Since the opening of the year, the accepted fiscal marketplace has been connected a dependable downward spiral. Russia’s penetration of Ukraine seems to person acted arsenic a spark that ignited the problems that person been piling up since the opening of the pandemic, devastating astir assets successful its way.

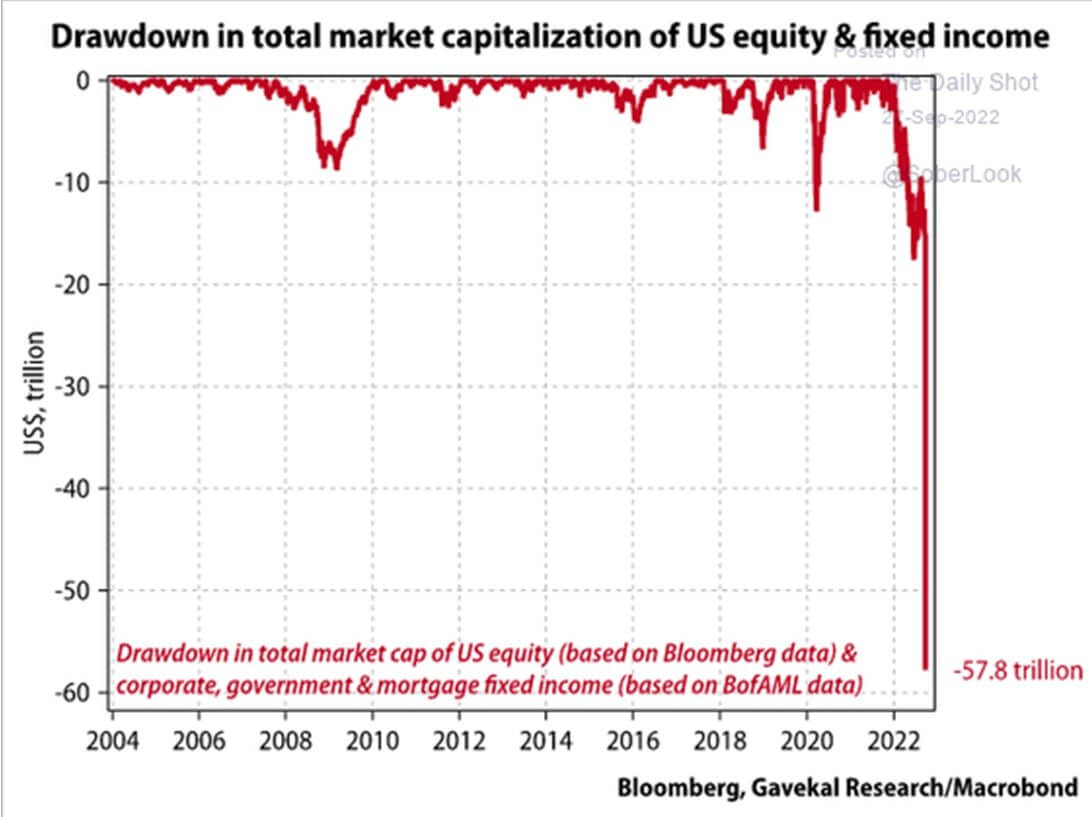

According to information from Bloomberg, astir $60 trillion has been wiped retired from the full marketplace headdress of U.S. equity and fixed income since February. The existent drawdown exceeds the marketplace downturns seen astatine the opening of the pandemic successful 2020 and during the Great Financial Crisis successful 2008.

Graph showing the drawdown successful full marketplace capitalization of U.S. equity and fixed income bonds (Source: Bloomberg)

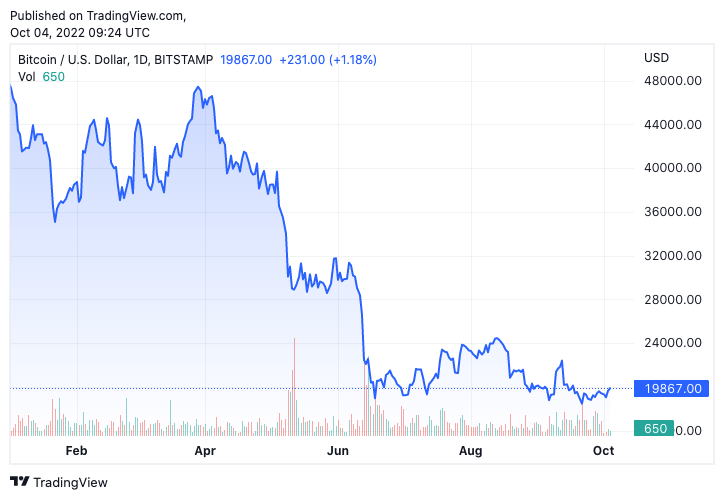

Graph showing the drawdown successful full marketplace capitalization of U.S. equity and fixed income bonds (Source: Bloomberg)Bitcoin hasn’t been immune to the macro factors that person been devastating the tradfi markets. After the illness of Terra (LUNA) successful June, Bitcoin failed to retrieve and has been connected a turbulent way of little upswings and crisp corrections.

Graph showing Bitcoin’s terms successful 2022 (Source: CryptoSlate Bitcoin)

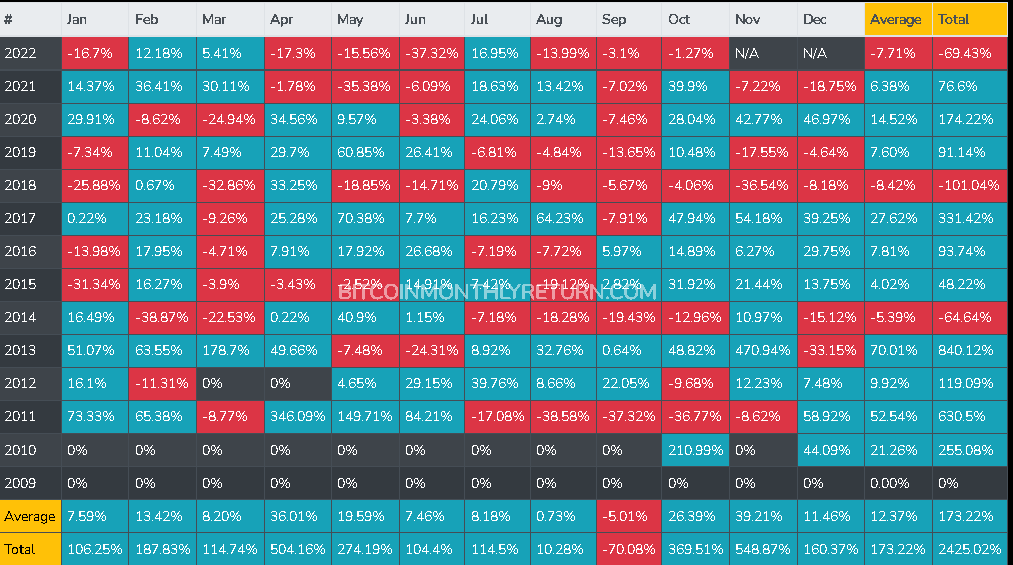

Graph showing Bitcoin’s terms successful 2022 (Source: CryptoSlate Bitcoin)However, Bitcoin’s deficiency of upward momentum could beryllium short-lived. September has historically been the worst period for Bitcoin — it failed to adjacent the period successful the greenish since 2016. Last month, Bitcoin closed the period astatine -3.1%, good beneath its monthly mean of -5.01%.

October, connected the different hand, has historically marked the opening of a bullish 4th for the cryptocurrency, with Bitcoin’s monthly mean adjacent lasting astatine 26.39%. It has besides historically been the second-best period for Bitcoin, arsenic it posted an accumulated full summation of 369.5% since 2009. The full 4th fourth besides saw historically affirmative closes.

Table showing the mean and full monthly closes for Bitcoin from 2009 to 2022

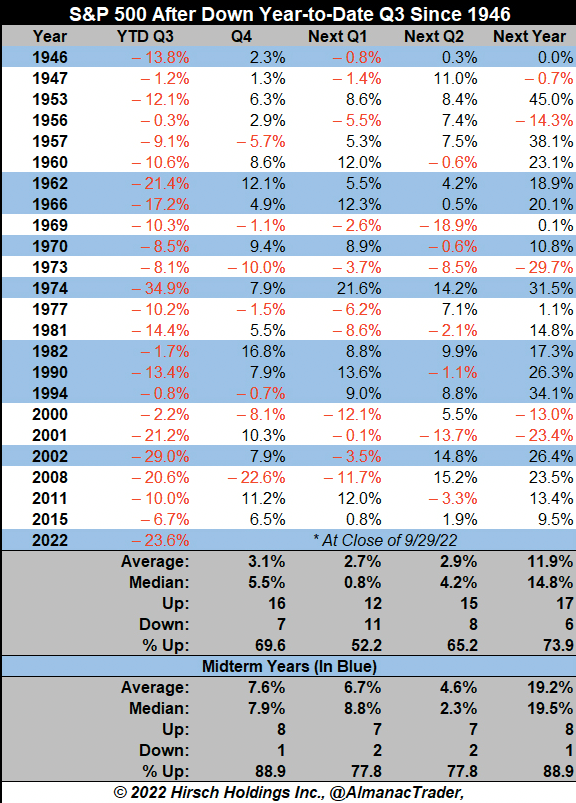

Table showing the mean and full monthly closes for Bitcoin from 2009 to 2022A September bloodbath is simply a recurring taxable successful the satellite of accepted concern arsenic well. Since 1946, the S&P 500 posted antagonistic year-to-date returns successful the 3rd 4th 23 times. Out of the 23 antagonistic 3rd quarters the S&P 500 saw, astir 70% were followed by a 4th fourth with affirmative returns. During a twelvemonth with midterm elections, this fig roseate to 89%.

Table showing humanities quarterly closes for the S&P 500 (Source: Hirsch Holdings Inc.)

Table showing humanities quarterly closes for the S&P 500 (Source: Hirsch Holdings Inc.)If some markets proceed their humanities patterns, we could spot the unit alteration arsenic October closes and a comeback of affirmative returns. However, with planetary macroeconomic factors continuing to worsen and putting much unit connected some markets, there’s an arsenic precocious probability that these patterns could break.

The station Research: After September bloodbath, historically bullish Q4 could easiness the pain appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)