As June monthly accumulation updates rotation retired implicit the adjacent week, Core Scientific and Bitfarms person some sold astir 50% oregon much of their bitcoin treasuries.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Core Scientific Sells 7,202 BTC

On July 5, 2022, Core Scientific, the world’s third-largest publically traded bitcoin miner by marketplace headdress ($525.52 million) announced successful its June monthly update the merchantability of 78.6% of its bitcoin holdings.

“During the period of June, the Company sold 7,202 bitcoins astatine an mean terms of astir $23,000 per bitcoin for full proceeds of astir $167 million. As of June 30, 2022, the Company held 1,959 bitcoins and astir $132 cardinal successful currency connected its equilibrium sheet.

"Proceeds from bitcoin income successful June were chiefly utilized for payments for ASIC servers, superior investments successful further information halfway capableness and scheduled repayment of debt. The Company volition proceed to merchantability self-mined bitcoins to wage operating expenses, money growth, discontinue indebtedness and support liquidity.”

Last week, successful our latest mining issue, we covered immoderate of the dynamics of the bitcoin mining cycle, and the hash terms bull and carnivore market.

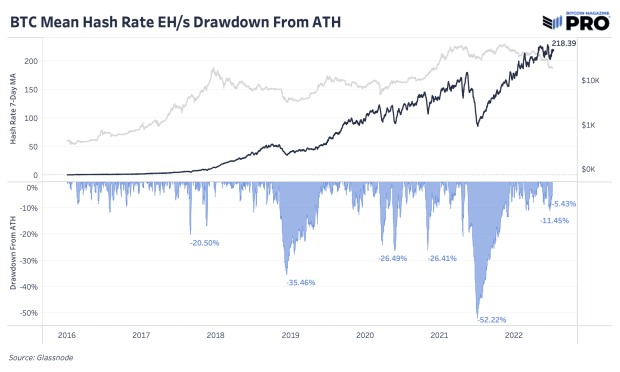

Given that hash complaint is lone 5.43% beneath its all-time precocious reading, immoderate much unit connected mining operations looks to beryllium connected the horizon. Previous carnivore marketplace miner capitulation periods saw hash complaint drawdowns of implicit 25% from erstwhile highs, with 52.22% aft the China miner prohibition being the largest drawdown successful the past of bitcoin.

Bitcoin mining hash complaint drawdown from all-time high

Bitcoin mining hash complaint drawdown from all-time high

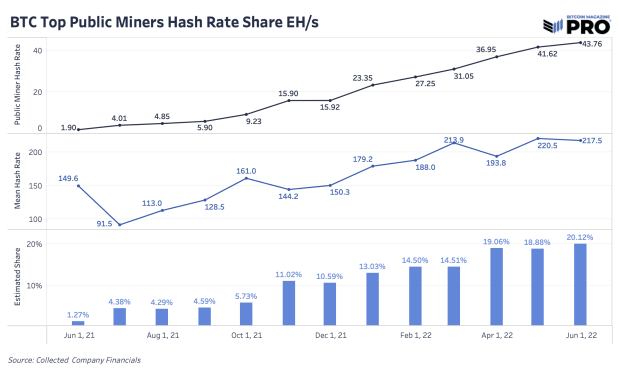

While the comparative maturation of hash complaint has diminished greatly successful caller years, the implicit maturation of the manufacture has been enormous, peculiarly successful the publically traded sector.

Public bitcoin miners' stock of hash rate

Public bitcoin miners' stock of hash rate

The mining industry’s caller emergence and synergy with nationalist markets implicit the past 2 years gave it plentifulness of entree to indebtedness financing that was unavailable successful erstwhile cycles. This allowed for miners to boost equity marketplace valuations by borrowing against their holdings to concern operations and further superior expenditure.

This dynamic has led miner operations to beryllium underwater connected months of bitcoin mining gross portion inactive having to concern powerfulness agreements and outstanding debt. While this is simply a wide over-generationalization of the industry, it is the crushed wherefore the equity of said miners comparative to bitcoin person performed truthful poorly.

What Sparks A Recovery In Public Miners?

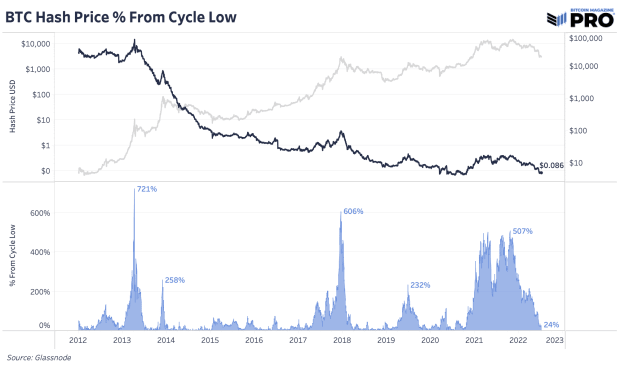

When investing successful bitcoin miner companies oregon infrastructure, you are investing for the adjacent hash terms bull marketplace — the “gold rush” signifier of the bitcoin marketplace cycle. Shown beneath is hash terms (in logarithmic scale) with the bottommost pane showing its emergence from erstwhile all-time lows.

As a reminder, hash terms is defined arsenic regular miner gross divided by hash rate.

Hash terms percent from marketplace rhythm lows

Hash terms percent from marketplace rhythm lows

Given the vicious competitory quality of mining, and hash rates caller bounce backmost to 218 EH/s, much headwinds are connected the skyline for the assemblage — which could spot adjacent much unit connected the BTC/USD speech rate, further reenforcing the compression connected margins successful the mining sector.

In tomorrow’s Bitcoin Magazine Pro Issue, we volition screen the latest moves successful the macroeconomic scenery regarding involvement rates, commodities and overseas speech markets. Subscribe to entree the afloat Bitcoin Magazine Pro newsletter.

3 years ago

3 years ago

English (US)

English (US)