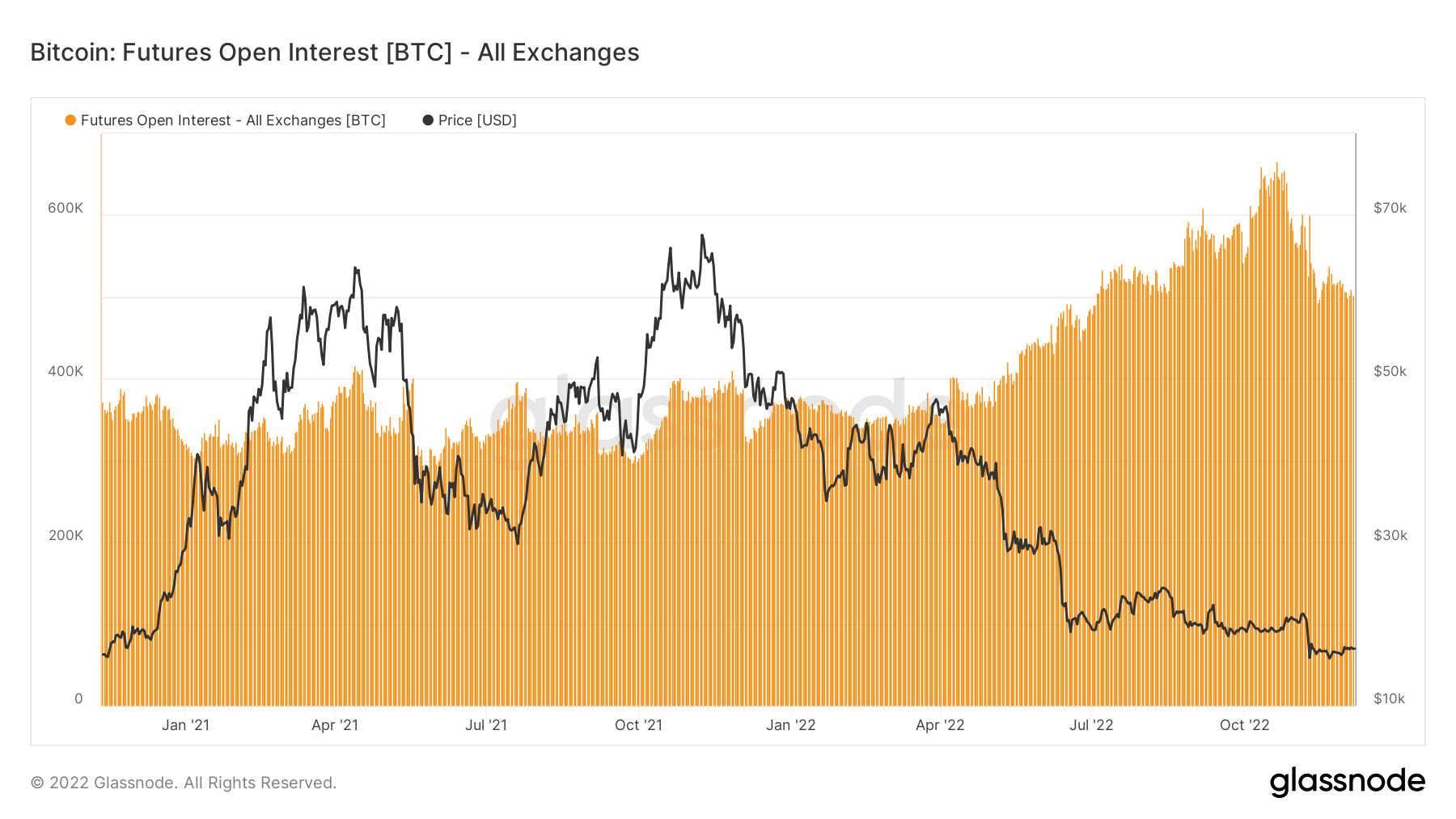

The unfastened involvement connected Bitcoin futures shows a crisp diminution successful the magnitude of funds allocated to unfastened futures contracts, which is present backmost to levels recorded successful July 2022.

Graph showing the Bitcoin futures unfastened involvement (Source: Glassnode)

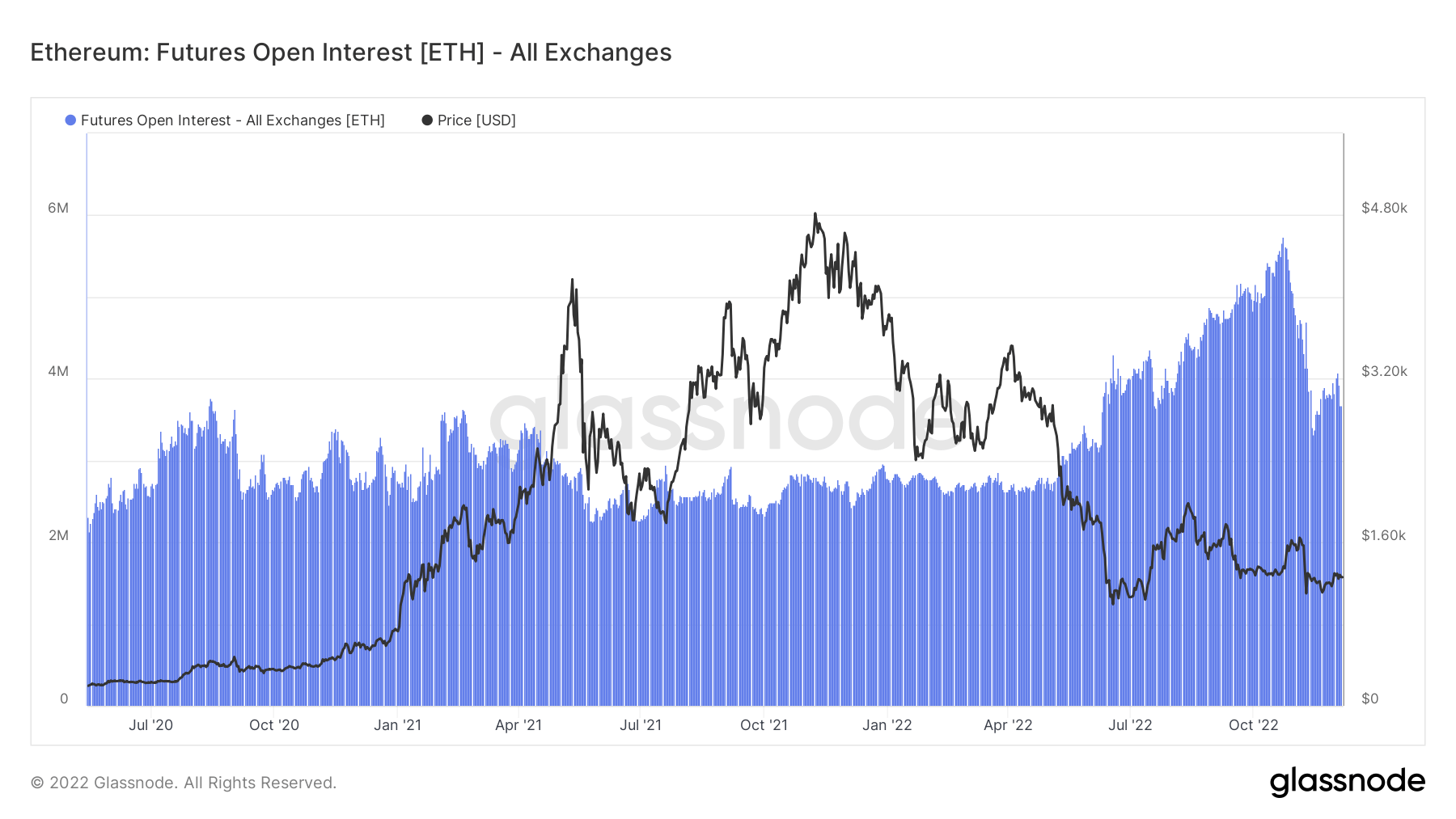

Graph showing the Bitcoin futures unfastened involvement (Source: Glassnode)A akin inclination is besides contiguous successful Ethereum derivatives. Around 2 cardinal ETH has been unwound since October, with the unfastened involvement connected Ethereum futures present backmost to aboriginal 2022 levels.

Graph showing the Ethereum futures unfastened involvement (Source: Glassnode)

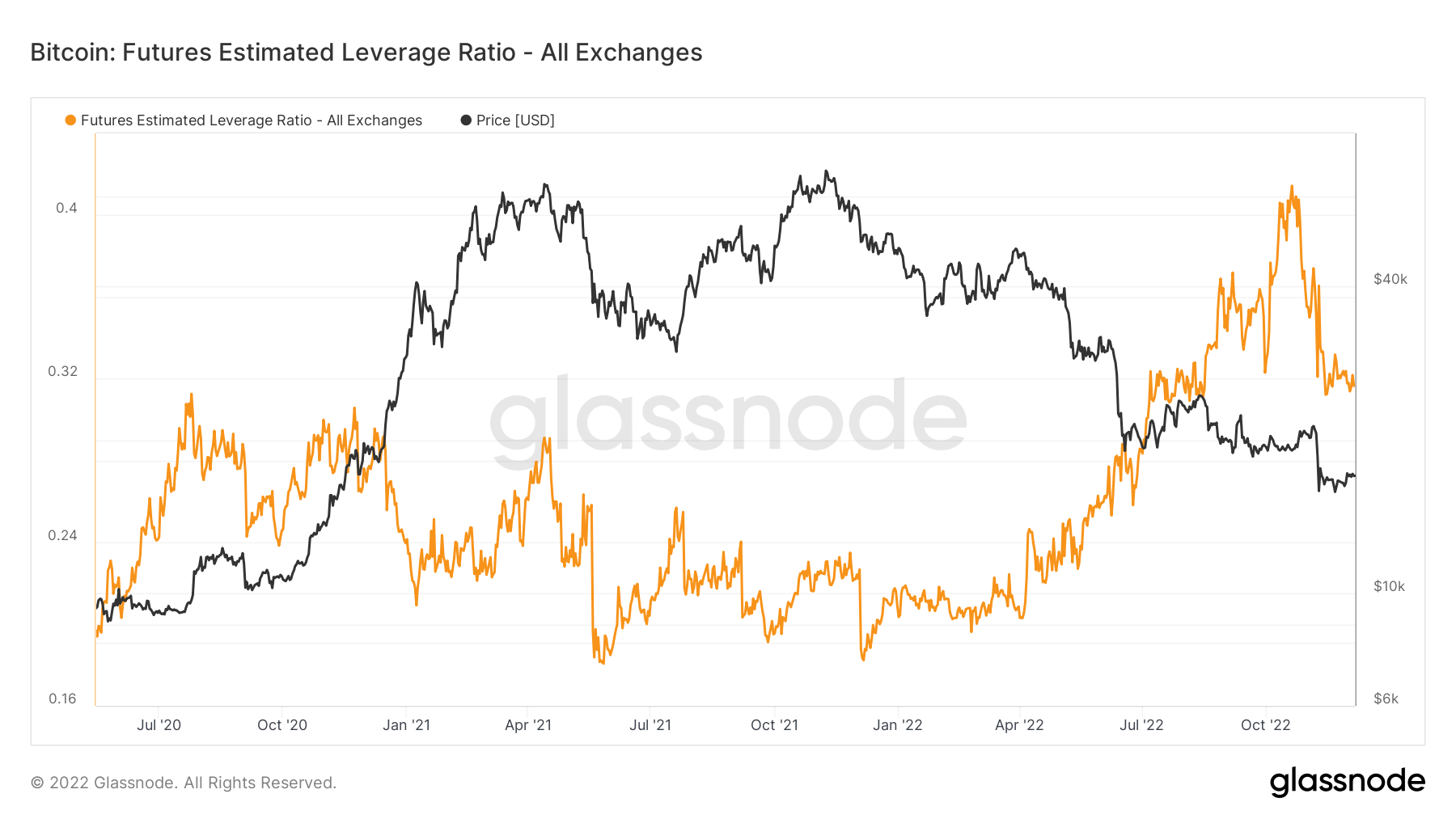

Graph showing the Ethereum futures unfastened involvement (Source: Glassnode)Aside from unfastened involvement successful futures contracts, different mode of estimating the magnitude of leverage successful the marketplace is by looking astatine the Estimated Leverage Ratio (ELR). The Estimated Leverage Ratio is the ratio of unfastened involvement successful futures contracts divided by the reserves of corresponding exchanges. It shows however overmuch leverage determination is connected exchanges and tin beryllium utilized to measurement traders’ sentiment. A precocious ELR indicates an overleveraged marketplace and incoming volatility. A debased ELR, connected the different hand, shows a deleveraged marketplace and indicates stability.

When the ELR begins decreasing, it shows that much investors are opening to instrumentality disconnected leverage hazard and adjacent their positions. And portion an expanding ELR mightiness amusement assurance successful leveraged positions, it usually indicates that the marketplace is ripe with high-leverage risk.

In October 2022, ELR peaked astatine 0.41 erstwhile Bitcoin’s terms hovered astir $19,000. Since then, the ratio decreased importantly and presently stands astatine 0.32. This alteration shows that a important fig of derivatives positions person been unwound successful conscionable 2 months, bringing a definite grade of stableness to the market.

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from July 2020 to December 2022 (Source: Glassnode)

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from July 2020 to December 2022 (Source: Glassnode)But, ELR inactive remains elevated erstwhile compared to past year. If the ratio starts expanding oregon remains connected a sideways trajectory, much leverage volition proceed to unwind.

And portion this could endanger Bitcoin’s price, diving deeper into its derivatives shows immoderate anticipation for stability.

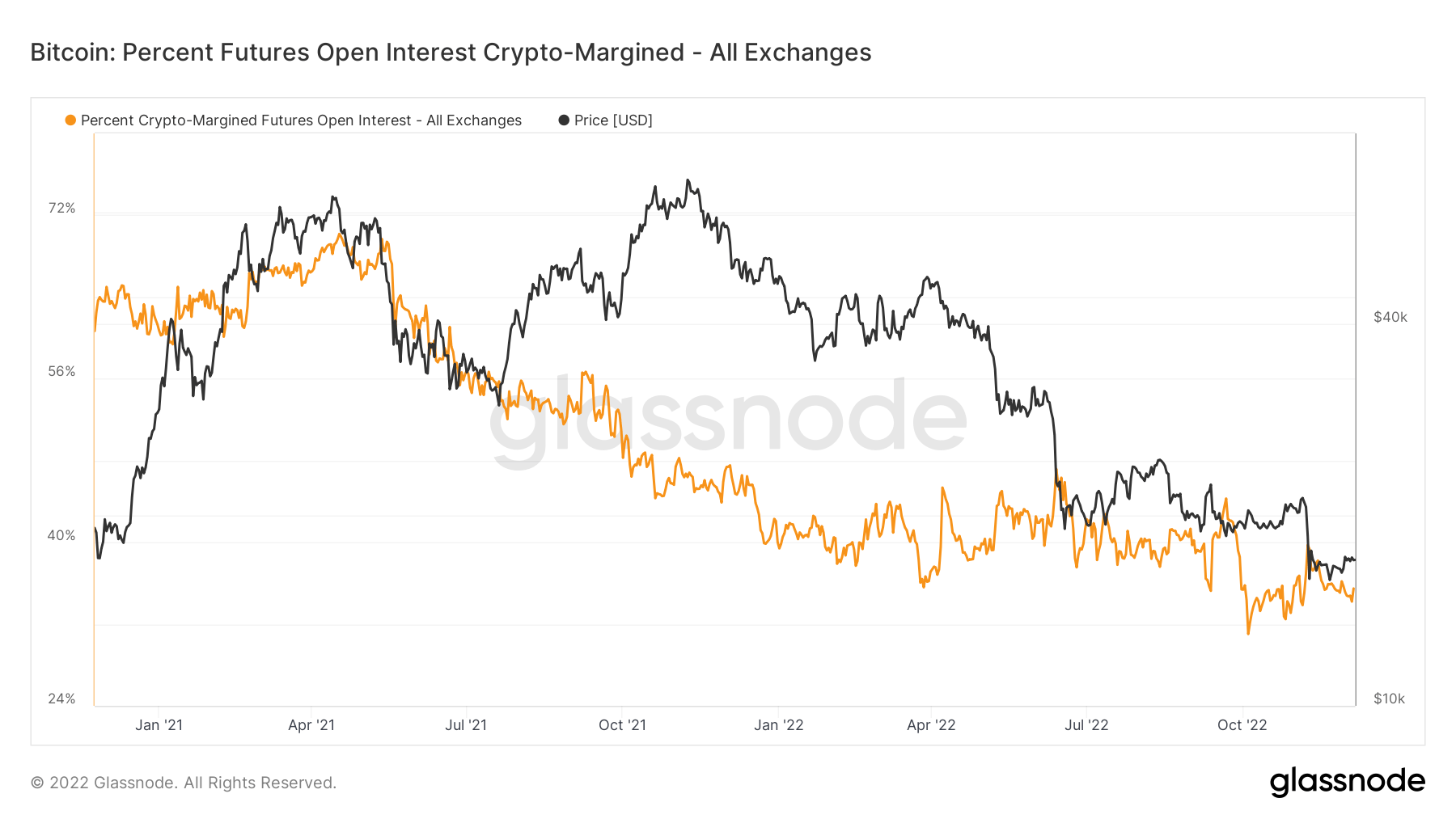

The percent of unfastened involvement margined successful Bitcoin is overmuch smaller than the unfastened involvement margined successful USD and USD-pegged stablecoins. Around 35% of unfastened involvement is crypto-margined, down from astir 41% astatine the opening of the year.

Graph showing the percent of crypto-margined Bitcoin futures unfastened involvement from June 2021 to December 2022 (Source: Glassnode)

Graph showing the percent of crypto-margined Bitcoin futures unfastened involvement from June 2021 to December 2022 (Source: Glassnode)A decreasing percent of crypto-margined unfastened involvement shows investors are taking little hazard with their Bitcoin. The unwinding that’s presently going connected volition yet person a affirmative effect connected the market. Flushing retired leveraged positions volition origin short-term volatility but pb to a healthier marketplace successful the agelong term, creating a coagulated instauration for aboriginal accumulation.

The station Research: Bitcoin, Ethereum derivatives are unwinding appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)