Introduction

The realized terms and the existent marketplace mean terms are captious indicators successful Bitcoin’s on-chain information analysis, each providing indispensable insights into the valuation and capitalist behaviour wrong the cryptocurrency landscape.

Understanding the favoritism betwixt these 2 metrics is important for a broad grasp of Bitcoin’s valuation, arsenic they collectively shed airy connected some the broader holder base’s sentiment and the existent marketplace enthusiasm.

Realized price

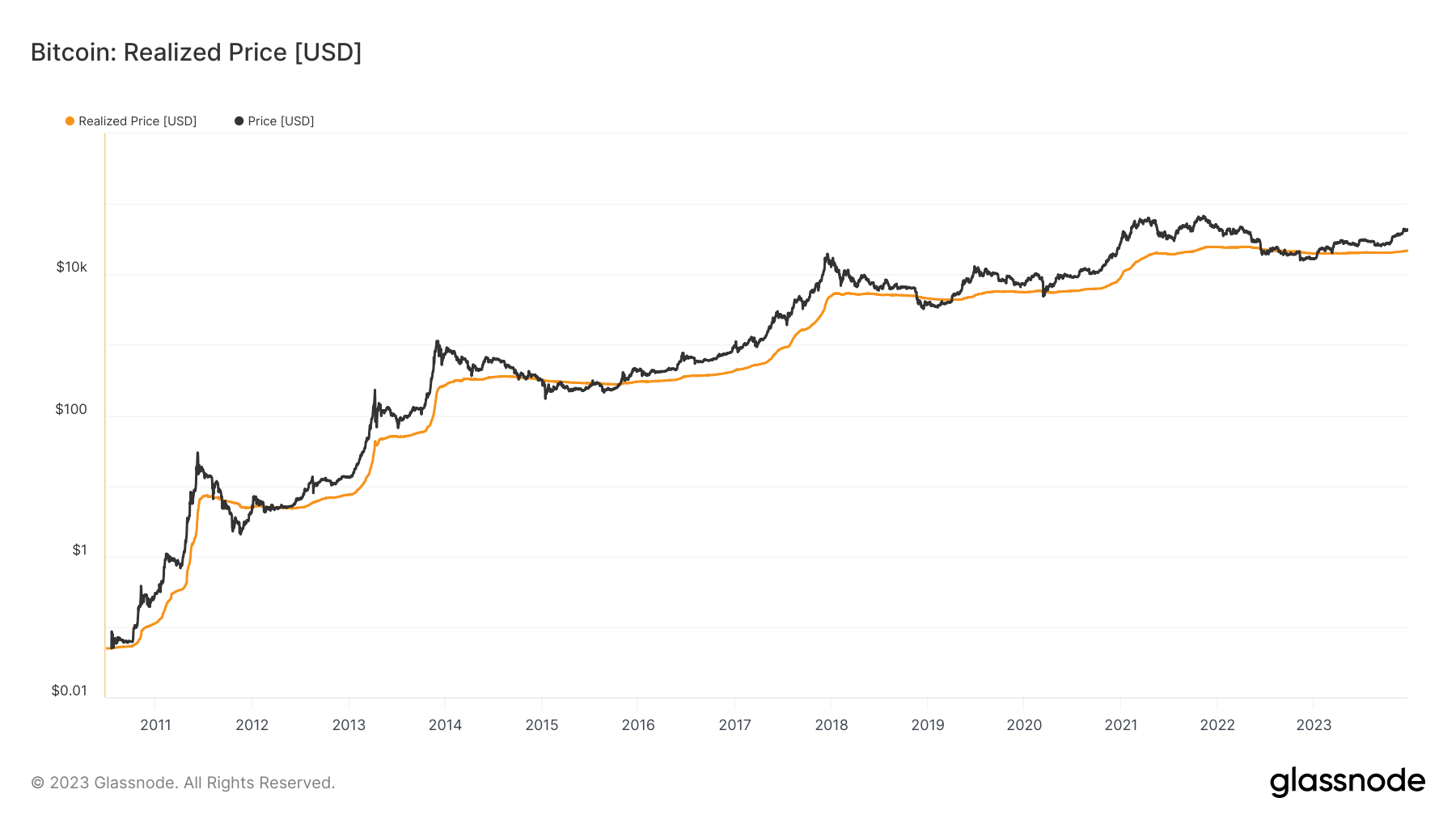

Realized terms is simply a much analyzable metric compared to the marketplace price, which is simply the existent trading terms connected exchanges. It is calculated by dividing the realized capitalization by the existent proviso of Bitcoin. It encompasses each coins successful circulation, careless of root (mining oregon secondary marketplace transactions). This broad attack ensures that the metric reflects the full economical value of each bitcoins, giving a fuller representation of the network’s value. Realized capitalization is the sum of the worth of each Bitcoins astatine the terms they were past transacted on-chain. This calculation provides a weighted mean terms of each Bitcoins based connected the past clip each Bitcoin changed hands.

Graph showing Bitcoin’s realized terms from 2010 to 2023 (Source: Glassnode)

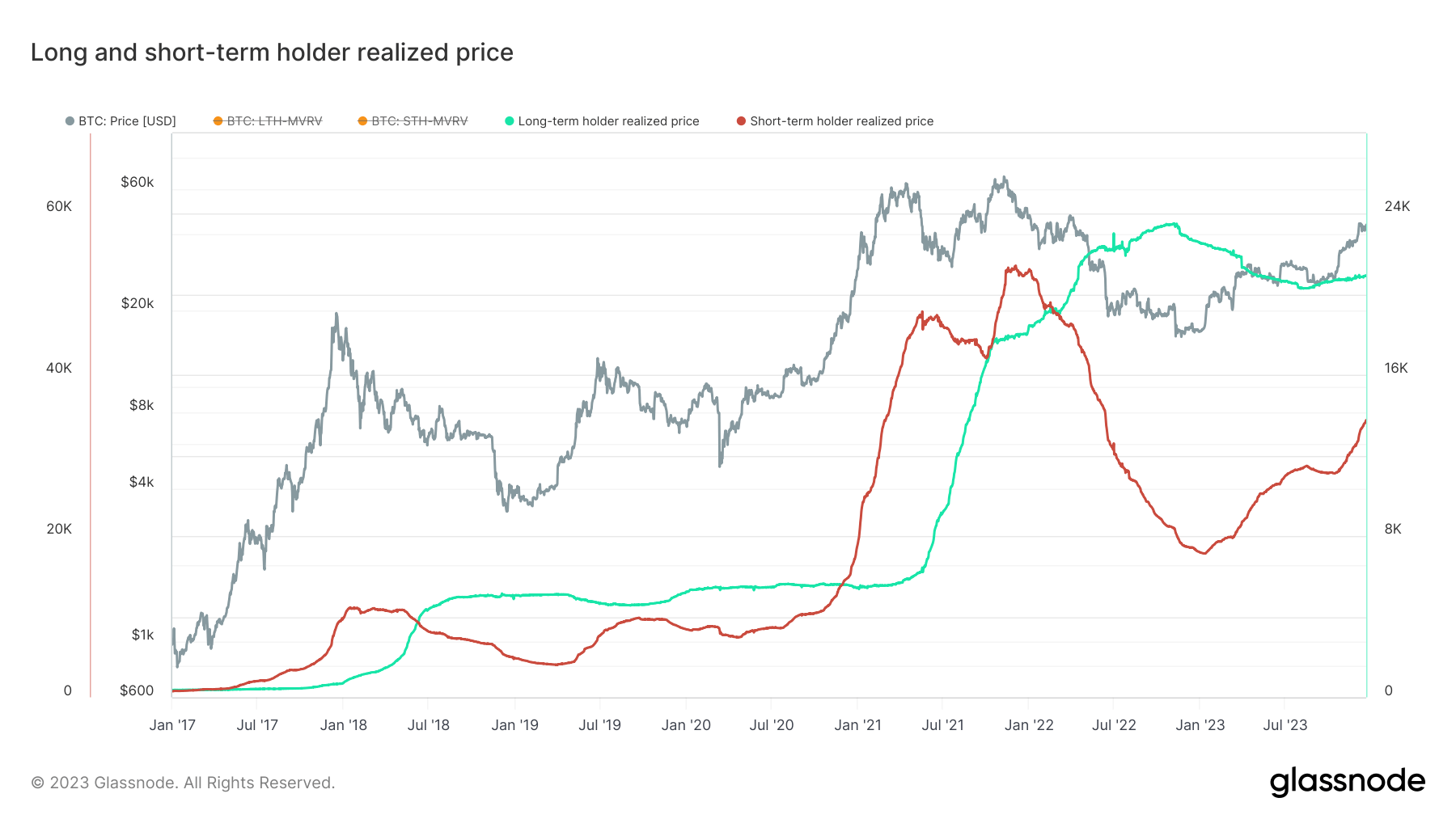

Graph showing Bitcoin’s realized terms from 2010 to 2023 (Source: Glassnode)The realized terms tin beryllium divided into 2 types: those held by semipermanent holders (LTH) and those held by short-term holders (STH). LTH realized terms is calculated considering lone those coins that haven’t moved successful astatine slightest 155 days, whereas STH realized terms accounts for coins moved wrong this period. This favoritism allows analysts to recognize the behaviour and sentiment of antithetic capitalist cohorts. The LTH realized terms often reflects a terms level that semipermanent investors entered at, serving arsenic a enactment level during carnivore markets. In contrast, the STH realized terms tin bespeak caller marketplace sentiment and imaginable absorption levels successful bull markets.

Graph showing the realized terms for agelong and short-term holders from 2017 to 2023 (Source: Glassnode)

Graph showing the realized terms for agelong and short-term holders from 2017 to 2023 (Source: Glassnode)True marketplace mean price

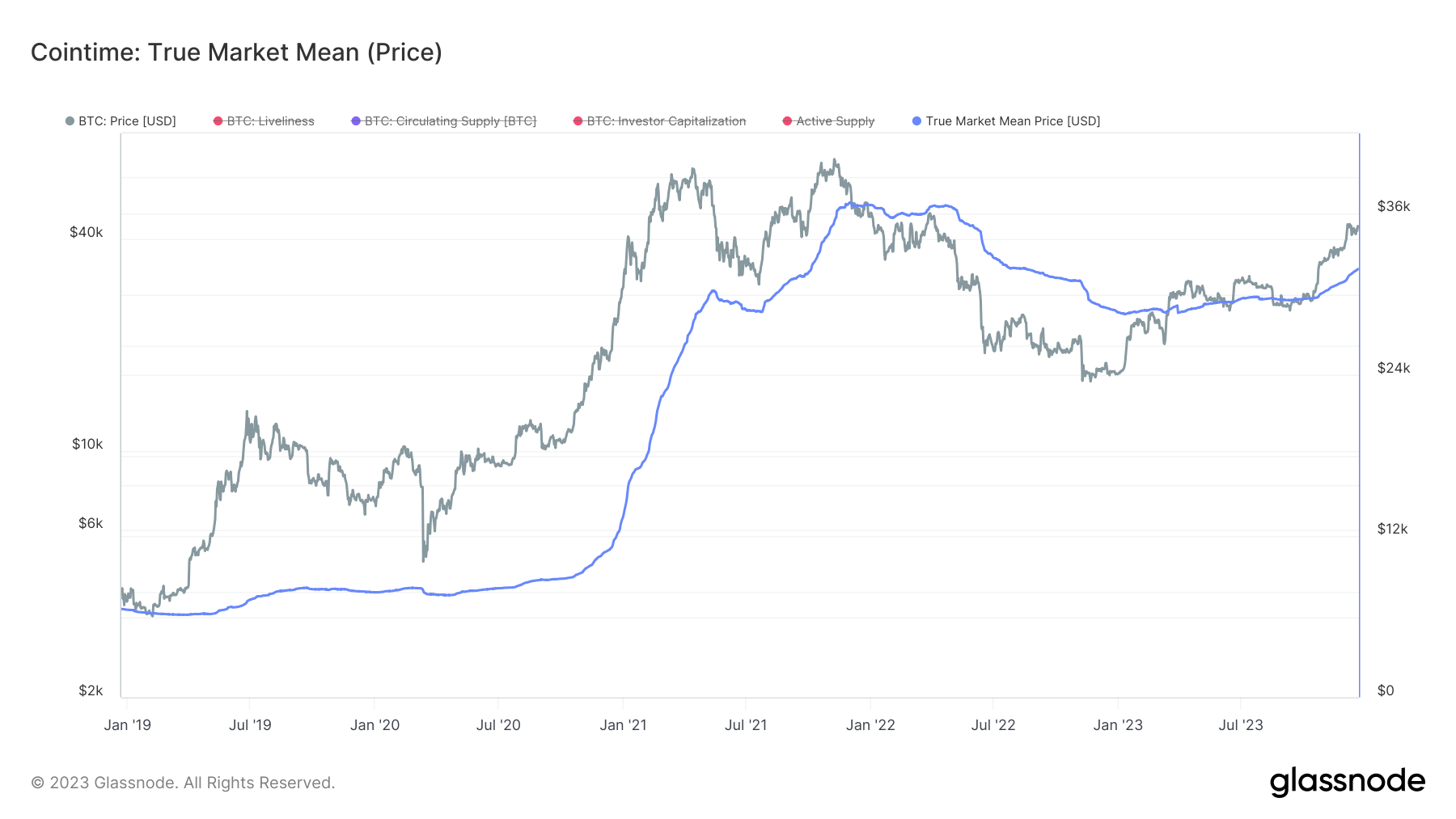

The existent marketplace mean price, a comparatively caller conception introduced successful Glassnode’s Cointime Economics study earlier this year, offers a antithetic lens for knowing Bitcoin. This metric focuses exclusively connected coins that person been actively traded, excluding Bitcoin’s thermocap. Thremocap represents the full cumulative gross miners person earned, including artifact rewards (newly minted coins) and transaction fees.

Graph showing Bitcoin’s existent marketplace mean terms from December 2016 to December 2023 (Source: Glassnode)

Graph showing Bitcoin’s existent marketplace mean terms from December 2016 to December 2023 (Source: Glassnode)By excluding Thermocap, the existent marketplace mean terms focuses solely connected the coins traded oregon transferred betwixt investors. Thermocap includes coins astir apt held successful miner reserves, which mightiness not bespeak progressive marketplace participation.

Mining activities are fundamentally antithetic from concern oregon trading activities. Miners person Bitcoin arsenic a reward for validating transactions and securing the network, autarkic of marketplace conditions. These coins mightiness beryllium held irrespective of marketplace sentiment oregon price, which tin skew the mean outgo ground if included. By excluding these coins, the existent marketplace mean terms offers a metric that much accurately reflects investor-driven marketplace dynamics.

While the realized terms provides a wide presumption of the market’s mean outgo basis, it includes each coins, irrespective of their existent economical activity. This wide inclusion tin sometimes disguise circumstantial capitalist behaviors, particularly during periods of debased on-chain activity. In contrast, the existent marketplace mean terms offers a much targeted view, focusing connected the segments of Bitcoin actively participating successful the market. This absorption makes it a perchance much acute instrumentality for knowing the contiguous marketplace sentiment and concern patterns.

Comparison and insights

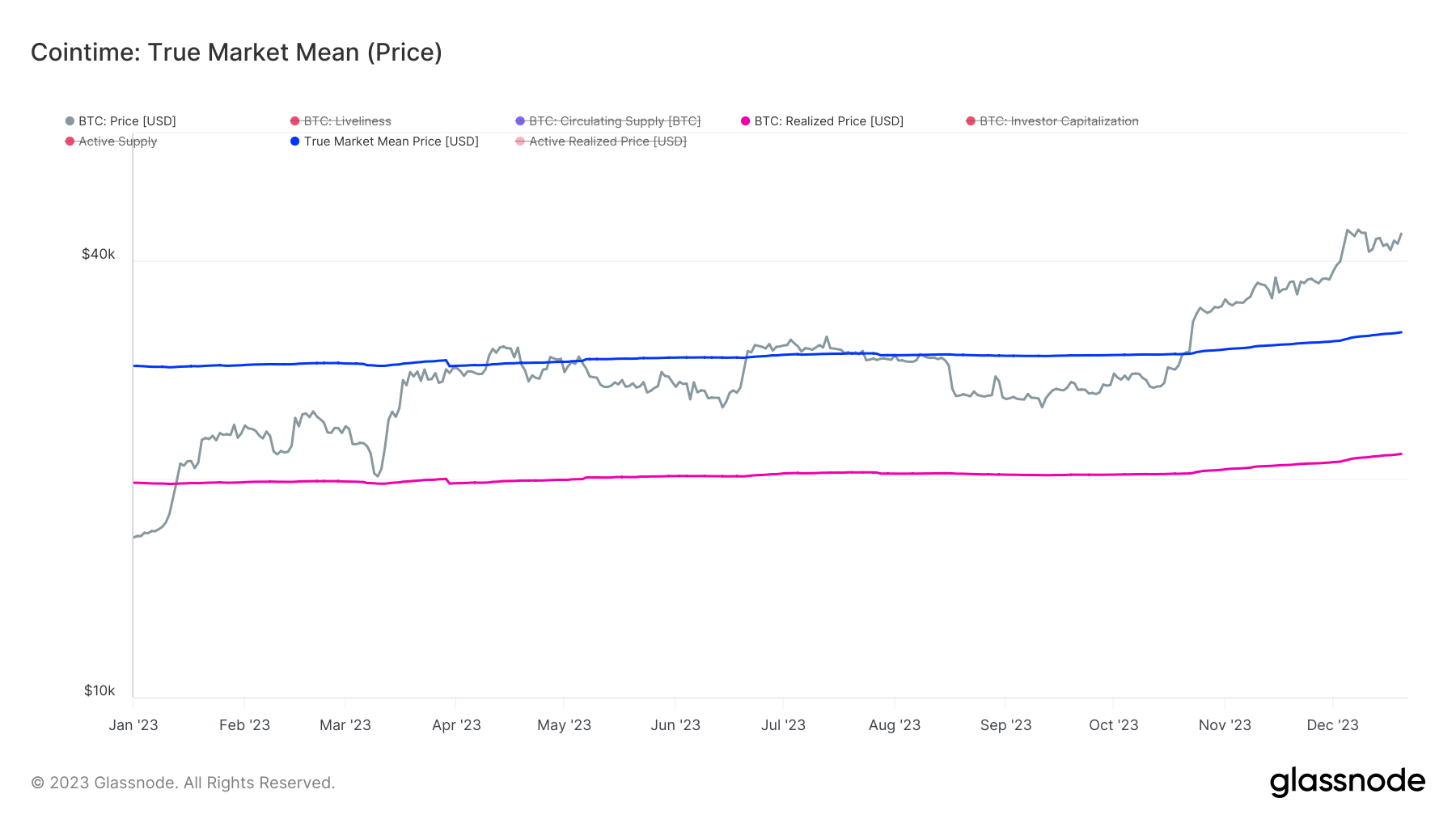

The existent marketplace mean terms accrued from $28,659 connected Jan. 1, 2023, to $31,896 connected Dec. 20, 2023. This emergence suggests that progressive investors connected secondary markets person accrued the mean acquisition terms of Bitcoin by 11%. This indicates accrued buying enactment astatine higher prices.

The realized terms accrued from $19,772 to $21,672 implicit the aforesaid period. This 9.6% increase, portion smaller than the existent marketplace mean price, besides indicates a wide upward question successful the mean outgo ground of each Bitcoin holders. This could mean much Bitcoin was moved oregon sold astatine higher prices, expanding the realized capitalization.

The marketplace terms of Bitcoin roseate importantly from $16,620 connected Jan. 1 to $43,629 connected Dec. 20. The ample spread betwixt the marketplace terms and some the existent marketplace mean terms and the realized terms implies that existent trading levels are overmuch higher than the mean acquisition prices. A prolonged play of precocious divergence could bespeak a perchance overvalued marketplace ripe with speculation. However, fixed that Bitcoin’s spot terms has been supra the existent marketplace mean terms for lone astir 60 days, it indicates a rising bullish sentiment successful the market.

Graph showing Bitcoin’s realized terms (pink) and Bitcoin’s existent marketplace mean terms (blue) successful 2023 (Source: Glassnode)

Graph showing Bitcoin’s realized terms (pink) and Bitcoin’s existent marketplace mean terms (blue) successful 2023 (Source: Glassnode)The examination betwixt the increases successful the existent marketplace mean terms and the realized terms of Bitcoin, portion akin successful percentages and dollar terms, carries antithetic implications owed to the quality of the metrics.

Given its exclusive absorption connected progressive investors, the summation successful the existent marketplace mean terms suggests a important level of enactment and sentiment alteration among this group. Since this metric lone accounts for coins that person been actively traded, an summation implies that progressive investors are buying and selling Bitcoin astatine higher prices. This could bespeak a beardown bullish sentiment oregon accrued request among traders and investors actively participating successful the market. The summation successful this metric, adjacent if numerically akin to the realized price, holds sizeable value due to the fact that it reflects a concentrated alteration successful the behaviour of a circumstantial conception of the market.

On the different hand, an statement tin beryllium made that realized terms provides a broader presumption of the market’s mean outgo ground due to the fact that it includes each coins — some actively traded and held dormant. In this regard, though the summation successful realized terms is somewhat smaller, it mightiness beryllium much important considering its broader base. This indicates that the mean outgo ground of each Bitcoin holders, including semipermanent holders, is besides rising.

However, CryptoSlate’s instrumentality is that the summation successful the existent marketplace mean terms holds much value due to the fact that it reflects a concentrated alteration successful the behaviour of a peculiar conception of the market. It’s much reflective of the contiguous marketplace sentiment, arsenic it straight reflects the actions of progressive traders, which person historically had a importantly higher interaction connected Bitcoin’s terms action.

Conclusion

The emergence successful the existent marketplace mean price, accentuating the progressive capitalist segment’s behavior, underscores a important displacement successful marketplace sentiment among this group. Conversely, the realized price’s growth, though somewhat little successful percent terms, offers a wide lens done which the full spectrum of Bitcoin holders is viewed.

The trajectories of these metrics successful 2023 amusement conscionable however analyzable and multifaceted Bitcoin’s operation is. The existent marketplace mean price’s sharper summation highlights the captious relation of progressive traders successful influencing Bitcoin’s short-term terms movements. Meanwhile, the dependable ascent successful realized terms indicates the underlying assurance and a dilatory and dependable alteration successful the cognition of the broader Bitcoin market, arsenic it includes some semipermanent holders and caller participants.

Moving forward, the interplay betwixt these metrics volition lone summation successful importance. Understanding the interaction of progressive trading, arsenic reflected successful the existent marketplace mean price, alongside the broader marketplace sentiment encapsulated by the realized price, volition beryllium important for investors, analysts, and traders aiming to navigate the market.

The station Realized terms and existent marketplace mean: Understanding Bitcoin’s cardinal cost-basis indicators appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)