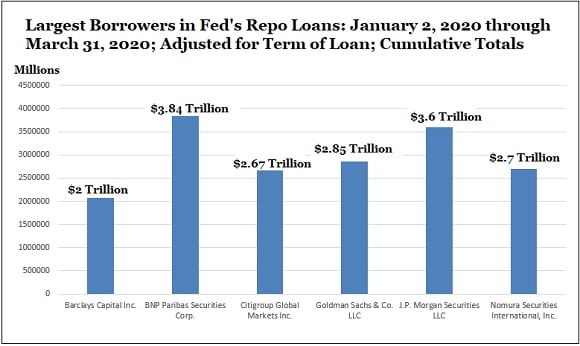

Following the arguable slope bailouts and Troubled Asset Relief Program (TARP) successful 2008, reports amusement successful precocious 2019 and 2020, the U.S. Federal Reserve participated successful providing trillions of dollars successful concealed repo loans to megabanks. At the extremity of March, investigative journalists, Pam and Russ Martens from Wall Street connected Parade, uncovered $3.84 trillion successful stealth repo loans from the Fed to the French fiscal institution, BNP Paribas successful Q1 2020. Additional information indicates that the U.S. cardinal slope leveraged concealed repo loans to supply a whopping $48 trillion to megabanks successful precocious 2019 and into 2020.

Reports Show the Fed Funneled Tens of Trillions to Megabanks successful 2019 and 2020

While Wall Street eagerly awaits the Federal Reserve’s adjacent benchmark complaint hike decision, a fig of investigative reports amusement the U.S. cardinal slope participated successful monolithic slope bailouts that are of biblical proportions. The archetypal report stems from Wall Street connected Parade’s Pam and Russ Martens, which accuses the Fed of secretly loaning the French megabank BNP Paribas $3.84 trillion successful the archetypal 4th of 2020.

The Martens’ findings item galore much concealed loans that travel from a data dump derived from the New York Federal Reserve branch. The information dump showcases concealed repo loans from the Fed to megabanks from September 17, 2019, to July 2, 2020. The Wall Street connected Parade authors accidental the media has not reported connected the information dump astatine all.

Data from the Wall Street connected Parade study published connected April 3, 2022, by the investigative journalists, Pam and Russ Martens.

Data from the Wall Street connected Parade study published connected April 3, 2022, by the investigative journalists, Pam and Russ Martens.“Mainstream media has heretofore instituted a quality blackout connected the names of the banks that received the repo indebtedness bailouts and the Fed’s information releases,” the Martens exposure details. “As of 4:00 p.m. today, we spot nary different quality reports connected this captious accusation that the American radical request to see,” the authors said connected March 31, 2022. As of today, April 13, 2022, determination are nary mainstream media outlets that person covered this news, aft Bitcoin.com News searched for much information.

Pam and Russ Martens’ findings are scathing, and the information dump’s numbers astir look unfathomable. The study states:

The Fed information released this greeting shows that the trading units of six planetary banks received $17.66 trillion of the $28.06 trillion successful word adjusted cumulative loans, oregon 63 percent of the full for each 25 trading houses (primary dealers) that borrowed done the Fed’s repo indebtedness programme successful the archetypal 4th of 2020.

Bailouts Given to Banks connected the ‘Verge of Failure’ and Institutions Holding Mountains of ‘Risky Derivatives’

Another report published connected substack.com written by “Occupy the Fed Movement” besides highlights the study from Wall Street connected Parade, arsenic it explained however the “NY Fed softly dumps information connected tens of trillions successful repo indebtedness bailouts to Wall Street.”

The researcher notes that Wall Street wants to support the Fed’s “$48 trillion repo bailout secret.” The Occupy the Fed writer asks wherefore the Fed did this, and notes the cardinal slope explains it was meant to “support overnight lending liquidity.” The probe adds:

The information tells a precise antithetic story. In the autumn of 2019, implicit 60 percent of the repo loans went to conscionable 6 trading houses: “Nomura Securities International ($3.7 trillion); J.P. Morgan Securities ($2.59 trillion); Goldman Sachs ($1.67 trillion); Barclays Capital ($1.48 trillion); Citigroup Global Markets ($1.43 trillion); and Deutsche Bank Securities ($1.39 trillion).” These firms are each massively exposed to risky derivatives, particularly Japan’s Nomura. Moreover, Germany’s Deutsche Bank was virtually connected the verge of total failure astatine the time.

Famed Economist Tells Wall Street connected Parade Journalists the Fed’s Secret Repos ‘Broke the Law’

In summation to the monolithic concealed repo loans, different report highlights statements from the renowned economist Michael Hudson that says the Fed’s concealed loans whitethorn person been illegal. Hudson claims determination was “no liquidity situation whatsoever,” and “emergency repo indebtedness operations for a liquidity situation that has yet to beryllium credibly explained.”

The economist explains that the bailouts were expected to beryllium stopped by the Dodd-Frank Act, but U.S. Treasury caput Janet Yellen helped alteration that. “Well, what happened, apparently, was that portion the Dodd-Frank Act was being rewritten by the Congress, Janet Yellen changed the wording astir and she said, ‘Well, however bash we specify a wide liquidity crisis?’ Hudson told the Martens during a telephone interview. “Well, it doesn’t mean what you and I mean by a liquidity crisis, meaning the full system is illiquid,” Hudson added.

The prof of economics astatine the University of Missouri–Kansas City continued:

[Dodd-Frank] was expected to say, ‘OK, we’re not going to fto banks person their trading facilities, the gambling facilities, connected derivatives and conscionable placing bets connected the fiscal markets – we’re not expected to assistance the banks retired of these problems astatine all.’ So I deliberation the crushed that the newspapers are going quiescent connected this is the Fed broke the law. And it wants to proceed breaking the law.

Fed Members Split connected Whether oregon Not US Inflation Will Be Persistent

Meanwhile, arsenic radical are awaiting the Federal Reserve’s determination to rise the benchmark slope complaint a 2nd clip successful 2022, a mates of Federal Reserve members are split connected whether oregon not ostentation volition beryllium a immense occupation going guardant and whether oregon not a bid of complaint hikes are needed.

The 2 divided members see Federal Reserve politician Lael Brainard and Richmond Fed president Thomas Barkin. Brainard told the Wall Street Journal that getting ostentation down to the 2% people is the Fed’s “most important task.” Brainard expects ostentation to chill down and Barkin agrees with her.

The Richmond Fed subdivision president explained that firm entities request to marque proviso chains resistant to immoderate imaginable issues and Barkin is targeting a much blimpish ostentation complaint of astir 2.4%.

“The champion short-term way for america is to determination rapidly to the neutral scope and past trial whether pandemic-era ostentation pressures are easing, and however persistent ostentation has become,” Barkin told an assemblage astatine a Money Marketeers league successful New York. “If necessary, we tin determination further,” the Richmond Fed subdivision president added.

Tags successful this story

Bailouts, Bank Bailouts, Barclays Capital, bnp paribas, CitiGroup, Deutsche Bank Securities, Dodd-Frank Act, famed economist, Fed’s concealed loans, Goldman Sachs, investigative journalists, investigative reports, J.P. Morgan Securities, Lael Brainard, Liquidity Crisis, Mainstream media, Martens, Michael Hudson, no liquidity crisis, Nomura Securities, Occupy the Fed, Occupy the Fed Movement, Pam and Russ Martens, repo indebtedness program, Thomas Barkin, Wall Street, Wall Street connected Parade

What bash you deliberation astir the reports that assertion the Fed’s participated successful concealed bailouts that were against the instrumentality according to the economist Michael Hudson? Do you deliberation this is thing the American populace should wage attraction to? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)