On Friday, Michael Barr, the vice seat for supervision astatine the U.S. Federal Reserve, published a study connected the vulnerabilities that led to the eventual nonaccomplishment of Silicon Valley Bank (SVB). In addition, Marshall Gentry, the main hazard serviceman of the Federal Deposit Insurance Corporation (FDIC), released a akin study connected Signature Bank’s illness and its overreliance connected uninsured deposits.

Fed Is Confident Supervisory Recommendations ‘Will Lead to a Stronger and More Resilient Banking System’

The Federal Reserve and the FDIC published reports connected Friday concerning the autumn of the 2nd and third-largest U.S. slope failures successful history. The archetypal report, published by the Fed’s vice seat for supervision Michael Barr, claims the cardinal bank’s supervisors failed to admit the grade of vulnerabilities astatine Silicon Valley Bank (SVB) arsenic it grew successful size and complexity. Barr wrote that SVB had 31 unfastened supervisory findings portion different banks had overmuch less successful comparison.

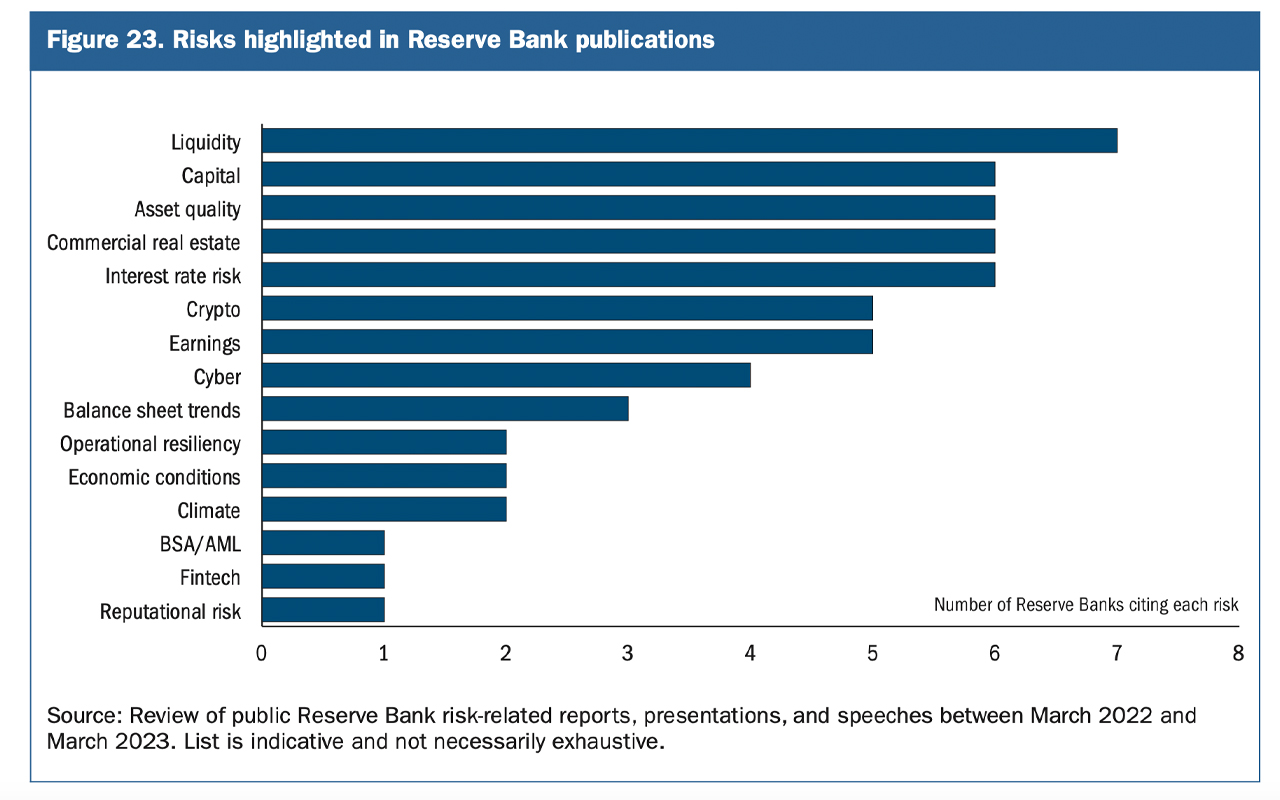

The study offers a broad perspective, noting that the Federal Reserve’s supervisory attack failed to afloat contemplate the ramifications of rising involvement rates. Then a slowing enactment successful the exertion sector, yet paved the mode for the demise of SVB. “The supervision of SVB did not enactment with capable unit and urgency, and contagion from the firm’s nonaccomplishment posed systemic consequences not contemplated by the Federal Reserve’s tailoring framework,” Barr said. Barr’s study mentions crypto 3 times and 1 lawsuit is located connected a barroom illustration describing risks.

“As I person antecedently announced, the Federal Reserve has begun to physique a dedicated caller enactment supervisory radical to absorption connected the risks of caller activities (such arsenic fintech oregon crypto activities) arsenic a complement to existing supervisory teams,” Barr stated.

FDIC Report Discusses Crypto Risks and SBNY’s ‘Flurry of Negative Press’

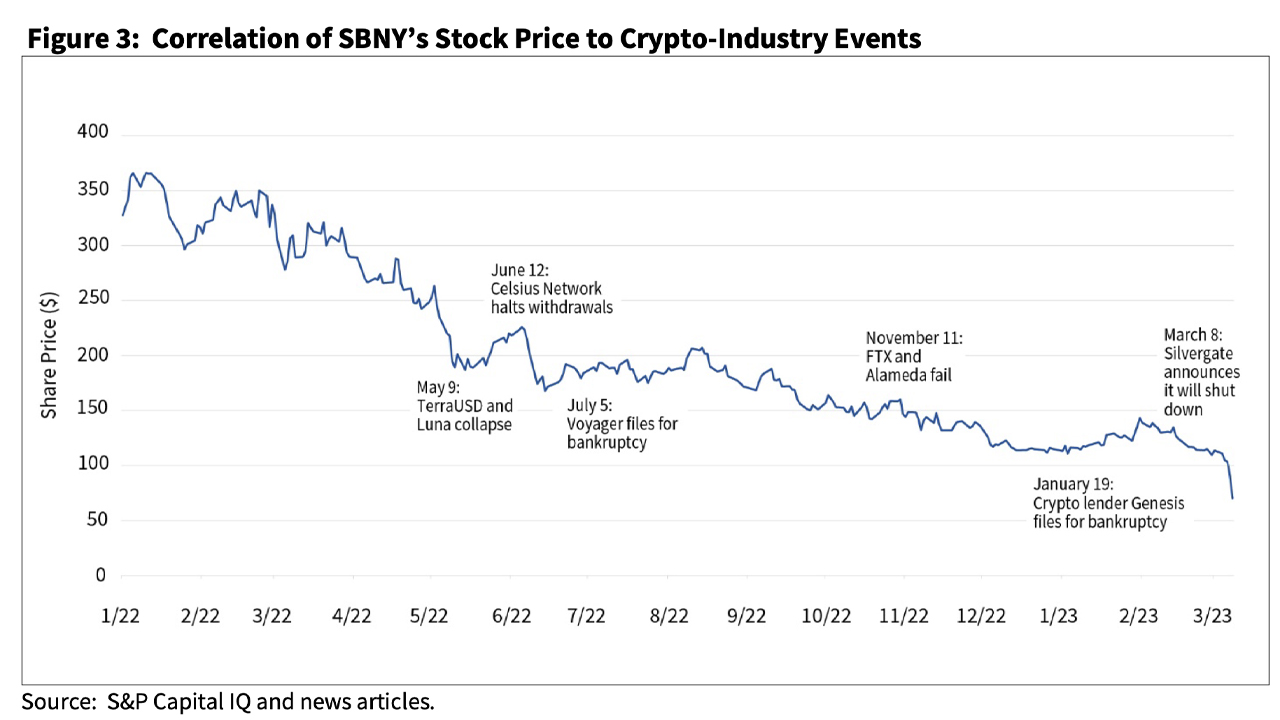

The FDIC published its report connected Signature Bank’s (SBNY) illness and the study authored by Marshall Gentry talks a batch much astir crypto assets and the FTX failure. Throughout the report, Gentry discusses however liquidity hazard absorption witnessed withdrawals of uninsured deposits emergence to captious levels. On leafage 13, the FDIC study goes into large item astir the crypto manufacture turmoil that bolstered SBNY’s failure. ”The strategy exposed SBNY to greater susceptibility to liquidity, reputation, and regulatory hazard owed to the uncertainty and volatility of the integer plus space,” Gentry explained.

The study describes however 2 cryptocurrencies collapsed successful May 2022 (terrausd and luna), starring to further turbulence successful the manufacture and further discusses the illness of FTX. It noted that SBNY’s shares were correlated with the crypto industry. “Due to its estimation arsenic a banker to galore successful the crypto industry, SBNY’s banal terms intimately tracked these tumultuous events successful the crypto manufacture abstraction and dropped importantly during 2022,” the study notes. Both reports were approved by the Fed’s seat Jerome Powell and the FDIC’s seat Martin Gruenberg.

Tags successful this story

What’s your instrumentality connected the reports published by the Federal Reserve and the FDIC connected the autumn of Silicon Valley Bank and Signature Bank? Let america cognize your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)