While Bitcoin’s caller downturn suggests volatile times ahead, underlying metrics suggest a marketplace afloat of nuance, anticipation, and beardown belief, the latest Bitfinex Alpha study says. About 40% of Bitcoin’s full proviso has been inactive for much than 3 years — the highest ever for this measure, highlighting the apical cryptocurrency’s beardown basal of holders.

Diamond Hands: Bitcoin’s Long-Term Believers Remain Resolute Despite Recent Tumult

The Bitfinex Alpha study shows a person look astatine Bitcoin’s proviso dynamics reveals compelling details. The one-year inactive supply, which means coins that person been dormant for astatine slightest a year, seems to reflector BTC’s terms changes with singular accuracy, perchance acting arsenic a gauge for volatility.

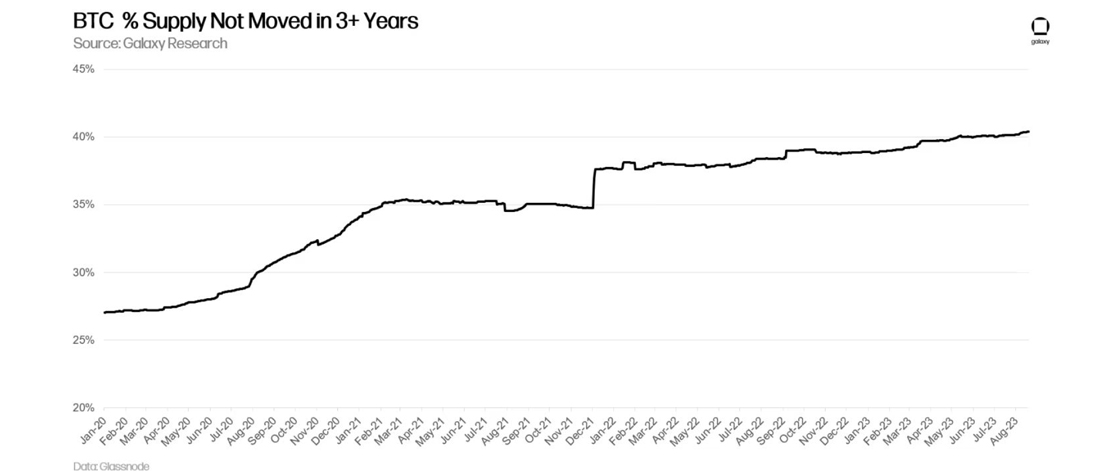

Before the crisp terms driblet connected August 17, 2023, the one-year inactive proviso decreased dramatically from 13.45 cardinal to 13.32 million, perchance indicating the upcoming drop. However, a broader presumption tells a antithetic story. Bitcoin’s metric for proviso inactive for much than 3 years continues to rise, precocious reaching a grounds high.

An introspection of “Coin Days Destroyed” aft the clang shows small enactment from aged coins, emphasizing holders’ committedness to waiting. Bitfinex researchers observed that these holders person been steadily amassing much coins implicit time.

“It’s wide that semipermanent bitcoin holders person been consistently accumulating,” Bitfinex’s researchers say. “Specifically, implicit a rolling 30-day period, this accumulation inclination has been evident since March 2023. This behaviour suggests a wide feeling of optimism and imaginable absorption to marketplace fluctuations.”

At the aforesaid time, Bitcoin miners proceed their work, pushing the web trouble to 55.62 trillion hashes successful August — the highest ever. This computational powerfulness safeguards the web and rewards miners for their trust. Adding to this, Bitcoin’s hash complaint surpassed 414 terahash per 2nd (TH/s) successful August, marking a 60% summation since January, the Alpha study points out.

Still, the study indicates that, by humanities standards, volatility measures are subdued. Implied volatility has calmed since the August 17 drop, aligning with mild humanities volatility. The one-year Bitcoin Velocity metric, which tracks onchain activity, dropped earlier this year, perchance signaling a pause. Though challenges whitethorn beryllium connected the horizon, underlying metrics uncover a divers acceptable of actions acceptable to power its adjacent phase.

“In conclusion, portion holders from arsenic acold backmost arsenic 3 years agone oregon much who person held their bitcoin passim the bull marketplace highest and carnivore marketplace stay comparatively resilient with their stack, ‘newer’ semipermanent holders who acquired their spot positions implicit the carnivore marketplace are present ‘unsettled,’ but not successful a authorities of panic,” the study concludes.

What bash you deliberation astir the latest Bitfinex Alpha report? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)