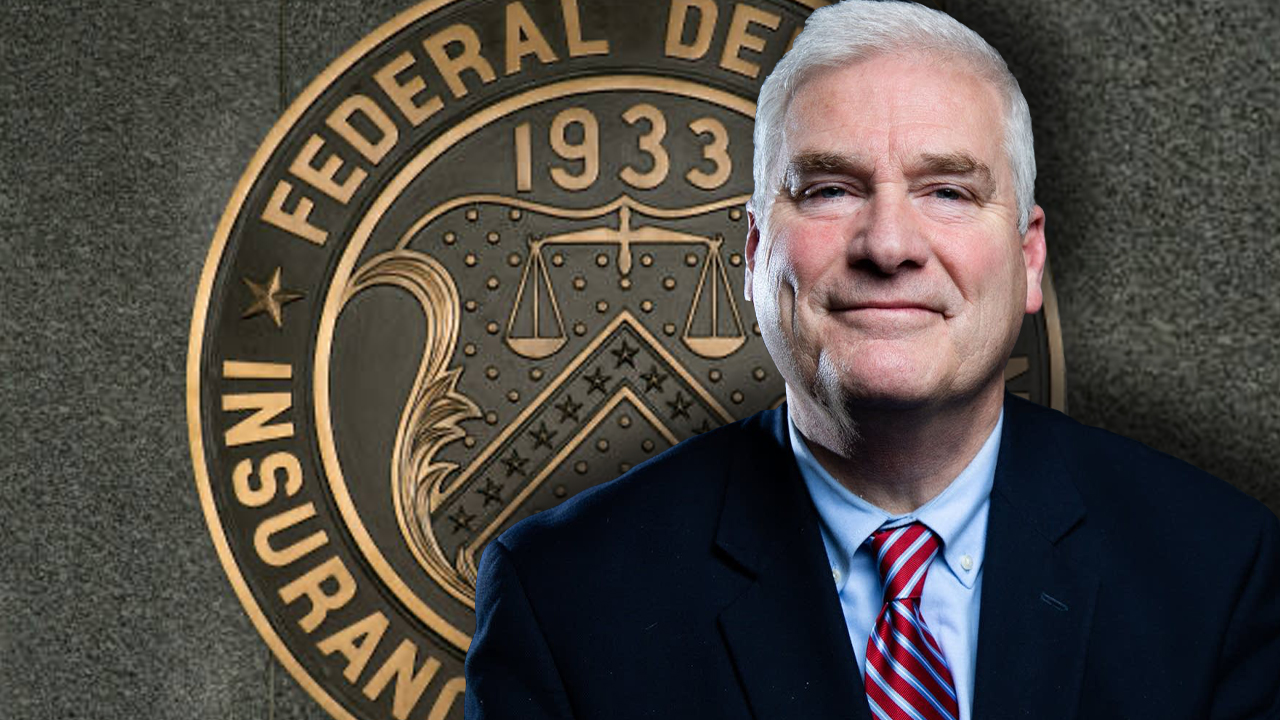

On Wednesday, Tom Emmer, the U.S. Republican congressman from Minnesota, revealed helium sent a missive to Martin Gruenberg, the president of the Federal Deposit Insurance Corporation (FDIC), regarding reports that the FDIC is “weaponizing caller instability” successful the U.S. banking manufacture to “purge ineligible crypto activity” from the United States. Specifically, Emmer asked Gruenberg if the FDIC instructed banks not to supply banking services to cryptocurrency firms.

GOP Majority Whip Emmer Questions FDIC’s Involvement successful Purging Legal Crypto Activity

Tom Emmer, a Republican person from Minnesota, sent a letter to the president of the FDIC questioning whether the bureau directed banks not to supply services to integer currency businesses. “Recent reports bespeak that national fiscal regulators person efficaciously weaponized their authorities implicit the past respective months to purge ineligible integer plus entities and opportunities from the United States,” Emmer’s missive read.

The Minnesota congressman added:

Individuals from crossed the industry, including erstwhile House Financial Services Committee president Barney Frank highlighted the targeted quality of these regulatory efforts to ‘single out’ fiscal institutions and ‘send a connection to get radical distant from crypto.’

Emmer has been querying different U.S. lawmakers and agencies astir their actions against crypto businesses, including questioning Securities and Exchange Commission (SEC) seat Gary Gensler astir actions taken during the apprehension of FTX’s disgraced co-founder, Sam Bankman-Fried. The person has besides introduced legislation that would prohibit the U.S. cardinal slope “from issuing a [central slope integer currency] straight to anyone.”

Emmer’s comments astir erstwhile lawmaker Barney Frank stem from the Signature Bank committee member’s commentary astir being amazed by Signature’s collapse. Frank said helium suspected determination was an “anti-crypto message” down the bank’s demise. The New York State Department of Financial Services disagrees and explained that placing Signature into receivership of the FDIC had “nothing to bash with crypto.”

Despite the regulator’s denial of specified accusations, Emmer’s missive to the FDIC’s Gruenberg implicitly asks the president whether the FDIC specifically directed banks not to supply banking services to cryptocurrency firms.

”Have you communicated — explicitly oregon implicitly — to immoderate banks that their supervision volition beryllium much onerous successful immoderate mode if they instrumentality connected caller (or support existing) integer plus clients,” the person asked. Emmer is insisting that Gruenberg supply the accusation arsenic soon arsenic imaginable and nary aboriginal than 5:00 p.m. connected March 24, 2023.

Tags successful this story

anti-crypto message, banking services, Barney Frank, central slope integer currency, co-founder, collapse, Crypto activity, crypto businesses, Cryptocurrency, deposit security corporation, Digital Assets, Digital Currencies, FDIC, Financial Institutions, Financial Technology, ftx, Gary Gensler, GOP, GOP Majority Whip, government oversight, Gruenberg, legal entities, purging, receivership, Regulatory Compliance, regulatory efforts, Republican lawmakers, SEC, Signature Bank, Targeted, tom emmer, U.S. banking industry, U.S. Central Bank, U.S. fiscal regulators, U.S. lawmakers

What are your thoughts connected the regularisation of cryptocurrency successful the United States and the imaginable interaction it could person connected the aboriginal of the industry? Do you judge that regulators are unfairly targeting crypto businesses? Share your opinions successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)