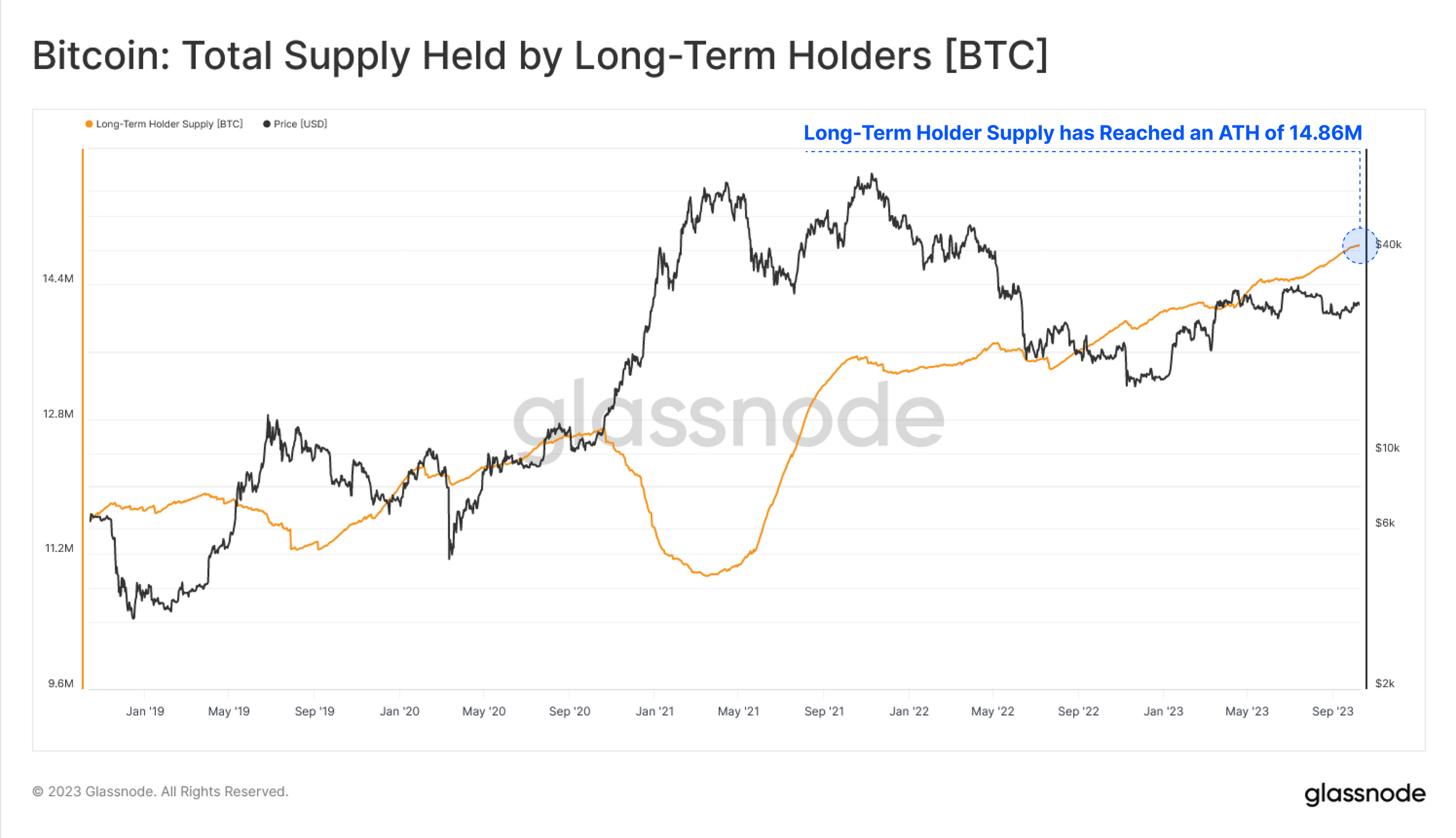

Seasoned crypto investors proceed scooping up bitcoin (BTC) astatine a complaint of 50,000 coins per period valued astatine $1.35 billion, according to blockchain analytics steadfast Glassnode’s latest onchain report. This proviso tightening comes arsenic the broader integer plus marketplace remains “exceptionally dormant” some onchain and crossed exchanges.

Long-Term Bitcoin ‘Hodlers’ Tighten Grip Amidst Dormant Market

While Bitcoin’s terms has fluctuated dramatically this year, the cohort of semipermanent holders oregon “hodlers” remains resolute, Glassnode’s latest report shows. Glassnode’s Hodler Net Position Change metric reveals these investors, specifically those holding coins for astatine slightest 155 days, are withdrawing implicit 50,000 BTC from exchanges each month. This information highlights some the tightening proviso and reluctance among seasoned investors to transact successful the existent marketplace conditions.

Glassnode notes the marketplace has been successful a authorities of debased and contracting liquidity akin to the 2014-15 and 2018-19 carnivore markets, present lasting 535 days. Both the worth transferred onchain and the influx of caller superior into the Bitcoin web are astatine multi-year lows. Exchange enactment besides exhibits pervasive apathy among investors. The 30-day mean for full speech measurement presently sits astir $1.5 billion, a 75.5% diminution from its all-time precocious of $6 cardinal successful May 2021.

Glassnode’s researchers state:

The measurement of Profit and Loss realized by coins sent to Exchange Addresses has besides experienced a implicit detox from the 2021-22 cycle, with some measures hitting the lowest levels seen since 2020.

Identifying Peak Altseason Regimes

To place periods of explosive altcoin speculation, Glassnode introduced a exemplary to measure risk-on and risk-off environments done the lens of superior rotation. Despite volatility successful altcoin prices, this model reveals superior is not presently rotating from Bitcoin done Ethereum and stablecoins astatine expanding rates, a hallmark of “altseason mania.”

“This exemplary is accomplished by looking for a affirmative and expanding 30-day alteration successful the ETH Realized Cap and Stablecoin Total Supply (i.e a affirmative 2nd derivative),” Glassnode’s study details. “This exemplary simulates the waterfall effect of superior rotating from larger caps, into tiny caps.”

Amid the chaotic swings successful altcoin prices, Glassnode suggests these oscillations are much a effect of existing debased liquidity than a genuine risk-on mood. For the moment, hodlers are hungrily snapping up BTC, constricting proviso successful anticipation of a forthcoming bull surge. Moreover, with the adjacent reward halving conscionable 196 days away, we’re acceptable to witnesser an adjacent much aggravated compression connected supply.

What bash you deliberation astir Glassnode’s information connected semipermanent bitcoin holders and identifying highest altseason regimes? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)