The bitcoin marketplace is seeing antithetic activity, hinting astatine accrued adoption of the U.S.-listed spot ETFs for purely directional plays alternatively than arbitrage strategies.

Since Nov. 20, the ETFs person seen beardown regular uptake — different than Nov. 25 and 26 — capturing implicit $3 cardinal successful nett inflows, according to information root Farside Investors. On Tuesday, BlackRock's IBIT registered a $693.3 cardinal nett inflow, the astir since successful the period, bringing the beingness tally to $32. 8 billion.

Meanwhile, unfastened involvement successful CME futures has declined by astir 30,000 BTC ($3 billion) to 185,485 BTC, according to information root Glassnode.

The divergence is antithetic and mightiness beryllium a motion of marketplace participants buying the ETFs arsenic outright bullish plays alternatively than arsenic portion of a price-neutral cash-and-carry strategy.

Since the ETFs debuted successful January, institutions person chiefly utilized them to acceptable up that strategy, involving a agelong presumption successful the ETF and a abbreviated presumption successful the CME futures. The opposing positions fto institutions pouch the futures premium portion bypassing terms risks. That's wherefore ETF inflows and the CME unfastened involvement person tended to determination successful tandem.

Carry output is inactive attractive

Note that the transportation strategy is inactive attractive, offering returns acold much charismatic than the U.S. 10-year Treasury enactment oregon ether's staking yield.

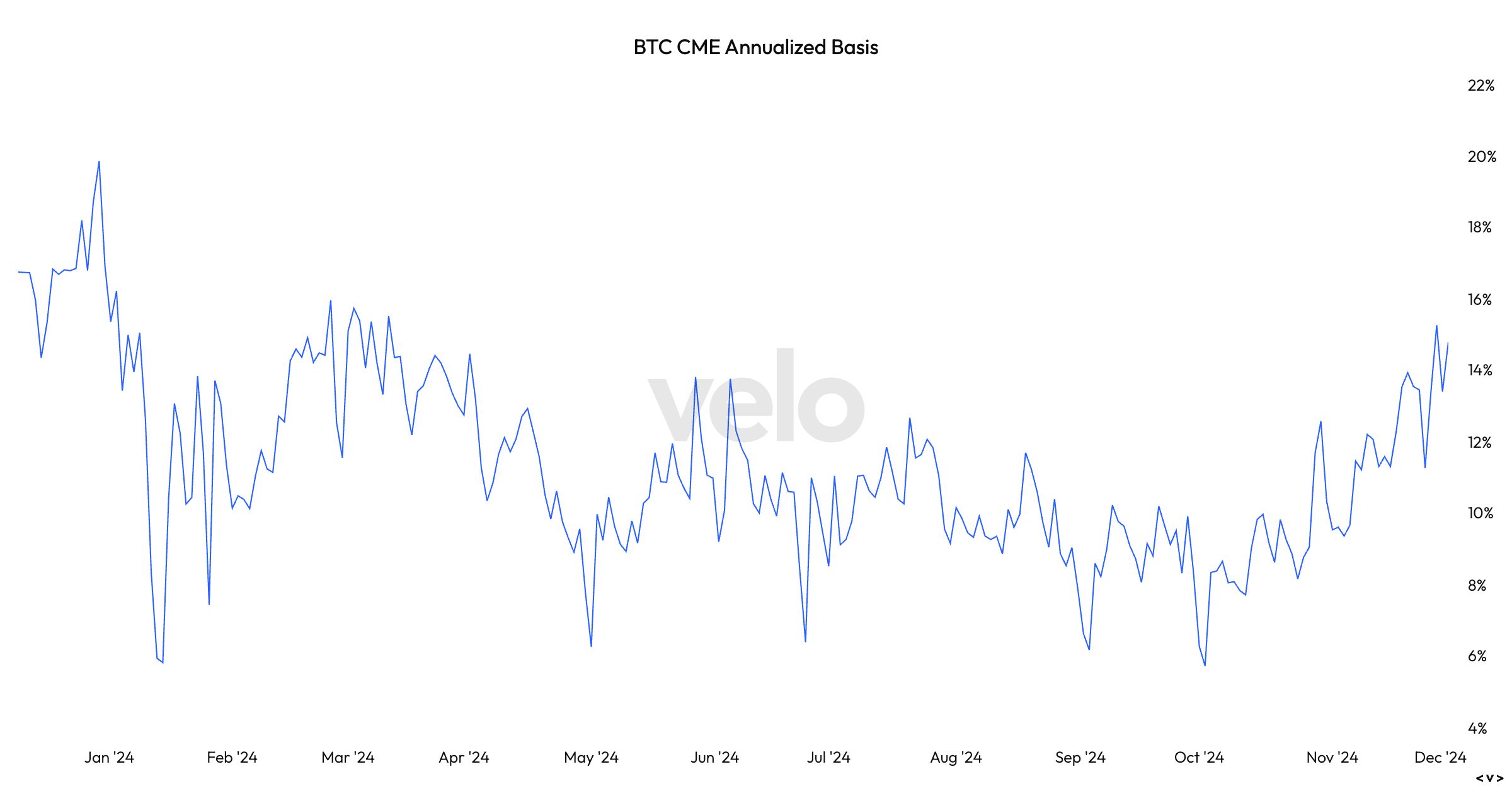

As of writing, the annualized three-month ground successful CME's BTC futures was 16%. In different words, mounting up a currency and transportation commercialized would gain you 16%, though it's a acold outcry from really holding the cryptocurrency, which is up implicit 100% this year.

The cash-and-carry yield, represented by the futures premium, peaked supra 20% successful the archetypal quarter.

8 months ago

8 months ago

English (US)

English (US)