Is it 2021 each implicit again?

Circle (CRCL) debuted to wild upside action connected the New York Stock Exchange connected Thursday, its shares much than tripling from the IPO terms of $31. The lawsuit was the culmination of a agelong travel for the USDC stablecoin issuer, which had been pursuing an IPO for respective years.

For the crypto industry, it’s surely a triumph — a motion of beardown accepted capitalist request and that nether the Trump administration, crypto autochthonal firms truly bash person a way to going public.

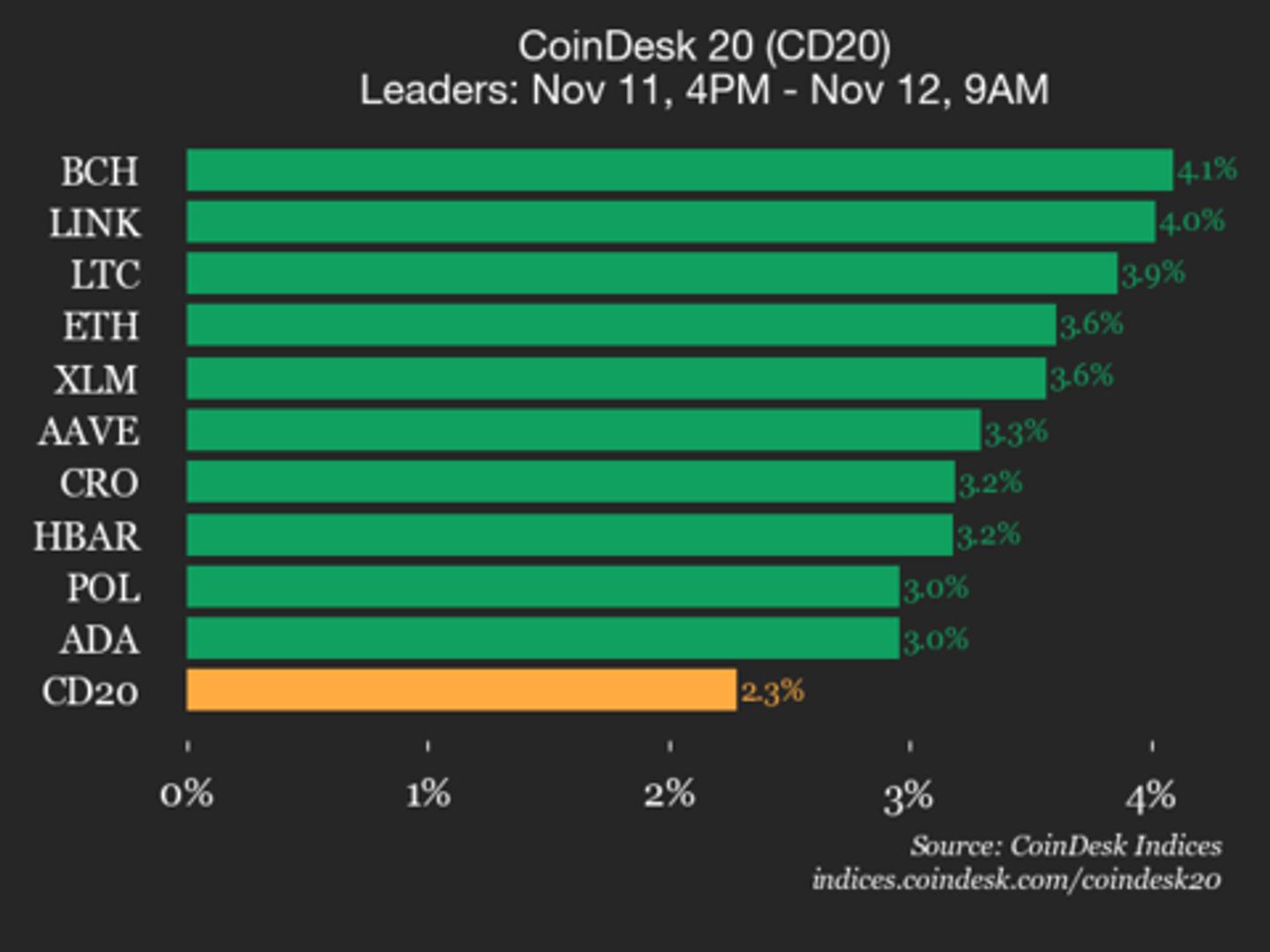

But cryptocurrencies themselves weren’t enthused. Bitcoin BTC slid much than 2% to $102,800, its weakest level successful astir a month, portion the CoinDesk 20 (an scale of the apical 20 cryptocurrencies by marketplace capitalization but for stablecoins, memecoins and speech coins) fell implicit 3%. Leading the selloff are tokens specified arsenic SOL, AVAX and AAVE, each little by astir 6%.

It’s excessively aboriginal to archer whether the downtrend volition persist successful the short, mean oregon agelong term, but for manufacture veterans, it’s hard not to spot shades of different crypto IPO — that of Coinbase (COIN), which took spot connected April 14, 2021 and marked a then-epic apical of $65,000 for bitcoin. Roughly 2 months pursuing the COIN debut, bitcoin had plunged astir 60% to astir the $28,000 level.

A crisp autumn bounce successful prices did person bitcoin again re-claiming that $65,000 level, but the selling rapidly took clasp erstwhile again. A brutal carnivore marketplace ensued done precocious 2021 and passim 2022, with bitcoin yet bottoming astatine astir $15,000. Bitcoin wouldn't reclaim a caller grounds terms until March 2024, astir 3 years aft the Coinbase IPO.

Read more: Bitcoin May Be Headed Towards a 2021-Like Double Top

5 months ago

5 months ago

English (US)

English (US)