According to a Newsweek canvass conducted by Redfield & Wilton Strategies, 55% of Americans are “very” oregon “fairly” acrophobic astir paying disconnected recognition indebtedness this year. The full recognition paper equilibrium of Americans is astatine its highest constituent since the U.S. Federal Reserve began tracking the data, and existent metrics bespeak that Americans are utilizing recognition to mitigate inflationary pressures.

U.S. Consumers Rely connected Credit Cards to ‘Navigate Costs Associated With Inflation’

While the astir caller user terms scale (CPI) report from the U.S. Bureau of Labor Statistics indicates a cooling of ostentation successful the United States, Americans person turned to recognition cards to offset the rising prices. According to a poll published by Newsweek and Redfield & Wilton Strategies, which surveyed 1,500 American citizens connected May 31, astir 30% of respondents person indebtedness ranging from $1,000 to $5,000. Among Americans aged 22-34, astir 22% person accumulated implicit $10,000 successful debt, portion 21% of U.S. citizens aged 35-44 besides transportation the aforesaid level of debt.

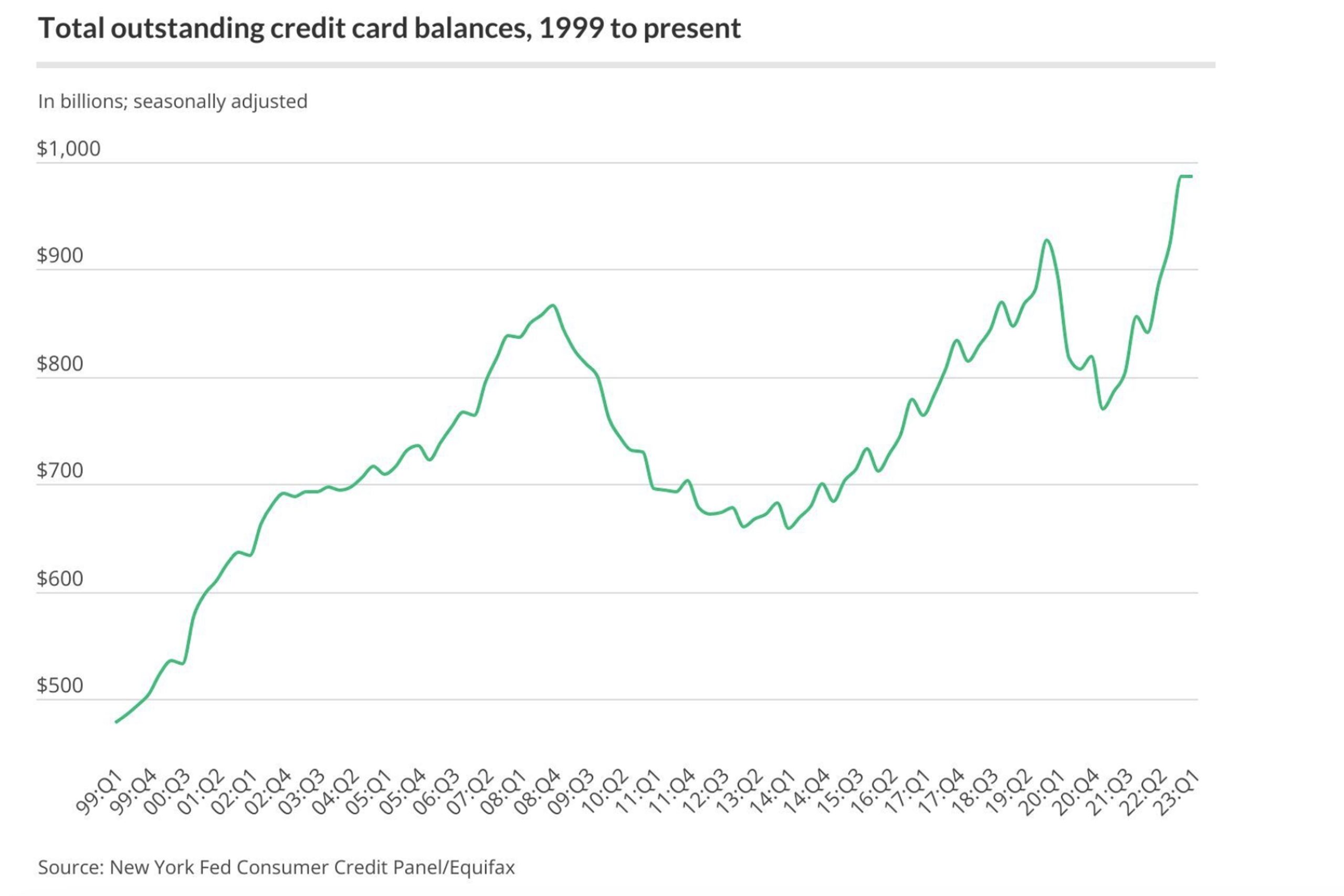

Melissa Lambarena, a recognition cards adept astatine Nerdwallet, stated to Newsweek that U.S. “consumers person been actively utilizing their recognition cards to navigate costs associated with inflation.” The Nerdwallet enforcement noted that expanding prices person caused immoderate Americans to beryllium connected their recognition cards to conscionable their fiscal needs. According to statistics from Lendingtree, recognition paper indebtedness has reached a grounds precocious for American consumers, citing consumer indebtedness data from the Federal Reserve Bank of New York.

“Americans’ full recognition paper equilibrium is $986 cardinal successful the archetypal 4th of 2023, according to the latest user indebtedness information from the Federal Reserve Bank of New York,” a Lendingtree study details. “That’s unchanged from the 4th fourth of 2022’s grounds number, leaving the equilibrium the highest since the New York Fed began tracking successful 1999.”

American Credit Card Debt Has Risen Significantly Since Q3 2020, Credit Debt Has Surged connected a Global Scale

The all-time precocious represents a 17% summation compared to the twelvemonth prior, indicating that millions of Americans are relying connected recognition much than ever earlier to screen their expenses. Credit paper indebtedness had been steadily rising until the pandemic hit, and successful 2020, it importantly declined arsenic Americans reduced their usage of these fiscal tools. According to Newsweek’s survey, 55% of U.S. residents explicit important oregon mean concerns astir their quality to repay recognition paper indebtedness this year. The statistic besides uncover that this inclination is peculiarly pronounced among younger property groups, specifically those aged 18-24.

Moreover, Americans are not the lone ones relying connected recognition paper charges to marque ends meet, arsenic multiple sources bespeak a planetary surge successful recognition paper debt. Data reveals that the United States presently holds the highest magnitude of recognition paper debt, followed by Canada, the United Kingdom, and Japan. Conversely, Italy, Brazil, and India person comparatively little mean recognition paper debt. According to the Newsweek poll, definite experts suggest the necessity of “debt forgiveness” oregon suggest that American consumers could perchance “benefit from outgo holidays.’”

What are your thoughts connected the rising recognition paper indebtedness successful the look of inflation? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)