Bitcoin’s semipermanent holders are addresses that person held onto their Bitcoin for implicit 155 days. And portion 155 days mightiness not dependable similar a batch of clip successful the discourse of Bitcoin, addresses that person held onto their assets for longer than that person a statistically little accidental of selling their BTC.

Therefore, the actions and decisions of this peculiar entity tin importantly power the crypto marketplace and Bitcoin’s terms trajectory. Historically, semipermanent holders person shown resilience during Bitcoin’s terms fluctuations, often holding onto their assets during downturns and selling during peaks.

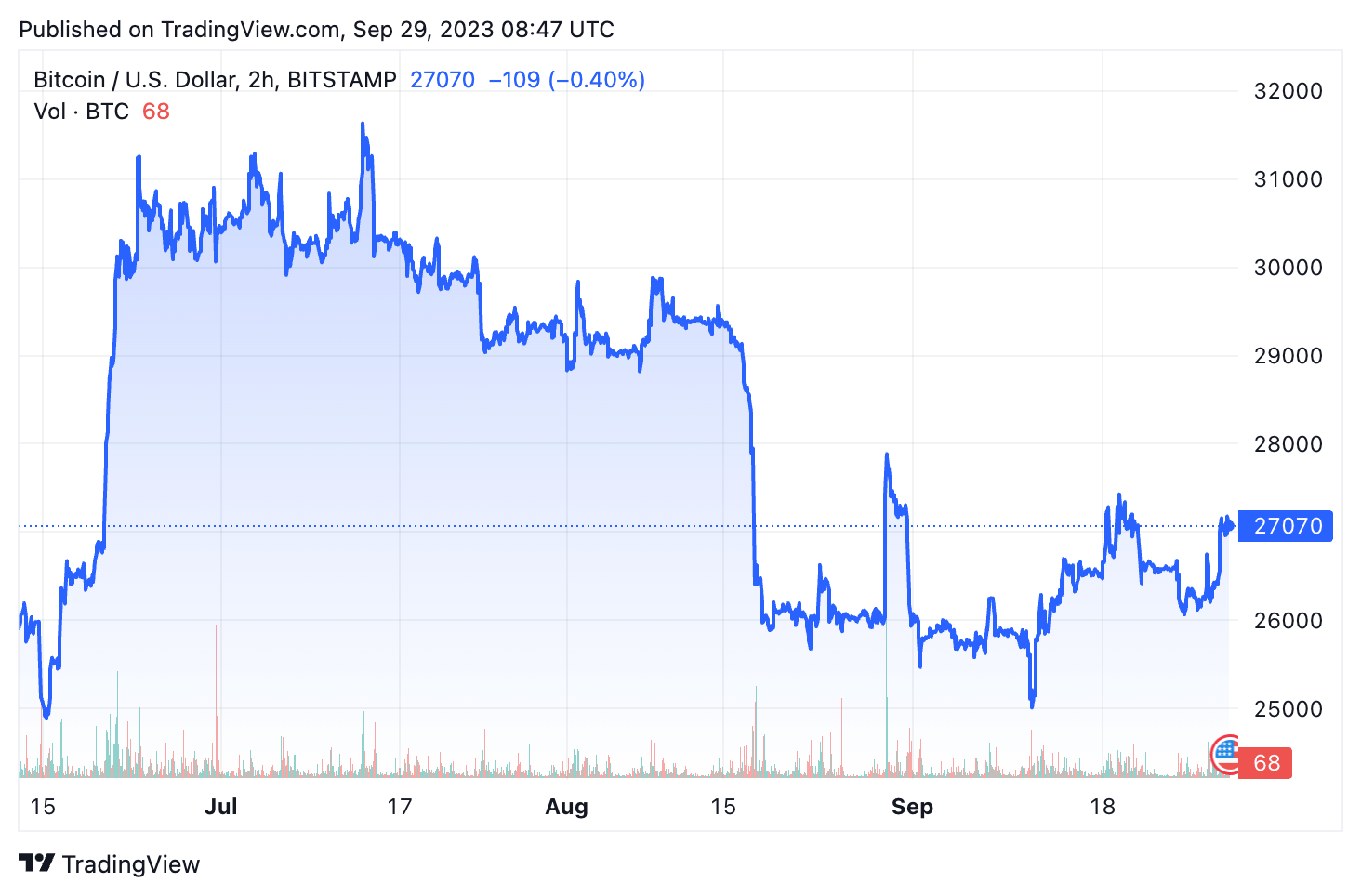

Recently, Bitcoin’s terms has shown a comparatively level trading pattern, hovering astir the $26,200 people aft reclaiming its $26,000 enactment conscionable past week. This stabilization comes connected the heels of a tumultuous month, wherever Bitcoin’s terms plummeted to lows of $25,000, a stark opposition to the preceding months of sideways question betwixt $29,000 and $30,000.

Graph showing Bitcoin’s terms from June 2023 to September 2023 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms from June 2023 to September 2023 (Source: CryptoSlate BTC)Despite the terms volatility, the Bitcoin proviso held by semipermanent holders has surged to an all-time high.

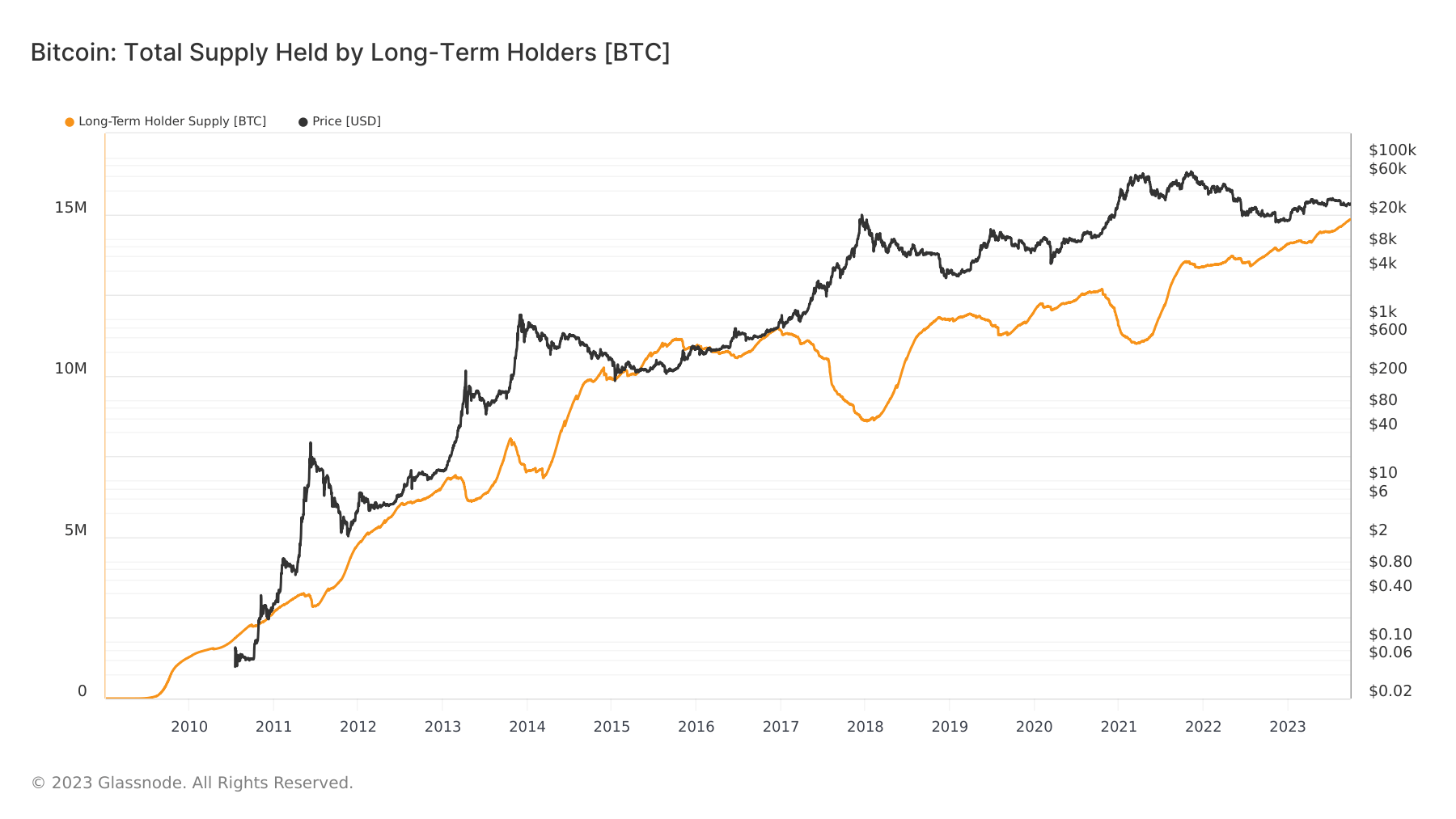

Graph showing the full proviso held by semipermanent holders from 2010 to 2023 (Source: Glassnode)

Graph showing the full proviso held by semipermanent holders from 2010 to 2023 (Source: Glassnode)The semipermanent holder proviso present stands astatine 14.83 cardinal BTC. Since the opening of 2023, this proviso has seen an summation of 757,177 BTC. Over the past year, it has grown by 1.07 cardinal BTC, with 152,216 BTC added successful conscionable the past 30 days.

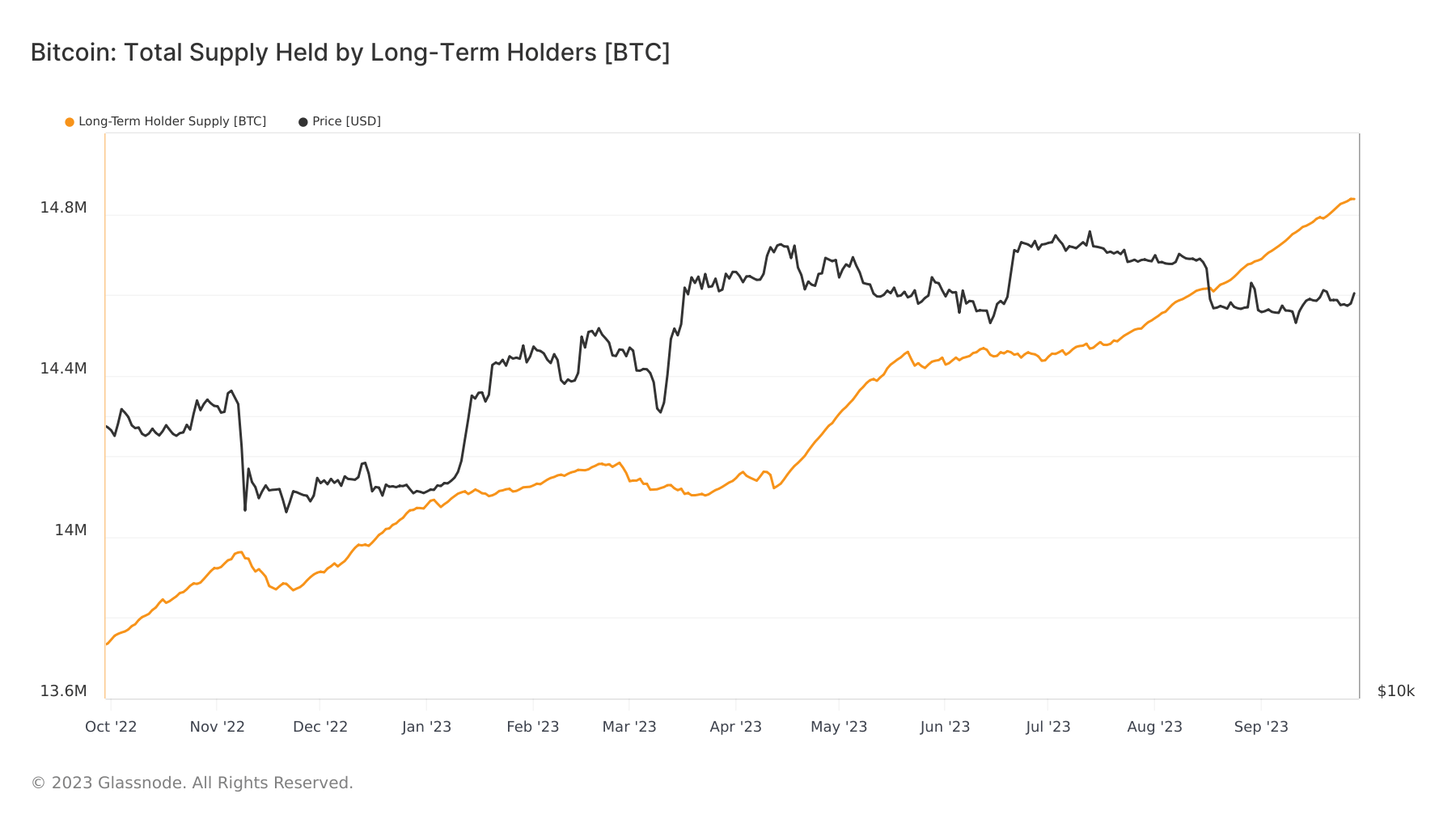

Graph showing the full proviso held by semipermanent holders from September 2022 to September 2023 (Source: Glassnode)

Graph showing the full proviso held by semipermanent holders from September 2022 to September 2023 (Source: Glassnode)This surge successful semipermanent holder proviso underscores these holders’ assurance successful Bitcoin’s semipermanent potential. Even amidst terms fluctuations, their willingness to clasp suggests a content successful the cryptocurrency’s enduring value. Moreover, with specified a important information of Bitcoin’s proviso being held long-term, there’s reduced liquidity successful the market, which tin pb to accrued terms volatility.

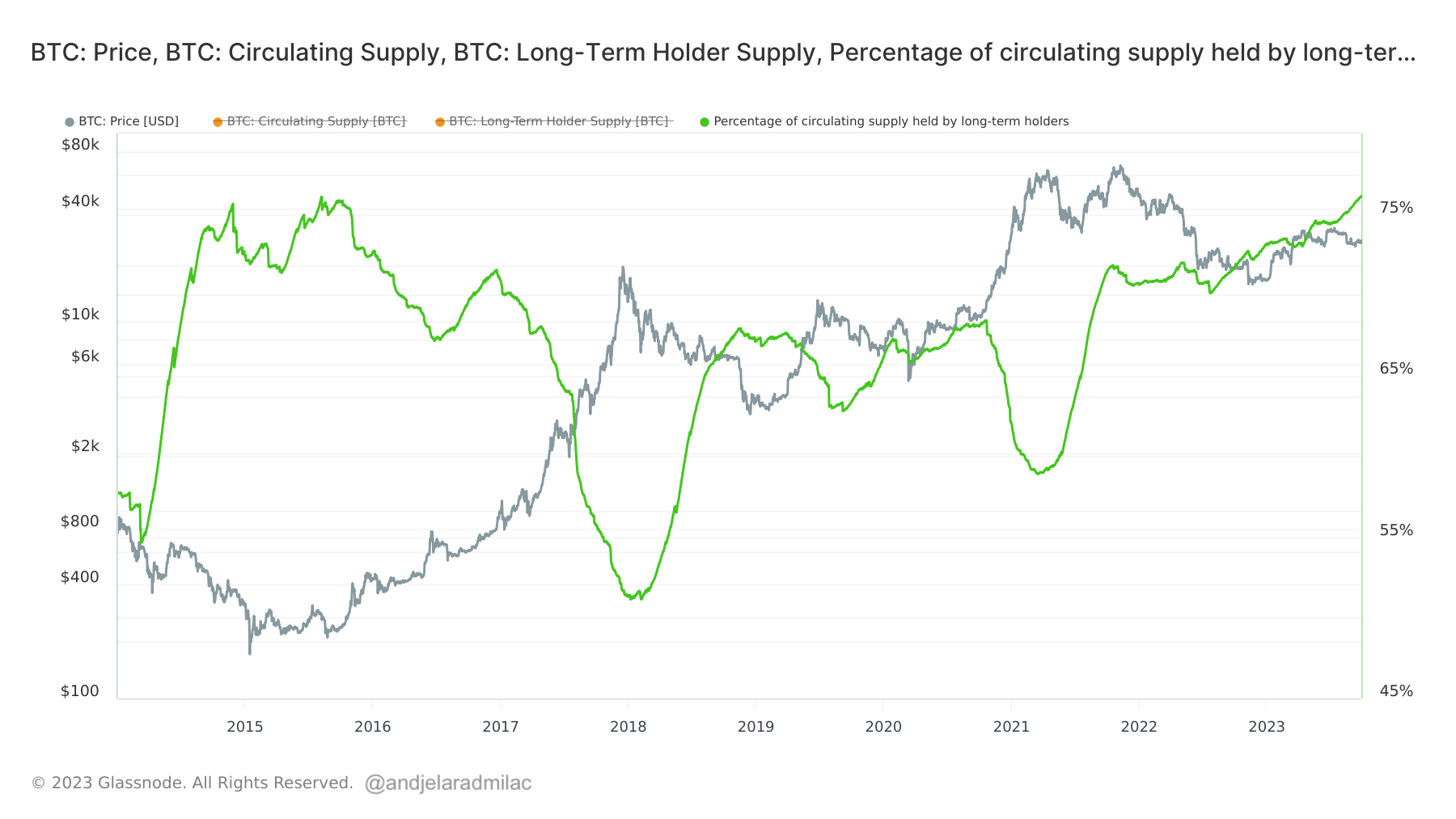

Currently, the semipermanent holder proviso constitutes a whopping 76.09% of Bitcoin’s circulating supply. The past clip this percent was surpassed was successful August 2015, erstwhile it concisely exceeded 76%. This indicates that astir of Bitcoin’s circulating proviso is present successful the hands of those who judge successful its semipermanent worth proposition.

Graph showing the percent of Bitcoin’s circulating proviso held by semipermanent holders from 2014 to 2023 (Source: Glassnode)

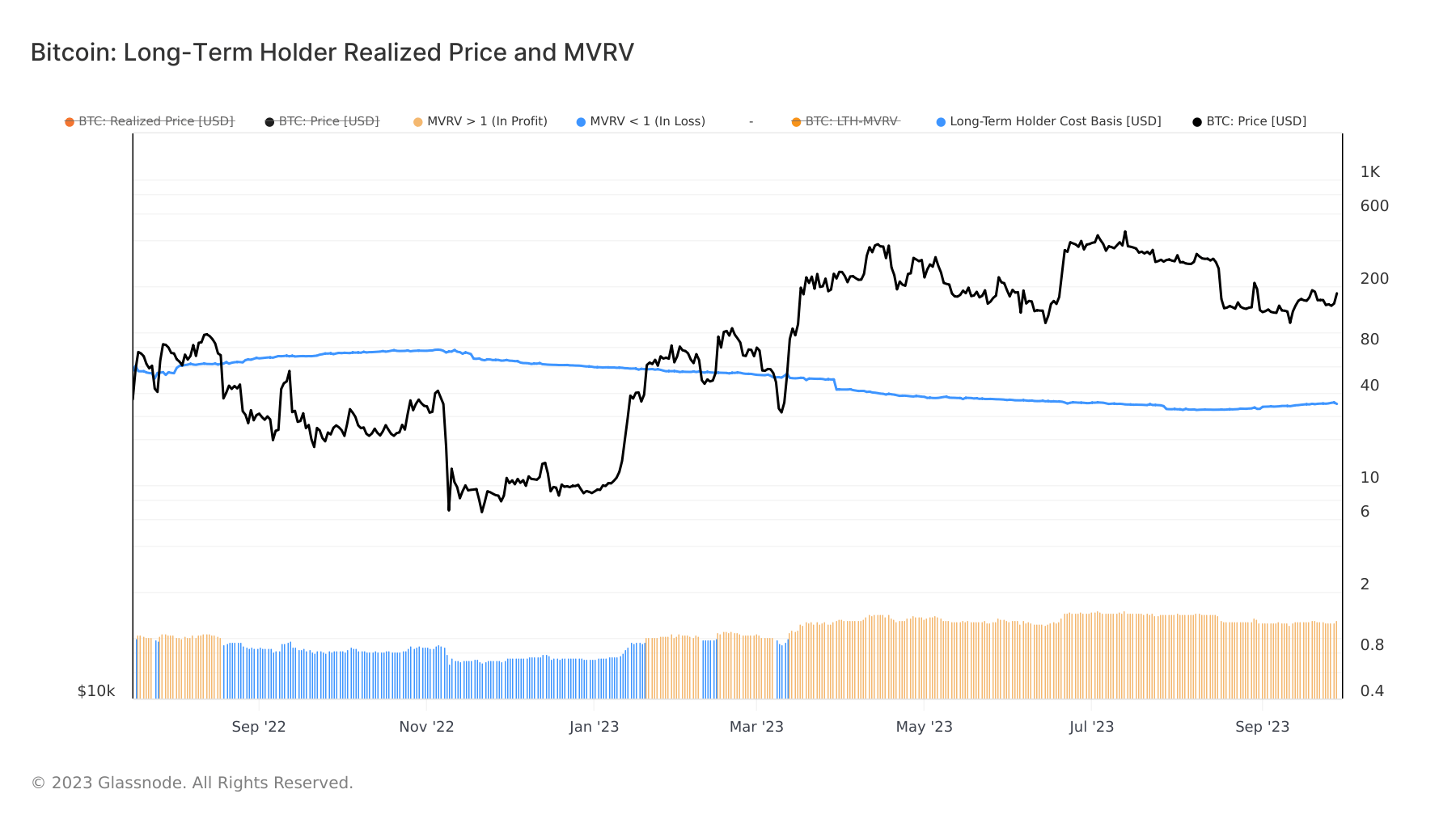

Graph showing the percent of Bitcoin’s circulating proviso held by semipermanent holders from 2014 to 2023 (Source: Glassnode)The semipermanent holder realized terms and the MVRV ratio connection further insights. The realized terms is the mean terms of the semipermanent holder Bitcoin supply, calculated based connected the past transaction day of each coin on-chain. It’s often viewed arsenic this group’s ‘on-chain outgo basis.’ Data from Glassnode reveals that the realized terms for semipermanent holders is presently $20,599. This has declined since November 2022, erstwhile it was pegged astatine $23,500.

The MVRV ratio, connected the different hand, is simply a measurement of the marketplace worth (spot price) comparative to the realized worth (realized price) for the semipermanent holder cohort. An MVRV ratio of 1.311, arsenic it stands now, suggests that the existent terms is 31.1% supra the mean outgo ground for semipermanent holders.

Graph showing the realized terms and MVRV ratio for semipermanent holders from July 2022 to September 2023 (Source: Glassnode)

Graph showing the realized terms and MVRV ratio for semipermanent holders from July 2022 to September 2023 (Source: Glassnode)These metrics bespeak that a important information of Bitcoin’s proviso is presently successful profit. The MVRV ratio, successful particular, tin beryllium a invaluable instrumentality to gauge marketplace sentiment. Extreme precocious oregon debased values tin awesome periods wherever the marketplace is overheated oregon undervalued.

The surge successful Bitcoin’s semipermanent holder supply, coupled with the insights from on-chain metrics, paints a representation of a marketplace that remains optimistic astir Bitcoin’s future. While terms volatility is simply a fixed successful the crypto realm, the steadfastness of semipermanent holders suggests a continued content successful Bitcoin’s semipermanent potential.

The station Record highs successful Bitcoin’s semipermanent holder proviso awesome marketplace confidence appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)