The accumulation inclination people is an on-chain indicator utilized to find whether entities are actively accumulating coins. It’s a overmuch amended indicator of the wide marketplace sentiment toward buying and selling, arsenic 1 tin use it to immoderate cohort to find the behaviour of immoderate peculiar group.

The indicator comprises 2 metrics — an entity’s information people and equilibrium alteration score. An entity’s information people represents its wide coin balance, portion the equilibrium alteration people represents the fig of caller coins bought oregon sold implicit 1 month.

An accumulation inclination people person to 1 shows that the largest portion of the web is accumulating, portion a people person to 0 shows that the web is chiefly distributing its coins.

When applied to Bitcoin, the accumulation inclination people provides large penetration into marketplace participants’ equilibrium size and behaviour implicit 1 month. Exchanges and miners are excluded from the metric to marque the data much typical of the marketplace conditions,

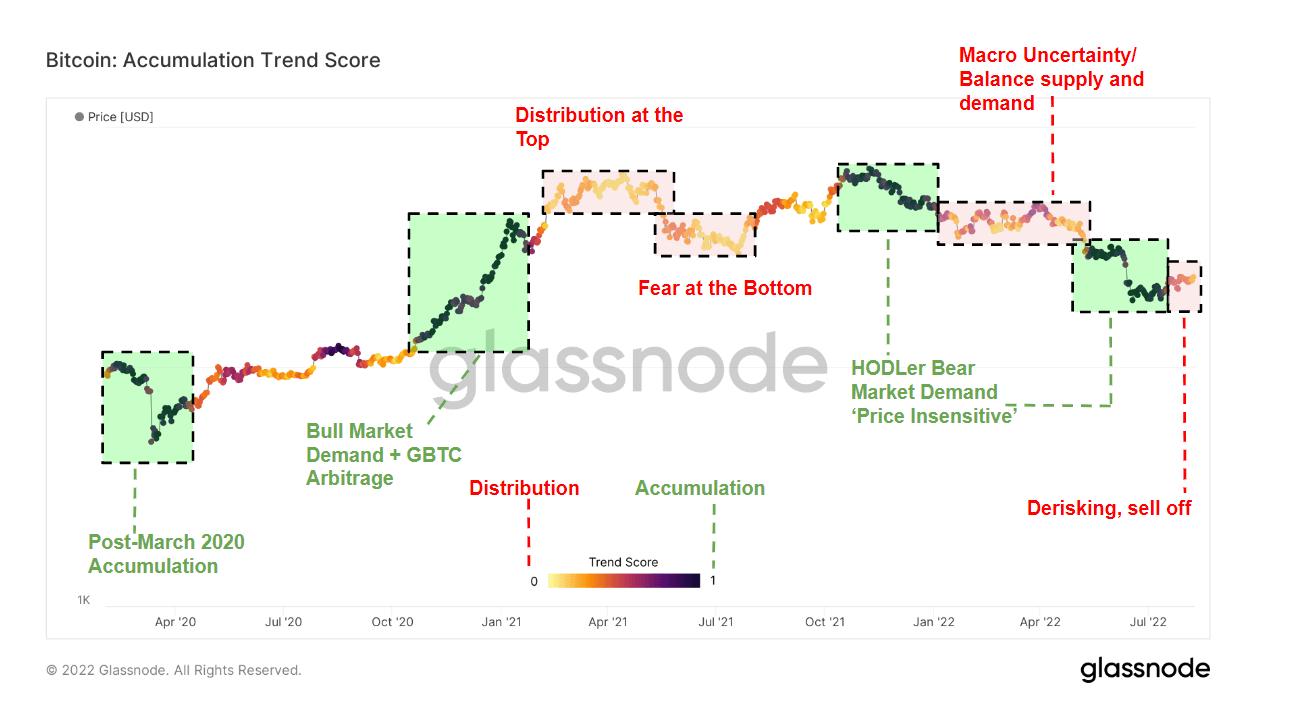

Bitcoin accumulation inclination people (Source: Glassnode)

Bitcoin accumulation inclination people (Source: Glassnode)Bitcoin’s accumulation inclination people from April 2020 to August 2022 shows 4 chiseled accumulation periods. Highlighted greenish connected the illustration above, the accumulation periods occurred successful March 2020, aboriginal 2021, aboriginal 2022, and precocious May 2022. The astir important accumulation complaint was seen successful March 2020 arsenic the onset of the COVID-19 pandemic crushed planetary markets. The large sell-off we’ve seen successful the aftermath of the Terra (LUNA) clang successful precocious May and aboriginal July triggered a large accumulation spree.

Highlighted successful reddish and yellow, periods of coin organisation followed each periods of accumulation. Some of the highest rates of coin organisation were seen during the exodus of miners from China successful the summertime of 2021 and the commencement of Russia’s penetration of Ukraine successful February 2022. This summertime has besides seen galore addresses merchantability their BTC arsenic macro uncertainty pushes much investors to de-risk their portfolios.

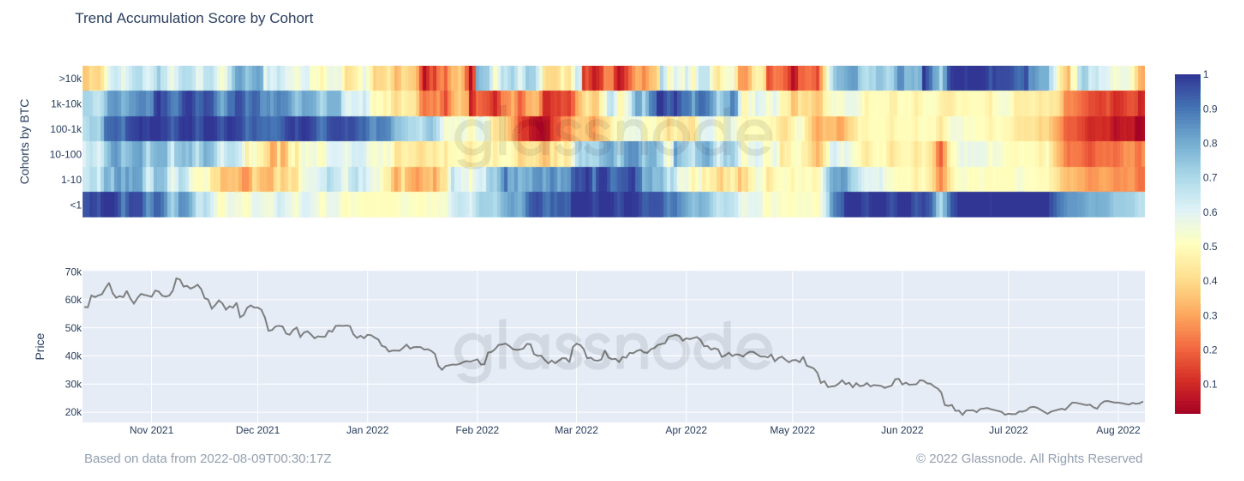

Breaking down the accumulation inclination people by cohorts reveals the behaviors of 2 large groups connected the Bitcoin web — whales and shrimps. Whales are defined arsenic addresses owning much than 1,000 BTC, portion shrimps are addresses with little than 1 BTC.

Throughout July, some whales and shrimps person been aggressively accumulating BTC. The illustration beneath shows the complaint of accumulation by cohorts, with whales, shrimp, and everyone successful betwixt accumulating for the full month.

Bitcoin accumulation inclination people by cohorts (Source: Glassnode)

Bitcoin accumulation inclination people by cohorts (Source: Glassnode)However, arsenic August progresses, the complaint of accumulation among whales is opening to decrease. The wide macro uncertainty has pushed galore ample holders to de-risk and merchantability disconnected their BTC holdings. Many investors are anticipating a hard wintertime and looking to get arsenic overmuch liquidity arsenic possible.

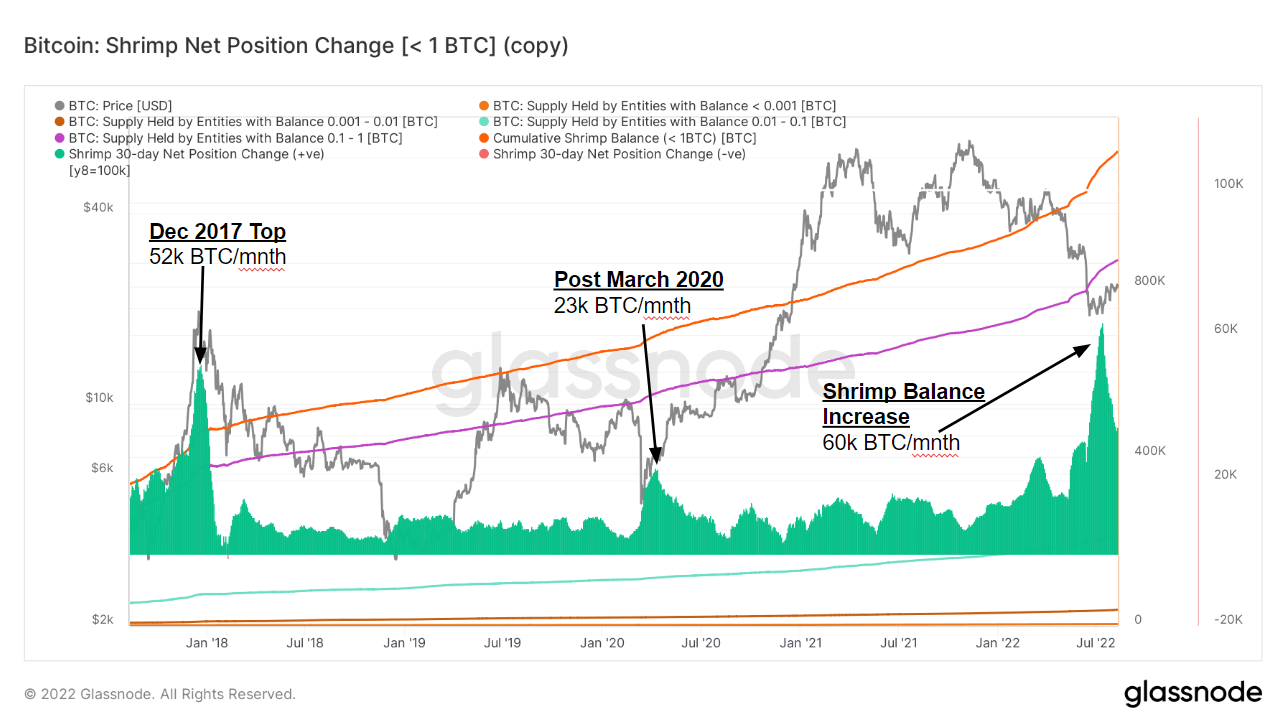

The lone entities inactive stacking BTC are shrimps, which person kept accumulating adjacent erstwhile the bulk of ample holders began selling off. July was the astir important accumulation period for tiny holders since 2018, with shrimp expanding their equilibrium by implicit 60,000 BTC successful a azygous month. The second-largest accumulation was successful December 2017 arsenic Bitcoin reached its all-time precocious erstwhile shrimp accumulated 52,000 BTC successful a month.

Net presumption alteration for Bitcoin shrimps holding little than 1 BTC (Source: Glassnode)

Net presumption alteration for Bitcoin shrimps holding little than 1 BTC (Source: Glassnode)This shows that tiny holders spot Bitcoin’s terms of astir $20,000 arsenic precise charismatic and proceed to get coins for semipermanent investment, adjacent if its terms remains flat.

The station Research: Bitcoin accumulation inclination people shows shrimps buying, whales selling appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)