A survey by Henley & Partners, an concern migration consultancy successful London, reveals an absorbing insight: of the world’s 56.1 cardinal millionaires, a notable 88,200 person earned their fortunes successful cryptocurrency.

Crypto’s Elite: How Bitcoin and Cryptocurrency Carved Out a New Generation of Millionaires and Billionaires

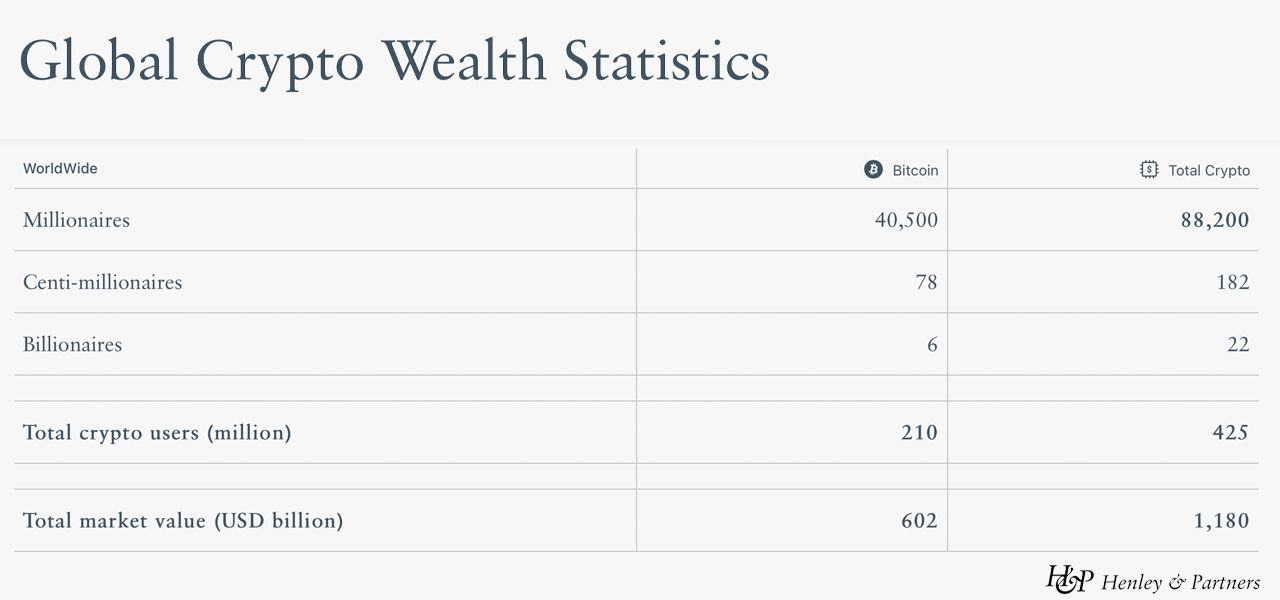

At the clip of writing, the crypto system boasts a valuation somewhat supra $1 trillion. This immense sum has birthed a caller procreation of crypto millionaires and billionaires implicit time. Henley & Partners, a salient concern consultancy, reports that retired of today’s 88,200 crypto millionaires, 40,500 beryllium their affluence exclusively to bitcoin (BTC). This means that crypto millionaires correspond a specified 0.157% of the full 56.1 million millionaires globally.

Diving deeper into Henley & Partners’ data, 182 individuals person reached the presumption of centi-millionaires done crypto investments. For clarity, a centi-millionaire is idiosyncratic with investable assets surpassing $100 million. Remarkably, 78 of these centi-millionaires beryllium their fortunes to BTC alone. Moreover, astir six individuals person go billionaires done BTC, portion astir 22 billionaires person amassed their wealthiness from the broader crypto realm.

The elite radical of crypto centi-millionaires and billionaires successful 2023 includes Binance’s CEO Changpeng Zhao (CZ), Ripple’s Chris Larsen, the Winklevoss twins from Gemini, task capitalist Tim Draper, Galaxy’s Michael Novogratz, Coinbase’s Brian Armstrong, Block.one’s Dan Larimer, Ethereum’s Anthony Di Iorio, Digital Currency Group’s Barry Silbert, Ripple’s Brad Garlinghouse, Bitcoin.com’s laminitis Roger Ver, ex-Bitmain CEO Jihan Wu, and task capitalist Matthew Roszak.

Dr. Juerg Steffen, the CEO of Henley & Partners, highlighted successful the study that arsenic governments draught crypto regulations, crypto enthusiasts and investors are actively seeking concern migration avenues to safeguard their assets. “We person seen a important spike successful inquiries from crypto millionaires implicit the past six months, who are each looking to physique a viable ‘Plan B’ to support themselves against immoderate imaginable aboriginal bans connected the trading oregon usage of cryptocurrencies successful their countries and to allay the risks of assertive fiscal policies that taxation integer assets astatine source,” Steffen remarked.

On the different hand, the 2 ascendant integer currencies, bitcoin and ethereum (ETH), person seen a diminution of implicit 10% successful the past month. Bitcoin’s worth is 62% beneath its highest of $69K successful November 2021, portion ethereum has plummeted 66% from its precocious of $4,878 during the aforesaid period. Jeff D. Opdyke, a idiosyncratic concern and concern guru, cited successful the Henley & Partners Crypto Wealth Report, suggests that specified a downturn is simply a emblematic signifier successful BTC’s fiscal trajectory.

Opdyke opined, “From the infinitesimal bitcoin was calved successful 2009, crypto was ever going to go the astir inevitable commercialized successful 30 years.” He drew parallels with the archetypal net buzz, emphasizing the inevitable roar and bust cycles. “Crypto today, successful the aftermath of a carnivore market, is simply a replay of 1999 to 2001 — successful different words, a fantastic accidental to bargain erstwhile humor stains the streets due to the fact that we’re not apt to ever spot these prices again.”

You tin cheque retired Henley & Partners’ Crypto Wealth statistic and the report’s methodology successful its entirety here.

What bash you deliberation astir the Crypto Wealth Report published by Henley & Partners? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)